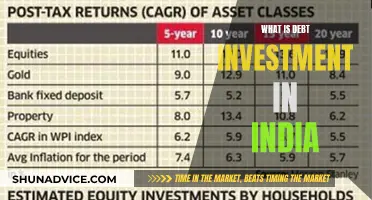

Diversifying your 401k investments is a proven plan that helps lower your risk by spreading out your investments. Diversification helps you capture returns from a mix of investments—stocks, bonds, commodities, and others—while protecting your balance against the risk of a downturn in any one asset class. Work with your financial advisor to choose mutual funds with a long history of strong returns and stay away from single stocks.

| Characteristics | Values |

|---|---|

| Diversify your portfolio | Spread the portion you’ve allocated to equities among these funds |

| Pick an asset-allocation approach | Choose an asset-allocation approach you can live with during up and down markets |

| Review your asset allocations periodically | Review your asset allocations periodically, perhaps annually |

| Say no to company stock | Avoid company stock as it concentrates your 401(k) portfolio too narrowly |

| Invest in four different types of mutual funds | Growth, growth and income, aggressive growth, international |

| Consider your risk tolerance | Consider your risk tolerance, age, and the amount you’ll need to retire |

| Avoid funds with high fees | Be sure to diversify your investments to mitigate risk |

What You'll Learn

Choose asset-allocation approach

Diversification is the answer to investing risk. It helps lower your risk by spreading out your investments. Work with your financial advisor to choose mutual funds with a long history of strong returns and stay away from single stocks! You might already know that spreading your 401(k) account balance across various investment types makes good sense. Diversification helps you capture returns from a mix of investments—stocks, bonds, commodities, and others—while protecting your balance against the risk of a downturn in any one asset class.

K) plans typically offer mutual funds that range from conservative to aggressive. Before choosing, consider your risk tolerance, age, and the amount you’ll need to retire. Avoid funds with high fees. Be sure to diversify your investments to mitigate risk, although many funds are already diversified. At a minimum, contribute enough to maximize your employer’s match. Once you have established a portfolio, monitor its performance and rebalance it when necessary.

The best way to diversify your portfolio is to invest in four different types of mutual funds: growth and income, growth, aggressive growth, and international. These categories also correspond to their cap size (or how big the companies within that fund are). Investments like index funds and most ETFs try to mirror what’s happening in the market. But if you pick the right mutual funds, you can beat the market’s growth.

Diversify your portfolio by spreading the portion you’ve allocated to equities among these funds. That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S.

Review your asset allocations periodically, perhaps annually, but try not to micromanage. Some experts advise saying no to company stock, which concentrates your 401(k) portfolio too narrowly and increases the risk that a bearish run on the shares could wipe out a big chunk of your savings.

Is Investing in Turkey Safe? Navigating Risks and Rewards

You may want to see also

Review your asset allocations periodically

Reviewing your asset allocations periodically is a crucial step in ensuring your 401(k) investments are well-diversified and aligned with your financial goals. Here's a detailed guide on how to approach this process:

- Frequency of Review: It is generally recommended to review your 401(k) asset allocations annually. This periodic review allows you to make necessary adjustments based on market changes and your evolving financial situation. However, don't micromanage; instead, focus on making informed decisions based on your long-term goals.

- Risk Assessment: Evaluate your risk tolerance and the impact of market downturns on your portfolio. Consider your age, investment time horizon, and retirement needs. Diversification is key to managing risk, so ensure your investments are spread across different asset classes such as stocks, bonds, and commodities.

- Asset Allocation Strategy: Assess the current asset allocation of your 401(k). Aim to diversify by spreading your equity allocation among various funds. For instance, you could allocate a portion to U.S. large-cap funds, international funds, and U.S. funds, ensuring a balanced approach. Consider mutual funds that offer a mix of growth, income, aggressive growth, and international investments.

- Avoid Concentrated Risk: Steer clear of over-concentration in company stock, as this can significantly increase risk. Diversify your portfolio to reduce the impact of a single stock's performance on your overall savings.

- Rebalancing: Periodically review and rebalance your portfolio to maintain your desired asset allocation. Rebalancing involves buying or selling assets to restore the original allocation percentages. This process ensures your investments stay on track and helps manage risk effectively.

S-Corp Savings: Investing for Growth and Security

You may want to see also

Invest in four different types of mutual funds

Diversifying your 401(k) investments is a proven strategy to maximize your contributions and lower your risk. Spreading your investments across different asset classes such as stocks, bonds, and commodities can help protect your balance against market downturns.

One effective approach is to invest in four different types of mutual funds:

- Growth and income: These funds focus on capital appreciation and dividend income. They are suitable for long-term investors who can ride out market fluctuations.

- Growth: Growth funds aim to capitalize on the growth potential of large-cap companies. They are less focused on income and more on long-term capital appreciation.

- Aggressive growth: These funds seek to outperform the market by investing in smaller, more aggressive companies. They are high-risk, high-reward and are suited for investors who can withstand significant market volatility.

- International: International funds invest in companies outside the United States. They offer diversification across global markets and can provide exposure to emerging markets.

When investing in mutual funds, it's essential to consider your risk tolerance, age, and retirement goals. Work with a financial advisor to choose funds with a strong track record of performance and stay away from single stocks to diversify your portfolio.

Investing: Risks, Losses, and Uncertainties

You may want to see also

Diversify your portfolio by spreading the portion

Diversifying your 401(k) investments is a proven strategy to lower your risk and maximize your returns. Here are some steps to help you diversify your portfolio:

- Understand your options and assess your risk tolerance, age, and retirement needs.

- Choose mutual funds that align with your risk tolerance and offer a mix of asset classes. Consider funds with a history of strong returns and avoid those with high fees.

- Spread your equity allocation across different types of funds, such as U.S. large cap, international, and U.S. small-cap funds.

- Regularly review and rebalance your portfolio to maintain your desired asset allocation and mitigate risk.

- Avoid micromanagement and resist the temptation to time the market or trade too frequently.

Remember, diversification is a long-term strategy, and it's essential to stick with a proven plan to grow your savings steadily over time.

Diversifying Investments: Reducing Risk Through Strategic Allocation

You may want to see also

Avoid funds with high fees

Diversifying your 401(k) investments is a proven way to lower your risk and maximize your returns. Diversification helps you capture returns from a mix of investments—such as stocks, bonds, and commodities—while protecting your balance against the risk of a downturn in any one asset class.

Diversifying your portfolio can be done by spreading the portion you’ve allocated to equities among these funds. For example, you might want to put 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, and 10% into a U.S. small-cap fund.

Diversification can be achieved by investing in four different types of mutual funds: growth and income, growth, aggressive growth, and international. These categories also correspond to their cap size (or how big the companies within that fund are).

Before choosing your investments, consider your risk tolerance, age, and the amount you’ll need to retire. Avoid funds with high fees and work with your financial advisor to choose mutual funds with a long history of strong returns.

At a minimum, contribute enough to maximize your employer’s match. Once you have established a portfolio, monitor its performance and rebalance it when necessary.

Goldman's Investment Management: Powering Success and Growth

You may want to see also

Frequently asked questions

Diversifying your 401k investments is a proven way to lower risk and maximize returns. The best way to diversify your portfolio is to invest in four different types of mutual funds: growth and income, growth, aggressive growth, and international.

Diversification helps you capture returns from a mix of investments—stocks, bonds, commodities, and others—while protecting your balance against the risk of a downturn in any one asset class.

Review your asset allocations periodically, perhaps annually, but try not to micromanage. Once you have established a portfolio, monitor its performance and rebalance it when necessary.

Diversify your portfolio by spreading the portion you’ve allocated to equities among these funds. Work with your financial advisor to choose mutual funds with a long history of strong returns and stay away from single stocks! Avoid funds with high fees.