Earning a million dollars through investing is a goal that many aspire to, but it requires a strategic approach and a deep understanding of the financial markets. This guide will explore the key principles and strategies that can help you achieve this financial milestone. From understanding the basics of investing to mastering advanced techniques, we'll cover the essential steps to build a robust investment portfolio. Whether you're a beginner or an experienced investor, these insights will provide valuable insights into the world of finance and offer practical advice on how to reach your financial aspirations.

What You'll Learn

- Identify High-Growth Stocks: Research and invest in companies with strong growth potential

- Diversify Your Portfolio: Spread investments across various assets to minimize risk

- Master Market Timing: Time your investments to maximize returns during market peaks

- Utilize Compounding: Leverage the power of compounding to accelerate wealth accumulation

- Stay Informed and Adapt: Continuously learn and adjust strategies based on market trends

Identify High-Growth Stocks: Research and invest in companies with strong growth potential

To earn a million dollars through investing, one of the most effective strategies is to focus on identifying and investing in high-growth stocks. This approach leverages the power of compounding returns and the potential for significant gains over time. Here's a detailed guide on how to identify and invest in these high-growth companies:

Understand the Basics of High-Growth Stocks:

High-growth stocks are shares of companies that are expected to experience rapid revenue and earnings growth. This growth can be driven by various factors such as innovative products, expanding markets, strong management teams, or disruptive technologies. Understanding these drivers is crucial for making informed investment decisions.

Research and Analysis:

- Financial Metrics: Study key financial ratios and metrics that indicate a company's growth potential. Look for companies with consistent revenue growth, increasing profit margins, and strong cash flow. Metrics like Return on Equity (ROE), Price-to-Earnings (P/E) ratio, and Sales Growth Rate can be valuable indicators.

- Industry and Market Analysis: Research the industry in which the company operates. Identify trends, competitors, and potential challenges. Look for industries with strong growth prospects, such as technology, healthcare, renewable energy, or e-commerce.

- Company Fundamentals: Dive deep into the company's business model, competitive advantage, management team, and strategic initiatives. Assess their ability to execute their plans and adapt to market changes. Look for companies with a clear vision, strong market position, and a history of successful innovation.

Identify Growth Drivers:

- Disruptive Technologies: Invest in companies developing cutting-edge technologies that can revolutionize industries. This could include artificial intelligence, blockchain, renewable energy solutions, or biotechnology.

- Market Expansion: Look for companies expanding into new markets or capturing a larger market share. This might involve international expansion, entering new product categories, or targeting underserved customer segments.

- Product Innovation: Companies that consistently innovate and introduce new products or services can drive significant growth. Assess their R&D efforts, product pipeline, and ability to stay ahead of the competition.

Diversification and Risk Management:

While high-growth stocks offer significant potential, they also come with higher risks. Diversify your portfolio by investing in multiple companies across different sectors and industries. This reduces the impact of any single stock's performance on your overall investment. Regularly review and rebalance your portfolio to manage risk and ensure it aligns with your investment goals.

Long-Term Perspective:

Investing in high-growth stocks is typically a long-term strategy. These companies may experience short-term volatility, but over time, they can deliver substantial returns. Stay invested for the long haul, and focus on the company's growth trajectory rather than short-term market fluctuations.

Continuous Learning and Adaptation:

The business landscape is constantly evolving, so stay updated on industry news, market trends, and company-specific developments. Regularly review your investments and be prepared to adjust your portfolio based on changing circumstances and new information.

By following these steps and conducting thorough research, you can identify high-growth stocks with strong potential for substantial returns. Remember, investing in high-growth companies requires a disciplined approach, a long-term perspective, and a willingness to adapt to market dynamics.

The Crypto Conundrum: Navigating the Volatile World of Digital Currency Investments

You may want to see also

Diversify Your Portfolio: Spread investments across various assets to minimize risk

When aiming to earn a million dollars through investing, one of the most crucial strategies is to diversify your portfolio. This approach involves spreading your investments across various assets, industries, and sectors to minimize risk and maximize potential returns. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio, ensuring a more stable and consistent growth trajectory.

The core principle behind diversification is to avoid putting all your eggs in one basket. This means not investing all your capital in a single stock, industry, or asset class. For instance, if you invest solely in technology stocks, a downturn in the tech sector could significantly impact your portfolio. However, by diversifying into other sectors like healthcare, energy, or consumer goods, you create a safety net. If one sector underperforms, others may compensate, leading to a more balanced and resilient investment strategy.

To start diversifying, consider the following steps:

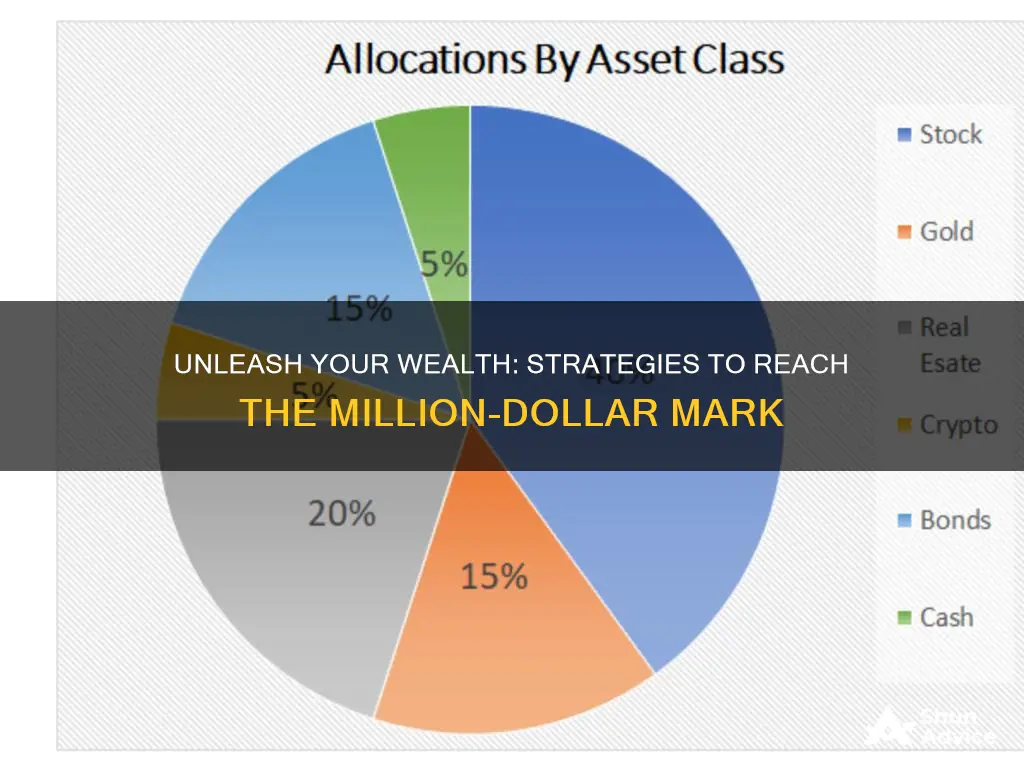

- Asset Allocation: Divide your portfolio into different asset classes such as stocks, bonds, real estate, commodities, and cash. Each asset class has its own risk and return characteristics. For example, stocks generally offer higher returns but come with higher risk, while bonds are more stable but offer lower returns. Aim for a balanced allocation that aligns with your investment goals and risk tolerance.

- Industry and Sector Diversification: Within each asset class, further diversify by investing in various industries and sectors. For instance, instead of buying only tech stocks, invest in healthcare, financial services, energy, and consumer staples. This way, you benefit from the growth of multiple sectors, reducing the risk associated with any single industry's performance.

- Geographical Diversification: Consider investing in companies and assets from different countries and regions. International diversification can help protect against economic and political risks specific to a particular country. It also provides exposure to different growth markets and can enhance overall portfolio returns.

- Consider Alternative Investments: Explore alternative investments like mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). These can provide instant diversification, allowing you to gain exposure to a wide range of assets and industries without buying individual stocks or properties.

By implementing a diversified investment strategy, you create a robust and resilient portfolio. This approach is particularly important when aiming for long-term wealth accumulation, as it helps smooth out the volatility of individual investments and ensures that your portfolio can weather various market conditions. Remember, diversification does not guarantee profit or protect against losses in a declining market, but it significantly reduces the risk associated with any single investment decision.

Unveiling the Power of Mining: A Comprehensive Guide to Investing

You may want to see also

Master Market Timing: Time your investments to maximize returns during market peaks

Mastering market timing is an art that can significantly impact your investment journey and the potential to earn a substantial amount, including a million dollars. It involves making strategic decisions to buy and sell assets at the most opportune moments, often during market peaks, to maximize returns. Here's a guide to help you navigate this crucial aspect of investing:

Understanding Market Peaks: Market peaks, also known as market tops, are periods when asset prices reach their highest levels before typically experiencing a decline. Identifying these peaks can be challenging but is essential for successful timing. Market peaks are often characterized by various indicators, such as high trading volumes, rising interest rates, or overvalued stock prices as indicated by technical analysis tools. For instance, during a market peak, you might observe a surge in stock prices, with many investors taking profits and selling their holdings.

Research and Analysis: To master market timing, extensive research and analysis are your best tools. Study historical market data to identify patterns and trends. Look for recurring behaviors during market peaks, such as specific sectors or industries leading the charge. For example, technology stocks often show remarkable growth during market peaks, attracting investors seeking substantial returns. Utilize various financial tools and resources, including economic calendars, market sentiment indicators, and technical analysis charts, to make informed decisions.

Risk Management and Diversification: While market timing can be lucrative, it also carries risks. To manage these risks, employ a disciplined approach. Diversify your investment portfolio across different asset classes, sectors, and regions. This diversification strategy reduces the impact of any single market peak on your overall portfolio. Additionally, set stop-loss orders to limit potential losses if your investments start to decline during a market downturn.

Stay Informed and Adapt: Markets are dynamic, and successful timing requires staying informed about global economic events, geopolitical developments, and industry-specific news. Keep yourself updated on market trends and be prepared to adapt your investment strategy. Market peaks can be short-lived, so being agile and responsive to changing conditions is crucial. Consider using market timing models and indicators, such as the Relative Strength Index (RSI) or moving average convergence divergence (MACD), to identify potential market turning points.

Patience and Discipline: Market timing is not about impulsive decisions but rather a patient and disciplined approach. Avoid the temptation of trying to time the market perfectly, as market peaks can be challenging to predict accurately. Instead, focus on your investment strategy and stick to your plan. Learn from past experiences, both successful and unsuccessful, and use these lessons to refine your timing skills over time.

By mastering market timing, you can strategically position yourself to capture substantial returns during market peaks. Remember, successful investing requires a combination of research, analysis, risk management, and adaptability. Stay informed, diversify your portfolio, and approach market timing with a long-term perspective to increase your chances of achieving the million-dollar investment goal.

Unveiling the Art of Investing: A Beginner's Guide to Buying Art

You may want to see also

Utilize Compounding: Leverage the power of compounding to accelerate wealth accumulation

The concept of compounding is a powerful tool in the world of investing, and it can be the key to unlocking significant wealth over time. Compounding refers to the process of earning interest on both the initial investment and the accumulated interest, creating a snowball effect that grows your money exponentially. This strategy is particularly effective for those aiming to reach the million-dollar mark through investing.

To utilize compounding effectively, start by investing in assets that offer the potential for regular, consistent returns. Stocks, bonds, and mutual funds are excellent choices as they provide opportunities for capital appreciation and dividend income. The key is to invest in a diverse range of these assets to minimize risk. For instance, consider a portfolio that includes a mix of large-cap stocks, bonds with stable interest rates, and growth-oriented mutual funds. This diversification ensures that your investments can weather market fluctuations and provide a steady stream of returns.

Compounding works best when you consistently reinvest the earnings generated by your investments. This means that instead of withdrawing profits, you use them to purchase additional shares or bonds. Over time, this practice will lead to a substantial increase in the total value of your portfolio. For example, if you invest $10,000 in a stock that pays a 5% dividend, reinvesting those dividends annually will result in a larger purchase of shares each year, thus accelerating the growth of your investment.

Another strategy to enhance compounding is to take advantage of tax-efficient investment vehicles. Tax-efficient accounts, such as retirement accounts (e.g., 401(k)s or IRAs), allow your investments to grow faster by reducing the impact of taxes. Contributions to these accounts are often tax-deductible, and the earnings can grow tax-free until they are withdrawn, providing a significant long-term benefit. Additionally, some investments offer tax advantages, such as index funds or exchange-traded funds (ETFs), which can further optimize your compounding strategy.

Lastly, consider the power of long-term investing. Compounding is most effective when given time to work its magic. By maintaining a long-term perspective, you can ride out short-term market volatility and benefit from the overall upward trend of the markets. This approach requires patience and discipline, but it is a proven strategy for building substantial wealth over the years. Remember, some of the most successful investors in history have attributed their success to their ability to stay invested through market cycles.

Buy-to-Let London: Where to Invest for Maximum Returns

You may want to see also

Stay Informed and Adapt: Continuously learn and adjust strategies based on market trends

Staying informed and adapting to market trends is a crucial aspect of successful investing, especially when aiming for substantial financial gains like earning a million dollars. The financial markets are dynamic and ever-changing, and what works today might not work tomorrow. Therefore, investors must embrace a mindset of continuous learning and flexibility to navigate this complex landscape effectively.

One of the primary ways to stay informed is by developing a strong foundation of financial knowledge. Start by educating yourself about various investment vehicles, such as stocks, bonds, mutual funds, and derivatives. Understand the principles of investing, including risk assessment, diversification, and long-term growth strategies. Numerous online resources, books, and courses can provide a comprehensive understanding of these concepts. For instance, exploring topics like value investing, as popularized by Warren Buffett, or growth investing, associated with Peter Lynch, can offer valuable insights.

Market trends and economic cycles are essential to grasp. Keep abreast of economic indicators, interest rates, and global events that can impact markets. Subscribe to reputable financial news sources, follow influential economists and analysts, and regularly review economic reports and forecasts. Understanding these trends will enable you to anticipate market shifts and make informed decisions about when to buy or sell investments.

Additionally, consider building a network of like-minded investors or joining investment communities. These connections can provide valuable insights, as experienced investors often share their strategies and lessons learned. Networking can also offer access to exclusive investment opportunities and a broader perspective on market trends.

Adaptability is key to success in investing. Market conditions can change rapidly, and being able to adjust your strategies accordingly is essential. For example, during a market downturn, a flexible investor might consider rebalancing their portfolio towards more defensive assets or implementing a dollar-cost averaging strategy to buy more shares at lower prices. Conversely, in a bull market, an investor might focus on growth-oriented investments. Regularly reviewing and updating your investment plan ensures that your strategies remain relevant and aligned with your financial goals.

In summary, earning a million dollars through investing requires a commitment to lifelong learning and adaptability. By staying informed about market trends, economic factors, and investment strategies, you can make well-informed decisions. Embrace a growth mindset, be open to new ideas, and continuously refine your investment approach to navigate the ever-evolving financial markets successfully. Remember, the journey to earning a million dollars is a marathon, not a sprint, and adaptability is a powerful tool along the way.

Unveiling the Power of Government Investment: A Comprehensive Guide

You may want to see also

Frequently asked questions

Earning a million dollars through investing is a significant financial goal and requires a well-thought-out strategy. It's important to note that building such a substantial amount of wealth takes time, discipline, and a long-term investment approach. Here are some key steps to consider:

- Define your investment strategy: Decide on your investment style, whether it's value investing, growth investing, or a mix of both. Research and understand the markets, industries, and companies you're interested in.

- Diversify your portfolio: Diversification is a crucial risk management tool. Spread your investments across different asset classes such as stocks, bonds, real estate, commodities, and alternative investments. Diversification helps reduce the impact of any single investment's performance on your overall portfolio.

- Start early and consistently invest: The power of compounding returns is a significant factor in growing your wealth. Starting to invest early allows your money to grow over an extended period, benefiting from compound interest. Consistency is key; set up regular investment contributions, such as monthly or quarterly, to build a substantial investment over time.

- Research and learn: Continuously educate yourself about the markets, economic trends, and investment strategies. Stay updated on industry news, follow financial experts, and analyze historical data to make informed decisions.

- Risk management: Understand and manage risk by setting stop-loss orders, diversifying, and regularly reviewing your portfolio. Be prepared to adjust your strategy based on market conditions and your risk tolerance.

- Seek professional advice: Consider consulting a financial advisor or investment professional who can provide personalized guidance based on your financial goals, risk profile, and time horizon.

Remember, earning a million dollars through investing is a long-term journey, and it's essential to have a clear plan, stay disciplined, and adapt to market changes.

Reaching a million-dollar investment goal often involves employing various investment strategies tailored to your risk tolerance and financial objectives. Here are a few popular approaches:

- Index Funds and ETFs: Investing in index funds or exchange-traded funds (ETFs) that track a specific market index (e.g., S&P 500) can provide broad market exposure. This strategy offers diversification and historically has shown strong long-term performance.

- Value Investing: This approach involves identifying undervalued companies with strong fundamentals. Investors look for stocks trading below their intrinsic value, aiming to buy them at a discount and hold them for the long term as the market recognizes their true worth.

- Growth Investing: Growth investors focus on companies with above-average growth potential. These companies often reinvest their profits to fuel expansion, and investors aim to capture the benefits of compound growth over time.

- Real Estate Investment: Investing in real estate can be done through direct property purchases or real estate investment trusts (REITs). Real estate has the potential to generate both rental income and capital appreciation, making it a popular choice for wealth accumulation.

- Startup and Venture Capital: Investing in startups or venture capital funds can offer high-risk, high-reward opportunities. Early-stage companies have the potential for significant returns but also carry a higher risk of failure.

- Dividend Reinvestment: Building a portfolio of dividend-paying stocks and reinvesting the dividends can lead to compound growth over time. This strategy is particularly effective for long-term wealth accumulation.

While it's challenging to predict specific industries or sectors that will consistently generate high returns, certain areas have historically shown potential for significant gains:

- Technology and Innovation: The tech sector, including software, hardware, and innovative companies, has been a significant driver of wealth creation. Disruptive technologies and innovative businesses can offer substantial returns.

- Healthcare and Pharmaceuticals: With an ever-growing aging population and advancements in medical research, the healthcare industry presents opportunities for investment. Biotech and pharmaceutical companies working on groundbreaking treatments can attract investors.

- Renewable Energy and Sustainability: As the world shifts towards sustainable practices, renewable energy sources, and green technologies are gaining traction. Investing in companies leading the way in renewable energy, electric vehicles, and environmental solutions can be lucrative.

- Financial Services: The financial industry, including banking, insurance, and asset management, often provides stable and consistent returns. However, it's essential to stay updated on regulatory changes and market trends within this sector.

- Consumer Discretionary: This sector includes companies that produce goods and services that consumers can purchase on their own discretion, such as automobiles, retail, and leisure. Consumer trends and economic growth can significantly impact this industry's performance.

Remember, while these sectors may offer potential, thorough research and a well-diversified portfolio are essential to managing risk and achieving your investment goals.