Social Security is a crucial component of retirement planning, offering financial security to individuals and their families. It works by investing a portion of your earnings into a trust fund, which then grows over time through interest and investment returns. This investment strategy ensures that your benefits are protected and can provide a steady income stream during retirement. Understanding how Social Security invests your money is essential for making informed decisions about your future financial well-being.

What You'll Learn

- Social Security Benefits: Understanding eligibility, types, and payment structures

- Investment Options: Diversification strategies, mutual funds, and retirement accounts

- Tax Implications: How Social Security impacts taxes and vice versa

- Estate Planning: Strategies to maximize benefits for heirs and beneficiaries

- Fraud Prevention: Recognizing and avoiding common scams related to Social Security

Social Security Benefits: Understanding eligibility, types, and payment structures

Social Security is a vital program designed to provide financial support to individuals and families who have reached retirement age or are facing certain disabilities or other qualifying conditions. It is a federal insurance program that offers a steady income stream to eligible individuals, ensuring a more secure future. Understanding the intricacies of Social Security benefits is crucial for anyone approaching retirement or facing potential eligibility.

Eligibility for Social Security benefits is primarily based on a combination of factors, including age, work history, and disability status. To be eligible for retirement benefits, individuals must have worked and paid Social Security taxes for a certain number of years, typically 10 years or more. The age requirement for retirement benefits varies, with full benefits becoming available at 66 or 67 years old for those born in or after 1943. For those who start receiving benefits earlier, the amount is permanently reduced, and the earlier the start, the greater the reduction. Additionally, spousal and survivor benefits are available to eligible family members, such as spouses, ex-spouses, and dependent children.

There are several types of Social Security benefits, each with its own set of eligibility criteria and payment structures. Retirement benefits, as mentioned, are for individuals who have reached the specified retirement age. These benefits are calculated based on an individual's earnings history and can be claimed as a monthly payment. Disability benefits are provided to individuals who have a severe medical condition that prevents them from engaging in substantial gainful activity and is expected to result in death or last for at least 12 months. The payment amount is determined by the individual's earnings record and the severity of the disability. Survivor benefits are available to the surviving spouse or children of a deceased worker, providing financial support during a challenging time.

The payment structure of Social Security benefits is designed to provide a steady income stream. Benefits are typically paid out on a monthly basis, ensuring a consistent financial cushion. The amount received is based on a formula that considers the individual's earnings history and the age at which benefits are claimed. For retirement benefits, the payment amount is calculated using a formula that takes into account the highest 35 years of earnings and adjusts for inflation. This ensures that the benefits keep pace with the rising cost of living.

Understanding the intricacies of Social Security benefits is essential for making informed decisions about one's financial future. It is a complex system, and eligibility, types of benefits, and payment structures can vary based on individual circumstances. Seeking guidance from the Social Security Administration or a financial advisor can help individuals navigate this system effectively and ensure they receive the benefits they are entitled to.

ETFs: Invest Now or Later?

You may want to see also

Investment Options: Diversification strategies, mutual funds, and retirement accounts

When it comes to investing in Social Security, understanding the various investment options and strategies is crucial for building a robust financial portfolio. Diversification is a key principle in investing, and it involves spreading your investments across different asset classes to minimize risk. This strategy is particularly important when dealing with Social Security, as it provides a safety net for your future income. Here's a breakdown of how you can approach diversification, along with the role of mutual funds and retirement accounts:

Diversification Strategies: Diversification is about allocating your investments in a way that reduces the impact of any single asset's performance on your overall portfolio. In the context of Social Security, this could mean investing in a mix of stocks, bonds, and other securities. One common approach is to create a balanced portfolio, often referred to as a 60/40 or 50/50 split. For instance, you might invest 60% of your Social Security funds in stocks, which offer the potential for higher returns but come with higher risk, and the remaining 40% in bonds, which are generally considered safer but provide lower returns. This strategy ensures that your portfolio can weather market fluctuations and provides a more stable long-term growth potential.

Mutual Funds: Mutual funds are an excellent tool for diversification. These funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. By investing in a mutual fund, you instantly gain exposure to a wide range of assets, reducing the risk associated with individual stock or bond selections. There are various types of mutual funds, including equity funds, bond funds, and balanced funds, each with its own level of risk and return potential. For Social Security investors, considering mutual funds that align with your risk tolerance and investment goals is essential. For example, a retirement-focused mutual fund might offer a mix of growth and income-generating assets, providing a balanced approach to investing for the long term.

Retirement Accounts: Utilizing retirement accounts is a strategic way to invest in Social Security. These accounts, such as 401(k)s or IRAs, offer tax advantages that can boost your savings over time. When investing through a retirement account, you can often choose from a variety of investment options, including mutual funds, index funds, and even direct stock or bond purchases. The key benefit is tax deferral, allowing your investments to grow faster. Additionally, many retirement accounts provide access to a wide range of mutual funds, making it easy to implement a diversification strategy. It's important to regularly review and adjust your retirement account investments to ensure they remain aligned with your financial goals and risk profile.

In summary, investing in Social Security involves a thoughtful approach to diversification, utilizing mutual funds, and taking advantage of retirement account benefits. By spreading your investments across different asset classes and vehicles, you can build a robust financial portfolio that is prepared for various market scenarios. Remember, diversification is a long-term strategy, and it's essential to regularly review and adjust your investments to stay on track with your financial objectives.

Retirement Planning: 401(k) Investors Count

You may want to see also

Tax Implications: How Social Security impacts taxes and vice versa

Understanding the tax implications of Social Security is crucial for anyone receiving benefits, as it can significantly impact your overall financial situation. When you start receiving Social Security benefits, these payments are generally taxable income, which means they are subject to federal income tax. The taxability of your benefits depends on your overall income and the rules set by the Internal Revenue Service (IRS). If your combined income (which includes Social Security benefits and other sources of income) exceeds a certain threshold, a portion of your benefits may be subject to taxation. This threshold varies each year and is adjusted for inflation. For instance, in 2023, the base amount of Social Security benefits that is taxable is $25,000 for single filers and $32,000 for married couples filing jointly.

The amount of tax you owe on your Social Security benefits can vary. Typically, you will pay income tax on up to 85% of your benefits if your income is above the specified thresholds. This means that if you have other sources of income, such as a pension or investments, and your total income pushes you over the threshold, a larger portion of your Social Security benefits may become taxable. It's important to note that the tax rules for Social Security benefits are complex and can vary depending on your individual circumstances.

On the other hand, paying taxes can also impact your Social Security benefits. When you pay taxes on your benefits, it doesn't directly reduce the amount you receive, but it can affect your overall financial planning. Additionally, if you have significant taxable income from other sources, you may be able to reduce the tax burden on your Social Security benefits by maximizing deductions and credits. For example, contributing to a Roth IRA or making charitable donations can help offset taxable income, potentially reducing the tax on your Social Security payments.

Furthermore, it's essential to consider the impact of Social Security on your tax obligations throughout the year. Social Security benefits are typically paid out monthly, and each payment is subject to the same tax rules. This means that if you receive a large Social Security payment in one month, it may push your income over the tax threshold, resulting in a higher tax liability for that month. Proper financial planning and understanding the tax implications can help you manage these fluctuations in income.

In summary, Social Security benefits have tax implications that can significantly affect your financial situation. Being aware of the tax rules and understanding how your Social Security income interacts with other sources of income is crucial. By managing your finances strategically and considering the tax impact, you can ensure that you are prepared for any tax obligations that may arise from receiving Social Security benefits. It is always advisable to consult with a tax professional or financial advisor to navigate these complexities and make informed decisions regarding your Social Security investments and tax planning.

Invest in Yourself: Your Greatest Asset

You may want to see also

Estate Planning: Strategies to maximize benefits for heirs and beneficiaries

Estate planning is a crucial aspect of financial management, especially for those who want to ensure their loved ones are taken care of and their assets are distributed according to their wishes. When it comes to maximizing benefits for heirs and beneficiaries, understanding the intricacies of social security and its investment potential is essential. Here are some strategies to consider:

Utilize Social Security Benefits Strategically: Social Security is a government-run program that provides financial support to retirees, disabled individuals, and surviving spouses. It is a valuable resource for many, but it can also be a tool in estate planning. One strategy is to delay claiming Social Security benefits until the highest possible age. By doing so, you can increase your monthly benefit amount, which can be significant over time. This delay strategy can result in larger payments for your heirs, as the benefits will continue to accrue interest. Additionally, consider the spousal benefit option, which allows a spouse to receive up to 50% of the other's benefit, depending on their age. This can be advantageous if one spouse has a higher earning record, ensuring a more substantial financial cushion for the surviving partner.

Invest in Diversified Assets: Maximizing benefits for heirs involves not only understanding Social Security but also investing wisely. Diversification is a key strategy to consider. By investing in a variety of assets such as stocks, bonds, real estate, and mutual funds, you can create a well-rounded portfolio. This approach reduces risk and provides a more stable foundation for your estate. For example, investing in dividend-paying stocks can generate a steady income stream, which can be passed on to beneficiaries. Real estate investments, such as rental properties, can also provide long-term wealth accumulation and potential tax benefits.

Consider Trust Funds: Establishing trust funds is an effective way to manage and protect assets for beneficiaries. A trust allows you to specify how and when assets are distributed. You can set up irrevocable trusts, which provide tax benefits and protect assets from potential creditors. For instance, you could create a trust that provides regular payments to beneficiaries during their lifetimes and then passes the remaining assets to heirs upon your passing. This strategy ensures a steady income stream for beneficiaries and provides control over the distribution process.

Review and Update Regularly: Estate planning is not a one-time task; it requires regular review and updates. Life events, such as marriages, births, or significant financial changes, may necessitate adjustments to your plan. Reviewing your will, trusts, and beneficiary designations periodically ensures that your wishes are up-to-date and aligned with your current circumstances. Additionally, stay informed about changes in Social Security laws and investment opportunities to make informed decisions that maximize benefits for your heirs.

By implementing these strategies, you can effectively navigate the complexities of estate planning and ensure that your heirs and beneficiaries receive the maximum benefits from your financial resources, including a well-structured Social Security investment plan. It is essential to seek professional advice tailored to your specific situation, as estate planning can be highly personalized.

The Power of Self-Investment: Unlocking Your True Potential

You may want to see also

Fraud Prevention: Recognizing and avoiding common scams related to Social Security

Social Security is a critical financial support system for many Americans, providing income and benefits to retirees, the disabled, and the deceased. However, the very nature of this system makes it an attractive target for fraudsters who seek to exploit vulnerable individuals and institutions. Understanding the common scams and implementing fraud prevention measures are essential to safeguarding your Social Security benefits and personal information.

One prevalent scam involves identity theft, where fraudsters steal personal information to gain access to Social Security accounts. They may use various methods such as phishing emails, phone calls, or even physical theft of documents. These criminals often pose as Social Security representatives, offering to "help" with benefit claims or account management. They request sensitive data like Social Security numbers, birth dates, and bank account details, which they then use to take control of the victim's account and potentially withdraw funds. To avoid this, it is crucial to verify the identity of anyone requesting personal information. Never provide such details over the phone or via email unless you have initiated the contact and are certain of the person's legitimacy.

Another common scam is the "imposter" scheme, where fraudsters impersonate government officials or Social Security representatives to gain trust. They may call or write to individuals, claiming there is an issue with their Social Security account or that they are owed a refund. These imposters often use official-sounding language and may even have some personal details about the victim, making their deception more convincing. Always be wary of unexpected contact, especially if it involves financial requests. Contact the Social Security Administration directly through their official channels to verify any such claims.

Scammers also target individuals who are eligible for Social Security benefits but may not be aware of their rights. They might offer to help these individuals increase their benefits or provide early access to funds in exchange for a fee. While some legitimate organizations provide such services, it is essential to thoroughly research and choose reputable providers. Always check the credentials of any company offering to assist with Social Security matters and be cautious of high-pressure sales tactics.

To protect yourself, stay informed about the latest fraud schemes and be vigilant with your personal information. Regularly review your Social Security statements and account activity, and report any suspicious activity immediately. Educate yourself and others about the potential risks and stay updated on the Social Security Administration's guidelines for fraud prevention. By recognizing these common scams and taking proactive measures, you can help ensure the security of your Social Security benefits and contribute to a safer financial environment.

Insurance as Investment: A Risky Gamble or Safe Bet?

You may want to see also

Frequently asked questions

Social Security investments are a strategy used by the Social Security Administration (SSA) to ensure the long-term financial stability of the program. When beneficiaries receive their Social Security payments, a portion of these funds is invested in special trust funds, which are managed by the U.S. Treasury. These investments earn interest and help to grow the trust fund balances, ensuring that there are sufficient funds to pay future benefits. The SSA carefully manages these investments to maintain a balanced portfolio, typically consisting of a mix of government securities and other low-risk assets.

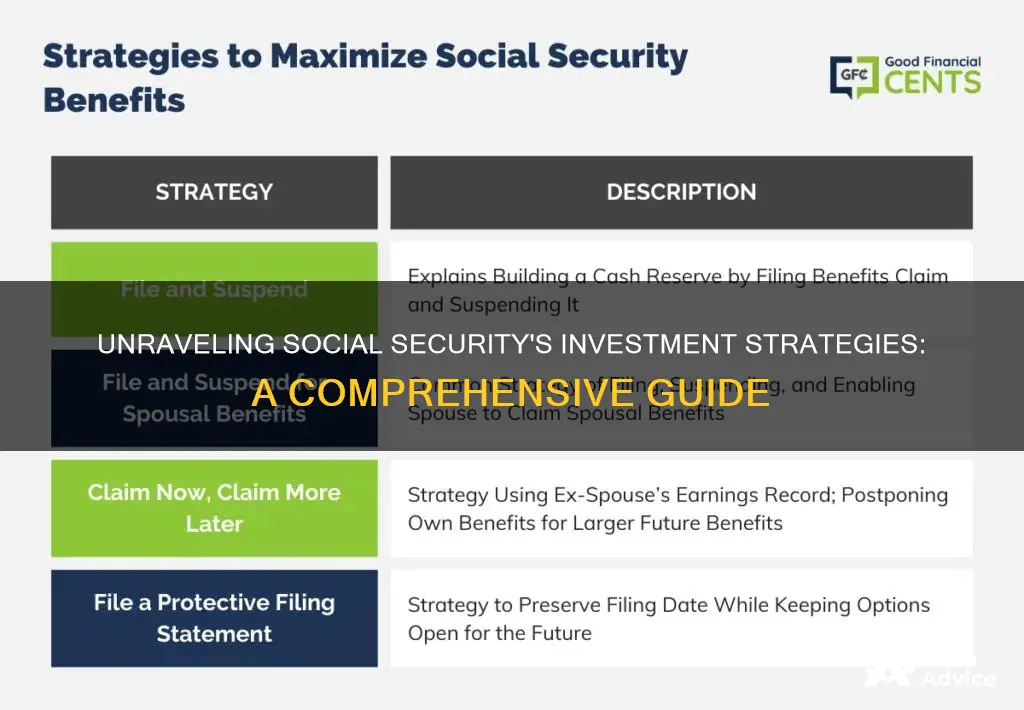

While you cannot directly invest in the Social Security trust funds, you can take steps to optimize your Social Security benefits. One way is to consider your claiming strategy. Delaying your Social Security retirement benefits until a later age can result in higher monthly payments due to the delayed retirement credit. Additionally, you can explore options like the spousal benefit, which allows you to claim benefits based on your spouse's earnings record, potentially increasing your overall income. It's also beneficial to review and optimize your work history to ensure accurate earnings records, as higher earnings can lead to higher benefits.

The Social Security Trust Fund plays a crucial role in retirement planning for many Americans. It is a reserve of assets, primarily consisting of government securities, that are used to pay Social Security benefits. The trust fund's investments generate interest, and the interest earned is used to pay benefits when the fund's principal is depleted. The SSA regularly monitors the trust fund balances and makes adjustments to ensure the program's solvency. Understanding the health of the trust fund is essential for individuals planning their retirement, as it can impact the sustainability of Social Security benefits over the long term.