An investment portfolio is a collection of assets that an individual holds with the aim of generating income or capital appreciation. The process of devising an investment portfolio involves several steps, from understanding one's financial goals and risk tolerance to selecting the right investment accounts and assets.

Firstly, it is crucial to define clear financial goals and sort them by time horizon – short-term, medium-term, or long-term. This helps determine the level of risk one can take and guides investment decisions.

Secondly, understanding risk tolerance is vital. It reflects an investor's ability to accept losses in pursuit of higher returns. Generally, younger investors can tolerate more risk, while older investors tend to have lower risk tolerance.

Thirdly, choosing the right investment accounts is key. Accounts like IRAs and 401(k)s are suitable for retirement goals, while taxable brokerage accounts are better for non-retirement goals.

Fourthly, selecting the right investments is critical. Stocks, bonds, mutual funds, exchange-traded funds (ETFs), and alternative investments like real estate or cryptocurrencies are common options.

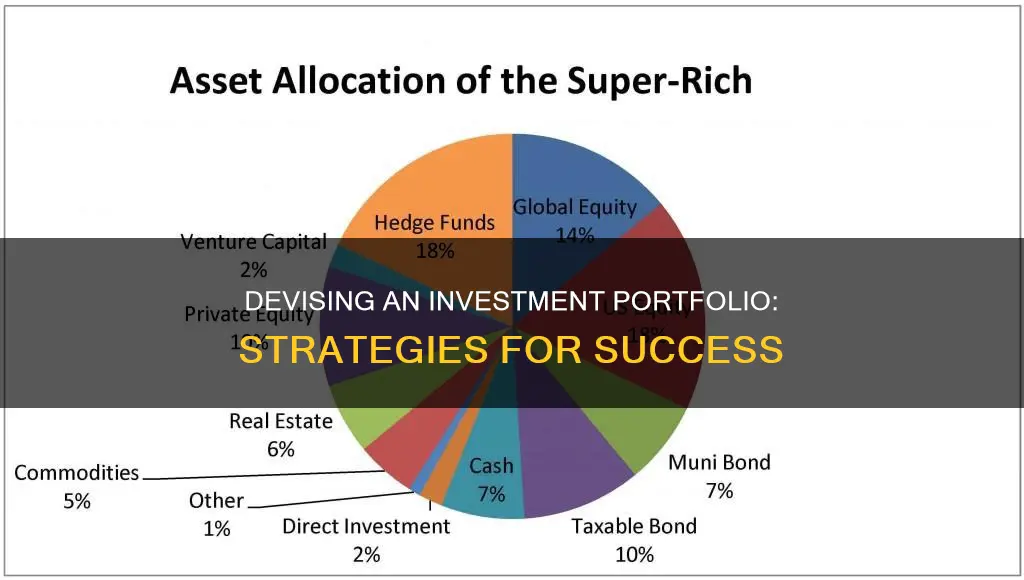

Lastly, determining the best asset allocation based on one's risk tolerance is essential. This involves deciding how much of each asset class, such as stocks, bonds, or cash, to include in the portfolio.

By following these steps, individuals can devise a well-diversified investment portfolio that aligns with their financial goals and risk tolerance.

| Characteristics | Values |

|---|---|

| Purpose | Maximising returns, achieving financial goals |

| Risk | Depends on tolerance and time horizon |

| Time horizon | Short-term, medium-term, long-term |

| Investment types | Stocks, bonds, funds, real estate, cash/cash alternatives |

| Tax | Tax-advantaged accounts for retirement, taxable brokerage accounts for non-retirement goals |

| Diversification | Spread risk, don't put all your eggs in one basket |

| Monitoring | Regularly check and adjust portfolio |

What You'll Learn

Understand your risk tolerance

Understanding your risk tolerance is a key part of devising an investment portfolio. Risk tolerance refers to the amount of financial risk you're comfortable taking when investing. Market volatility is unavoidable, and investment values are constantly changing. These changes can be triggered by the strength of the economy, global crises, disruptions within certain industries, or positive or negative earnings reports.

Your risk tolerance will be influenced by your personality, age, and financial goals. For example, younger people with a longer time horizon are often seen as more risk-tolerant and therefore more likely to invest in stocks and stock funds than fixed-income assets. However, it's important to remember that age is not the only factor at play. Net worth and available risk capital should also be considered when determining your risk tolerance.

- What are your investment goals? Common goals include paying for a child's education, financial independence, or saving for retirement.

- What is your time horizon? Generally, the longer the time horizon, the more risk you can take on as you have time to recover from any downturns.

- How comfortable are you with short-term loss? Risk-averse investors may choose to invest in a diverse portfolio of stocks, bonds, and real assets to reduce the impact of any single asset class on their overall portfolio.

- Do you have non-invested savings? It's important to have some savings set aside in liquid accounts, regardless of your risk tolerance.

- How closely will you track your investments? If you plan to track your investments closely, are you doing it because you're nervous or because you're excited about new opportunities?

It's also important to remember that your risk tolerance can change over time and in response to market conditions and life events. For example, losing your job or starting a business may impact your financial situation and goals, as well as your attitude towards risk.

Savings Investment Strategies: Accessibility and Growth

You may want to see also

Diversify your investments

Diversifying your investments is a crucial aspect of devising an investment portfolio. Here are some detailed tips to help you diversify your investments effectively:

Spread the Wealth

It is important to diversify across different industries and sectors. Avoid putting all your investments in one sector, even if it is performing well, such as the pharmaceuticals sector during the Covid-19 pandemic. Diversify into other sectors like education technology or information technology.

You can also consider investing in different asset classes, such as stocks, bonds, commodities, exchange-traded funds (ETFs), and real estate investment trusts (REITs). By spreading your investments across various sectors and asset classes, you reduce the risk of losing all your money if one sector or asset class underperforms.

Consider Index Funds or Bond Funds

Index funds, which aim to match the performance of a specific market index, offer instant diversification. For example, an S&P 500 index fund gives you exposure to 500 large US companies. Index funds also have very low fees, as they don't involve active fund management.

Bond funds or fixed-income funds are another option to consider. These funds invest in securities that track various indexes and provide a good long-term diversification strategy. By adding fixed-income solutions, you further hedge your portfolio against market volatility and uncertainty.

Keep Building Your Portfolio

Regularly add to your investments. A strategy called dollar-cost averaging can help smooth out market volatility. With this approach, you invest the same amount of money over a period, buying more shares when prices are low and fewer when prices are high.

Know When to Get Out

While buying and holding is a sound strategy, it's important to stay informed about your investments and the overall market conditions. This will help you make timely decisions about cutting losses and moving on to other investment opportunities.

Keep an Eye on Commissions

Be aware of the fees and charges associated with your investments. Some firms charge monthly fees, while others have transactional fees. These costs can add up and eat into your profits. While $0 commission trading is available for many stocks and ETFs, trading mutual funds, illiquid stocks, and alternative asset classes often incurs fees.

Maximizing Cash Savings: Best Investment Options for You

You may want to see also

Choose an account that works towards your goals

Choosing the right account is crucial to achieving your investment goals. There are several types of investment accounts, each with its own advantages and suitability for different goals. Here are some factors to consider when selecting an account that aligns with your objectives:

- Tax-advantaged accounts: These accounts, such as Individual Retirement Accounts (IRAs) and 401(k) plans, offer tax benefits that make them ideal for long-term retirement goals. They can accommodate various risk tolerance levels and help maximize your returns while minimizing taxes.

- Taxable brokerage accounts: These are suitable for non-retirement goals, such as saving for a down payment on a house. They offer more flexibility and the potential for higher returns compared to deposit accounts.

- Deposit accounts: This category includes Certificates of Deposit (CDs), money market accounts, and high-yield savings accounts. These accounts are best for short-term goals where capital preservation is a priority. They provide modest growth while ensuring your money remains accessible and relatively low-risk.

- Robo-advisors: If you prefer a hands-off approach, robo-advisors can build and manage your investment portfolio based on your risk tolerance and goals. They are a cost-effective alternative to traditional financial advisors.

- Online financial planning services and financial advisors: If you seek comprehensive financial planning beyond just investment management, consider engaging the services of a professional. They can help you build a portfolio aligned with your goals and provide personalized advice.

When choosing an account, carefully consider your time horizon and risk tolerance. For long-term goals, you may be willing to take on more risk to achieve higher returns. In contrast, short-term goals usually require a more conservative approach to avoid significant losses. Additionally, evaluate the tax implications of each account type and determine whether tax-advantaged or taxable accounts align better with your objectives.

Smart Ways to Invest Your RBFCU Savings

You may want to see also

Decide how much help you want

Deciding how much help you want with your investment portfolio depends on how much time and energy you want to spend on managing your investments. If you want to be completely hands-off, you can outsource the task to a robo-advisor or financial advisor who will manage your assets for you. Robo-advisors are an inexpensive alternative, taking your risk tolerance and overall goals into account to build and manage an investment portfolio for you.

If you want more than just investment management, an online financial planning service or a financial advisor can help you build your portfolio and map out a comprehensive financial plan.

Financial advisors can also help you understand your risk profile – how much risk you are willing to take to achieve a certain level of investment return. Generally speaking, younger investors can "tolerate" more risk because they have more time to make back money lost in a downturn, while older people, especially those living on a fixed income, have a lower risk tolerance.

If you decide to take a DIY approach, you can follow a few simple steps to build your own investment portfolio. First, start by making a list of your financial goals and sorting them by time horizon – how long you'll need to hold the investments until you require the money. Then, decide your risk tolerance – how much you're willing to lose in the short term to achieve each goal.

Next, choose an investment account that aligns with your investment goals. Tax-advantaged accounts like IRAs and 401(k)s work best for long-term, retirement-related goals, while taxable brokerage accounts are better for non-retirement goals, like a down payment on a house.

Finally, choose your investments based on your risk tolerance. Stocks, bonds, mutual funds, and exchange-traded funds (ETFs) are all common types of investments. Stocks are a tiny slice of ownership in a company and tend to be higher-risk, while bonds are considered safer investments but generally have lower returns. Mutual funds and ETFs provide instant diversification to your portfolio, as they allow you to invest in a basket of securities all at once.

Invest Your Savings Wisely: A California Guide

You may want to see also

Monitor, rebalance and adjust

Once you've hit "buy", your investment portfolio will still need ongoing care and attention. That's why it's important to monitor and adjust your portfolio regularly. Here are some tips on how to do this:

Monitoring your portfolio

You might want to check in on your portfolio twice a year to ensure your asset allocation is still aligned with your goals. You may also want to monitor your portfolio to keep an eye on how your investments are performing. This can be done by regularly researching the financial performance of your stocks to make informed decisions.

Rebalancing your portfolio

If the market has been volatile, you might need to rebalance your holdings. This can be done by restoring your investment portfolio to its original makeup. For example, if you have a portfolio that is 60% stocks and it increases to 65%, you may want to sell some of your stocks or invest in other asset classes until your stock allocation is back at 60%. Some investments can rebalance themselves, such as target-date funds, which are a type of mutual fund that automatically rebalances over time.

Adjusting your investment strategy

You may also need to adjust your investment strategy as your life changes. Getting married or divorced, becoming a parent, receiving an inheritance, or nearing retirement are all life events that could necessitate rethinking your current investment strategy.

When to rebalance

Some advisors recommend rebalancing at set intervals, such as every six or 12 months, or when the allocation of one of your asset classes (such as stocks) shifts by more than a predetermined percentage, such as 5%.

Using a robo-advisor

If you're investing through a robo-advisor, they will likely take care of rebalancing your portfolio for you.

Modern Portfolio Theory (MPT)

MPT is a theory that seeks to maximise returns based on an investor's tolerance for risk. It was first proposed by American economist Harry Markowitz, who argued that portfolios should optimise expected returns relative to volatility. According to MPT, a well-balanced and calculated portfolio will mean that if some assets fall due to market conditions, others should raise an equal amount in compensation.

Accessing Your ENT Investment Portfolio: A Step-by-Step Guide

You may want to see also

Frequently asked questions

An investment portfolio is a collection of invested assets such as stocks, bonds, funds, and even real estate.

First, decide how much help you want. You can use a robo-advisor or financial advisor to manage your assets, or you can take a DIY approach. Next, choose an account that works towards your goals. Then, select your investments based on your risk tolerance.

Your risk tolerance is your ability to accept investment losses in exchange for the possibility of earning higher investment returns. Generally, younger people can tolerate more risk because they have more time to recover from losses.

You can buy stocks in companies you already know and like. You can also research companies that are innovating in their field and offering great customer service.