Building a balanced investment portfolio is an art that requires a combination of cash, bonds, and stocks to help manage risk and maximise return potential. The ideal investment portfolio is unique to each individual and is influenced by factors such as their financial situation, short- and long-term financial objectives, and tolerance for risk. While there is no one-size-fits-all approach, a well-balanced portfolio typically includes a mix of assets, such as stocks, bonds, mutual funds, exchange-traded funds, and cash.

The key to maintaining a balanced portfolio is regular rebalancing, which involves adjusting your investments to ensure they align with your desired level of risk and investment goals. This is because the value of investments can fluctuate over time, causing your portfolio to become lopsided. By rebalancing, you can ensure your portfolio continues to support your long-term goals and reflects your tolerance for risk.

| Characteristics | Values |

|---|---|

| Purpose | Achieve your desired proportions of risk and return potential |

| Balancing | Ensure a mix of investment assets appropriate for your risk tolerance and investment goals |

| Rebalancing | Maintain your desired level of risk over time |

| Time Interval | Once or twice a year |

| Diversification | Divide your money among asset classes to reduce risk |

| Asset Allocation | Determined by your goals, investment horizon, need for capital, and tolerance for risk |

What You'll Learn

Diversify your portfolio

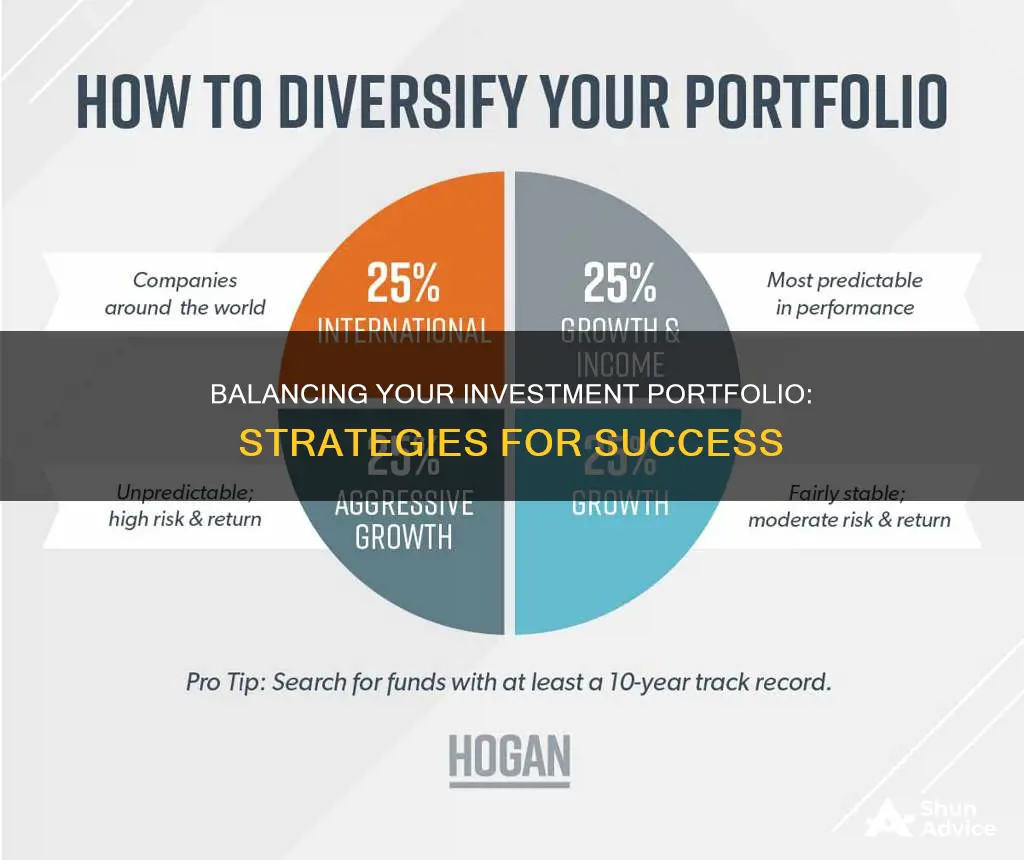

Diversifying your portfolio is a key part of balancing your investments. Diversification is the process of dividing your money among different asset classes to reduce risk. It's a way to smooth out the ups and downs your portfolio could go through if you hold too few or too similar investments. By diversifying, you spread your money across different investment types, giving you more options and control over your portfolio.

There are several ways to diversify your portfolio:

- Diversify across asset classes: The main asset classes are stocks, bonds, and cash. Within these broad categories, there are sub-asset classes and different styles. For example, within stocks, there are large, small, and mid-cap stocks, as well as growth, value, and blend styles. You can also invest in foreign and domestic stocks, and within foreign stocks, you can choose stocks from developed countries or emerging markets. Bonds also come in different types, such as government and corporate bonds.

- Diversify across industries and sectors: The performance of stocks can vary significantly depending on the industry and sector. For example, the factors influencing stocks in the technology sector may be very different from those in the energy sector.

- Diversify across bond types: The price of a bond is influenced by factors such as the time until maturity, the credit quality of the issuer, and the rate of exchange. By investing in different types of bonds, you can reduce the risk associated with any single type.

- Diversify using mutual funds and exchange-traded funds (ETFs): Mutual funds and ETFs are great tools for diversifying your portfolio. These funds are typically invested in a specific asset class, such as stocks, bonds, or cash, but some are a mix of different asset classes. By investing in several mutual funds and ETFs, you can gain exposure to a wide range of securities and benefit from their diversification. Additionally, these funds offer a cost-effective way to diversify for investors with a limited amount of capital.

- Diversify across regions: Investing in different countries and economies can help spread the risk associated with any single market or currency.

It's important to note that diversification does not eliminate investment risk completely. Financial crashes and global events can affect all investments simultaneously. However, diversification is still a crucial strategy for reducing risk and enhancing the risk-adjusted returns of your portfolio.

Invest Wisely for Your Grandchild's Future: A Guide

You may want to see also

Assess your risk tolerance

When balancing an investment portfolio, assessing your risk tolerance is crucial. It's one of the most important factors in building your portfolio and choosing your investments. Your risk tolerance is influenced by factors such as your age, financial situation, goals, and comfort with risk.

- Understand your financial situation: Consider your current income, expenses, and financial obligations. If you have a stable financial cushion and can afford potential losses, you may be more comfortable taking on higher-risk investments.

- Define your investment goals: Are you investing for retirement, saving for a down payment on a house, or pursuing other financial objectives? Each goal will have a different time horizon and risk profile. For example, if you're investing for retirement, you might have a longer time horizon and be more willing to take on risk.

- Evaluate your time horizon: Your risk tolerance is closely tied to the amount of time you plan to invest. If you're a young investor with a long time horizon, you can generally afford to take on more risk, as you have more time to recover from potential market downturns. As you approach retirement, you may want to shift towards more conservative investments to preserve your capital.

- Assess your comfort with risk: How do you feel about market volatility and potential losses? Are you comfortable with aggressive investments that offer higher return potential but come with higher risk, or do you prefer a more conservative approach with lower risk? Be honest with yourself about your risk tolerance to ensure you're comfortable with your investment strategy.

- Consider diversification: Diversification is a risk management technique where you spread your investments across various asset classes, industries, and individual securities. By diversifying your portfolio, you can reduce the impact of any single investment on your overall financial health. This can help you manage risk and maximise return potential.

- Seek professional advice: Consult a financial advisor or a wealth management advisor to help you assess your risk tolerance accurately. They can provide valuable insights and guidance based on your unique circumstances and goals.

Remember, assessing your risk tolerance is an essential step in creating a balanced investment portfolio. It ensures that your investments align with your financial situation, goals, and comfort level with risk.

Invest Less, Save More: Strategies for Financial Success

You may want to see also

Determine asset allocation

Balancing your investment portfolio is an important task that requires careful consideration of your financial goals, risk tolerance, and investment timeframe. Here are some detailed instructions on determining your asset allocation to create a balanced portfolio:

Determine your financial goals and risk tolerance:

Start by understanding your unique financial objectives and risk appetite. Are you investing for retirement, or do you have other specific goals in mind? Assess how comfortable you are with taking on risk. If you have a low tolerance for risk, you may want to allocate a larger portion of your portfolio to less risky assets like bonds and cash. On the other hand, if you are willing to take on more risk for potentially higher returns, you may lean more towards stocks.

Identify your investment timeframe:

Consider your investment horizon, which is the amount of time you plan to invest for. If you are investing for the long term, such as for retirement, you may have a longer timeframe that allows for potential recovery from market downturns. This could influence your asset allocation, as certain investments may be more suitable for longer-term goals.

Understand the different asset classes:

Familiarize yourself with the main asset classes: stocks (equities), bonds, and cash. Stocks are typically considered high-risk, high-reward investments, while bonds are generally less risky. Cash, on the other hand, tends to be a stable, low-risk option but may offer lower returns. Understanding the characteristics of each asset class will help you make informed decisions about your asset allocation.

Allocate your assets:

Once you have a clear understanding of your financial goals, risk tolerance, and investment timeframe, you can start allocating your assets. Decide on the percentage of your portfolio you want to allocate to each asset class. For example, you may choose to allocate 60% to stocks, 40% to bonds, or adjust these percentages based on your specific circumstances. Keep in mind that there is no one-size-fits-all approach, and your asset allocation should be tailored to your individual needs and goals.

Diversify within asset classes:

Diversification is a crucial aspect of determining your asset allocation. It involves spreading your investments across different types of assets to reduce risk. For example, if you decide to allocate 60% of your portfolio to stocks, you can further diversify by investing in a mix of foreign and domestic stocks and stocks with different market capitalizations. Similarly, you can diversify your bond holdings by investing in a combination of government and corporate bonds with different terms and types. Diversification helps to minimize the impact of market fluctuations and improve the overall risk-reward profile of your portfolio.

Remember, determining your asset allocation is a personal process that depends on your specific circumstances. It's always a good idea to seek the guidance of a financial advisor or professional who can help you assess your goals, risk tolerance, and investment timeframe to create a customized asset allocation strategy.

Investing vs. Saving: Which is Riskier?

You may want to see also

Rebalance regularly

The financial markets and your life are ever-changing, so it's important not to adopt a "set it and forget it" approach to your portfolio. Regularly monitor your portfolio and rebalance your investments and asset classes to ensure they continue to align with your risk tolerance, investment goals, and time until you retire. Changes in the markets can cause asset allocations to deviate from their target, so periodically reviewing your portfolio will help you make any necessary adjustments to stay on track.

It is recommended to rebalance at least once or twice a year, or at specific time intervals such as yearly. However, you can also choose to rebalance only when your portfolio becomes clearly unbalanced.

There are a few ways to bring your portfolio back into balance:

- Funnel stock dividends towards underperforming asset classes until you reach your desired allocation.

- Purchase new investments within underweighted asset classes until things balance out.

- Sell portions of high-performing assets and use the proceeds to invest in asset classes that you want to boost.

For example, if your desired asset allocation is 70% stocks and 30% bonds, and over time it has shifted to a 75/25 split, you can sell off some stocks and invest in bonds to restore the balance.

Just be mindful of potential costs and tax implications. For instance, selling investments from a taxable account may result in capital gains tax. To avoid this, you could consider rebalancing strictly within tax-advantaged accounts.

Savings and Investments: Economy's Growth Engine

You may want to see also

Consider your goals

When balancing an investment portfolio, it is important to consider your goals. These goals will determine your risk tolerance, investment horizon, need for capital, and the types of assets you will include in your portfolio.

Firstly, you should understand why you are investing in the first place. What do you want to achieve, and how long are you willing to wait? Setting specific and meaningful investment goals will help you determine the level of risk you are willing and able to take. For example, if you are investing for retirement, you need to determine when you plan to retire and how much money you will need. This will influence the types of assets you choose to include in your portfolio.

Your risk tolerance will also depend on your life stage and financial situation. For instance, younger investors may have a longer-term outlook, demand higher returns, and be willing to tolerate bigger swings in asset prices. As a result, their portfolio balance will likely include higher-risk assets with greater potential for growth. On the other hand, older investors may have a shorter time horizon and a lower risk appetite, preferring more predictable and less volatile assets that offer high security and liquidity.

Additionally, consider your short-term and long-term financial objectives. For instance, if you are saving for a down payment on a house in the next year, you may opt for more conservative investments such as bonds and cash. In contrast, if you are investing for retirement that is many years away, you can afford to take on more risk by investing in stocks, which have the potential for higher returns.

Finally, it is important to note that your goals may change over time, and you should regularly review and rebalance your portfolio to ensure it remains aligned with your current objectives and risk tolerance.

The Emotional Rewards of Saving and Investing

You may want to see also

Frequently asked questions

A balanced investment portfolio is a combination of all your investments, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and money market accounts. It should be tailored to your financial situation, risk tolerance, age, and investment goals.

First, determine your financial goals, risk tolerance, and investment timeframe. Then, decide on the asset allocation that aligns with your goals, typically a mix of stocks, bonds, and cash. Diversify your portfolio by dividing your money across different asset classes to reduce risk.

It is recommended to review and rebalance your portfolio at least annually or after significant life events. Portfolios naturally get out of balance as the prices of individual investments fluctuate over time.

An imbalanced portfolio may lead to higher risks and potential losses if heavily invested in high-risk assets. On the other hand, playing it too safe may hamper growth and prevent you from generating desired returns.