Calculating the monthly interest rate on a 30-year investment can be a complex process. The formula involves dividing the annual interest rate by 12 to get the monthly rate, then multiplying this by the principal amount. However, there are also online interest calculators that can do this for you.

| Characteristics | Values |

|---|---|

| How to calculate monthly interest rate | Divide the annual interest rate by 12 to get the monthly interest rate |

| How to calculate monthly interest | Multiply the principal amount by the monthly interest rate |

| How to calculate monthly interest rate over 30 years | Use a financial calculator, such as the HP 10b, or an online interest calculator |

What You'll Learn

How to calculate monthly interest

To calculate the monthly interest rate on a 30-year investment, you first need to determine the annual percentage rate. This is usually provided as a percentage. Once you have this figure, you can divide it by 12 to get the monthly interest rate.

Next, you need to identify the principal amount. This is the initial sum of money that is either invested or borrowed. With these two figures, you can calculate the monthly interest. Multiply the principal amount by the monthly interest rate. This will give you the amount of interest that accrues on the investment each month.

You can also use a free, online interest calculator to work out the monthly interest rate. Alternatively, you can use a financial calculator, such as the HP 10b, to calculate the interest rate.

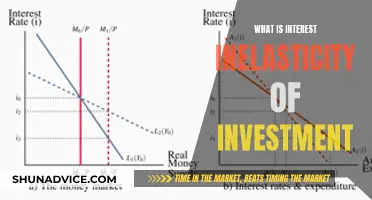

Interest Rates: Primary to Investment Changes Explained

You may want to see also

How to convert an annual rate to a monthly rate

To convert an annual rate to a monthly rate, divide the annual interest rate by 12. This is because there are 12 months in a year, so dividing the annual rate by 12 provides the equivalent monthly rate.

For example, to determine the monthly rate on a $1,200 loan with one year of payments and a 10% APR, divide 10 by 12, to arrive at 0.83% as the monthly rate.

You can also use an online interest calculator to convert an annual rate to a monthly rate.

Understanding Interest Expense: Carry Forward Rules for Investors

You may want to see also

How to calculate the monthly interest payment

To calculate the monthly interest payment on a 30-year investment, you will need to know the principal amount (the initial sum of money that is either invested or borrowed) and the annual interest rate.

The first step is to convert the annual interest rate to a monthly rate. To do this, divide the annual interest rate by 12, as there are 12 months in a year. This will give you the monthly interest rate.

The next step is to calculate the monthly interest amount. Multiply the principal amount by the monthly interest rate. This will give you the amount of interest that accrues on the investment each month.

You can also use a free, online interest calculator or a financial calculator, such as the HP 10b, to calculate the monthly interest payment.

The Magic of Growing Money: A Guide for Young Investors

You may want to see also

How to determine the principal amount

To determine the principal amount, you need to know the initial sum of money that is either invested or borrowed. This is the amount of money you have to start with. Once you have this figure, you can calculate the monthly interest rate by dividing the annual interest rate by 12 (as there are 12 months in a year).

For example, if you have a $150,000 mortgage with a 3.5% interest rate, your monthly payment would be $674 with a total of $92,544 in interest over the 30-year loan.

You can also use a financial calculator, such as the HP 10b, or a free online interest calculator to work out the monthly interest rate.

Interest Rates: Impacting Future Investment and Spending Decisions

You may want to see also

How to identify the annual percentage rate

To identify the annual percentage rate, you will need to know the principal amount (the initial sum of money that is either invested or borrowed) and the annual interest rate (the percentage of interest charged per year).

The annual interest rate can be converted to a monthly rate by dividing it by 12, as there are 12 months in a year. This will give you the equivalent monthly rate.

Once you have the monthly interest rate, you can calculate the monthly interest amount by multiplying the principal amount by the monthly interest rate. This calculation will give you the amount of interest that accrues on the investment each month.

You can also use a free, online interest calculator to determine your monthly interest rate. These calculators will require you to input the principal amount and the annual interest rate, and they will perform the calculations for you.

Alternatively, you can use a financial calculator, such as the HP 10b, to calculate the interest rate. This calculator will require you to input the principal amount, the monthly payment, and the term of the investment.

Higher Interest Rates: Investing Incentive or Hindrance?

You may want to see also

Frequently asked questions

To calculate the monthly interest rate, you need to divide the annual interest rate by 12. This will give you the equivalent monthly rate.

Once you have the monthly interest rate, multiply this by the investment amount. This will give you the amount of interest that accrues on the investment each month.

No, you can use a free, online interest calculator. You can also use a financial calculator, such as the HP 10b.

The monthly interest rate is the percentage of interest charged per month. The monthly interest amount is the amount of interest that accrues on the investment each month.