Diversifying your investment portfolio is a crucial step in ensuring the safety of your money and minimising risk. Diversification is about spreading your money across different types of investments, or asset classes, to protect your portfolio from adverse stock market conditions. The old adage don't put all your eggs in one basket sums up this strategy. By diversifying, you reduce the likelihood of losing all your assets if a particular market sector takes a dive. For example, if you had a portfolio of stocks, bonds, real estate and international securities, a drop in stock prices may not affect your overall portfolio value as much. Diversification is also about investing in different industries, interest plans and tenures, rather than putting all your money in one sector, like pharmaceuticals.

The right way to divide your investment portfolio depends on your goals and risk tolerance. If you're young, you may opt for a riskier portfolio with more stocks, whereas someone closer to retirement age might prefer the stability of bonds. Your portfolio should also take into account your current financial situation, including your income, expenses and savings.

There are various strategies for dividing your portfolio, such as the 100 minus your age rule, where the percentage of stocks in your portfolio equals 100 minus your age. For example, a 30-year-old might keep 70% in stocks and 30% in bonds.

Other factors to consider when dividing your investment portfolio include the performance of different asset classes over time, market conditions and your personal financial goals. It's important to periodically review and rebalance your portfolio to ensure it aligns with your goals and risk tolerance.

| Characteristics | Values |

|---|---|

| Investment type | Stocks, bonds, real estate, cash, securities, ETFs, mutual funds, etc. |

| Risk tolerance | Depends on age, financial goals, and personal preference |

| Investment horizon | Depends on age and financial goals |

| Diversification | Spread investments across asset classes and market sectors |

Diversification

Types of Investments

There are two basic types of investments: stocks and bonds. Stocks are considered high-risk, high-return investments, while bonds are generally more stable with lower returns. Diversification involves dividing your money between these two options to minimise risk exposure.

Asset Allocation

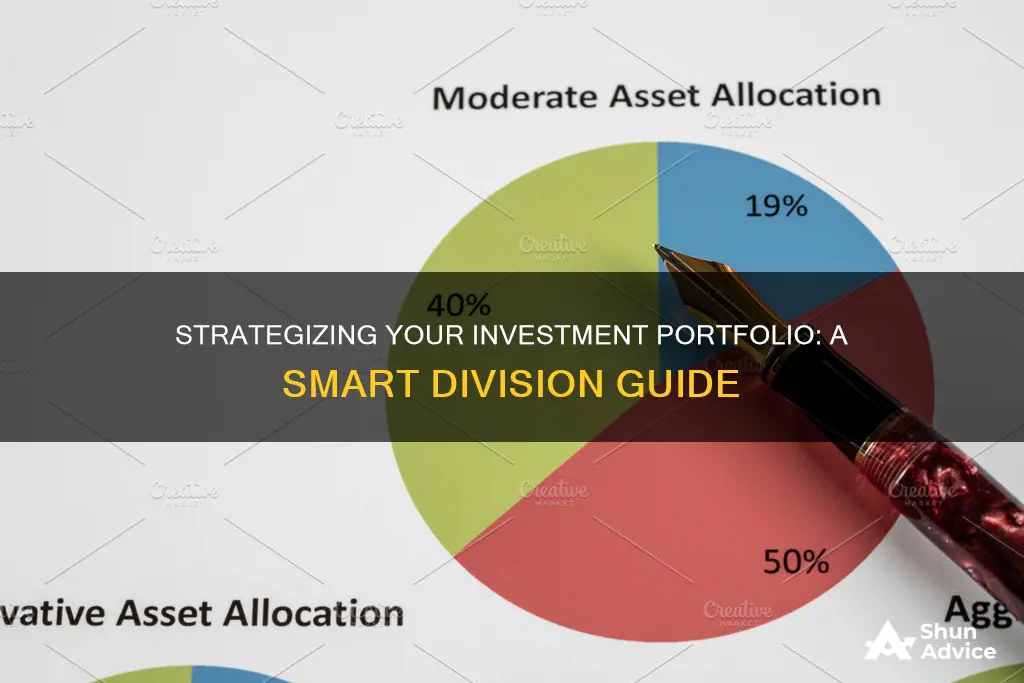

The distribution of assets in your portfolio should be based on your age and lifestyle. Younger investors can opt for riskier investments, such as stocks, that offer higher returns. A common rule of thumb for asset allocation is to subtract your age from 100, and the resulting number should be the percentage of stocks in your portfolio. For example, a 30-year-old could allocate 70% of their portfolio to stocks and 30% to bonds. As you get older, it is generally recommended to reduce risk exposure by increasing the proportion of bonds.

Having a lot of investments does not necessarily mean you are diversified. True diversification means having a wide range of different types of investments. In addition to stocks and bonds, you should consider investing in real estate, international securities, cash, commodities, and more.

- Spread the Wealth: Don't put all your money in one stock or sector. Invest in a variety of companies from different industries. You can also consider investing in commodities, exchange-traded funds (ETFs), and real estate investment trusts (REITs).

- Index or Bond Funds: Consider adding index funds or fixed-income funds to your portfolio. These funds track various indexes and can provide long-term diversification. By including fixed-income solutions, you further hedge your portfolio against market volatility.

- Build Your Portfolio Over Time: Regularly add to your investments. A strategy called dollar-cost averaging can help smooth out market volatility by investing the same amount of money over a period of time.

- Know When to Get Out: Stay informed about your investments and overall market conditions. This will help you make timely decisions about cutting losses and moving on to other investments.

- Be Mindful of Fees: Understand the fees you are paying, whether monthly or transactional. While some investments may have low fees, they might also offer less in terms of active management, which can be beneficial during challenging economic periods.

Benefits of Diversification

Risks of Over-Diversification

While diversification is generally beneficial, it is possible to over-diversify your portfolio. If adding a new investment increases the overall risk and lowers the expected return without reducing risk accordingly, it defeats the purpose of diversification. This can happen when there are already a large number of securities in a portfolio or if closely correlated securities are added.

Building a Solid Investment Portfolio: A Beginner's Guide

You may want to see also

Asset allocation

Stocks, or shares of ownership in a company, are known for their high risk and high return potential. They are volatile in the short term but can deliver substantial returns over the long term.

Bonds, on the other hand, represent loans to a company or government and are generally more stable, with lower returns. They are suitable for investors seeking a steady income with reduced risk.

Cash and cash equivalents, such as savings accounts and money market funds, are the safest and most liquid asset class, providing easy access to funds without significant losses.

The key to effective asset allocation lies in understanding your investment goals, time frame, and risk tolerance. A younger investor with a longer time horizon can afford to take on more risk by allocating a larger portion of their portfolio to stocks. As a rule of thumb, subtracting your age from 100 gives the percentage of stocks to hold in your portfolio. For example, a 30-year-old may hold 70% stocks and 30% bonds.

However, it's important to consider your financial circumstances and risk tolerance. If you share a significant portion of family expenses, opting for a more conservative approach with a higher allocation to bonds may be prudent.

Additionally, it's crucial to diversify within each asset class. For instance, investing in various industries, interest plans, and tenures, rather than concentrating solely on one sector, helps protect against sector-specific risks.

Remember, asset allocation is a personal decision, and there is no one-size-fits-all model. It requires careful consideration of your unique circumstances, goals, and comfort with risk.

Building a Balanced Investment Portfolio: Strategies for Success

You may want to see also

Risk tolerance

An investor's risk tolerance is influenced by factors such as age, investment goals, and income. For example, younger investors with a longer time horizon can generally tolerate more risk in their portfolios, as they have more time to recover from potential losses. On the other hand, retirees or those approaching retirement age typically have a lower risk tolerance and seek investments with guaranteed returns.

An investor with a higher risk tolerance is often referred to as an aggressive investor, who is willing to risk losing money in pursuit of potentially better results. Their investments usually emphasize capital appreciation and they tend to allocate more of their portfolio to stocks, with little to no allocation to bonds or cash. In contrast, a conservative investor with a lower risk tolerance seeks to accept minimal volatility in their investment portfolio and targets guaranteed and highly liquid investment vehicles such as bank certificates of deposit (CDs), money markets, or U.S. Treasuries.

It is important to note that risk tolerance is not a static concept and can change over time as an investor's financial situation, goals, and time horizon evolve. Therefore, it is essential to periodically review and adjust one's investment portfolio to ensure it remains aligned with their risk tolerance and investment objectives.

Building a Tax-Efficient Investment Portfolio: Strategies for Success

You may want to see also

Growth goals

When dividing your investment portfolio, it's important to keep in mind your growth goals. Here are some tips to help you with this:

Diversification

Diversification is a crucial aspect of managing your investment portfolio and mitigating risks. By diversifying your portfolio, you can smooth out the peaks and valleys of investing, making it more likely that you'll stick to your investment plan. It's important to invest in a variety of asset classes, such as stocks, bonds, real estate, international securities, and cash. Diversification is not limited to just different types of investments but also extends to different industries, interest plans, and tenures within each class of investment. For example, instead of putting all your money in the pharmaceutical sector, consider diversifying into other sectors like education technology or information technology.

Asset Allocation

The allocation of your assets should be based on your age and risk tolerance. A common rule of thumb is to subtract your age from 100 and invest the resulting percentage in stocks, with the rest in bonds. For instance, a 30-year-old could allocate 70% of their portfolio to stocks and 30% to bonds. However, as you get older, it's generally recommended to reduce your risk exposure by adjusting the stock-to-bond ratio. So, for a 60-year-old, a stock-to-bond allocation of 40:60 might be more appropriate. It's important to note that family finances and expenses might also factor into these decisions.

Growth Potential and Risk

When focusing on growth goals, it's essential to understand the relationship between growth potential and risk. Stocks are typically considered high-risk investments with high growth potential, while bonds are seen as more stable but with lower returns. If you're aiming for aggressive growth, you may opt for a higher allocation of stocks in your portfolio. However, this also means taking on more risk. On the other hand, if you're nearing retirement or prefer a more conservative approach, you might want to allocate more to fixed-income securities like bonds, which offer lower growth potential but also carry less risk.

Regular Review and Rebalancing

To ensure your portfolio remains aligned with your growth goals, it's crucial to review and rebalance it periodically. Over time, the performance of different investments will cause shifts in the weightings within your portfolio. To maintain proper diversification, it's recommended to rebalance at least twice a year or quarterly. This involves adjusting your investments back to their appropriate weights to match your desired level of risk and growth potential.

Global Perspective

Don't forget about global investment opportunities. Consider investing in funds focused on emerging markets or international markets, such as Europe or China, which have the potential for high long-term growth rates. Diversifying globally can also protect your portfolio from negative events specific to a particular country or region.

Investing More, Saving Less: Surplus Secrets

You may want to see also

Investment types

There are several different types of investments to choose from, each with its own unique characteristics and risk profile. Here are some of the most common investment types:

- Stocks: Stocks, also known as equities, represent ownership in a company. They are considered high-risk but also offer the potential for high returns. Stocks can be further categorised into different classes based on the size of the company, such as large-cap, mid-cap, or small-cap.

- Bonds: Bonds are a type of fixed-income security, where investors essentially loan money to a company or government entity for a set period. Bonds are typically more stable and less risky than stocks, offering consistent income through interest payments.

- Mutual Funds: Mutual funds are investment pools that combine money from multiple investors to purchase a diversified portfolio of stocks, bonds, and other securities. They are managed by professional fund managers and offer investors a simple way to achieve diversification.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds in that they also pool money from multiple investors to purchase a diversified portfolio of securities. However, ETFs are traded on an exchange like stocks, offering more flexibility and liquidity than mutual funds.

- Real Estate: Investing in real estate involves purchasing property, such as land, buildings, or homes, with the expectation of price appreciation or rental income. Real estate can provide a hedge against inflation and is often considered a stable, long-term investment.

- International Securities: Investing in international securities means purchasing stocks, bonds, or other financial instruments from companies or entities based in other countries. This type of investment provides exposure to global markets and can help maintain buying power in an increasingly globalised world.

- Cash and Cash Equivalents: This includes money market instruments, such as certificates of deposit (CDs), commercial papers (CPs), and treasury bills (T-bills). These investments offer liquidity and are typically considered low-risk, providing security and stability to a portfolio.

- Cryptocurrencies: Cryptocurrencies are digital or virtual currencies that use cryptography for security and are typically decentralised, meaning they are not controlled by any central authority. Cryptocurrencies are highly volatile and are considered a high-risk, high-return investment.

- Commodities: Commodities are tangible assets such as gold, silver, oil, or agricultural products. Investing in commodities can provide a hedge against inflation and diversify a portfolio, especially during times of economic uncertainty.

- Options, Futures, and Commodities: These are more complex financial instruments that involve contracts and can be used for speculation or hedging purposes. Options give the holder the right to buy or sell an asset at a specific price within a certain time frame. Futures, on the other hand, represent a legal agreement to buy or sell an asset at a set price at a future date.

When deciding how to allocate your investments across these different types, it's important to consider your risk tolerance, investment goals, time horizon, and other factors. Diversification across various investment types is generally recommended to reduce risk and maximise the potential for returns.

Public Saving and Investment: Two Sides of the Same Coin?

You may want to see also

Frequently asked questions

Diversification is important because it minimises the risk of major losses by reducing your exposure to a single security or asset class. It also helps to protect your portfolio from adverse stock market conditions and market swoons.

The amount of money you allocate to each asset class will depend on your goals, risk tolerance, and investment horizon. Generally, younger investors can take on more risk and should therefore allocate a larger percentage of their portfolio to stocks or other high-return investments. Older investors, or those with a lower risk tolerance, should allocate more of their portfolio to fixed-income securities such as bonds or certificates of deposit.

To build a diversified portfolio, you should spread your investments across different asset classes, such as stocks, bonds, real estate, and cash. Within each asset class, you can further diversify by investing in different industries and sectors. For example, if you're investing in stocks, you can buy shares of small, medium, and large companies across different sectors and geographies.