Deciding whether to buy or rent a home is a complex decision that depends on a range of factors, including financial, lifestyle, and personal considerations.

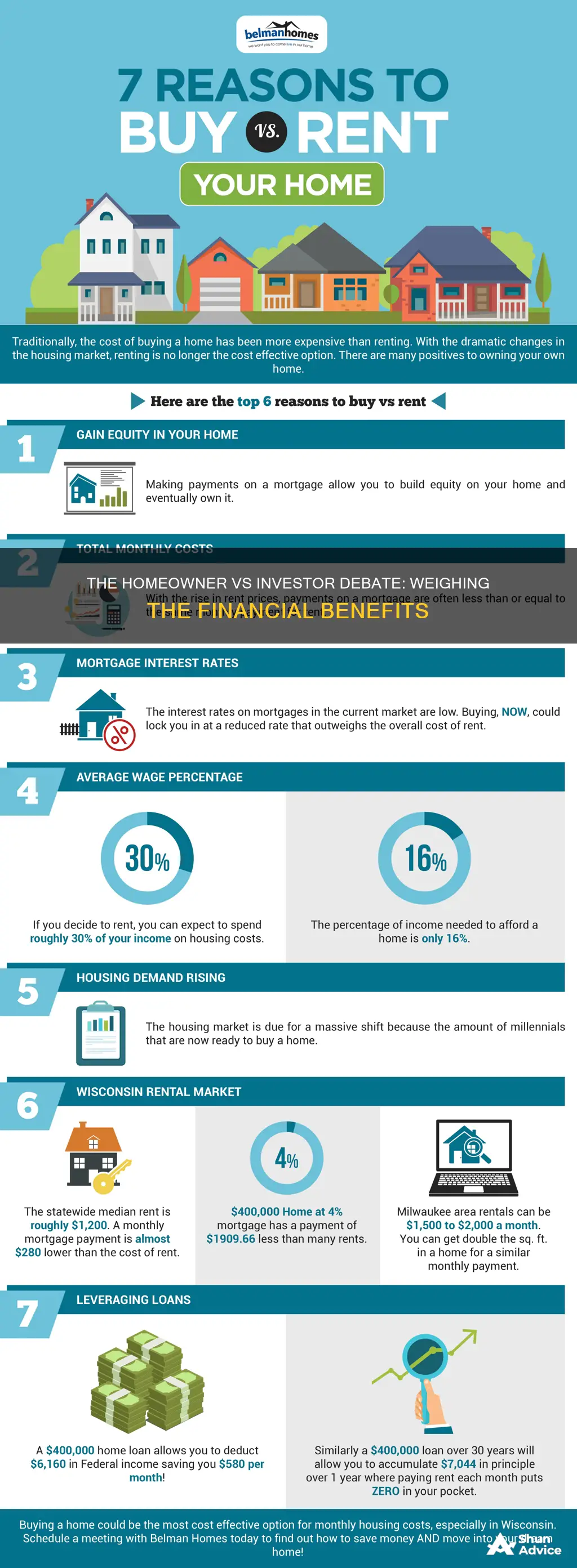

From a financial perspective, both options have their advantages and disadvantages. Buying a home can provide the opportunity to build equity and benefit from rising home values, but it also requires a significant financial commitment and comes with additional costs such as maintenance, taxes, and insurance. On the other hand, renting offers more flexibility and lower upfront costs, but it may not offer the same potential for building wealth over time.

Lifestyle and personal factors also play a crucial role in the decision. Homeownership provides a sense of stability and the freedom to customise your living space, while renting offers the flexibility to move more easily and relieves you of the responsibility for maintenance and repairs.

Ultimately, the choice between buying and renting depends on your individual circumstances, financial situation, and long-term goals. It is important to carefully consider the benefits and drawbacks of each option before making such a significant decision.

| Characteristics | Values |

|---|---|

| Financial situation | Both renting and buying require a regular income. |

| Flexibility | Renting offers more flexibility, as you are not tied down to a property. |

| Monthly expenses | Renting offers predictable monthly expenses. |

| Maintenance | With renting, the landlord is responsible for maintenance and repairs. |

| Taxes | Homeownership offers tax deductions. |

| Equity | Homeownership allows you to build equity. |

| Investment | Renting allows you to invest the money saved in a diversified portfolio. |

| Emotional factors | Homeownership provides a sense of stability and pride of ownership. |

Financial situation

The decision to rent or buy a home depends on your financial situation, and there are several factors to consider. Firstly, evaluate your current income and expected future income. Can you afford the down payment and closing costs of buying a home, which typically range from 5% to 20% of the purchase price? Lenders generally suggest that your monthly mortgage payment should not exceed 28% of your gross monthly income, while total monthly debt payments should not exceed 36%.

Another crucial aspect is the length of your stay. Buying a home involves significant one-time expenses, such as broker fees and mortgage origination fees. Therefore, staying in a home for less than two to three years may not be financially prudent, as you won't reap the benefits of spreading out these costs over time.

The comparison between renting and buying prices in your desired area is also essential. Calculate the price-to-rent ratio by multiplying the monthly rent by 12 and dividing the purchase price of a similar property by that annual rent. A ratio above 20 usually indicates that renting is more favourable, while a ratio below 20 suggests buying.

Additionally, consider the opportunity cost of using your savings for a down payment versus investing it elsewhere. If renting is cheaper, you could invest the money saved in a diversified portfolio to build wealth over time.

Other financial considerations include the potential for building equity, tax benefits, and the impact of inflation on housing costs. Remember to factor in ongoing costs associated with homeownership, such as maintenance, repairs, insurance, and utilities, which can be substantial.

In summary, carefully assess your financial situation, including income, debts, and expected length of stay, to make an informed decision about renting versus buying a home.

Retirement Savings Strategies: Navigating Your Golden Years with Confidence

You may want to see also

Lifestyle

Flexibility

Renting offers more flexibility in terms of location and mobility. As a renter, you can easily relocate when your lease ends, whereas homeowners need to budget time and money for selling their property. Renting is a good option if you long to live elsewhere or are not ready to commit to staying in one place for at least three years. On the other hand, homeownership provides stability and the freedom to put down roots in a community. If you're ready to settle down and want the security of owning your home, buying may be a better choice.

Financial Predictability

Renting typically provides more financial predictability in the short term. With renting, you know exactly what your housing costs will be each month, as it's indicated on your lease. While rent increases may occur during lease renewals, there are also areas with rent ceilings and rent control that limit these increases. On the other hand, homeowners face various expenses, such as closing costs, property taxes, insurance, repairs, and maintenance, which can be unpredictable and add up quickly. However, with a fixed-rate mortgage, homeowners can benefit from stable monthly payments over the long term.

Time Commitment

Homeownership comes with a significant time commitment. There are always projects and chores to take care of, from repairs and maintenance to yard work. If you value your free time, work long hours, or travel frequently, the demands of homeownership may be more than you want to take on. Renting can free up your time, as landlords are responsible for handling repairs and maintenance.

Personalization

Homeownership offers more freedom to personalise your living space. You can renovate and design your home to suit your tastes. While some landlords may allow renters to make certain modifications, it often depends on the terms of the lease, and any improvements made will ultimately benefit the landlord. If having a space that truly feels like your own is important to you, buying may be the better option.

Sense of Pride

Homeownership brings a sense of pride and accomplishment. It provides a permanent place to raise a family and the opportunity to create your dream residence. While renting may be more affordable and flexible, it doesn't offer the same sense of ownership and stability that comes with buying a home.

Investing for Income: Exploring Four Dividend-Paying Strategies

You may want to see also

Personal goals

When deciding whether to buy or rent a home, it's important to consider your personal goals and how they align with the benefits and drawbacks of each option. Here are some key points to keep in mind:

Financial Goals

For many people, financial considerations are a primary factor when deciding between buying and renting a home. Here are some ways that personal financial goals can influence your decision:

- Building Equity: One of the biggest advantages of buying a home is the opportunity to build equity. As you make payments on your loan and/or if the value of your home increases, you build equity, which can be a lower-risk form of investment. As a renter, you don't have the same opportunity to build equity, and your rent payments may be seen as "throwing money away."

- Tax Benefits: As a homeowner, you may be able to take advantage of tax deductions and exemptions. For example, you may be able to deduct mortgage interest, property taxes, and some closing costs from your income taxes. Renters generally don't have access to the same tax benefits, although there may be certain renter's credits available.

- Upfront Costs: Buying a home typically requires a substantial financial commitment upfront, including a down payment, closing costs, insurance, and more. Renting, on the other hand, usually requires a security deposit and first month's rent, which can be more manageable for those with limited funds.

- Long-Term Savings: If you're looking to save money over the long term, buying a home may be a better option. While renting may be cheaper in the short term, the costs can add up over time, especially if your landlord regularly increases the rent. With a fixed-rate mortgage, your monthly payments will stay relatively stable, making it easier to budget.

- Investment Opportunities: If you're interested in investing in real estate, buying a home can be a great way to get started. You can leverage your home as an investment property by renting it out and using the income to build wealth. This is especially appealing if you're young and can handle more risk.

- Credit Requirements: Buying a home typically requires a stronger credit history and higher credit score than renting. If you have decent but not excellent credit, renting may be a more achievable option in the short term while you work on building your credit.

Lifestyle Goals

In addition to financial goals, your personal lifestyle goals can also play a significant role in your decision to buy or rent:

- Flexibility: Renting offers more flexibility and mobility, as you're not tied down to a long-term commitment. If you're not ready to settle down in one place or want the option to relocate easily, renting may be a better fit. On the other hand, buying a home provides a sense of stability and permanence, especially if you plan to put down roots in a community.

- Maintenance and Repairs: As a renter, you don't have to worry about the cost and hassle of maintenance and repairs, as these are the responsibility of the landlord. As a homeowner, you're fully responsible for these costs, which can be significant and unpredictable.

- Design and Customization: When you rent, you often have limited freedom to make improvements or customize the space to your taste. As a homeowner, you have more control over the design and can remodel or upgrade your home as you please.

- Privacy: Homeowners typically enjoy more privacy compared to renters, especially in single-family homes or rural areas. If privacy is a priority for you, buying a home may align better with your personal goals.

- Location: Apartments are typically located in or near cities, offering proximity to services, attractions, and public transportation. When you buy a home, you have more varied location options, including rural areas with more land.

Emotional Goals

Finally, it's important to consider your emotional goals and how they fit into the decision-making process:

- Pride of Ownership: For many people, buying a home is a source of pride and satisfaction. It represents a significant milestone and can provide a sense of accomplishment.

- Responsibility: Homeownership comes with added responsibility, and it's important to be prepared for that commitment. If the idea of being solely responsible for repairs, maintenance, and financial obligations is overwhelming, renting may be a less stressful option.

- Peace of Mind: Renting can offer peace of mind by removing the financial risks associated with homeownership, such as the possibility of losing money if home values decline. Additionally, as a renter, you don't have to worry about unexpected costs or the hassle of selling if you decide to move.

In conclusion, when weighing the decision to buy or rent a home, carefully consider your personal goals and how they align with the financial, lifestyle, and emotional aspects of each option. Both choices have their advantages and drawbacks, and the right decision will depend on what matters most to you.

Investment Strategies: Navigating the Ideal Percentage of Your Paycheck to Invest

You may want to see also

Longevity of stay

When deciding whether to buy or rent a home, it's important to consider how long you plan to stay in the property. This is because the longevity of your stay can impact the financial viability of buying versus renting.

If you're planning to stay in a property for less than three years, it may not make financial sense to buy. This is because you will face a number of one-time expenses when buying a home, such as broker fees, mortgage origination fees, and title insurance. Staying put for longer gives you more time to spread out these costs and for your home to increase in value. Staying for less than two years can also come with tax disadvantages, as you generally won't qualify for a capital gains tax exclusion and will owe tax on any increase in your home's value.

Renting, on the other hand, offers more flexibility if you're not planning to stay in one place for a long time. It also provides predictable monthly expenses, as your housing costs are indicated on your lease. However, you may face rent increases when your lease is up for renewal, and your landlord could decide to sell the property or increase the rent beyond what you can afford.

If you're considering buying, it's worth noting that it's generally recommended that you plan to stay in the property for at least three to five years to make it a worthwhile investment. This gives you time to build equity in your home and for your home to appreciate in value.

In summary, when weighing up the decision to buy or rent, carefully consider how long you plan to stay in the property. If it's less than three years, renting may be the more financially prudent option. If it's three to five years or more, buying could be a good investment, but it's important to also take into account other factors such as your financial situation, lifestyle, and personal goals.

Junk Silver: A Smart Investment Strategy

You may want to see also

Tax benefits

When it comes to tax benefits, there are several advantages to owning a home instead of renting. Here are some key points to consider:

Mortgage Interest Deduction

Homeowners can deduct the interest paid on their mortgage from their taxable income, resulting in a reduced tax burden. This deduction can be particularly beneficial during the early years of a mortgage, when a significant portion of the monthly payments goes towards interest. In contrast, renters cannot claim a similar deduction, as their rental payments are not tax-deductible.

Property Tax Deduction

Property taxes, levied by local governments, can vary significantly depending on the area. Homeowners can deduct these property taxes from their federal income taxes, further reducing their overall tax liability. Renters, on the other hand, do not have to pay property taxes directly and cannot claim this deduction.

Capital Gains Exclusion

Homeownership can lead to profits from the sale of the property over time. When homeowners sell their property, they may be eligible for a capital gains exclusion, allowing them to exclude a certain amount of profit from the sale from their taxable income. This exclusion benefits long-term homeowners, encouraging them to build equity. Renters do not have a similar opportunity as they do not own the property.

Home Equity Loan Interest Deduction

Homeowners have the advantage of accessing additional funds through home equity loans or home equity lines of credit (HELOCs). The interest paid on these loans can be tax-deductible, subject to certain limitations. Renters do not have this opportunity as they do not have equity in the property they occupy.

Moving Expense Deduction

Homeowners who need to relocate for work-related reasons and meet certain criteria may be eligible for a moving expense deduction. They can deduct qualified moving expenses from their taxable income. Renters, however, are not eligible for this deduction.

Depreciation Deduction

The IRS allows homeowners to depreciate the value of their property over a period, typically 27.5 years, to account for wear and tear. This depreciation expense can be deducted from the property's cost basis, reducing the taxable income.

Operating and Owner Expense Deductions

Various operating expenses, such as property management fees, repairs, maintenance, insurance, and professional service fees, are deductible for homeowners. Additionally, owner expenses like continuing education costs, dues for real estate investing clubs, and travel expenses related to the property may also be deductible.

FICA Tax Avoidance

Income from rental properties is generally not considered earned income, so it is not subject to FICA or payroll tax. This can result in significant tax savings for self-employed individuals, as they would otherwise have to pay both the employer and employee portions of Social Security and Medicare taxes.

While renting can provide flexibility and reduced responsibilities, homeownership offers notable tax advantages that can positively impact your financial future. These tax benefits, along with other factors, should be carefully considered when deciding whether to rent or buy a home.

Will Brooks Investments: Navigating the Financial Landscape

You may want to see also

Frequently asked questions

Renting offers flexibility, predictable monthly expenses, and less responsibility for repairs and maintenance. It also requires less upfront capital and provides the freedom to be mobile.

Buying a home provides a sense of stability, pride of ownership, and the potential for building equity. It also offers tax benefits and the freedom to personalise and upgrade your living space.

The upfront costs of buying a home include a down payment and closing costs, which can range from 2-6% of the loan amount. Ongoing costs include mortgage payments, property taxes, homeowners insurance, HOA fees, and maintenance.

Consider your financial situation, lifestyle, personal goals, and the state of the housing market. Ask yourself how long you plan to stay in the same location, whether you're financially ready to buy, and what your job security and satisfaction are.