The concept of equilibrium in economics is crucial for understanding the dynamics between saving and investment. According to classical economists, the equilibrium is attained when savings are equal to investments, and this equality is facilitated by the rate of interest. However, Keynesian economics offers a different perspective, arguing that equality between saving and investment is a condition of equilibrium at any level of employment, not just full employment. This equality, known as accounting equality, is further supported by the functional equality concept, which considers the dynamic behaviour of savers and investors. In a market for goods and services, equilibrium occurs when aggregate demand equals aggregate supply, resulting in a stable economy.

What You'll Learn

- Inventory levels: If savings exceed investments, inventory falls below the desired level

- Interest rates: Classical economists view interest rates as a strategic variable to balance savings and investments

- Employment levels: Classical economists believe in equilibrium at full employment, while Keynes disagrees

- Income changes: Keynes views income as the equilibrating variable, not interest rates

- Aggregate demand and supply: Equilibrium in the economy is reached when total demand equals total supply

Inventory levels: If savings exceed investments, inventory falls below the desired level

Inventory levels are a key component of the savings-investment equilibrium. If savings exceed investments, the inventory falls below the desired level. This can occur when the interest rate is higher than the equilibrium interest rate, leading to a higher return on savings and a higher cost of investment. As a result, the desired saving is greater than the desired investment, causing a surplus of savings.

To restore the desired inventory level, producers will need to take action. They can start by expanding their output, which leads to two outcomes: an increase in income and a rise in planned investment. With more output available, there is a higher potential for sales and revenue, leading to increased income. Additionally, the rise in output means that there is now more inventory available, which helps to bring the inventory levels closer to the desired state.

The increase in income has a direct impact on savings. As income rises, individuals have more disposable income, and their savings also increase. This, in turn, further contributes to the surplus of savings over investments.

To address the imbalance between savings and investments, there are market forces at play that push the economy back towards equilibrium. In this case, banks play a crucial role. Banks with excess cash from higher savings will want to lend out more money to firms. To do this, they will lower the real interest rate, making loans more attractive and accessible to businesses.

As the interest rate decreases, we move closer to the equilibrium point, where the desired savings and desired investment are equal. This dynamic relationship between savings, investments, and inventory levels is a critical aspect of understanding the savings-investment equilibrium.

Tax-Free Investing: Strategies to Keep Your Profits

You may want to see also

Interest rates: Classical economists view interest rates as a strategic variable to balance savings and investments

Classical economists view interest rates as a strategic variable to balance savings and investments. They believe that equality between savings and investments is brought about by the mechanism of the interest rate.

The classical theory treats savings as a direct function of the interest rate and investments as an inverse function. The higher the interest rate, the greater the incentive to save, and the lower the incentive to invest. Therefore, if savings and investments are not equal, the interest rate will adjust to bring them back into equilibrium.

For example, if savings are greater than investments, there is an excess supply of savings, and banks will have more cash than they can loan out to firms. To create more loans, banks will lower the interest rate. As the interest rate falls, the savings curve will move down, and the investments curve will move up, eventually reaching equilibrium.

Conversely, if investments are greater than savings, there is an excess demand for investments, and the interest rate will rise to bring savings up and investments down until they reach equilibrium.

Classical economists also visualised equality between savings and investments at a point of full employment. They believed that the economy's equilibrium was at full employment, and the interest rate was the equilibrating variable that brought about equality between savings and investments at this level.

However, it is important to note that this view has been controversial and rejected by Keynes, who argued that equality between savings and investments could occur at any level of employment, not just full employment.

The Cost of Waiting: Why Investing Now Pays Off

You may want to see also

Employment levels: Classical economists believe in equilibrium at full employment, while Keynes disagrees

Classical economics holds that an economy will automatically adapt to provide full employment, even in equilibrium. However, Keynes disagreed with this notion, believing that the volatile and unpredictable psychology of markets would instead lead to periodic booms and crises.

In his book, 'The General Theory of Employment, Interest and Money', Keynes denied that full employment was the natural result of competitive markets in equilibrium. He argued that the level of employment is determined not by the price of labour, as in classical economics, but by the level of aggregate demand. If the total demand for goods at full employment is less than the total output, then the economy has to contract until equality is achieved.

Keynesians believe that the economy does not tend towards a full employment equilibrium. They argue that there is no reason to think that the level of aggregate expenditure in the economy will ensure that everyone who wants to work gets a job. Keynesians assert that demand drives supply, and that when the economy is in disequilibrium, output adjusts rather than prices.

Keynesians generally advocate a regulated market economy, predominantly driven by the private sector but with an active role for government intervention during recessions and depressions. They believe that government intervention can stabilise the economy and reduce the amplitude of the business cycle, which they rank among the most serious of economic problems.

Keynesians also argue that aggregate demand is volatile and unstable, and that consequently, a market economy often experiences inefficient macroeconomic outcomes, including recessions when demand is too low and inflation when demand is too high. They believe that these economic fluctuations can be mitigated by economic policy responses coordinated between the government and central bank.

Protecting Retirement: Strategies to Shield Investments from Trade War Fallout

You may want to see also

Income changes: Keynes views income as the equilibrating variable, not interest rates

John Maynard Keynes, the founder of Keynesian economics, believed that equality between saving and investment is a condition of equilibrium at any level of employment, and not necessarily at full employment. He disagreed with classical economists, who believed that the economy's equilibrium is at full employment, and that saving-investment equality is brought about by the mechanism of the interest rate.

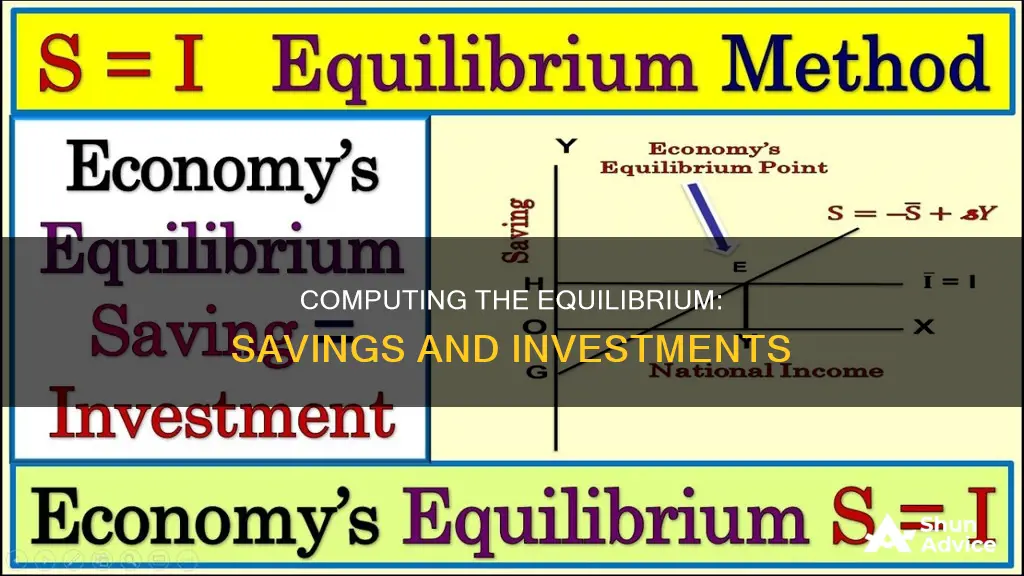

Keynes's view was that savings and investment are brought into equality by income changes. He introduced income as the equilibrating variable, a revolutionary idea at the time. In his concept of functional equality, savers and investors react to income variations in a way that their desire to save and invest is harmonised.

If saving exceeds investment, income will fall until the saving out of the lower income is equal to the reduced investment. Conversely, if investment increases, income will rise until the saving out of the higher income is equal to the increased investment.

Keynes's theory is that varying levels of income cannot be sustained in an economy unless the amounts of savings at these levels of income are offset by an equivalent amount of investment. This equilibrium level of national income is reached when investment equals savings, as at this level there is no tendency for income and output to change.

Keynes also believed that investment does not depend significantly on the level of income. Instead, it depends on dynamic factors such as population growth, territorial expansion, and progress of technology.

TMobile and Sprint Merger: What's the Hold Up?

You may want to see also

Aggregate demand and supply: Equilibrium in the economy is reached when total demand equals total supply

The concept of equilibrium in economics refers to a state where the total demand for goods and services is equal to the total supply. This equilibrium can be understood through the lens of aggregate demand and supply, which considers the economy as a whole.

Aggregate Supply and Demand

Aggregate supply refers to the total quantity of output that firms will produce and sell, also known as the real Gross Domestic Product (GDP). The aggregate supply curve is upward-sloping, illustrating the positive relationship between the price level of outputs and real GDP in the short run. When the output price level rises while input costs remain constant, firms are incentivised by the prospect of higher profits to increase production.

On the other hand, aggregate demand represents the total spending on domestic goods and services within an economy. The aggregate demand curve is downward-sloping, indicating an inverse relationship between the price level of outputs and the quantity of total spending. As output prices increase, the quantity of total spending decreases, as consumers are less willing or able to purchase at higher prices.

Equilibrium in the Economy

Equilibrium in the economy is achieved when aggregate demand equals aggregate supply. This occurs at the intersection point of the aggregate supply and demand curves, signifying both the equilibrium level of real GDP and the equilibrium price level. At this point, there is no pressure on prices to change, and the economy is stable.

Saving-Investment Equilibrium

The concept of equilibrium also applies to the relationship between saving and investment. Classical economists, including Keynes, emphasised the equality of saving and investment as a condition for equilibrium in income, output, and employment. When savings exceed investment, firms will reduce output to clear unwanted inventory, leading to a decrease in income and, consequently, savings. Conversely, when investment surpasses savings, firms will increase output to meet demand, resulting in higher income and, subsequently, higher savings. The system will adjust until savings equal investment, restoring equilibrium.

In summary, equilibrium in the economy is a state of balance where aggregate demand intersects with aggregate supply, determining the equilibrium price and output levels. This equilibrium concept also extends to the relationship between savings and investment, where any disparity triggers adjustments to restore equality.

Cambridge Investment Research: The Sell-Off Strategy

You may want to see also

Frequently asked questions

The saving-investment approach is an economic theory that states that equilibrium is reached when investment equals savings, as at this level there is no tendency for income and output to change.

Using this approach, the equilibrium level of national income is determined by the intersection of savings and investment curves. When savings and investments are equal, there is no incentive for producers to adjust output.

When savings are greater than investments, the planned inventory falls below the desired level. To correct this, producers expand output, which increases income and, in turn, increases investment until savings and investments are equal again.

Classical economists believe that saving-investment equality is brought about by the rate of interest and that this equality is indicative of full employment. Keynes, on the other hand, argues that equality is brought about by changes in income and that full employment is not necessary for this equality to occur.