Compound interest is a powerful tool that can help your savings grow faster over time. It is calculated by multiplying the initial principal amount by one plus the annual interest rate raised to the number of compound periods minus one. The higher the number of compounding periods, the larger the effect of compounding. In this article, we will explore how to find the initial investment in compound interest calculations.

| Characteristics | Values |

|---|---|

| Formula | A = Pert |

| Variables | P = initial investment, r = rate of interest, t = time |

| Calculation | Multiply the initial investment by one plus the annual interest rate raised to the number of compound periods minus one |

What You'll Learn

The formula for compound interest

For example, if $5000 is invested in a bank where the amount is compounded continuously at a rate of 7% per year, then the resultant amount after 3 years is $6168.39. The compound interest is the total compounded amount minus the initial amount.

Compound interest is the interest that is earned on an initial principal amount as well as the accumulated interest from previous periods. It is calculated at regular intervals, such as annually, semi-annually, quarterly, or monthly. The higher the number of compounding periods, the larger the effect of compounding. For example, if you invest $10,000 in a high-yield savings account with a 4% annual yield, compounded daily, your savings will grow faster over time.

Maximizing Returns: Strategies for High-Interest Investments

You may want to see also

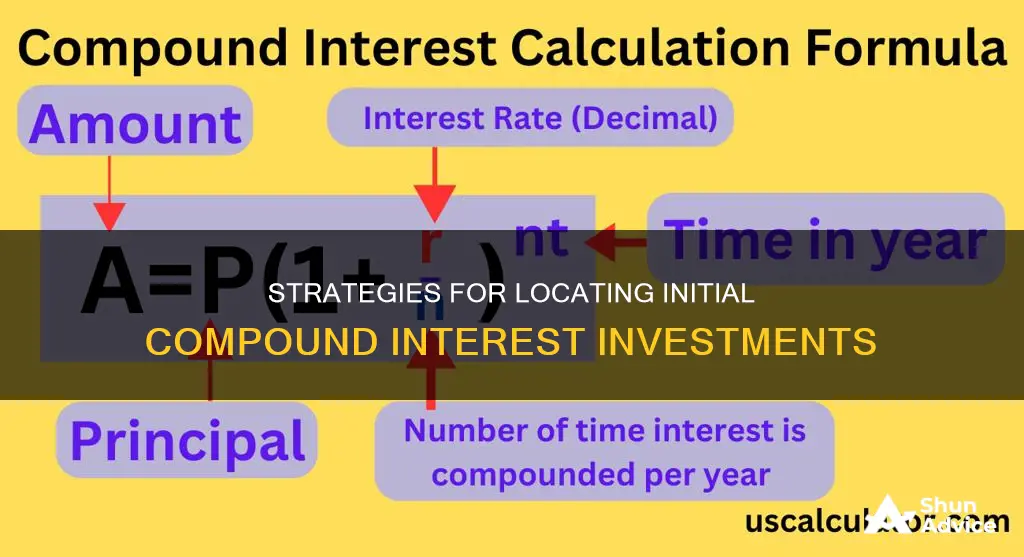

How to identify the principal amount

The principal amount, or initial investment, is a key component of compound interest. It refers to the initial amount of money that is invested or borrowed. To identify the principal amount, you can use the compound interest formula and rearrange it to solve for the principal. The formula for compound interest is:

> A = P(1 + r/n)^(nt)

Where:

- A is the amount of money accumulated after n years, including interest

- P is the principal amount (the initial amount of money)

- R is the annual interest rate (in decimal form)

- N is the number of times that interest is compounded per year

- T is the time the money is invested for in years

To find the principal amount (P), you can rearrange the formula as follows:

> P = A/(1 + r/n)^(nt)

By plugging in the known values for A, r, n, and t, you can calculate the principal amount. This formula allows you to determine the initial investment or principal amount in compound interest calculations.

Maximizing Investment Returns: Understanding Interest Calculations

You may want to see also

How to identify the rate of interest

To identify the rate of interest, you need to know the formula for calculating compound interest. The formula is: A = Pert, where A is the final amount, P is the principal amount, r is the rate of interest and t is the time period.

Once you have this formula, you can rearrange it to solve for the rate of interest. To do this, you would divide both sides of the equation by Pt, which gives you: A/Pt = r. This means that to find the rate of interest, you need to know the final amount (A), the principal amount (P), and the time period (t).

For example, let's say you invest $5,000 in a bank account that offers a compound interest rate of 7% per year. After 3 years, your account balance has grown to $6,168.39. To calculate the rate of interest, you would use the formula: 6168.39/ (5000 x 3) = 0.07, or 7%.

It's important to note that compound interest is calculated at regular intervals, such as annually, semi-annually, quarterly, or monthly. The more frequently the interest is compounded, the larger the effect of compounding. So, when identifying the rate of interest, you also need to consider the compounding period.

In summary, to identify the rate of interest, you need to know the final amount, the principal amount, and the time period. You can then use the formula for compound interest and rearrange it to solve for the rate of interest. By plugging in the values for A, P, and t, you can calculate the rate of interest for any given investment scenario.

Investments and Interest: Multiple Bets, Better Returns?

You may want to see also

How to calculate the total compounded amount

To calculate the total compounded amount, you need to know the initial principal amount, the rate of interest per annum, the time period in years, and the frequency of the number of times the interest is compounded annually.

The formula for calculating the total compounded amount is:

> P(1 + r/n)^(nt)

Where:

- P = initial principal amount

- R = rate of interest per annum

- N = frequency of the number of times the interest is compounded annually

- T = time period in years

For example, if $5000 is invested in a bank where the amount is compounded continuously at a rate of 7% per year, then the resultant amount after 3 years is:

> A = $5000(e0.07 × 3) = $6168.39

The compound interest is the total compounded amount minus the initial amount.

Interest Rate Hike: Impact on Foreign Investment Flows

You may want to see also

How to calculate the compound interest

To calculate compound interest, you need to know the initial investment, also known as the principal amount. You also need to know the rate of interest and the time period. The formula for calculating compound interest is:

> A = Pert

Where:

- A = the total amount of money after interest

- P = the principal amount (the initial investment)

- E = the mathematical constant, approximately equal to 2.71828

- R = the rate of interest (as a decimal, so 7% = 0.07)

- T = the time period in years

For example, if you invest $5000 in a bank account with an interest rate of 7% per year, the total amount of money after 3 years would be:

> A = 5000(e0.07 × 3) = $6168.39

The compound interest is then found by subtracting the initial amount from the total amount:

> $6168.39 - $5000 = $1168.39

Compound interest is calculated at regular intervals, such as annually, semi-annually, quarterly, or monthly. The more frequently the interest is compounded, the larger the effect of compounding.

Interest Rates: Investment Incentives or Deterrents?

You may want to see also

Frequently asked questions

The initial investment is the principal amount.

The formula for compound interest is: A = Pert = P(e^rt)

To calculate the compound interest, you need to know the initial investment, the annual interest rate, and the number of compound periods. You can use the following formula: Initial investment x (1 + annual interest rate)^number of compound periods - 1

Compound interest is calculated at regular intervals, such as annually, semi-annually, quarterly, or monthly.

The higher the number of compounding periods, the larger the effect of compounding. This means that compound interest allows your savings to grow faster over time.