Creating an investment portfolio can be a straightforward process if you have a solid understanding of a few key principles. These include tax efficiency, time horizon, risk tolerance, and diversification. Once you know how these topics apply to your situation, you can start building a portfolio that aligns with your goals.

It's important to remember that everyone's situation is unique, and there is no one-size-fits-all approach to investing. However, by educating yourself on these core principles and seeking guidance when needed, you can make informed decisions about your financial future.

| Characteristics | Values |

|---|---|

| Investment portfolio definition | A collection of invested assets such as stocks, bonds, funds, real estate, and cryptocurrency. |

| Investment portfolio purpose | Retirement, down payment on a home, child's college fund |

| Risk tolerance | Ability to accept investment losses for the possibility of higher returns; influenced by time horizon and personality |

| Time horizon | How long until you begin to make withdrawals from your portfolio |

| Asset allocation | Distribution of assets across different classes (e.g. equities, bonds) and subclasses (e.g. market capitalization, sectors) |

| Investment selection | Individual stocks, mutual funds, exchange-traded funds (ETFs), real estate investment trusts (REITs), bonds |

| Diversification | Investing in a variety of asset classes and subclasses to mitigate risk |

| Tax efficiency | Using tax-efficient investments in taxable accounts and tax-deferred accounts for higher-yielding investments |

| Rebalancing | Periodically reassessing and adjusting portfolio weightings to maintain desired asset allocation |

What You'll Learn

Understanding your risk tolerance

When assessing your risk tolerance, it is important to consider your investment goals and time horizon. If you have a long-term financial goal, investing in higher-risk assets, such as stocks, may lead to greater returns. On the other hand, if your investment horizon is relatively short, a more conservative approach with lower-risk cash investments may be more appropriate.

Your risk tolerance is also tied to your emotional and mental response to market fluctuations. It's important to assess how comfortable you are with seeing your investments rise and fall in value. If you are just starting, it is advisable to proceed with caution and strive for the preservation of capital.

Another factor that impacts risk tolerance is your net worth and available risk capital. Individuals with a higher net worth and more liquid capital can generally afford to take on more risk. It is important to distinguish between risk capital, which will not significantly affect your lifestyle if lost, and capital that is essential for maintaining your standard of living.

Additionally, your investment experience plays a role in determining your risk tolerance. If you are new to investing, it is prudent to start cautiously and gain experience before taking on more substantial risks.

Chris Gardner's Life Savings Investment: A Fateful Decision

You may want to see also

Choosing the right asset allocation

Understand Your Risk Tolerance:

Firstly, you need to assess your risk tolerance, which is your ability to handle investment losses while aiming for higher returns. Your risk tolerance depends on your personality and how you react to market fluctuations. Ask yourself if you are comfortable with the potential loss of some money for the possibility of greater returns. While everyone desires high returns, it's crucial to consider if you can manage the stress of short-term drops in your investments.

Time Horizon:

Another essential factor is your time horizon, which refers to the amount of time you have until you need to access your investments. For example, if you are planning for retirement, your time horizon is the number of years until you retire. If you are saving for a shorter-term goal, such as buying a vacation home in the next 5-10 years, your time horizon is shorter. Generally, the longer your time horizon, the more aggressive your investments can be.

Conservative vs Aggressive Investors:

Your risk tolerance will determine whether you are a conservative or aggressive investor. A conservative investor seeks to protect the value of their portfolio and is more risk-averse. They allocate a larger portion of their portfolio to fixed-income securities like bonds and a smaller portion to equities. On the other hand, an aggressive investor can bear more risk and has a higher allocation of equities in their portfolio.

Asset Allocation Strategies:

Once you understand your risk tolerance and time horizon, you can allocate your capital between different asset classes such as equities and bonds. You can further diversify by dividing the equity portion into different sectors, market capitalizations, and domestic and foreign stocks. Similarly, the bond portion can be allocated between short-term and long-term bonds, government and corporate debt, etc.

Tax Efficiency:

When designing your portfolio, consider your current tax situation, especially for taxable accounts. For example, investing in municipal bonds can shield interest from state and federal income taxes, while investing in securities with low dividend payouts can help avoid tax consequences.

Diversification:

Diversification is a crucial component of a well-constructed investment portfolio. To achieve true diversification, include asset classes that are non-correlated to each other. For instance, instead of solely investing in large-cap technology stocks, consider investing across different market capitalizations and sectors. This approach helps "smooth" out the volatility and provides more consistent returns over time.

Smart Saving and Investing Strategies for Your Kids' Future

You may want to see also

Diversifying your portfolio

Spread Your Investments

Avoid putting all your money into a single stock or sector. Diversify across different companies and sectors you know, trust, and believe in. Consider investing in a range of options, such as commodities, exchange-traded funds (ETFs), and real estate investment trusts (REITs). Think globally, rather than just locally, to spread your risk and potentially increase your rewards. A good rule of thumb is to limit yourself to a manageable number of investments, perhaps 20 to 30 different options, to ensure you can keep track of them effectively.

Consider Index and Bond Funds

Adding index funds or fixed-income funds to your portfolio can be a great long-term diversification strategy. These funds track various indexes and aim to match the performance of broad markets, reducing the need for active management. Index funds also tend to have lower fees, which puts more money back in your pocket. However, keep in mind that passive management may not be optimal during challenging economic periods.

Regularly Add to Your Portfolio

Continuously build your portfolio by adding to your investments regularly. A strategy called dollar-cost averaging can help smooth out the highs and lows of market volatility. With this approach, you invest a fixed amount at regular intervals, buying more shares when prices are low and fewer when prices are high.

Know When to Exit

While buying and holding, as well as dollar-cost averaging, are sound strategies, it's important to stay informed about your investments and the overall market conditions. Keep an eye on the companies you've invested in, and be prepared to cut your losses and move on when necessary.

Be Aware of Commissions

If you're not an active trader, understand the fees you're paying and what you're getting in return. Some firms charge monthly fees, while others have transactional fees. Be mindful of any changes to your fees, and remember that the cheapest option isn't always the best.

Diversification Benefits

Diversification is a crucial concept in investing, helping you manage risk and return. By spreading your investments across different asset classes, you reduce the chances of losing everything if one investment or market slumps. It also helps to lower the overall risk of your portfolio without sacrificing expected returns.

Avoid Over-Diversification

While diversification is essential, it is possible to over-diversify your portfolio. Adding too many closely correlated securities or including investments that increase overall risk and lower expected returns can be detrimental. The goal is to find the right balance of securities to optimise your risk and return.

Monitor and Rebalance

Finally, diversification is not a one-time task. It's important to regularly monitor and rebalance your portfolio to ensure it stays aligned with your investment goals, risk tolerance, and financial circumstances. Check your asset allocation at least once a year or whenever your financial situation changes significantly.

By following these steps, you can effectively diversify your portfolio, manage risk, and improve your long-term investment outcomes.

Young Adults: Best Places to Invest Your Savings

You may want to see also

Setting an investment policy statement

Define Your Objectives and Risk Levels:

Start by clearly defining your financial objectives and goals. Be honest with yourself about what you want to achieve and why you are investing. Consider your risk tolerance and how much risk you are willing to take. Speculative investments offer higher returns but come with the risk of losing your funds.

Set Your Asset Allocation Limits:

Think about the different asset classes you want to include in your portfolio, such as stocks, bonds, mutual funds, or real estate. Decide on the allocation limits for each asset class, ensuring they align with your objectives and risk tolerance. For example, consider maintaining a certain percentage of your portfolio in cash and cash equivalents for emergency funds.

Establish the Mechanics of Running the Portfolio:

Determine how often you will evaluate your portfolio to ensure it aligns with your goals and stays within your predetermined limits. Decide on the investment philosophy or strategy you will use to add new securities or funds to your portfolio. For example, you might set criteria for stocks you consider for investment, such as a history of increasing dividends.

Include Important Details:

Your IPS should include specific information such as your current account information, current allocation, how much has been accumulated, and how much is currently being invested across different accounts. It should also outline monitoring and control procedures, including the frequency of monitoring and benchmarks for comparing portfolio returns.

Review and Update:

Review your IPS regularly, such as annually or bi-annually, to ensure it remains aligned with your financial goals and circumstances. Be prepared to make adjustments as needed, especially if there are significant changes in your life or the market conditions.

Remember, your IPS is a living document that should evolve as your financial situation and goals change over time. It is a tool to help you stay focused on your long-term objectives and make informed investment decisions.

Maximizing Your Investment Portfolio: Strategies for Success

You may want to see also

Knowing when to rebalance

Set a Time Interval

One common approach is to rebalance your portfolio at regular time intervals, such as once a year, twice a year, or every quarter. This helps ensure that you are consistently monitoring your investments and making any necessary adjustments. For example, you might choose to review and rebalance your portfolio annually or semi-annually.

Monitor Deviations from Target Allocation

Another strategy is to rebalance only when your portfolio deviates from your target asset allocation by a certain percentage. For instance, you might decide to rebalance when your portfolio's allocation to stocks exceeds your target by 5% or 10%. This approach allows for more flexibility, as you are not tied to a specific time interval and can let your investments grow without constant adjustments.

Combine Time Intervals and Deviations

You can also combine the above two strategies. For example, you could choose to rebalance either annually or whenever your portfolio deviates from your target allocation by a certain percentage, whichever comes first. This gives you the benefits of both approaches and allows for a more dynamic rebalancing strategy.

Consider Tax Implications

When deciding when to rebalance, it is important to consider the tax implications of selling certain assets. For example, if you have investments that have appreciated significantly and will incur high capital gains taxes if sold, you may want to hold off on rebalancing until the tax consequences are more favourable. Alternatively, you could use a strategy called "tax-loss harvesting," where you sell losing investments to offset the capital gains and reduce your tax burden.

Life Changes and Risk Tolerance

It is also important to rebalance your portfolio when your life circumstances or risk tolerance changes. For example, if you get married, inherit a large sum of money, have children, or experience a change in your health, you may want to adjust your portfolio to reflect your new situation. Similarly, if your risk tolerance changes and you become more or less comfortable with taking risks, you should rebalance your portfolio to align with your updated risk profile.

Use Automated Tools

Finally, you can utilise automated tools to help you determine when to rebalance. Robo-advisors, for instance, can monitor your portfolio and automatically rebalance it for you based on predetermined parameters. Additionally, some investment platforms offer features like target-date funds or balanced funds, which automatically rebalance your portfolio to maintain a specific asset allocation. These tools can take the guesswork out of deciding when to rebalance.

Savings, Investment, Employment, and GDP: A Balancing Act

You may want to see also

Frequently asked questions

An investment portfolio is a collection of invested assets such as stocks, bonds, mutual funds and exchange-traded funds (ETFs).

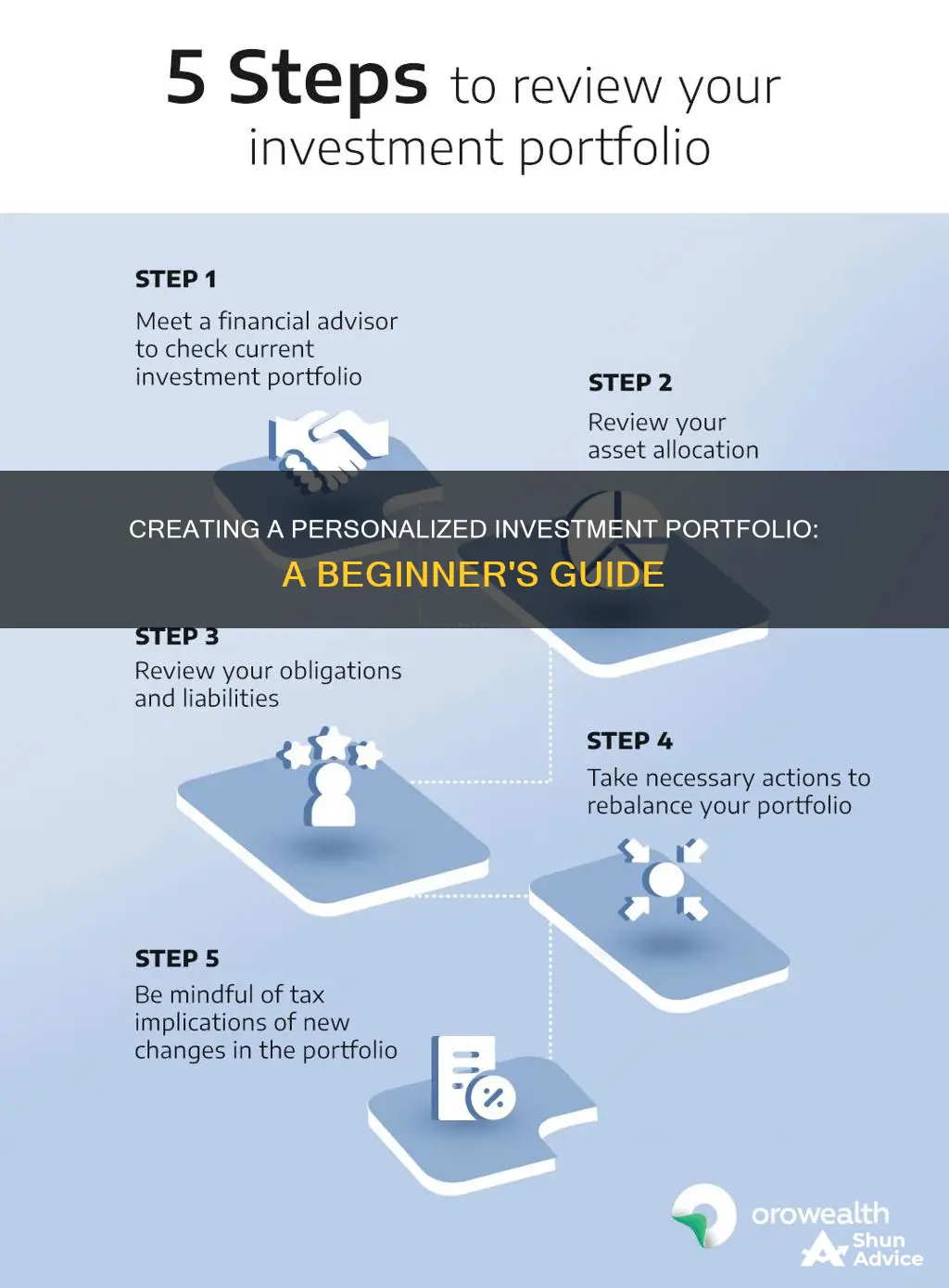

First, determine the appropriate asset allocation for your investment goals and risk tolerance. Second, pick the individual assets for your portfolio. Third, monitor the diversification of your portfolio, checking to see how weightings have changed.

It's important to have a clear investing goal, be aware of your risk tolerance, and to diversify your investments.

Common investments include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate.

Cryptocurrencies and options. While it can be fun to speculate that crypto might be the future of money, it's not something to bet your future on.