Understanding how to showcase your investments on a net worth statement is crucial for accurately reflecting your financial health. This guide will provide insights into the process of documenting your investments, ensuring that your net worth statement accurately represents your financial position and the value of your assets. By following these steps, you can effectively communicate your investment portfolio's impact on your overall financial picture.

What You'll Learn

- Asset Allocation: Detail how you've distributed investments across various asset classes

- Risk Management: Explain strategies to mitigate investment risks

- Performance Metrics: Describe key metrics used to assess investment returns

- Tax Optimization: Discuss methods to minimize tax liabilities on investments

- Investment Strategy: Outline your approach to selecting and managing investment portfolios

Asset Allocation: Detail how you've distributed investments across various asset classes

Asset allocation is a crucial step in managing your investments and plays a significant role in determining your overall financial health. It involves dividing your investment portfolio among different asset classes, such as stocks, bonds, real estate, and cash, to achieve a balanced and diversified approach. Here's a detailed guide on how to approach asset allocation and present your investment distribution:

Understanding Asset Classes: Begin by familiarizing yourself with the various asset classes. Stocks represent ownership in companies and can be further categorized into large-cap, mid-cap, and small-cap stocks. Bonds are debt instruments issued by governments or corporations, offering fixed returns. Real estate includes properties and can be invested in directly or through REITs (Real Estate Investment Trusts). Cash equivalents are highly liquid assets like savings accounts or short-term bonds. Understanding these classes is essential to make informed decisions.

Assessing Your Risk Tolerance: Asset allocation is closely tied to your risk tolerance, which is your ability to withstand market fluctuations. A higher risk tolerance might lead to a more aggressive allocation, favoring stocks, while a lower tolerance could result in a more conservative mix, with a larger portion in bonds and cash. Consider your financial goals, time horizon, and personal comfort level with risk to determine an appropriate asset allocation strategy.

Creating a Portfolio: Start by deciding on the percentage or weight to allocate to each asset class. A common approach is to use a 60/40 or 50/50 model, where a significant portion is invested in stocks and the rest in bonds or a combination of bonds and cash. For instance, you might allocate 60% to stocks, 30% to bonds, and 10% to cash. This distribution can be tailored to your specific needs and risk profile. Remember, asset allocation is a long-term strategy, and adjustments can be made over time.

Diversification: Diversification is a key principle in asset allocation. It involves spreading your investments across different sectors, industries, and geographic regions to minimize risk. For example, within the stock portion, you could allocate funds to various sectors like technology, healthcare, and finance, ensuring that your portfolio is not overly exposed to any single industry. Diversification helps reduce the impact of market volatility and provides a more stable investment experience.

Regular Review and Adjustment: Asset allocation is not a set-and-forget strategy. Regularly reviewing and adjusting your portfolio is essential to stay aligned with your financial goals and risk tolerance. Market conditions, economic changes, and personal circumstances may require modifications to your asset allocation. Periodically assess the performance of each asset class and make adjustments to maintain your desired distribution. This proactive approach ensures that your investments remain optimized for your needs.

The Daily Grind: Investment Bankers' Commute to Success

You may want to see also

Risk Management: Explain strategies to mitigate investment risks

When it comes to managing investment risks, there are several strategies that can help investors navigate the complexities of the financial markets and protect their capital. Here are some effective approaches to consider:

Diversification is a fundamental principle in risk management. By spreading your investments across various asset classes, sectors, and geographic regions, you can reduce the impact of any single investment's performance on your overall portfolio. Diversification ensures that your investments are not overly concentrated in one area, which can minimize potential losses during market downturns. For example, if you invest in a mix of stocks, bonds, real estate, and commodities, a decline in one sector will be partially offset by gains in others, thus maintaining the overall health of your portfolio.

Conducting thorough research and due diligence is essential before making any investment decision. This involves analyzing financial statements, industry trends, company management, and market conditions. By gathering and assessing relevant information, investors can identify potential risks and make informed choices. For instance, examining a company's financial history, including revenue growth, debt levels, and cash flow, can provide insights into its stability and ability to weather economic storms.

Risk assessment and analysis are critical components of effective risk management. Investors should regularly review their portfolios to identify potential risks and their likelihood and impact. This process involves creating a comprehensive list of risks, categorizing them, and assigning a level of severity. For example, market risk, credit risk, liquidity risk, and operational risk are common categories. By quantifying these risks, investors can develop strategies to mitigate them, such as adjusting investment allocations or implementing stop-loss orders.

Implementing a robust risk management framework is essential for long-term success. This includes setting clear risk tolerance levels, establishing risk limits, and regularly monitoring and reviewing investment performance against these parameters. A well-defined framework helps investors stay disciplined and make timely adjustments to their portfolios. For instance, if an investor's risk tolerance is set at moderate, they should avoid highly speculative investments and focus on more stable, long-term growth opportunities.

Regular portfolio rebalancing is a powerful strategy to manage risk and maintain the desired asset allocation. Over time, market fluctuations can cause the composition of your portfolio to deviate from your original plan. Rebalancing involves buying or selling assets to restore the original allocation, thus managing risk exposure. For example, if your portfolio has become overly weighted towards technology stocks, which have underperformed, rebalancing would involve selling some of these stocks and buying undervalued assets in other sectors.

In summary, managing investment risks requires a proactive and disciplined approach. Diversification, thorough research, risk assessment, and a well-structured risk management framework are essential tools for investors. By implementing these strategies, individuals can navigate the financial markets with greater confidence, protect their capital, and work towards achieving their investment goals while minimizing potential losses.

Ready to Invest? Here's What You Need to Know

You may want to see also

Performance Metrics: Describe key metrics used to assess investment returns

When evaluating investment returns, it's crucial to understand and utilize key performance metrics that provide a comprehensive view of the investment's success. These metrics serve as a quantitative language to communicate the value and impact of your investments. Here are some essential performance metrics to consider:

Return on Investment (ROI): ROI is a fundamental metric that measures the profitability of an investment. It calculates the net profit or loss as a percentage of the initial investment. A higher ROI indicates better performance, but it's important to consider the time frame and the risk associated with the investment. ROI can be calculated using the formula: ROI = (Net Profit / Initial Investment) * 100. This metric is widely used and easily understood, making it a popular choice for assessing investment returns.

Total Return: This metric provides a more holistic view by considering both the capital appreciation and the income generated from the investment. It represents the total growth in value over a specific period, including dividends, interest, or other distributions. Total return is particularly useful for long-term investments, as it captures the cumulative effect of compounding. Investors can compare different investment options by analyzing their total returns over time.

Risk-Adjusted Returns: To assess the true performance of an investment, it's essential to consider the risk taken. Risk-adjusted returns metrics, such as the Sharpe Ratio, provide a more nuanced understanding. The Sharpe Ratio measures the excess return per unit of volatility, giving investors an idea of how well an investment has performed relative to its risk. A higher Sharpe Ratio indicates better risk-adjusted returns. This metric is valuable for investors who want to evaluate the trade-off between risk and reward.

Time-Weighted Return: This metric is particularly useful for analyzing investment performance over varying time periods. It calculates the return on investment, taking into account the timing of investments and withdrawals. Time-weighted return ensures that the performance is not influenced by changes in the investment amount over time. It provides a fair comparison of investment strategies, making it an essential tool for investors and financial advisors.

CAGR (Compound Annual Growth Rate): CAGR is a powerful metric to understand the average annual growth rate of an investment over a specific period. It smooths out the volatility and provides a consistent measure of performance. CAGR is calculated by taking the geometric average of the annual returns and is expressed as a percentage. This metric is valuable for investors who want to assess the long-term growth potential of their investments.

By utilizing these performance metrics, investors can make informed decisions, compare investment options, and effectively communicate the value of their investments. Each metric offers a unique perspective, allowing for a comprehensive evaluation of investment returns and helping investors navigate the complex world of finance with confidence.

Salem's Investment: Town Secrets

You may want to see also

Tax Optimization: Discuss methods to minimize tax liabilities on investments

When it comes to tax optimization for investments, there are several strategies that can help minimize tax liabilities and maximize after-tax returns. One common approach is to take advantage of tax-efficient investment vehicles and account types. For example, contributing to a tax-deferred retirement account like a 401(k) or an Individual Retirement Account (IRA) can defer taxes on investment income until retirement, allowing for potential tax savings over time. Additionally, investing in tax-free municipal bonds can provide an income stream without federal income tax, and in some cases, state and local taxes, making it an attractive option for certain investors.

Another method to optimize tax payments is to engage in tax-loss harvesting. This strategy involves selling investments that have decreased in value to offset capital gains and use those losses to reduce taxable income. By strategically selling losing positions, investors can realize tax benefits while potentially maintaining or even improving their overall investment portfolio. It's important to note that tax-loss harvesting should be done carefully, considering the specific rules and limitations set by tax authorities to ensure compliance.

Furthermore, understanding the different types of investment income and their tax treatments is crucial. Ordinary income, which includes wages, interest, and certain dividend income, is taxed at regular income tax rates. On the other hand, capital gains and qualified dividends are typically taxed at lower rates, depending on the investor's income level. By recognizing the tax implications of each type of income, investors can make informed decisions about when and how to realize gains or losses to optimize their tax situation.

In addition to these strategies, investors should also consider the timing of their investment activities. For instance, long-term capital gains are generally taxed at more favorable rates than short-term gains. Holding investments for the long term can result in lower tax rates, making it a tax-efficient approach. Moreover, staying informed about changes in tax laws and regulations is essential, as these can significantly impact investment strategies and tax planning.

Lastly, consulting with a tax professional or financial advisor can provide valuable guidance tailored to an individual's specific circumstances. These experts can help navigate the complexities of tax laws, identify suitable investment options, and develop a comprehensive tax optimization plan. By combining these methods and staying proactive in tax planning, investors can effectively minimize their tax liabilities and enhance their overall financial well-being.

Diversity Pays Dividends: Unlocking Performance Through Inclusion

You may want to see also

Investment Strategy: Outline your approach to selecting and managing investment portfolios

When it comes to showcasing your investments on your net worth statement, it's important to provide a clear and comprehensive overview of your financial assets. Here's an investment strategy outline to help you approach this task effectively:

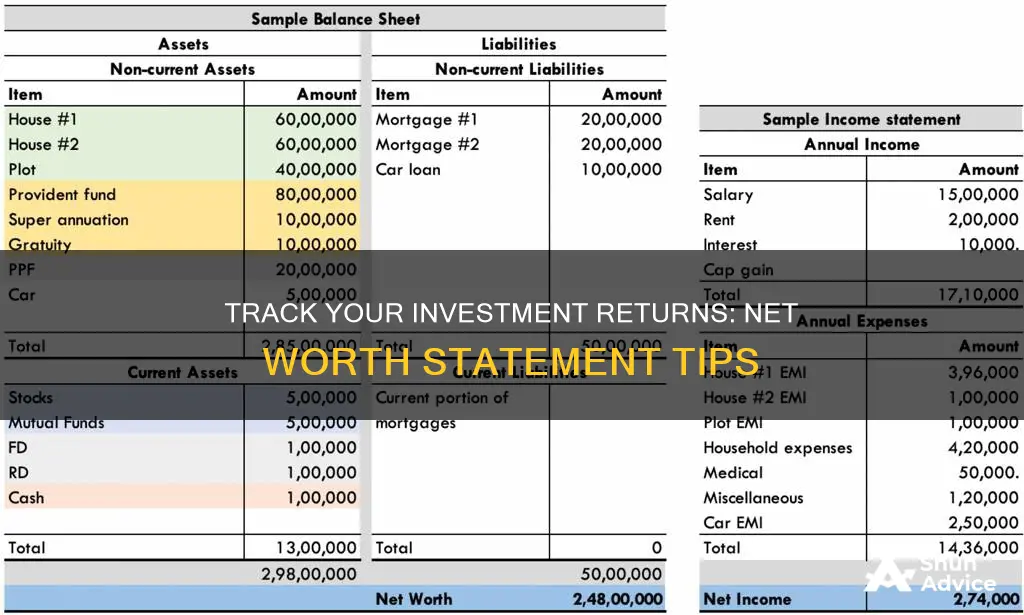

- Categorize and Prioritize: Begin by categorizing your investments into different asset classes such as stocks, bonds, real estate, mutual funds, or any other investment vehicles you hold. Prioritize these investments based on their value and significance in your overall portfolio. For instance, a large stake in a tech startup might be a significant asset, while a small holding in a diversified index fund could be considered a smaller investment.

- Detail the Holdings: For each category, provide a detailed list of the specific investments you own. Include the name of the investment, the purchase date, the purchase price, and the current market value or fair value. This level of detail is crucial for an accurate representation of your net worth. For instance, you could list "Apple Inc. (100 shares) purchased at $150 each, current value: $1,500" under the stocks category.

- Calculate Returns: Calculate the returns generated from each investment. This can be done by subtracting the purchase price from the current value and then dividing it by the purchase price. For example, if you bought 100 shares of Apple at $150 each and now hold them at $200 each, the return is ($200 - $150) / $150 = 33.33%. Repeat this calculation for all investments to get a clear picture of your overall investment performance.

- Consider Investment Strategies: Explain the strategies you employ to select and manage your investment portfolios. This could include a mix of active management, where you actively research and choose individual securities, or passive management, which involves investing in index funds or ETFs that track a specific market or sector. Describe your investment philosophy, such as whether you focus on long-term growth, income generation, or a balanced approach.

- Regular Review and Adjustment: Emphasize the importance of regularly reviewing and adjusting your investment portfolios. Market conditions and personal financial goals can change over time, so it's essential to stay updated. Periodically rebalance your portfolio to maintain your desired asset allocation. This process involves buying or selling assets to ensure your investments align with your risk tolerance and financial objectives.

By following this strategy, you can provide a transparent and detailed representation of your investments on your net worth statement, offering a comprehensive view of your financial assets and their performance. It also allows you to showcase your investment acumen and decision-making process to anyone reviewing your financial statement.

Vegetable Gardens: Healthy, Wealthy, Happy

You may want to see also

Frequently asked questions

To showcase your investments in your net worth statement, you should list all your investment assets, such as stocks, bonds, real estate, or any other financial investments. Assign a value to each asset based on its current market price or fair value. This will give you a clear picture of your total investments and their contribution to your overall net worth.

When valuing investments, it's important to use reliable and up-to-date information. You can use the current market price for publicly traded securities or consult professional appraisals for private investments. For real estate, you might consider using recent sales data of comparable properties. Ensure that your valuation method is consistent and provides an accurate representation of your investment portfolio.

Yes, it is recommended to include all significant investments in your net worth statement. This includes both liquid assets like stocks and mutual funds, as well as illiquid investments such as real estate, private equity, or collectibles. By providing a comprehensive list, you offer a transparent view of your financial situation and the sources of your wealth.