Investment funds are a great way to build a diversified portfolio of stocks, bonds, or short-term investments. There are several types of investment funds, including mutual funds, exchange-traded funds (ETFs), and unit trusts. These funds can be found through online brokerages, financial advisors, or directly from the fund companies themselves. When deciding which funds to invest in, it is important to consider factors such as fees, fund choices, research and educational tools, and ease of use. Additionally, understanding the different types of funds, such as active or passive funds, open-end or closed-end funds, and load or no-load funds, can help investors make informed decisions. By carefully evaluating these options and considering one's financial goals and risk tolerance, individuals can effectively invest in funds that align with their investment strategies.

| Characteristics | Values |

|---|---|

| Number of funds | 4,500+ |

| Types of funds | ETFs, Unit trusts, offshore funds, open-ended investment companies (OEICs), Mutual funds |

| Fund sectors | Corporate Governance, Russia Sanctions Regime, Culture, Talent and Inclusion, Future of UK Funds Regime, Productive Finance Working Group, Investment & Capital Markets, Sustainability and Responsible Investment |

| Fund locations | UK, EEA |

| Target investors | Individual investors, large investors (e.g. pension and insurance funds) |

| Investment types | Stocks, bonds, securities, short-term investments, stocks of companies in specific segments of the economy, public and private companies |

| Investment styles | Active, passive |

| Investment accounts | Stocks and Shares ISA, Self-Invested Personal Pension (SIPP), Investment Account, Junior ISA, Junior SIPP |

| Investment tools | Fund Evaluator, Investment Finder |

What You'll Learn

Investment funds for beginners

The idea of investing can be intimidating if you're just starting out, but it's an important part of saving for various financial goals and building wealth. Here are some tips and investment fund options for beginners.

Tips for Beginners

- Before making any investment, it's important to know your tolerance for risk. Different investments carry different levels of risk, and you don't want to be caught off guard after investing.

- Think about how long you can do without the money you'll be investing and whether you're comfortable not accessing it for a few years or longer.

- It's more important to just start investing than to try to determine the best investment. Don't let the fear of making the wrong choice prevent you from starting at all.

Investment Funds

- High-yield savings accounts: These accounts, often opened through an online bank, tend to pay higher interest on average than standard savings accounts while still giving customers regular access to their money.

- Certificates of deposit (CDs): CDs are another way to earn additional interest on your savings, but they will tie up your money for longer than a high-yield savings account. You can purchase a CD for different time periods, such as six months, one year, or even five years.

- 401(k) or another workplace retirement plan: This is a simple way to get started with investing, and it often comes with incentives like employer matching contributions.

- Mutual funds: Mutual funds give investors the opportunity to invest in a basket of stocks or bonds that they might not be able to build on their own.

- Exchange-traded funds (ETFs): ETFs are similar to mutual funds in that they hold a basket of securities, but they trade throughout the day like a stock. They don't have the same minimum investment requirements as mutual funds, so they can be purchased for lower amounts.

- Individual stocks: Buying stocks in individual companies is the riskiest option but can also be rewarding. Before buying individual stocks, consider whether you are investing for the long term (at least five years) and whether you understand the business.

Other Options

- Robo-advisors: Robo-advisors use algorithms to automatically select and manage a diversified portfolio of exchange-traded funds for you, based on your financial needs and risk tolerance.

- Micro-investing apps: Micro-investing apps are a type of robo-advisor that allows you to invest money in very small increments. Some round up purchases made via linked credit or debit cards, while others allow for payroll deductions or periodic transfers from your bank account.

Remember, investing is a highly personal endeavour, and the optimal investment program depends on your objectives and tolerance for risk. It's important to do your own research and, if needed, consult a financial advisor before making any investment decisions.

Mutual Funds in India: Best Investment Options

You may want to see also

Online investment funds

Online investment fund platforms allow investors to access a variety of investment funds and manage their portfolio from the convenience of their homes. These platforms often provide tools and resources to help investors make informed decisions about their investments.

Types of Online Investment Funds

- Stocks and Shares: Buying stocks means purchasing a small part of ownership in a company, allowing investors to participate in its growth and success.

- Mutual Funds: These are professionally managed funds that pool money from multiple investors to invest in a diversified range of stocks, bonds, or other assets. Mutual funds are valued at the end of the trading day and are not traded on an exchange.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges and are valued constantly throughout the trading day. They often aim to perform in line with a specific index or commodity, such as gold, and usually have low management fees.

- Bonds: When you buy a bond, you are essentially lending money to a government, municipality, or corporation, which will pay you periodic interest and return the bond's face value when it matures.

- Real Estate Investment Trusts (REITs): REITs are a type of pooled investment that focuses on investing in commercial or residential properties. They provide regular distributions to investors from the rental income generated by these properties and offer the advantage of instant liquidity as they trade on stock exchanges.

Choosing an Online Investment Platform

When selecting an online investment platform, consider factors such as fees, fund choices, research and educational tools, and ease of use. Some popular online brokers for mutual funds include Merrill Edge® Self-Directed and NerdWallet, which offer a range of funds and tools to help you make informed investment decisions.

Benefits of Online Investment Funds

- Diversification: Online investment funds provide access to a diverse range of investment options, allowing investors to spread their risk across different assets, industries, or geographic regions.

- Convenience and Accessibility: With online investment platforms, you can manage your investments from anywhere, at any time. This convenience and accessibility make it easier for individuals to start investing and build their investment portfolios.

- Lower Fees: Online investment platforms often have lower fees compared to traditional financial advisors. Additionally, certain types of funds, such as ETFs, tend to have lower management fees.

Remember, investing carries inherent risks, and it is essential to carefully consider your financial goals, risk tolerance, and investment horizon before committing your money. Conduct thorough research, understand the fees associated with each investment, and diversify your portfolio to mitigate risks effectively.

Bond Funds: Risky Business, Not Worth Your Investment

You may want to see also

Mutual funds

There are more than 8,700 mutual funds in the US, with most falling into four main categories: stock, money market, bond, and target-date funds. Mutual funds are known by the kinds of securities they invest in, their investment objectives, and the type of returns they seek.

How to Choose Mutual Funds

When choosing a mutual fund, it's important to consider your goals, risk tolerance, and the rest of your portfolio. You'll also want to decide whether you want to invest in active or passive funds, calculate your budget, and understand the fees involved.

Advantages of Mutual Funds

- Diversification: Mutual funds provide access to a diversified portfolio of stocks, bonds, or other securities, reducing risk for investors.

- Professional management: Mutual funds are managed by professional money managers who research and skillfully trade the fund's assets.

- Economies of scale: Mutual funds enable investors to take advantage of dollar-cost averaging and benefit from lower transaction costs.

- Accessibility: Mutual funds are highly liquid and trade on major stock exchanges, making them relatively easy to buy and sell.

- Variety: There is a wide variety of mutual funds available, providing investors with many options to choose from.

Disadvantages of Mutual Funds

Despite their benefits, mutual funds also have some drawbacks:

- Fees: Mutual funds charge annual fees, expense ratios, or commissions, which can reduce overall returns.

- Cash drag: Mutual funds require a significant portion of their portfolios to be held in cash to satisfy share redemptions, resulting in a "cash drag" that earns no return.

- Taxes: Capital gains taxes may be triggered when the fund manager sells a security, and these taxes can be passed on to the investor.

- Lack of transparency: It can be challenging to compare mutual funds due to a lack of transparency in holdings and difficulty in evaluating funds with similar names or objectives.

Examples of Mutual Funds

- Fidelity Investments' Magellan Fund (FMAGX): Established in 1963, this fund had an investment objective of capital appreciation through investing in common stocks.

- Fidelity Select Semiconductors: One of the best-performing US equity mutual funds as of October 2024.

- T. Rowe Price U.S. Equity Research Fund (PRCOX): Ranked by US News as one of the best stock funds from companies in the US.

In conclusion, mutual funds offer a versatile and accessible way to diversify your portfolio and benefit from professional management. However, it's essential to carefully consider your investment goals and understand the associated fees and risks before investing.

Co-Invest Funds: Higher Returns, Lower Risk?

You may want to see also

Sustainable investing

There are two main strategies used by sustainable investors:

- ESG incorporation: This involves considering ESG criteria in investment decision-making and portfolio construction across a range of asset classes. Approaches include positive/best-in-class screening, negative/exclusionary screening, ESG integration, impact investing, and sustainability-themed investing.

- Shareholder engagement: For those with shares in publicly traded companies, this strategy involves filing shareholder resolutions and practicing other forms of shareholder engagement to encourage responsible business practices.

- Mutual funds: These funds specialize in seeking companies with good labour and environmental practices.

- Credit unions and community development banks: These institutions have a specific mission to serve low- and middle-income communities.

- Hospitals and medical schools: These institutions may refuse to invest in tobacco companies, aligning with their values and societal impact goals.

- Foundations: They may support community development loan funds and other high social impact investments that align with their mission.

- Religious institutions: These organizations file shareholder resolutions to urge companies in their portfolios to meet ethical and governance standards.

- Venture capitalists: They identify and develop companies that provide environmental services, create jobs in low-income communities, or offer other societal benefits.

- Responsible property funds: These funds help develop or retrofit residential and commercial buildings to high energy efficiency standards.

When choosing sustainable investment funds, it is important to consider your values, investment goals, and risk tolerance. Additionally, fees and costs can impact your returns over time, so be sure to compare expense ratios across different funds.

- Vanguard ESG U.S. Stock ETF (ESGV): This fund holds a well-diversified portfolio that meets its environmental, social, and governance principles, abstaining from investing in adult entertainment, alcohol, tobacco, weapons, fossil fuels, and other industries that do not align with its values.

- Pimco Enhanced Short Maturity Active ESG ETF (EMNT): This actively managed ETF focuses on securities of issuers whose ESG practices align with its investment strategy, aiming to preserve capital while maximizing income.

- Nuveen ESG Dividend ETF (NUDV): With five decades of experience in ESG investing, Nuveen offers a fund that selects high-dividend U.S. stocks screened for specific environmental, social, and governance criteria.

- IShares MSCI Global Sustainable Developmental Goals ETF (SDG): This ETF screens for companies that derive most of their revenue from products and services provided in ways that aim to alleviate major social and environmental challenges identified by the United Nations Sustainable Development Goals.

- Fidelity U.S. Sustainability Index Fund (FITLX): This passive index fund tracks the MSCI USA ESG Index, offering a low-cost option for ESG investors with a diverse range of U.S. companies from various industries.

- BlackRock Sustainable Advantage CoreAlpha Bond Fund (BIAAX): This actively managed bond fund screens bond issuers for their potential to deliver positive societal impact, striving for both capital appreciation and income.

These examples showcase a variety of sustainable investment funds with different focuses and strategies, allowing investors to align their investments with their values and contribute to advancements in ESG practices.

Arbitrage Funds: A Smart Investment Move for Europeans

You may want to see also

Investment funds for retirement

Investment funds are a great way to save for retirement. They allow investors to pool their money, which a fund manager then invests on their behalf. The manager is responsible for choosing investments for the fund and tries to grow investors' money by spreading it over a range of company shares, bonds, etc.

Balanced Funds

These funds own portfolios of stocks and fixed income, with a strong focus on dividends and interest income. They aim to balance the potential growth of stocks with the stability and income generation of fixed-income assets. The target allocation between stocks and fixed income can vary depending on the fund's objectives and strategy, but a common allocation is 60% stocks and 40% bonds. Some examples of balanced funds include:

- Vanguard Wellington Fund (VWELX)

- Dodge and Cox Income Fund (DODIX)

- Schwab Balanced Fund (SWOBX)

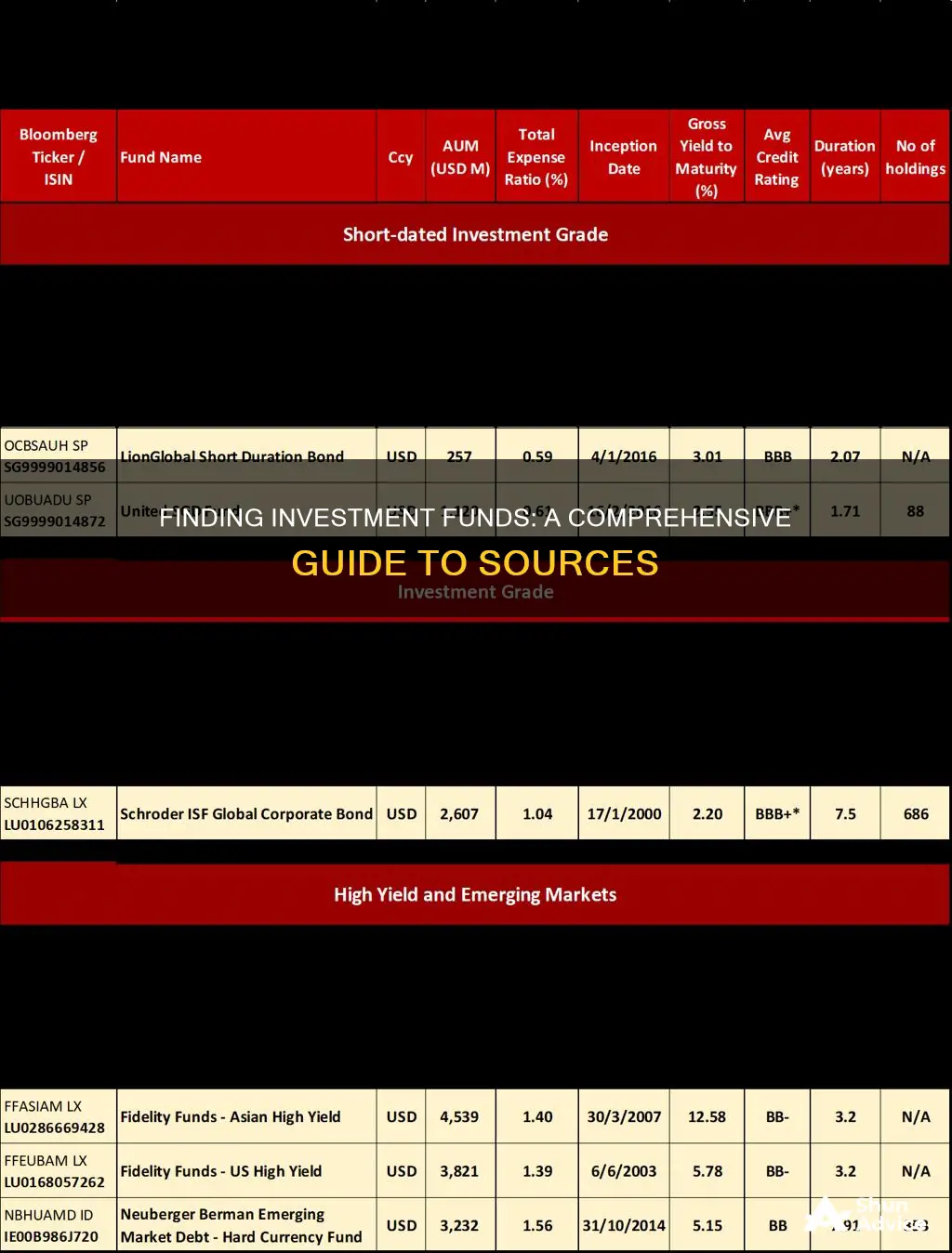

Bond Funds

Bond mutual funds own fixed-income assets such as government bonds, corporate bonds, or municipal bonds. They provide a steady stream of income through periodic interest payments. Some examples of bond funds include:

- PGIM High Yield Fund (PHYZX)

- Vanguard Long-Term Tax-Exempt Fund (VWLTX)

- BBH Limited Duration Fund (BBBMX)

Target-Date Funds

These funds are designed for investors who want a hands-off approach to retirement savings. They own a diversified portfolio of stocks and bonds and gradually shift from riskier stock investments to more conservative fixed-income investments as the target retirement date approaches. Some examples of target-date funds include:

- BlackRock LifePath Index Target-Date series

- T. Rowe Price Retirement lineup

- Vanguard Target Retirement Income Fund

Dividend Funds

Dividend funds own stocks of companies that regularly pay dividends to their shareholders. They aim to generate income from dividend payments and also deliver increased value from the capital appreciation of the stocks. Some examples of dividend funds include:

- T. Rowe Price Dividend Growth Fund (PRDGX)

- Vanguard Dividend Appreciation (VIG or VDADX)

When choosing an investment fund for retirement, it's important to consider your risk tolerance, the fund's performance history, and the associated fees. Consulting a financial advisor can also provide personalized guidance based on your specific financial situation and goals.

The S&P 500 Index Fund: A Smart Investment Move

You may want to see also