Compounding is a way to earn interest on interest, which can help investors grow their wealth over time. In India, there are several ways to do this. One way is to invest in stocks, bonds, mutual funds, etc. Compounding investments can be classified into two categories: safe compounding investments and aggressive compounding investments. Safe compounding investments have a higher degree of safety with foreseeable and expected returns, while aggressive compounding investments aim at maximising returns with higher levels of risk. Some of the best compounding interest investments in India include fixed deposits, public provident funds, life insurance savings plans, national pension schemes, and unit-linked insurance plans (ULIPs).

| Characteristics | Values |

|---|---|

| Investment Types | Stocks, bonds, mutual funds, savings accounts, certificates of deposit (CDs), money market accounts, fixed deposits, life insurance savings plans, equity-linked savings schemes (ELSS), national savings schemes (NSC), national pension schemes (NPS), unit-linked insurance plans (ULIPs) |

| Interest Type | Compound interest |

| Interest Calculation | Interest is calculated on the principal amount and accumulated interest, creating a chain reaction of generating returns on returns. |

| Investment Horizon | Long-term |

| Reinvestment of Interest | Interest earned is typically reinvested to generate exponential growth. |

| Investment Amount | Flexible, allowing investors to start with small amounts. |

| Diversification | Diversified investment portfolios help spread risk and enhance returns. |

| Tax Benefits | Many compound interest investments offer tax advantages, such as tax-deductible contributions or tax-free withdrawals. |

| Professional Management | Some compound interest investments, such as mutual funds, provide professional management. |

| Liquidity | Some compound interest investments offer varying degrees of liquidity, allowing early withdrawals with penalties. |

| Automatic Reinvestment | Many compound interest investments automatically reinvest dividends or capital gains. |

What You'll Learn

Safe compounding investments

Public Provident Fund (PPF)

The PPF is a long-term investment option backed by the Indian government, offering guaranteed returns and tax benefits. It has a fixed tenure of 15 years, with partial withdrawals allowed after 6 years. Contributions to a PPF account qualify for tax deductions, and the interest earned, as well as the maturity amount, are tax-free.

National Pension Scheme (NPS)

The NPS is a government-supported retirement savings scheme offering diverse investment options, including equity and bonds. Contributions to the NPS qualify for tax benefits under Sections 80C and 80CCD, and partial withdrawals are permitted for specific needs like education or home purchases. At retirement, you must use a minimum of 40% of your accumulated corpus to buy an annuity, providing a regular pension.

Life Insurance Savings Plans

Life insurance savings plans are a safe, long-term investment that offers guaranteed returns. These plans can help you build a financial cushion for the future while also providing protection for your family in the event of your death. The premiums paid towards many life insurance plans may be eligible for tax deductions, and the maturity proceeds or death benefits may be tax-exempt under certain conditions.

National Savings Certificate (NSC)

The NSC is a government-backed savings instrument offering guaranteed returns. It has a fixed maturity period of 5 years and is eligible for tax deductions under Section 80C of the Income Tax Act. The interest earned on the NSC is taxable in the year of maturity, and withdrawing funds before the maturity date will result in a penalty.

Unit Linked Insurance Plans (ULIPs) with Debt Fund Investment

ULIPs combine insurance coverage with investment options, providing a mix of protection and growth. ULIPs with debt fund investments are generally considered less risky than those with equity fund investments. The premiums paid are eligible for tax deductions, and the death benefit and maturity proceeds may also be tax-free under certain conditions. ULIPs typically have a 5-year lock-in period, after which partial withdrawals are allowed but may incur charges.

Debt Mutual Funds

Debt mutual funds invest in fixed-income securities like government bonds and corporate debentures, offering the potential for regular income and capital appreciation. While they are considered less risky than equity mutual funds, they are not completely risk-free, as the value of your investment can fluctuate due to changes in interest rates and market conditions. Long-term capital gains in debt mutual funds are taxed at a concessional rate, and short-term capital gains are taxed according to your income tax slab.

These safe compounding investment options can help you build wealth over time while minimising risk. However, it is important to carefully consider your financial goals, risk tolerance, and investment horizon before making any investment decisions.

Debt Investment Portfolio: Understanding Your Debt Investments

You may want to see also

Aggressive compounding investments

- Equity-Linked Savings Scheme (ELSS): A mutual fund that invests in equity markets and offers tax benefits. ELSS has a high risk, high-return profile and does not provide guaranteed returns. It has a three-year lock-in period, after which the investment can be redeemed or reinvested.

- National Pension Scheme (NPS): A long-term retirement savings scheme that provides a steady income after retirement. It is a market-linked investment option, and returns are influenced by the performance of the financial markets. NPS is flexible and allows for contributions ranging from ₹500-₹1000 per annum.

- Unit-Linked Insurance Plans (ULIPs) with Equity Fund Investment: ULIPs are insurance-cum-investment products that offer life cover and investment growth. ULIPs with equity funds are riskier than those with debt funds but offer the potential for higher returns. They have a five-year lock-in period, after which partial withdrawals are allowed.

- Equity Mutual Funds: These funds invest in the equities of various firms and are also known as growth funds. They offer higher returns than fixed-income investments and debt funds but come with a high risk associated with market conditions and company performance.

- Stock Market Investments: These are high-risk, high-return investments that do not provide guaranteed returns.

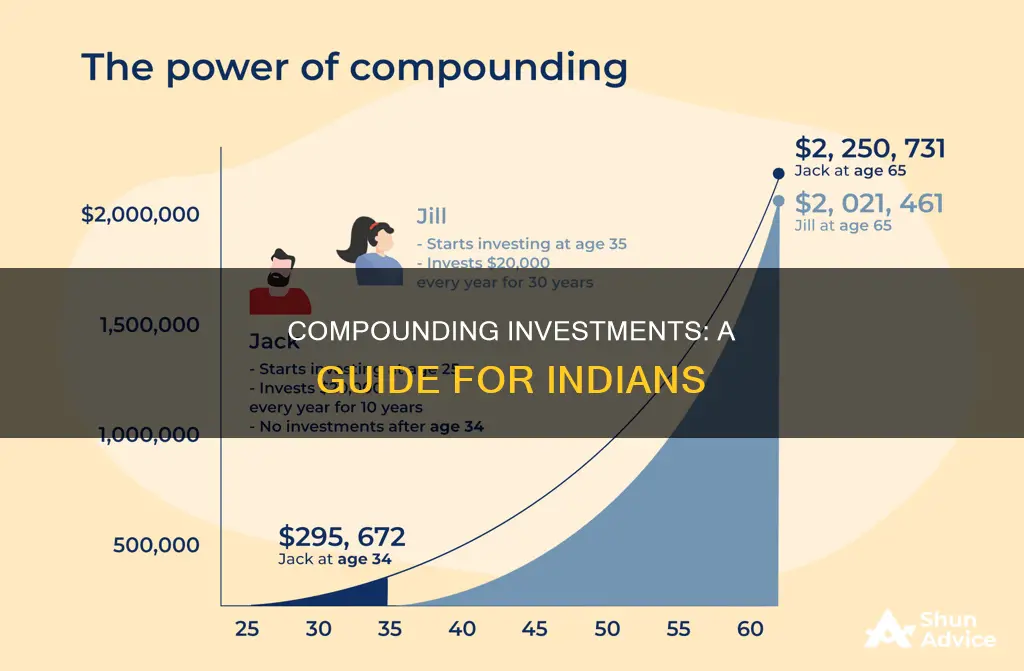

The key to maximising the benefits of compound interest investments is to start early and remain consistent. The longer the investment horizon, the more time compound interest has to grow your wealth.

SSS Workers Investment and Savings: A Guide to the Program

You may want to see also

How to calculate compound interest

To calculate compound interest, you need to know the following:

- Your principal investment amount

- The rate of interest your investor offers

- The number of times your interest gets compounded per year

- The number of years that you want to stay invested

The formula for calculating compound interest is:

A = P (1 + r/n) ^ nt

Where:

- A = Future value of the investment

- P = Principal amount invested

- R = The rate of interest (in decimal form)

- N = Number of times interest gets compounded per period

- T = Number of periods the money is invested for

For example, if you invest Rs. 50,000 with an annual interest rate of 10% for 5 years, the returns for the first year will be 50,000 x 10/100 or Rs. 5,000. For the second year, the interest will be calculated on Rs. 55,000 (Rs. 50,000 + Rs. 5,000). The interest for the second year will be Rs. 5,500. This process continues for the remaining years.

Using the formula, you can calculate the total compound interest accrued over the 5-year period:

A = 50000 (1 + 0.1/1) ^ 5

A = 50000 x 1.1^5

A = 50000 x 1.61051

A = Rs. 80,525.50

So, the total compound interest earned over the 5 years is Rs. 30,525.50.

It is important to note that compound interest has a snowball effect, where the interest is calculated on the aggregated principal amount and the interest incurred over time. This results in exponential growth of your wealth.

Corporate Investment Management: Strategies for Business Growth

You may want to see also

Long-term investment options

Public Provident Fund (PPF)

The PPF is a popular long-term investment option backed by the Government of India, offering a safe investment with attractive interest rates. It has a maturity period of 15 years, with the option to extend it in blocks of five years. Annual deposits range from a minimum of INR 500 to a maximum of INR 1.5 lakh. The PPF offers tax benefits under Section 80C of the Income Tax Act, 1961, and interest income is also tax-exempt.

Mutual Funds

Mutual funds are a great way to invest in a diversified portfolio of stocks, bonds, and other securities. They are regulated by the Securities and Exchange Board of India (SEBI) and managed by Asset Management Companies (AMCs). There are various types of mutual funds, such as equity funds, debt funds, money market funds, hybrid funds, and gold funds, offering different investment objectives and risk profiles. The Systematic Investment Plan (SIP) is a popular option for investing in mutual funds, allowing investors to contribute regularly.

Post Office Savings Schemes

Post Office Saving Schemes are considered one of the best long-term investment options for government employees, salaried individuals, and businessmen. They offer a moderate rate of interest and tax benefits under Section 80C of the Income Tax Act. Some popular schemes include the Senior Citizen Savings Scheme, Monthly Income Scheme Account, Recurring Deposit Accounts, National Savings Certificates (NSC), and Sukanya Samridhi Yojana (SSY).

Fixed Deposit (FD)

Fixed deposits are a common and straightforward investment instrument offering a fixed interest rate for a specified period, typically ranging from a few months to ten years. They are considered a risk-free investment option, and investors can choose the tenure and amount to invest. Fixed deposits offer tax benefits, with investments up to INR 1.5 lakh per year eligible for deduction under Section 80C of the Income Tax Act.

Gold

Gold is a traditional investment option in India and can be a good hedge against inflation. There are various ways to invest in gold, such as buying physical gold, gold deposit schemes, gold ETFs, gold bars, or gold mutual funds.

Real Estate

Real estate is a popular long-term investment option, offering the potential for significant returns over time. It can be done through direct property purchase or investment in REITs (real estate investment trusts), which allow investment in commercial and residential properties with a relatively low initial amount.

Bonds

Bonds are slowly gaining popularity as long-term investment options in India, offering predictable returns. They are debt instruments issued by governments, corporations, and financial institutions, with maturity periods typically exceeding one year. The returns depend on the issuer, maturity date, and current interest rate scenario.

National Pension Scheme (NPS)

The NPS is a long-term retirement savings scheme backed by the Indian government. It encourages individuals to contribute regularly during their employment, and upon retirement, they can withdraw a portion as a lump sum, while the remaining is used to purchase an annuity plan providing a regular pension. The NPS offers tax benefits on contributions and withdrawals.

Unit Linked Insurance Plans (ULIPs)

ULIPs combine insurance coverage with investment options, providing both life cover and investment growth. They offer tax benefits on premiums and maturity proceeds, and the death benefit is generally tax-free. ULIPs typically have a lock-in period of five years, after which partial withdrawals are allowed.

Equity-Linked Savings Scheme (ELSS)

ELSS is a type of mutual fund that invests primarily in equities or stock markets. It offers tax benefits, and investments can be made through a lump sum payment or Systematic Investment Plan (SIP). ELSS has a lock-in period of three years, after which investments can be redeemed.

Equity Mutual Funds

Equity mutual funds invest in the equities of various companies and offer higher returns than fixed-income investments. They provide an opportunity to diversify one's portfolio and are mostly open-ended, allowing withdrawals at any time without penalties. Equity mutual funds also offer tax benefits under Section 80C of the Income Tax Act.

How Investment Management Interviews Differ: What to Expect

You may want to see also

Tax-saving investments

Unit Linked Insurance Plan (ULIP)

ULIPs are investment-cum-insurance products that offer tax-saving benefits. They combine life insurance with investment options, providing financial protection while growing your wealth. ULIPs offer tax deductions of up to Rs. 1.5 lakhs per year on premiums under Section 80C of the Income Tax Act, 1961. The death benefit received is also tax-free under Section 10 (10D).

Equity Linked Savings Scheme (ELSS)

ELSS is a type of mutual fund that invests primarily in equity and equity-linked securities. It offers potential for capital appreciation along with tax savings. ELSS funds have a mandatory lock-in period of 3 years, during which the invested amount cannot be redeemed. Investments in ELSS qualify for tax deductions of up to Rs. 1.5 lakhs under Section 80C. Long-term capital gains above Rs. 1 lakh per year are subject to taxation.

Public Provident Fund (PPF)

The PPF is a long-term tax-saving investment scheme offered by the Government of India. It comes with a 15-year lock-in period and offers tax benefits under Section 80C. Investments up to Rs. 1.5 lakhs in a financial year are eligible for tax deductions. The interest earned and maturity amount are also exempt from tax.

Sukanya Samriddhi Yojana (SSY)

The SSY is a savings scheme launched by the Government of India as part of the 'Beti Bachao Beti Padhao' campaign. It offers tax deductions of up to Rs. 1.5 lakhs per year under Section 80C. The interest earned on SSY investments is also tax-free. The scheme has a lock-in period of 21 years and allows regular deposits with a minimum of Rs. 250 per year.

National Savings Certificate (NSC)

The NSC is a fixed-income investment scheme offered by the Government of India. It provides tax deductions of up to Rs. 1.5 lakhs under Section 80C. The interest earned is tax-free for the first 4 years, and taxable thereafter. The NSC has a fixed maturity period of 5 years, and early withdrawal is not allowed.

Tax-Saver Fixed Deposit (FD)

Fixed deposits with a lock-in period of 5 years are eligible for tax exemptions under Section 80C. They offer guaranteed returns at a fixed interest rate and are considered a safe investment option. However, premature withdrawals are not allowed, and interest earned is taxable.

Senior Citizen Savings Scheme (SCSS)

The SCSS is a savings scheme offered by the Government of India for senior citizens. It provides tax deductions of up to Rs. 1.5 lakhs under Section 80C. The interest earned is fully taxable if it exceeds Rs. 50,000. The scheme has a maturity period of 5 years, which can be extended by another 3 years.

National Pension Scheme (NPS)

The NPS is a government-sponsored pension scheme that provides tax benefits for retirement savings. It offers tax deductions on contributions under Section 80C and Section 80CCD(1B). The maturity proceeds are partially tax-free, with up to 60% of the corpus allowed to be withdrawn as a lump sum.

These tax-saving investment options can help individuals and businesses in India optimize their financial portfolios and reduce their tax liabilities. It is important to carefully consider each option's features, risks, and potential returns before making investment decisions.

Tilt Your Investment Portfolio: Value and Small-Cap Focus

You may want to see also

Frequently asked questions

Compounding is a strategy where the returns or interest generated on the principal amount is reinvested, creating a chain reaction of returns on returns.

Compounding accelerates wealth accumulation by reinvesting returns, especially with a long-term investment horizon. The longer your money remains invested, the more it grows with the power of compounding.

There are various compounding investment options in India, including safe and aggressive investments. Safe options include Public Provident Fund (PPF), National Savings Scheme (NSC), and Life Insurance Savings Plans. Aggressive options include Equity-Linked Savings Scheme (ELSS), National Pension System (NPS), and Unit-Linked Insurance Plans (ULIPs).

Compounding in mutual funds allows investors to earn interest on both their initial investment and the interest generated. The returns generated by mutual funds are reinvested, leading to exponential growth over time.

Compounding can help you exponentially grow your money with time. However, it may not be suitable for short-term financial goals as it requires a long-term investment horizon to be most effective.