Beta is a measure of the volatility of returns on an investment relative to the entire market. It is used to gauge the risk of an investment and is an integral part of the Capital Asset Pricing Model (CAPM). A beta greater than 1 indicates that the investment is more volatile than the market, while a beta less than 1 indicates that it is less volatile. Calculating the beta of an investment can be done using Microsoft Excel or similar software, and it involves comparing the percentage change in the investment's value to that of a market index, such as the S&P 500. This allows investors to determine the expected return on their investment and make informed decisions about their portfolio.

| Characteristics | Values |

|---|---|

| What is Beta? | A measurement of an investment security's volatility of returns relative to the entire market. |

| What does Beta measure? | The volatility of returns for an investment or the sensitivity of a firm's stock price to an index or benchmark. |

| How is Beta calculated? | Beta = Covariance of the two arrays / Variance of the array of the index. |

| What is the Beta formula? | β = Cov(ra, rb) / Var(rb) |

| What is the Beta coefficient? | β =1 exactly as volatile as the market, β >1 more volatile than the market, β <1 less volatile than the market, β =0 uncorrelated to the market, β <0 negatively correlated to the market |

| What is Levered Beta? | A measurement that compares the volatility of returns of a company's stock against the broader market, including business risk and the risk from taking on debt. |

| What is Unlevered Beta? | A measurement that compares the volatility of returns of a company's stock against the broader market, including business risk but not the risk from taking on debt. |

| What is Portfolio Beta? | A measure of the systematic risk of a portfolio of securities relative to a market benchmark. |

| How is Portfolio Beta calculated? | Portfolio Beta = ∑ (Portfolio Weight x Beta Coefficient) |

What You'll Learn

Calculating beta in Excel

Beta is a measure of a stock's relative risk to the broader stock market. It is a measure of volatility or risk, expressed as a number, that shows how the variance of an asset—from an individual security to an entire portfolio—relates to the covariance of that asset and the stock market or benchmark.

Beta can be calculated using Excel to determine the riskiness of a stock. Here is a step-by-step guide:

Step 1: Choose a Time Frame

The first step is to select a time frame for calculating beta. This should align with your investment time horizon. Long-term investors will want to assess risk over a longer period than short-term traders.

Step 2: Choose an Appropriate Index

The next step is to choose an index to calculate beta. The S&P 500 is commonly used as a benchmark, but if your portfolio includes international equities, you may want to choose a different index or use multiple indices.

Step 3: Gather Historical Data

Now, you need to gather historical price data for each equity in your portfolio and the chosen index. This data should cover the selected time frame and be downloaded as a spreadsheet.

Step 4: Calculate Percent Changes

Copy the closing price columns for each equity and the index into a new spreadsheet, ordered from newest to oldest. Calculate the percent change period-to-period for both the asset and the benchmark. For daily data, compare each day; for weekly data, compare each week, and so on.

Step 5: Calculate Variance and Covariance

Find the variance of the benchmark using the formula:

> =VAR.S(all the percent changes of the benchmark)

Then, find the covariance of the asset to the benchmark using:

> =COVARIANCE.S(all the percent changes of the asset and all the percent changes of the benchmark)

Step 6: Calculate Beta

Finally, calculate beta using the formula:

> Beta = COVAR(E2:E99, D2:D99) / VAR(D2:D99)

Additional Step: Calculate R-Squared

You can also calculate the r-squared to gauge the reliability of your beta. The formula is:

> R-Squared = RSQ(D2:D99, E2:E99)

The r-squared value ranges from zero to one, with a higher value indicating a more reliable beta.

Alternative Method: Linear Regression

Another method to calculate beta in Excel is to perform a linear regression. This involves using the SLOPE function in Excel, with the dependent variable being the performance of the stock over the chosen time period and the independent variable being the performance of the chosen index over the same period. The coefficient of the dependent variable will be the beta.

Understanding Your Cash Available to Invest

You may want to see also

Beta as a measure of risk

Beta (β) is a measure of risk that reflects the volatility of an individual security or portfolio's returns relative to the broader market. It is calculated by dividing the covariance of a security's returns with the returns of a market benchmark (e.g., the S&P 500) by the variance of the benchmark's returns over a specific period. A beta greater than 1 indicates higher volatility compared to the market, while a beta less than 1 suggests lower volatility.

Beta is an essential component of the Capital Asset Pricing Model (CAPM), which describes the relationship between systematic risk and expected returns for assets. CAPM is used to price risky securities and estimate expected returns, taking into account the risk of those assets and the cost of capital. By using CAPM, investors can determine the rate of return they might reasonably expect based on the perceived investment risk.

Beta provides investors with an approximation of how much risk a particular stock adds to their portfolio. A stock with a beta of 1 is considered to have the same level of volatility as the market. Stocks with betas greater than 1 are more volatile than the market and are expected to provide higher returns to compensate for the increased risk. On the other hand, stocks with betas less than 1 are less volatile and are often associated with more stable companies that deliver consistent revenues and profits.

While beta is a widely used measure, it has some limitations. It focuses on short-term risk and historical data, which may not accurately predict future stock movements, especially for long-term investments. Additionally, beta does not consider the fundamentals of a company, such as its earnings, growth potential, or other factors that could influence its risk profile. Therefore, investors should also evaluate stocks from fundamental and technical perspectives to make more comprehensive investment decisions.

Cash or Invest: Where Should Your Money Go?

You may want to see also

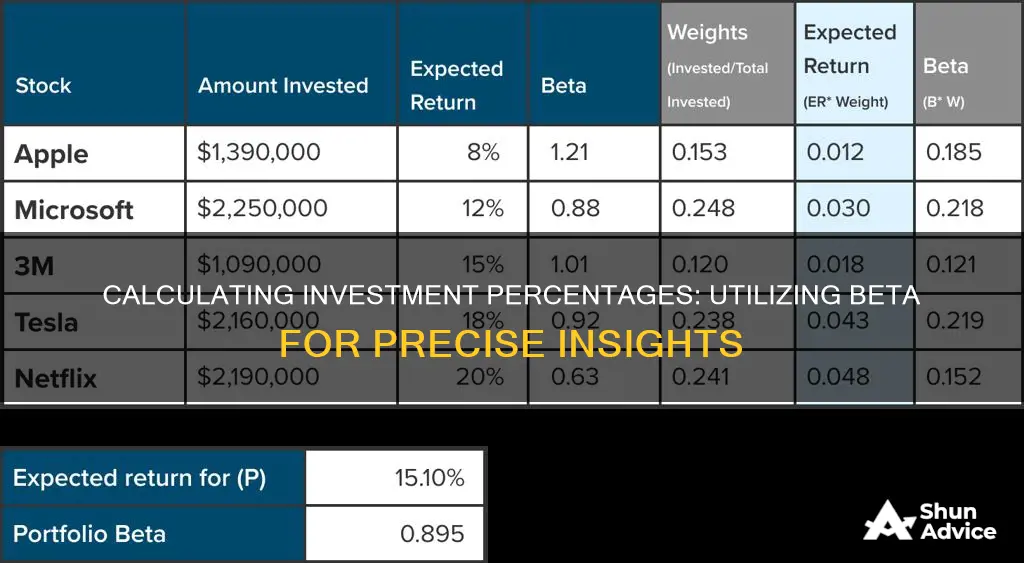

Portfolio beta

The beta of a portfolio is the weighted sum of the individual asset betas, according to the proportions of the investments in the portfolio. For example, if 50% of the money is in stock A with a beta of 2.00, and 50% of the money is in stock B with a beta of 1.00, the portfolio beta is 1.50.

The portfolio beta represents the overall systematic risk of a portfolio of securities. Beta (β) is a measure of risk that reflects the sensitivity of an individual security or portfolio to market risk, i.e., the fluctuations in the prices of securities in the broader market.

In portfolio management, diversification is critical to constructing a portfolio capable of mitigating market risk, as the total risk is spread across a wide range of different securities, asset classes, and industries (or sectors).

The portfolio beta can be calculated using the following four-step process:

- Identify Beta Coefficient: The first step is to identify the beta coefficient for each security in the investment portfolio, which can be retrieved via financial data platforms such as Bloomberg.

- Calculate Portfolio Weights (%): The next step is to compute the percentage weight attributable to each security in the portfolio. The portfolio weight is calculated by dividing the market value of the investment at present by the total portfolio value.

- Determine the Weighted Beta: From there, the beta of each individual security can be multiplied by its respective portfolio to arrive at each security's weighted beta.

- Portfolio Beta Calculation: In the final step, the sum of the weighted betas calculated thus far represents the portfolio beta.

The general rules for interpreting the beta of a portfolio are virtually identical to interpreting the beta of individual securities. A higher beta means undertaking more risk, so a rational investor should expect to earn a higher potential yield to compensate for the incremental risk.

Acorns Investing: Scam or Legitimate Investment Opportunity?

You may want to see also

Levered vs unlevered beta

Beta (β) is a measure of risk that reflects the volatility of returns for an investment relative to the market. It is an integral part of the Capital Asset Pricing Model (CAPM). A company's beta can be found on financial databases such as Bloomberg and Yahoo Finance.

Levered beta, also known as equity beta, includes both business risk and the risk that comes from taking on debt. It takes into account the impact of a company's capital structure and compares the volatility of returns of a company's stock against the broader market. It is calculated using the formula:

Levered Beta = Unlevered Beta x [1 + (1 - Tax Rate) x (Debt/Equity)]

Unlevered beta, also known as asset beta, only includes business risk and does not take into account the risk from debt. It compares the risk of an unlevered company to the market and is calculated as follows:

Unlevered Beta = Levered Beta / [1 + (1 - Tax Rate) x (Debt/Equity)]

The main difference between the two is that levered beta includes the effects of a company's capital structure, while unlevered beta removes these effects to isolate the risk related to a company's assets. Levered beta is useful for investors who want to assess the sensitivity of a security to macro-market risks, while unlevered beta is useful for those who want to measure a company's performance relative to the market without the impact of debt.

How to Find the Percentage of an Investment Using Beta

To calculate the percentage return of an investment using beta, you can use the following formula:

% Return = Beta x Market Return

For example, if a company has a beta of 1.5 and the market returns 10% in a given period, the percentage return of the investment would be:

5 x 10% = 15%

So, the investment returned 15% when the market returned 10%.

A Guide to Investing in Cash-Flow Websites

You may want to see also

Interpreting betas

Beta (β) is a measure of the volatility of a security or portfolio compared to the market. It is the second letter of the Greek alphabet and is used in finance to denote the volatility or systematic risk of an investment. The market, such as the S&P 500 Index, has a beta of 1.0, and individual stocks are ranked according to how much they deviate from this market value.

A beta coefficient of 1.0 indicates that the investment will move with the market. A beta of less than 1.0 means that the investment will be less volatile than the market, and a beta of greater than 1.0 indicates that the investment is more volatile than the market. For example, a beta of 1.3 means the investment is 30% more volatile than the market. A beta of 0 means the investment is uncorrelated to the market, and a negative beta means the investment moves in the opposite direction to the market.

Beta is a component of the Capital Asset Pricing Model (CAPM), which calculates the cost of equity funding and can help determine the rate of return relative to perceived risk. It is also used to price risky securities and to estimate the expected returns of assets, considering the risk of those assets and the cost of capital.

Beta is calculated using regression analysis, and it represents the tendency for a security's returns to respond to swings in the market. It is a useful tool for investors to gauge how much risk a stock adds to a portfolio. However, it has limitations as it is calculated using historical data and does not predict future moves. It also does not consider the fundamentals of a company, such as its earnings and growth potential.

Beta is probably a better indicator of short-term rather than long-term risk. It is also more useful for traders than for investors with long-term horizons.

The True Cost of Cashing in Your Investments

You may want to see also

Frequently asked questions

Beta (β) is a measure of the volatility of returns of an investment security (e.g. a stock) relative to the entire market. It is used as a measure of risk and a higher beta indicates greater risk and greater expected returns.

Beta can be calculated using the following formula:

Beta = Covariance of Returns (ra, rb) / Variance of Returns (rb)

Where ra = returns of the stock and rb = returns of the market index.

Beta can be calculated using Microsoft Excel or similar software.

A beta of 1 indicates that the investment is equally volatile as the market. A beta greater than 1 indicates higher volatility than the market, while a beta less than 1 indicates lower volatility.