Building a model investment portfolio can be a challenging task, especially for new advisors who need to determine how to invest their clients' money. The process involves several steps, from assessing the client's financial situation and goals to selecting the right investment strategies and regularly rebalancing the portfolio. Here are some key considerations for creating a successful model investment portfolio:

- Determining Asset Allocation: The first step is to understand the client's financial situation, including their age, investment horizon, capital amount, future income needs, and risk tolerance. This information will guide the asset allocation strategy.

- Choosing Investments: Select individual assets or securities that align with the client's goals and risk profile. This may include stocks, bonds, mutual funds, or exchange-traded funds (ETFs).

- Diversification: Diversifying the portfolio across different asset classes, sectors, and industries is crucial to managing risk and enhancing returns.

- Regular Reassessment and Rebalancing: Portfolios should be periodically analysed and rebalanced to ensure they remain aligned with the client's goals and risk tolerance. This involves monitoring the performance of investments and making necessary adjustments.

- Client Communication: Advisors should focus on communicating the overarching investment philosophy rather than discussing individual securities. This helps clients understand the strategy and makes it easier to stick to the plan during market volatility.

- Efficiency and Scalability: Model portfolios should be designed for efficiency and scalability. Standardized allocations that can be applied to multiple clients with similar financial objectives and risk tolerances can save time and streamline the investment process.

- Risk and Return Management: It is essential to understand and manage investment risk. Discretionary Fund Managers (DFMs) can assist in creating model portfolios that balance risk and return to meet the client's financial goals.

| Characteristics | Values |

|---|---|

| Number of model portfolios | 1-5 |

| Investment philosophy | Conservative, balanced, or growth |

| Investment approach | Value approach |

| Investment types | Stocks, funds, bonds, equities, mutual funds, ETFs, etc. |

| Investment selection | Based on financial objectives and risk tolerance |

| Back-testing | Use tools like Morningstar Advisor Workstation |

| Rebalancing | Calendar rebalancing (quarterly, semi-annually, or annually) |

| Tax implications | Consider capital gains taxes when selling assets |

| Diversification | Ensure diversification within asset classes and subclasses |

| Client communication | Focus on overarching philosophy rather than individual securities |

| Liquidity | Ensure selected securities are liquid enough for potential high demand |

What You'll Learn

Determining asset allocation

- Age and Time Horizon: Your age and the amount of time you have to grow your investments are crucial factors. Younger investors, like Sean O'Byrne, a 19-year-old student, have a longer time horizon, allowing them to take on more risk and focus on growth.

- Capital and Income Needs: Consider the amount of capital you have to invest and your future income needs. For example, a 22-year-old college graduate starting their career may have different investment needs from someone closer to retirement.

- Risk Tolerance: Assess your willingness to take on risk. Can you tolerate potential losses in pursuit of higher returns? While higher returns are desirable, it's important to determine if you're comfortable with the associated volatility and potential short-term drops in investment value.

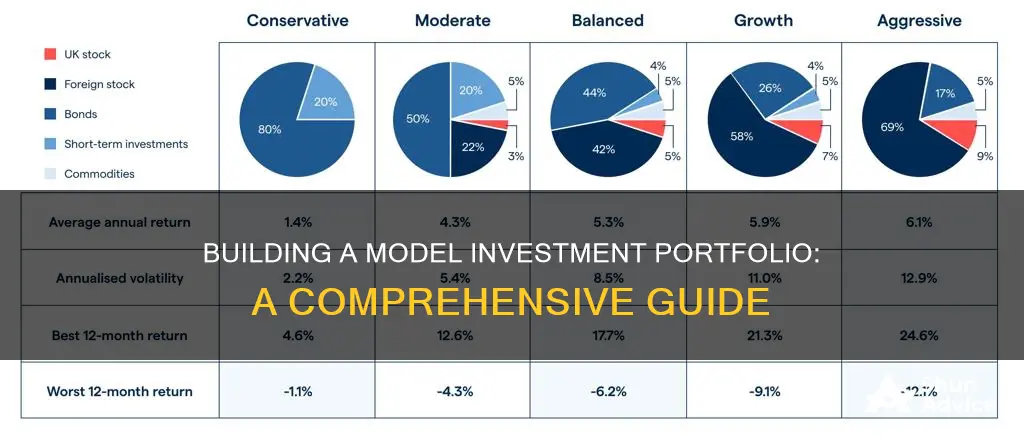

- Conservative vs. Aggressive Investors: Your risk tolerance will dictate the composition of your portfolio. More risk-averse, conservative investors will have a higher allocation of bonds and other fixed-income securities, while aggressive investors will allocate more to equities.

- Investment Philosophy: Determine your overarching investment philosophy, such as a value-based approach, to guide your security selection. This helps maintain consistency and makes it easier to manage your portfolio.

- Diversification: While diversification is essential, avoid over-diversifying. Start with a focused selection of investments and gradually expand as you gain more capital.

- Tax-Sheltered Accounts: Consider using tax-sheltered accounts, such as a TFSA (Tax-Free Savings Account) or an RRSP (Registered Retirement Savings Plan), to maximize tax efficiency, especially if you're a high-income earner.

- Personal Interests: Align your investments with your interests and values. For example, Sean O'Byrne, an engineering student, invested in the large Canadian engineering firm SNC Lavalin.

- Growth Potential: As a young investor, embrace some risk and focus on growth companies that can ride out market volatility. Canadian growth companies like Dollarama or Gildan Activewear could be good options.

- Education and Research: Enhance your financial literacy by attending annual meetings, checking SEDAR for financial filings, and staying informed about companies and stocks. This knowledge will empower you to manage your portfolio confidently.

How to Allocate Your Money: Rent, Savings, Investments, and Utilities

You may want to see also

Achieving the portfolio

Once you have determined the right asset allocation for your investment goals and risk tolerance, you can start building your portfolio. This involves dividing your capital between different asset classes, such as equities and bonds, and their subclasses, which carry different risks and offer different potential returns. For example, you may choose to divide the equity portion of your portfolio between different industrial sectors, market capitalizations, and domestic and foreign stocks.

When choosing the individual assets for your portfolio, you can select stocks, bonds, mutual funds, or exchange-traded funds (ETFs). If you opt for stocks, consider the level of risk you want to take, the sector, market cap, and stock type. Analyze potential stocks using screeners, and then conduct a more in-depth analysis of each stock's opportunities and risks. This method requires regular monitoring of price changes and staying up-to-date with company and industry news.

If you choose bonds, consider factors such as the coupon, maturity, bond type, credit rating, and the interest rate environment. Mutual funds are another option, where fund managers research and pick stocks or bonds for you, although this service comes with a fee. Index funds and ETFs are passively managed, mirror an established index, and usually have lower fees.

When selecting assets, it's crucial to analyze the quality and potential of each investment and ensure they align with your investment strategy. Additionally, consider the liquidity of each security, especially if you're an advisor managing multiple client portfolios.

Building Model Portfolios

If you're an investment advisor, creating model portfolios can enhance efficiency and consistency in managing multiple client portfolios. A model portfolio is a predetermined strategy based on a specific investment philosophy, such as conservative, balanced, or growth. When meeting with clients, focus on discussing the overarching philosophy rather than individual securities. This approach simplifies portfolio management and helps clients understand your investment strategy.

When building model portfolios, aim for one to five models that can be adapted to most client situations. Having too many models can become cumbersome and defeat the purpose of streamlining your processes. Ensure that each security you select is liquid enough to allow for easy buying and selling.

Back-Testing and Rebalancing

Before implementing a model portfolio, back-test its historical performance to gauge how it would have fared in different market conditions. Once you've optimized the model, transfer it into your portfolio management software and assign appropriate client accounts.

Remember that rebalancing is a crucial component of portfolio management. Develop a defined strategy for rebalancing, and communicate its purpose and timing to your clients. Calendar rebalancing, done quarterly, semi-annually, or annually, is a common approach. Specify a rebalancing threshold, typically above 3% or 5%, or use a dollar amount to limit smaller transactions and unnecessary costs.

Consider the tax implications of rebalancing, as selling assets may generate capital gains or losses. Additionally, factor in expenses, alternative investments, dividends, and withdrawals when determining your rebalancing strategy.

Retirement Planning: Understanding 401(k) Investment and Savings Plans

You may want to see also

Reassessing weightings

Once you have an established portfolio, it's important to periodically analyse and rebalance it. Changes in price movements may cause your initial weightings to change. To assess your portfolio's actual asset allocation, categorise your investments quantitatively and determine their values' proportion to the whole.

Your current financial situation, future needs, and risk tolerance are likely to change over time, and you may need to adjust your portfolio accordingly. For example, if your risk tolerance has dropped, you may need to reduce the number of equities held. Alternatively, if you're now seeking more significant risks, your asset allocation may require that a small proportion of your assets be held in more volatile small-cap stocks.

To rebalance, determine which of your positions are overweighted and underweighted. For instance, if you are holding 30% of your current assets in small-cap equities, but your asset allocation strategy suggests you should only have 15% of your assets in that class, you need to decide how much of this position to reduce and allocate to other classes.

When rebalancing, consider the tax implications of selling assets. For example, if you sell all your equity positions to rebalance your portfolio, you may incur significant capital gains taxes. In this case, consider not contributing any new funds to that asset class in the future, instead contributing to other asset classes to reduce its weighting over time without tax consequences.

Also, consider the outlook of your securities. If you suspect that overweighted stocks are due to fall, you may want to sell despite the tax implications. Analyst opinions and research reports can be useful tools to help predict the outlook for your holdings. Additionally, tax-loss selling can be a strategy to reduce tax implications.

Vanguard Investment Strategies: Choosing Your Portfolio

You may want to see also

Rebalancing strategically

Once you have determined which securities to reduce and by how much, decide on the underweighted securities you will buy with the proceeds from selling overweighted securities. To choose your securities, use the approaches discussed in Step 2.

When rebalancing and readjusting your portfolio, consider the tax implications of selling assets at a particular time. For example, if you were to sell all of your equity positions to rebalance your portfolio, you may incur significant capital gains taxes. In this case, it might be more beneficial to simply not contribute any new funds to that asset class in the future while continuing to contribute to other asset classes. This will reduce your growth stocks' weighting in your portfolio over time without incurring capital gains taxes.

At the same time, always consider the outlook of your securities. If you suspect that those same overweighted growth stocks are ready to fall, you may want to sell them, despite the tax implications. Analyst opinions and research reports can be useful tools to help gauge the outlook for your holdings. And tax-loss selling is a strategy you can apply to reduce tax implications.

Throughout the entire portfolio construction process, it is vital to maintain diversification. It is not enough to simply own securities from each asset class; you must also diversify within each class. Ensure your holdings within a given asset class are spread across an array of subclasses and industry sectors.

Remember, investors can achieve excellent diversification by using mutual funds and ETFs. These investment vehicles allow individual investors with relatively small amounts of money to obtain the economies of scale that large fund managers and institutional investors enjoy.

- Taxes: Selling assets can trigger capital gains and losses. Understanding your client's tax situation will give you time to offset any gains before the end of the year.

- Expenses: Rebalancing can generate costly transaction charges. Generally, only rebalance when the benefits outweigh the costs.

- Alternative investments: Assets like real estate, managed futures, and hedge funds can pose a rebalancing challenge. You may need to reallocate around some of these illiquid asset classes.

- Dividends: Should you reinvest dividends or put them into a cash sweep account? By putting dividends into cash, you may be able to use the money to balance out asset classes and avoid selling off winners.

- Withdrawals: Withdrawals can throw off your allocation. Try to plan ahead and leave money in cash to cover foreseeable withdrawals and your advisory fee. When you need to raise funds for a withdrawal, consider selling off overweighted positions to bring the portfolio closer to the recommended allocation.

Building an Investment Portfolio: A College Graduate's Guide

You may want to see also

Managing risk and return

The goal of an investment portfolio is to generate returns over time while managing risk. The first step in building a model investment portfolio is to determine your risk tolerance. Generally, younger investors have a higher risk tolerance and can take on more risk, while older investors tend to opt for lower-risk investments.

Once you have determined your risk tolerance, you can start thinking about asset allocation. Asset allocation is the process of spreading your investments across different asset classes such as stocks, bonds, cash, and real estate. Stocks are typically riskier but offer higher returns, while bonds are considered safer but tend to generate lower returns. Cash and cash equivalents like savings accounts and money market funds are the lowest-risk asset class.

To further reduce risk, you can diversify your portfolio by investing in different industries or sectors. Diversification helps to lower the risk of losses by spreading your investments across various assets.

Another strategy for managing risk is to adopt a passive or active portfolio management approach. Passive management aims to match the market's returns by replicating a specific market index, while active management involves buying and selling stocks to try to beat the market's performance. Active management may provide higher returns but comes with higher costs and market risk.

Additionally, you can consider using model portfolios, which are pre-designed portfolios managed by investment companies. Model portfolios can provide a cost-effective and diversified approach to investing, but they may lack flexibility and customization. They typically have lower fees than hedge funds or actively managed mutual funds but are not fee-free.

Finally, it is important to regularly rebalance your portfolio to maintain your desired asset allocation. Over time, the performance of different asset classes will vary, and you may need to sell some investments that have done well and invest in other areas to stay aligned with your financial goals and risk tolerance.

Who Runs Berkshire's Investment Portfolio?

You may want to see also

Frequently asked questions

The first step is to determine your asset allocation, which should be based on your individual financial situation, goals, and risk tolerance. This will help you decide how your investments should be allocated among different asset classes.

You can choose individual stocks, bonds, or other securities that align with your asset allocation strategy and risk tolerance. Alternatively, you can invest in mutual funds or exchange-traded funds (ETFs), which offer diversification and are managed by professionals.

It is recommended to create between one and five model portfolios that can be adapted to suit most client situations. This allows for efficiency and consistency in managing multiple client portfolios.

Regularly reassess and rebalance your model portfolio to ensure it remains suitable for your client's needs. Monitor price movements and changes in your client's financial situation, risk tolerance, and future needs, and make adjustments as necessary.