Building an investment portfolio can be a daunting task, but it is a necessary step towards achieving your financial goals. An investment portfolio is a collection of financial investments or 'asset classes', such as stocks, bonds, exchange-traded funds (ETFs), cash and its equivalents.

Before building your portfolio, it is essential to understand your financial goals, risk tolerance, and investment strategy. Your portfolio should be tailored to your specific needs and comfort with risk.

1. Determine your financial goals: Are you saving for retirement, a house deposit, or your child's education? Each goal will have a different timeline and risk profile, which will influence your investment choices.

2. Assess your risk tolerance: How much risk are you comfortable with? Are you willing to accept potential losses for the chance of higher returns? Your age, investment horizon, and personality will play a role in this assessment.

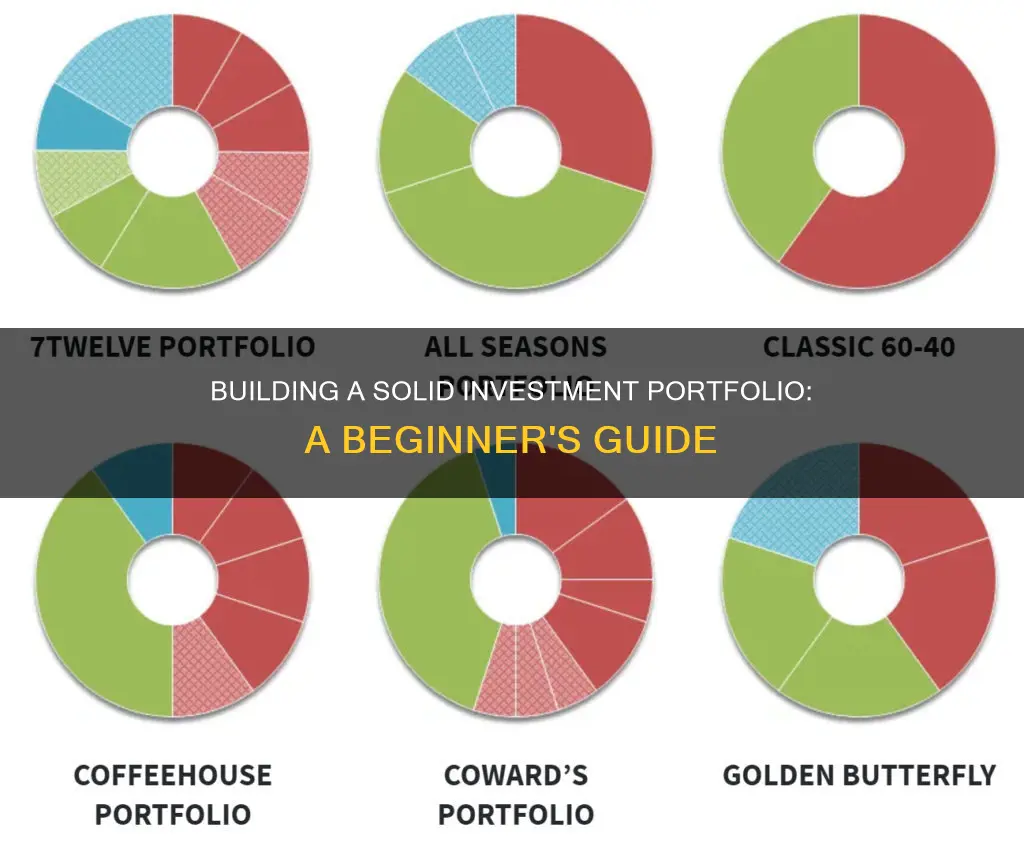

3. Choose your investments: Decide on the types of assets you want to include in your portfolio, such as stocks, bonds, mutual funds, or ETFs. Diversification is key to managing risk, so spread your investments across different asset classes, industries, and companies.

4. Select an investment account: Choose an account that aligns with your goals. For example, a taxable brokerage account for non-retirement goals or a tax-advantaged retirement account like a 401(k) or IRA.

5. Monitor and rebalance: Regularly review the performance of your investments and adjust as needed to maintain your desired asset allocation.

Remember, investing carries inherent risks, and there are no guarantees of returns. Always do your research, understand the risks involved, and consider seeking independent financial advice if needed.

| Characteristics | Values |

|---|---|

| Investment portfolio | A collection of financial investments or 'asset classes' |

| Investment portfolio example | S&P 500 index fund, small-cap and mid-cap stocks, non-U.S. stock markets, bonds, ETFs, mutual funds, 401(k) plan, IRA |

| Risk tolerance | Refers to your ability to accept investment losses in exchange for the possibility of higher investment returns |

| Asset allocation | The strategy for investing, involving picking what types of investment to hold |

| Diversification | Spreading your money across multiple types of investments to smooth out returns in the long run |

| Types of assets | Shares, bonds, alternatives like gold, real estate, cash equivalents, commodities, mutual funds, exchange-traded funds (ETFs) |

| Investment accounts | Tax-advantaged retirement account (e.g. 401(k), IRA), taxable brokerage account |

What You'll Learn

Understanding your risk tolerance

If your financial goal is many years away, you have more time to ride out the highs and lows of the market, which will allow you to take advantage of the market's general upward progression. On the other hand, if you are approaching retirement and your risk tolerance is lower, you may want to concentrate your portfolio more heavily in lower-risk investments such as bonds.

Your personality and risk tolerance should also be considered. Ask yourself if you are willing to hazard the potential loss of some money for the possibility of greater returns. Everyone wants high returns, but if you can't sleep at night when your investments take a short-term drop, the stress may not be worth it.

Clarifying your current situation, future capital needs, and risk tolerance will determine how your investments should be allocated among different asset classes. The possibility of greater returns comes at the expense of greater risk of losses (known as the risk/return trade-off). You don't want to eliminate risk altogether, but rather optimise it for your individual situation and lifestyle. For example, a young person who won't be dependent on their investments for income can afford to take greater risks in the quest for high returns.

As a general rule, investors who are many years away from retirement can afford to take greater risks by investing more in shares. For those approaching retirement, it is sensible to gradually lower the amount invested in shares and increase exposure to bonds, which typically offer less fluctuation in returns.

It is also important to remember that, on average, people live for over two decades after stopping work, so it is recommended that investors continue to hold some shares well into their retirement.

Roth Accounts: Savings or Investment?

You may want to see also

Choosing your investments

When it comes to choosing your investments, it's important to remember that there is no one-size-fits-all approach. The right investments for you will depend on your financial goals, risk tolerance, and time horizon. Here are some things to keep in mind when selecting your investments:

- Diversification: Spreading your money across multiple types of investments, or asset classes, is key to managing risk. Different investments perform well at different times, so having a mix can help smooth out returns over the long run. This includes investing in a mix of shares, bonds, and alternative assets like gold or real estate.

- Risk and return: Shares are generally riskier but offer higher potential returns, while bonds are considered safer but typically have lower returns. Your risk tolerance will depend on your financial goals, personality, and how much time you have to invest. If you're investing for the long term, you may be able to take on more risk as you have time to recover from any losses.

- Investment types: You can invest in individual stocks, but many people choose to invest in funds, such as mutual funds or exchange-traded funds (ETFs), which offer instant diversification by holding a collection of stocks or other assets. Index funds, for example, aim to match the performance of a specific market index.

- Tax considerations: Diversifying your investments can also help with tax exposure. For example, investing in a combination of traditional and Roth accounts can save you money on taxes now and in the future.

- Research and analysis: It's important to do your research when selecting individual stocks. Look at financial statements, quarterly and annual reports, and use stock screeners to identify potential picks. For bonds, consider factors such as coupon, maturity, bond type, and credit rating.

- Robo-advisors and financial advisors: If you don't want to choose your own investments, you can use a robo-advisor, which will build and manage a portfolio for you based on your goals and risk tolerance. Alternatively, a financial advisor can provide personalised recommendations and help you create a comprehensive financial plan.

Understanding Portfolio Investment: Strategies for Success

You may want to see also

Diversifying your portfolio

- Invest in a variety of asset classes: A well-diversified portfolio typically includes a mix of stocks, bonds and alternative assets like gold or property. Stocks are riskier but offer the potential for higher returns, while bonds tend to be less volatile and provide a more secure source of income. By combining these asset classes in your portfolio, you can aim to achieve higher returns without taking on too much risk.

- Diversify within each asset class: It's not enough to just invest in multiple asset classes. You also need to diversify within each class by investing in different types of stocks, bonds and alternative assets. For example, you could invest in a mix of large-cap and small-cap stocks, domestic and foreign stocks, short-term and long-term bonds, government and corporate bonds, etc. This helps to further reduce your risk because different types of assets within the same class tend to perform differently at different times.

- Consider using funds: Mutual funds and exchange-traded funds (ETFs) are an easy way to achieve instant diversification. These funds hold a basket of different stocks, bonds or other assets, allowing you to invest in a wide range of companies or industries with a single investment. Index funds, in particular, are a good option for beginners because they aim to match the performance of a specific market index and tend to have lower fees.

- Rebalance your portfolio regularly: Over time, the value of your investments will change, causing your original asset allocation to get out of balance. For example, if one of your stocks performs very well, it may become a larger portion of your portfolio than you intended. To maintain your desired level of diversification, you'll need to periodically sell some of your best-performing investments and use the proceeds to buy more of your underperforming investments. This process is known as rebalancing.

- Diversify your tax exposure: In addition to diversifying your investments, you can also diversify your tax exposure by holding a mix of tax-advantaged retirement accounts (such as a 401(k) or IRA) and taxable brokerage accounts. Traditional retirement accounts allow you to contribute pre-tax dollars and pay taxes on withdrawals in retirement, while Roth accounts use after-tax dollars and offer tax-free withdrawals.

Savings: Exploring Investment Options Beyond Fixed Deposits

You may want to see also

Asset allocation

The right asset allocation for you will depend on your investment goals and risk tolerance. For example, a younger person with a higher risk tolerance might opt for a portfolio comprising mostly shares, while an older person with a lower risk tolerance might choose a portfolio with a larger proportion of bonds.

It's important to get the mix of assets right for you, as different assets have different levels of risk and potential returns. You should also invest across different countries, industries and companies to further reduce risk.

Once you've set your asset allocation, you'll need to check in periodically to make sure it's still right for you. You may need to buy, sell and reinvest in certain areas to bring your portfolio back to your original weightings.

Tactical asset allocation is another approach, where you adjust your mix of assets based on short-term market forecasts.

Savings, Investments, and the Economy's Vital Balance

You may want to see also

Maintaining and rebalancing your portfolio

Monitor and review your portfolio: It is essential to periodically check in on your portfolio's performance and make adjustments as necessary. This includes assessing if your personal circumstances, financial situation, future needs, or risk tolerance have changed. Life events such as a new child, a change in career, moving house, or retirement may impact your investment strategy.

Rebalancing: To maintain your desired level of risk and ensure your portfolio aligns with your goals, you may need to rebalance it back to its original weightings. This involves selling a portion of investments that have performed well and reinvesting the proceeds in other areas. For example, if one of your holdings has grown faster than others and now accounts for a larger proportion of your portfolio than intended, you may choose to sell some of it to invest in other assets.

Selling and reinvesting: When rebalancing, determine which positions are overweighted and underweighted relative to your initial target allocations. Decide which underweighted securities to buy using the proceeds from selling the overweighted securities. Consider the tax implications of selling assets, as well as the outlook for your holdings. If you suspect that a particular investment is about to fall, you may want to sell despite potential tax consequences.

Diversification: Diversification is a crucial aspect of portfolio management. It helps to spread your risk by investing in a variety of asset classes, industries, and companies. Diversification ensures that your portfolio is not overly reliant on a single investment or sector. By investing in a mix of asset classes, such as shares, bonds, and alternatives, you can improve your portfolio's overall performance and reduce risk.

Regular rebalancing: To keep your portfolio aligned with your goals and risk tolerance, rebalancing should be done regularly. Some advisors recommend rebalancing at set intervals, such as every six or twelve months, or when the allocation of one of your asset classes deviates from your target allocation by a certain percentage (e.g., 5%).

Maintain an emergency fund: Before investing, it is essential to have an emergency savings pot of cash. This will ensure that you have a financial buffer in case of unexpected expenses or economic setbacks.

By following these steps, you can maintain and rebalance your investment portfolio to ensure it remains aligned with your financial goals, risk tolerance, and desired level of diversification.

Viewing Your Acorns Investment Portfolio: A Simple Guide

You may want to see also

Frequently asked questions

An investment portfolio is a collection of financial investments or 'asset classes' such as stocks, commodities, bonds, exchange-traded funds (ETFs), cash and its equivalents.

The first step is to decide the level of risk you're comfortable with. Generally, investing in stocks produces the highest returns, while investing in bonds increases stability. Younger people can invest in stocks to maximise the growth of their portfolio as they have time to recover from losses.

Assets can be broadly split into three main categories: shares, bonds and alternatives like gold. Shares give investors part-ownership of a company and are listed and traded on the stock exchange. Bonds are loans to companies or governments that are paid back with interest over time and are considered safer investments.

The way you split up your portfolio among different types of assets is called your asset allocation, and it depends on your risk tolerance. A common rule of thumb is to subtract your age from 100 or 110 to determine the portion dedicated to stocks. For example, if you're 30, this rule suggests allocating 70%-80% to stocks and 20%-30% to bonds.

To keep your portfolio on track, you need to rebalance it regularly by selling a little of what has done well and reinvesting elsewhere. This ensures you stick to your strategy and keep the ratio of different asset classes steadier over time.