Debt investment in India refers to investing in debt funds, which are a type of mutual fund that generates returns by lending money to the government and companies. These funds invest in fixed-income securities such as corporate bonds, treasury bills, government securities, and money market instruments. Debt funds are considered less risky than equity investments, making them attractive to investors with a lower risk tolerance. They offer stable and steady returns, making them suitable for investors seeking regular income with low volatility. However, debt funds also have moderate risks, including credit risk, interest rate risk, and liquidity risk. The performance of debt funds can be influenced by market fluctuations, interest rate movements, and credit ratings. Overall, debt funds provide investors in India with a relatively safe and flexible investment option, offering higher returns than traditional saving products like bank deposits.

| Characteristics | Values |

|---|---|

| Type of Investment | Debt investment |

| Country | India |

| Investment Type | Mutual funds |

| Investment Options | Debt funds, fixed-income securities, corporate bonds, treasury bills, government securities, money market instruments |

| Risk | Less risky than equity investments |

| Returns | Lower than equity investments |

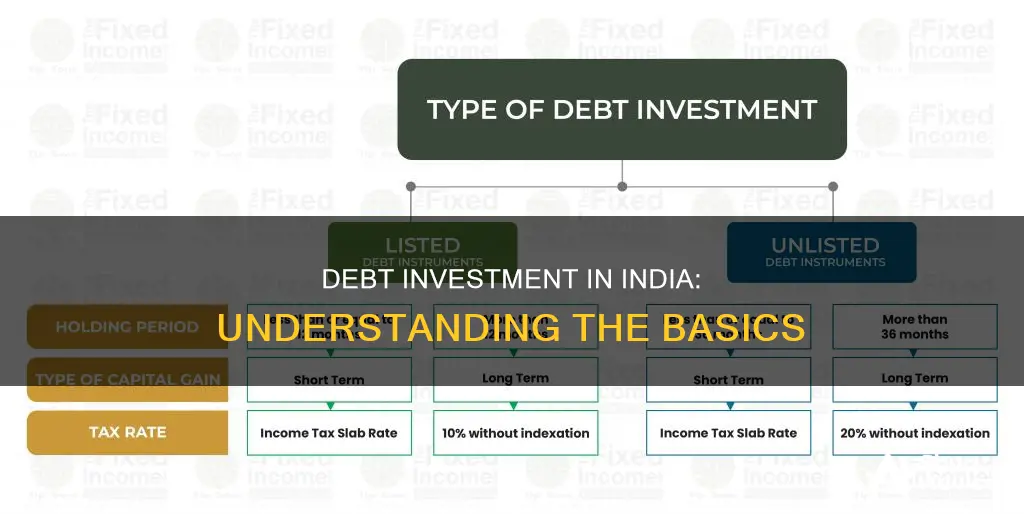

| Taxation | Short-term capital gains taxed at income tax slab rate; long-term capital gains (>3 years) taxed at 20% with indexation benefits |

| Investor Type | Risk-averse, short or medium-term, low-to-moderate returns |

| Advantages | Low cost, stable returns, high liquidity, reasonable safety, tax efficiency |

| Disadvantages | Exit load, interest rate risk, credit risk, liquidity risk |

What You'll Learn

Debt funds vs fixed deposits

Debt funds and fixed deposits are two of the most popular investment options in India. While fixed deposits (FDs) have been the traditional investment vehicle for most Indian households, debt funds have witnessed a surge in popularity in recent years. Here, we will compare debt funds and fixed deposits across various parameters to help you understand the differences and make informed investment decisions.

Risk Profile:

Fixed deposits (FDs) are considered a relatively safe investment option as they offer a guarantee of capital safety by the bank. However, in rare cases, banks may default on FDs if their net worth becomes negative due to high non-performing assets (NPAs). On the other hand, debt funds are subject to market risks, and there is no assurance of capital safety. Debt funds carry two types of risk: interest rate risk and credit risk. Interest rate risk depends on the duration profiles of the funds, while credit risk depends on the credit ratings of the underlying securities.

Returns:

FDs typically pay compound interest at a fixed rate over the term of the deposit. FD interest rates have been declining in recent years, with current rates for 2-3 year FDs ranging from 5.1% to 5.4%. Debt funds, on the other hand, do not offer assured returns but are market-linked. Historically, debt funds have usually outperformed FDs of similar tenures. Therefore, debt funds offer potentially higher returns compared to FDs.

Liquidity:

Both FDs and debt funds are highly liquid investment options, and there is no lock-in period for either. However, premature withdrawals from FDs may incur penalties, while debt fund redemptions within the exit load period will attract an exit load fee. Some debt fund schemes, such as overnight funds, do not charge any exit load.

Taxation:

Interest earned on FDs is taxed during the tenure of the investment and on maturity, according to the investor's income tax slab. Debt funds, especially for investors in higher tax brackets, enjoy a tax advantage over FDs. Short-term capital gains in debt funds (investments held for less than 3 years) are taxed similarly to FDs, while long-term capital gains in debt funds (investments held for more than 3 years) are taxed at a lower rate of 20% after allowing for indexation benefits.

Transparency:

FDs provide less transparency to investors, who have limited information about the bank's loans, NPAs, and bad debts. Debt funds, on the other hand, are more transparent as the scheme portfolio is disclosed monthly by asset management companies (AMCs) in factsheets, providing complete information about the instruments, credit ratings, and exposure of respective instruments in the portfolio.

Both debt funds and fixed deposits have their advantages and considerations. If capital safety and assured returns are paramount, then FDs may be the preferred option. However, if you are willing to take on slightly higher risk and seek potentially superior risk-adjusted returns, investing a portion of your fixed income assets in debt mutual funds can be a good choice. Additionally, debt funds offer the advantage of taxation benefits, making them a compelling alternative to FDs.

Air India: An Investment Guide for Beginners

You may want to see also

Debt fund taxation

Short-Term Capital Gains Tax

Debt funds held for less than three years are considered short-term investments. The tax on these gains is calculated according to the investor's income tax bracket. For example, if someone falls into the 20% tax bracket and earns Rs. 10,000 on a debt fund held for two years, they will pay 20% of Rs. 10,000 (Rs. 2,000) as tax.

Long-Term Capital Gains Tax

Debt funds held for more than three years are considered long-term investments. The applicable tax rate is 20% with indexation plus 3% cess, which comes to 20.90%. For example, if someone in the 20% tax bracket invests in a debt fund of Rs. 2,00,000 for five years, they will pay 20.90% tax on the returns.

Dividend Taxation

Dividends offered by debt funds are taxed at the investor's income tax slab rate. Until 2020, dividends were tax-free for investors, as companies paid a dividend distribution tax (DDT). Now, if you fall under the 20% income tax bracket, you will pay Rs 20 for every Rs 100 received as dividends.

Investment Management Fees: Industry Standards and Expectations

You may want to see also

Debt fund risks

Debt funds are considered to be low-risk investments, but they are not entirely risk-free. Here are some of the key risks associated with debt fund investments in India:

Interest Rate Risk

Interest rate risk is inherent in debt funds due to the inverse relationship between bond prices and interest rates. When interest rates rise, bond prices fall, and vice versa. This risk is difficult to avoid in debt funds, and it can lead to capital losses for investors. To manage this risk, investors can build a diversified portfolio that includes both short-term and long-term debt instruments, or invest in dynamic bond funds that aim to benefit from both rising and falling interest rates.

Credit Risk

Credit risk, also known as default risk, is the possibility that the borrower (the company or government) may be unable to repay the loan or make timely interest payments. This risk is assessed using credit ratings assigned by agencies like CRISIL, ICRA, and CARE in India. Investing in debt funds with higher credit ratings, such as those that invest in AAA or A1-rated bonds, can help mitigate this risk. Conservative investors should generally opt for funds with higher-rated bonds.

Liquidity Risk

Liquidity risk arises when investors are unable to easily sell their debt fund investments. This risk is particularly high in close-ended debt funds, such as Fixed Maturity Plans (FMPs), which can only be redeemed on a fixed maturity date. To avoid liquidity risk, investors should opt for open-ended debt funds, which can be redeemed at any time.

Reinvestment Risk

Reinvestment risk occurs when the underlying debt papers in a debt fund mature, and the fund manager has to reinvest the proceeds at a lower interest rate. This risk is more significant in a falling interest rate environment. To manage reinvestment risk, investors can consider long-term debt funds, which invest in longer-term papers that do not mature frequently, thus reducing the likelihood of reinvesting at lower rates.

Concentration Risk

Concentration risk arises when a debt fund manager fails to adequately diversify the portfolio. If a significant portion of the fund is invested in a single company or security, and that company experiences financial difficulties or defaults on its debt, it can result in substantial losses for the fund. Investors can mitigate this risk by choosing funds with well-diversified portfolios and avoiding funds that hold a large proportion of unrated or unlisted debt.

Morgan Stanley's Investment Management Options: Exploring the Choices

You may want to see also

Debt fund types

Debt funds are a type of mutual fund that generates returns by lending money to the government and companies. The risk level of a debt fund is determined by the lending duration and the type of borrower. Debt funds can be considered for an investment horizon of 1 day to 3 years. They offer better post-tax returns compared to fixed deposits if the investment is held for at least 3 years. Liquid debt funds are a great option for parking emergency funds as they offer better returns than savings bank accounts without taking on too much risk.

- Liquid Fund: Liquid funds invest in money market instruments with a maximum maturity of 91 days. They offer better returns than savings accounts and are suitable for short-term investments.

- Money Market Fund: Money market funds invest in money market instruments with a maximum maturity of 1 year. These funds are suitable for investors seeking low-risk debt securities for the short term.

- Dynamic Bond Fund: Dynamic bond funds invest in debt instruments of varying maturities based on the interest rate regime. They are suitable for investors with moderate risk tolerance and an investment horizon of 3 to 5 years.

- Corporate Bond Fund: Corporate bond funds invest at least 80% of their total assets in high-quality corporate bonds. These funds are suitable for investors with a low-risk tolerance seeking to invest in corporate bonds.

- Banking and PSU Fund: Banking and PSU funds invest at least 80% of their total assets in debt securities of public sector undertakings and banks.

- Gilt Fund: Gilt funds invest at least 80% of their investible corpus in government securities of varying maturities. Gilt funds do not carry any credit risk but have a high interest rate risk.

- Credit Risk Fund: Credit risk funds invest at least 65% of their investible corpus in corporate bonds with ratings below the highest-quality bonds. These funds carry a higher credit risk and offer slightly better returns than the highest-quality bonds.

- Floater Fund: Floater funds invest at least 65% of their investible corpus in floating-rate instruments, which carry a low interest rate risk.

- Overnight Fund: Overnight funds invest in debt securities with a maturity of 1 day. Both credit risk and interest rate risk are negligible, making these funds extremely safe.

- Ultra-Short Duration Fund: Ultra-short-duration funds invest in money market instruments and debt securities with a Macaulay duration of 3 to 6 months.

- Low Duration Fund: Low duration funds invest in money market instruments and debt securities with a Macaulay duration of 6 to 12 months.

- Short Duration Fund: Short duration funds invest in money market instruments and debt securities with a Macaulay duration of 1 to 3 years.

- Medium Duration Fund: Medium duration funds invest in money market instruments and debt securities with a Macaulay duration of 3 to 4 years.

- Medium to Long Duration Fund: Medium to long duration funds invest in money market instruments and debt securities with a Macaulay duration of 4 to 7 years.

- Long Duration Fund: Long duration funds invest in money market instruments and debt securities with a Macaulay duration of more than 7 years.

India's Graphene Investment: Strategies for Success

You may want to see also

Debt fund suitability

Risk Profile

Debt funds are generally considered low-risk investments, making them suitable for risk-averse individuals. They are less volatile than equity funds and are not significantly impacted by market fluctuations. This stability makes them ideal for those seeking regular income with minimal risk. However, it's important to remember that debt funds are not entirely risk-free. They carry interest rate risk, credit risk, and liquidity risk.

Investment Horizon

Debt funds can be suitable for short- to medium-term investors. The investment horizon depends on the type of debt fund chosen. Liquid funds, for instance, are ideal for very short-term investments, such as days or weeks, while short-term funds are suitable for investments ranging from one year or more. If you're looking for long-term investments, consider other options as debt funds are not designed for long-term holdings.

Return Expectations

Debt funds offer moderate returns compared to equity funds. They are suitable for investors who are comfortable with below-moderate returns and are not seeking high-risk, high-return investments. Debt funds can still provide greater returns than traditional bank deposits, making them attractive to those seeking higher returns than what banks offer while maintaining a lower risk profile.

Taxation

Taxation is an important consideration when investing in debt funds. Returns from debt funds are taxed, and the taxes can eat into your investment returns. Short-term capital gains (holding period up to 3 years) are taxed according to the applicable income tax slab, while long-term capital gains (holding period over 3 years) are taxed at a rate of 20% with indexation benefits. Understand the tax implications before investing.

Investment Objectives

Debt funds are suitable for investors with specific financial goals, such as retirement planning, buying a home, or saving for children's education. They can provide a steady income stream and help build a corpus over time. If you have well-defined financial objectives and prefer a more conservative approach, debt funds can be a good choice.

Alternative Investment Options

When considering debt funds, it's essential to compare them with alternative investment options available in the market. For instance, bank fixed deposits offer guaranteed returns with low risk, although the returns may be lower than debt funds. Understand the risk-return trade-off and assess if debt funds align better with your investment objectives than other available options.

In conclusion, debt funds are suitable for individuals seeking low-risk investments, regular income, and moderate returns. They are ideal for short- to medium-term investors and can provide tax-efficient returns. However, it's important to carefully consider your financial goals, risk appetite, and alternative investment choices before investing in debt funds.

The Workday of an Investment Management Analyst at Goldman Sachs

You may want to see also

Frequently asked questions

Debt investment involves investing in fixed-income instruments, such as corporate and government bonds, treasury bills, and other debt securities. These instruments have a pre-decided maturity date and interest rate, offering stable and steady returns with low volatility.

Debt funds invest in fixed-income securities, lending money to the government and companies. The lending duration and borrower determine the risk level. Debt funds generate returns through interest payments and capital gains when interest rates change.

Debt funds are ideal for risk-averse investors seeking regular income with moderate returns. They are suitable for short or medium-term investors and those with a low-risk appetite who want higher returns than bank deposits.

Debt funds carry interest rate risk, credit risk, and liquidity risk. An unexpected increase in interest rates can impact returns, and there is a chance of default on interest and principal payments. Additionally, there may be an exit load when leaving the fund.