Evaluating your retirement plan investment portfolio is crucial to ensure your investments are aligned with your financial goals and risk tolerance. Here are some key considerations to help you get started:

- Performance Evaluation: Track the performance of your portfolio over time, especially against relevant benchmark indexes. Assess if your investments are meeting your expected returns and evaluate the volatility of your investment mix.

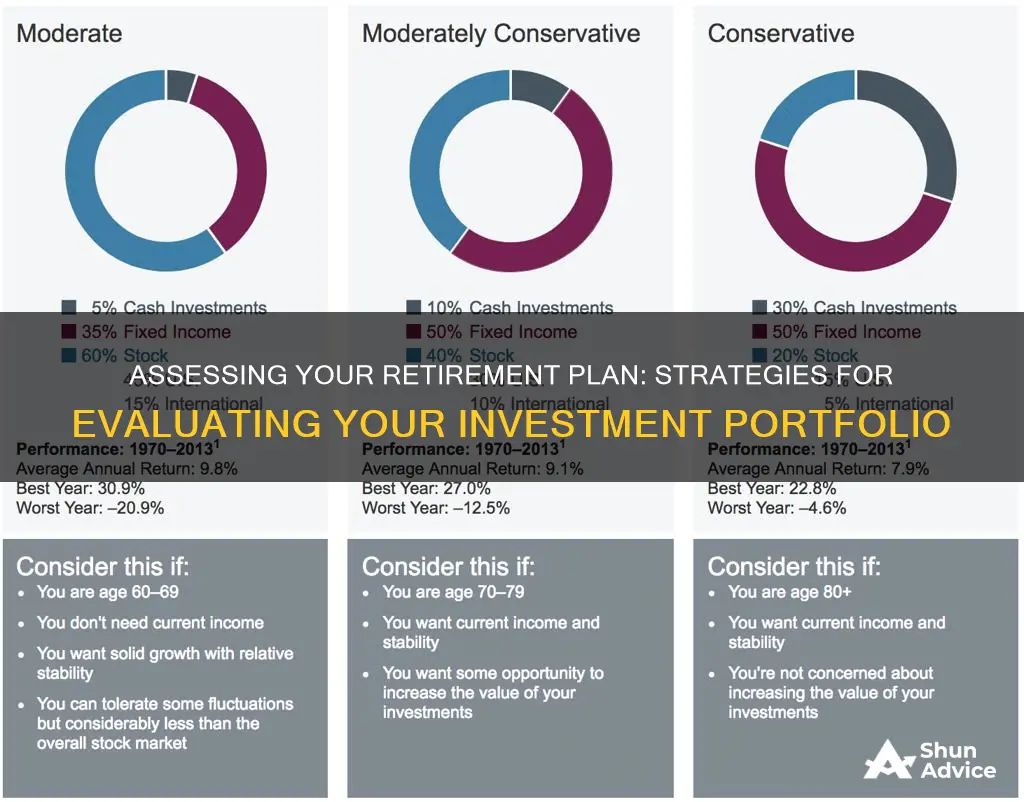

- Asset Allocation: Review your mix of stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Ensure they match your risk tolerance, financial situation, and time horizon. Diversify your portfolio across different asset classes, sectors, and geographies to minimise risk.

- Investment Fees: Monitor investment fees as they can significantly impact your portfolio's long-term returns. Expensive investment products with high fees may reduce your overall returns.

- Risk Assessment: Understand your risk tolerance and how it may change over time. Younger investors often have a higher risk appetite, while those nearing retirement may prefer a more conservative approach.

- Financial Goals: Evaluate your portfolio in the context of your financial goals, such as retirement planning, saving for education, or managing debt. Ensure your investments are helping you work towards these goals.

- Regular Reviews: Conduct regular reviews of your portfolio, ideally annually or after significant life changes. This helps you adjust your investment strategy and stay aligned with your evolving goals and market conditions.

| Characteristics | Values |

|---|---|

| Frequency of Review | Once a year, or after major life changes |

| Purpose | Ensure strategy matches goals, needs, and financial situation |

| Investment Performance | Tracked against the S&P 500 or other benchmarks |

| Investment Fees | Should be low to minimise impact on returns |

| Asset Allocation | Diversified across asset types, sectors, geographies, etc. |

| Risk Tolerance | Depends on age, financial goals, and personal preference |

| Returns | Should be evaluated in the context of the investment strategy |

What You'll Learn

Evaluate the performance of your portfolio

Evaluating the performance of your retirement plan investment portfolio is key to ensuring your strategy matches your goals and needs. Here are some detailed steps to help you evaluate the performance of your portfolio:

Set Clear Goals and Plans:

Start by setting clear financial goals and creating a comprehensive investment plan. This will serve as a benchmark to measure the performance of your portfolio and guide your decision-making. Your goals should be specific, achievable, and aligned with your risk tolerance, investment horizon, and financial situation.

Regularly Review Your Portfolio:

It is recommended to review your investment portfolio at least annually to ensure it remains aligned with your goals and market conditions. Conducting regular reviews allows you to identify any necessary adjustments and maximise your returns. Remember to pay close attention to your portfolio, especially after significant market shifts or life changes, such as marriage, career changes, or approaching retirement.

Evaluate Performance Against Benchmarks:

Compare the performance of your portfolio to relevant benchmark indexes, such as the Dow Jones US Total Stock Market Index or the MSCI All Country World Index. Assess whether your portfolio is meeting your expected returns and exhibiting a level of volatility consistent with or lower than these benchmarks.

Monitor Individual Investments:

Evaluate the performance of individual stocks, bonds, mutual funds, and exchange-traded funds (ETFs) within your portfolio. Check if they are meeting your expectations and are aligned with your investment strategy. Consider factors such as company fundamentals, analyst opinions, credit ratings, and duration when reviewing these investments.

Assess Fees and Expenses:

Expensive investment products and high fees can significantly impact your portfolio's long-term returns. Evaluate the fees associated with your investments and consider the potential impact on your overall returns. Compare fees across different investment options to ensure you're getting a competitive rate.

Analyse Risk and Return:

Understand the risk-return profile of your portfolio. Assess whether the level of risk you're taking is appropriate given your investment goals and risk tolerance. Remember that higher-risk investments typically offer higher potential returns but also carry a greater possibility of loss. Ensure the risk-reward balance aligns with your investment objectives.

Maintain Diversification:

Diversification is essential to reducing risk and enhancing stable returns. Review your asset allocation across different investment types, sectors, geographies, and market capitalisations. Ensure your portfolio remains well-diversified and make adjustments if certain asset classes become over-represented or under-represented. Diversification can help protect your portfolio from market volatility and negative performance in any single asset class.

Seek Expert Advice:

Consider consulting a financial advisor or investment professional, especially if you're unsure about evaluating your portfolio's performance. They can provide personalised recommendations, help you navigate common pitfalls, and ensure your portfolio aligns with your retirement goals and risk tolerance.

Remember, evaluating the performance of your retirement plan investment portfolio is an ongoing process. Stay informed about market conditions, review your portfolio regularly, and make adjustments as necessary to keep your investments on track.

Moderna: Invest Now or Never?

You may want to see also

Compare fees

When it comes to your retirement plan investment portfolio, fees are an important consideration. Even small fees can add up over time and impact your overall investment performance and wealth. Here are some things to keep in mind when comparing fees:

Understand the Types of Fees

Investment fees can include ongoing fees, which are recurring charges such as quarterly or annual account maintenance fees, and trading or transaction fees, which are one-time charges for each trade or transaction. Additionally, there are various types of investment fees, including loads or sales commissions, management fees, advisory fees, broker fees, and trading fees. Understanding the different types of fees will help you identify and compare them effectively.

Evaluate the Impact of Fees

When deciding which investment fees are worth paying, consider the long-term value and overall cost of the fees, as well as your expected return. Even a small difference in fees, such as a 1% fee, can significantly reduce the value of your portfolio over time. Compounding effects can result in a substantial impact on your wealth. It is important to evaluate how the fees will affect your investment performance and returns.

When comparing fees, look at different investment options, such as mutual funds or exchange-traded funds (ETFs). Mutual funds typically have ongoing fees, known as expense ratios, which cover the costs of running the fund, including management, distribution, and administrative fees. ETFs, on the other hand, tend to be cheaper than mutual funds, but it's important to consider the transaction fees associated with buying, selling, or exchanging shares. Compare the total costs, including all types of fees, to make an informed decision.

Benchmark Investment Fees

Benchmarking investment fees can be complex, but it is essential to fulfilling a retirement plan sponsor's fiduciary obligation. When benchmarking, avoid common pitfalls such as only considering the total expense ratio of the fund, which may not capture all components of the true cost. Revenue sharing, for example, can impact the net investment cost. Compare the net investment fee component to other investment managers in the same asset class or category. Additionally, ensure you are comparing relevant peer groups and considering actively and passively managed funds separately.

Consider the Value and Performance

While fees are important, they should not be the sole criterion for choosing an investment. The fund's investment fees may be reasonable if the fund is meeting performance standards, even if the net investment fee is higher than the category average. Consider the overall value and long-term track record of the investment, including its returns and management. A good combination to look for is a fund with a reasonable expense ratio, excellent historical returns, and competent management.

Overseas Investment: Why the Move?

You may want to see also

Check your asset allocation

Checking your asset allocation is a crucial part of evaluating your retirement investment portfolio. Here are some detailed instructions and considerations to help you through the process:

Understanding Asset Allocation:

Asset allocation refers to how your retirement account is diversified across different types of investments, such as stocks, bonds, and cash. The basic idea is to balance growth and risk. Stocks typically provide growth over the long term but come with higher risks. On the other hand, bonds provide regular income, reducing overall risk, and tend to be less volatile than stocks.

Factors Affecting Asset Allocation:

There are several factors you should consider when determining your asset allocation:

- Time Horizon: How long do you have until retirement? If you're younger, you might have a longer time horizon, allowing you to take on more risk.

- Goals: What are your financial goals for retirement? Do you want to focus on growth, or are you more interested in income generation?

- Risk Tolerance: How comfortable are you with market fluctuations? Your risk tolerance will influence whether you take a more aggressive or conservative approach.

- Current and Future Income: Your current and expected future income sources can impact your asset allocation. For example, if you're still working, you may be able to take on more risk.

Adjusting Allocation with Age:

It's generally recommended to adjust your asset allocation as you age. When you're younger, you may want to take on more risk by investing heavily in stocks. As you get closer to retirement, consider allocating more to bonds and cash to reduce risk. The exact percentages will depend on your personal circumstances and risk tolerance.

Rules of Thumb:

There are a few rules of thumb to help guide your asset allocation:

- Rule of 100: This suggests holding a percentage of stocks equal to 100 minus your age. For example, if you're 60, hold 40% of your portfolio in stocks.

- Rule of 110: Similar to the Rule of 100, but you subtract your age from 110. This rule evolved as people started living longer.

- Conservative Allocation in Retirement: Once you're retired, shift towards more conservative investments. While you still need growth, you don't have an active income to replace potential losses.

Other Considerations:

- Don't forget to review your asset allocation periodically, especially after major life events or market fluctuations that may impact your portfolio's weighting.

- Consider seeking advice from a financial advisor or using a target-date fund, which automatically adjusts its allocation as you get closer to retirement.

- Remember that asset allocation is just one part of evaluating your retirement plan. It's also essential to consider fees, performance, and how your portfolio fits your overall financial goals and risk tolerance.

By regularly checking and adjusting your asset allocation, you can ensure that your retirement investment portfolio remains aligned with your needs and goals throughout your working life and into retirement.

The Great Debate: Paying Off Bills vs. Investing – Which Should You Choose?

You may want to see also

Assess your risk tolerance

When evaluating your retirement plan investment portfolio, assessing your risk tolerance is crucial. Risk tolerance refers to the amount of volatility in their investments that an investor can withstand. As you approach retirement, your risk tolerance typically changes, and you may need to shift your focus from growth to capital preservation and income. Here are some factors to consider when assessing your risk tolerance:

- Age and Time Horizon: Age is often considered a factor in risk tolerance, with younger investors having a longer time horizon and being more tolerant of risk. However, it is important to note that people are living longer, and investors can remain aggressive for longer. As you get closer to retirement, you may want to reduce your exposure to high-risk investments. The time horizon for your financial goals also impacts your risk tolerance. For short-term goals, a more conservative approach is generally recommended, while long-term goals can accommodate more aggressive investing.

- Net Worth and Risk Capital: Investors with a higher net worth and more liquid capital can generally afford to take on more risk. If an investment or trade represents a small percentage of an individual's overall net worth, they can be more aggressive in their risk tolerance.

- Investment Goals: Consider what you are saving and investing for. If you are saving for retirement or a child's education, you may want to be more cautious with your risk tolerance. On the other hand, if you are using disposable income to earn extra income, you may be willing to take on more risk.

- Investment Experience: Your level of investing experience also plays a role in determining your risk tolerance. If you are new to investing or exploring a new area, it is generally advisable to start with caution and gain some experience before committing a significant amount of capital.

- Financial Circumstances: Your financial circumstances may justify taking some calculated risks or adjusting your risk profile. Be practical and assess your financial situation to determine if you can tolerate certain levels of risk.

- Market Risk and Diversification: Understanding market risk and diversification is essential. Standard deviation measures the variance of an investment's return from its average return, providing insights into potential gains or losses. Diversifying your investments across different baskets can help insulate against market shocks.

- Liquidity Risk: As you age, liquidity risk becomes more critical. Some investments may be illiquid, and accessing them later may incur penalties. Ensure you understand the liquidity of your investments, as a lack of liquidity may be a risk factor for some individuals.

- Inflation Risk: Inflation risk refers to the possibility of your purchasing power diminishing over time. If your investments do not keep up with inflation, you will lose ground economically. It is crucial to consider this risk when assessing your overall risk tolerance.

By considering these factors, you can gain a clearer understanding of your risk tolerance and make more informed decisions about your retirement plan investment portfolio.

Blackberry Stock: Why the Hype?

You may want to see also

Consider your retirement goals

When considering your retirement goals, it's important to remember that they will change over time. In the early stages of your career, your contributions to retirement savings may be modest, but you will reap the rewards of 40-plus years of investment growth. As you reach middle age, your income may peak, and you can set more specific income or asset targets. Once you retire, you will no longer pay into your retirement account and will instead begin collecting the rewards of your savings.

Retirement planning should include determining time horizons, estimating expenses, calculating required after-tax returns, assessing risk tolerance, and doing estate planning.

Your retirement goals should also take into account your estimated future expenses, liabilities, and life expectancy. This includes considering your family plans, as starting a family can put a large dent in your savings. Additionally, if you plan to travel extensively during retirement, this will eat into your savings faster than if you stay at home.

When considering your retirement goals, it's also important to remember that retirement plans are not static. They should be updated and reviewed regularly to monitor your progress and ensure they are still aligned with your goals.

The amount of money you will need to retire comfortably is highly personalized, but there are some rules of thumb to consider. One suggestion is to save about $1 million, or 12 times your pre-retirement annual income. Another rule of thumb is the 4% rule, which suggests that retirees should spend no more than 4% of their retirement savings each year. Many retirement experts recommend saving 10 times your pre-retirement salary and planning to live on 80% of your pre-retirement annual income.

Invest $100: Quick, Smart Options

You may want to see also

Frequently asked questions

You should assess your portfolio's overall returns and check if it's on pace to meet your goals. Compare the returns of your stocks, bonds, and cash holdings against benchmark indexes. Ideally, you want your returns to be close to, but hopefully exceeding, the relative benchmarks.

It's a good idea to review your investment portfolio at least once a year. You may also want to review it after major life changes such as marriage, growing your family, or receiving an inheritance.

You should consider your risk tolerance, investment objectives, and time horizon. As you get closer to retirement age, you may want to reduce your exposure to stocks and shift your focus to income and capital preservation.

You can make adjustments to your asset allocation, ensuring it aligns with your risk tolerance, financial situation, and investment goals. You can also consider rebalancing your portfolio by buying or selling investments to get back to your target allocation.