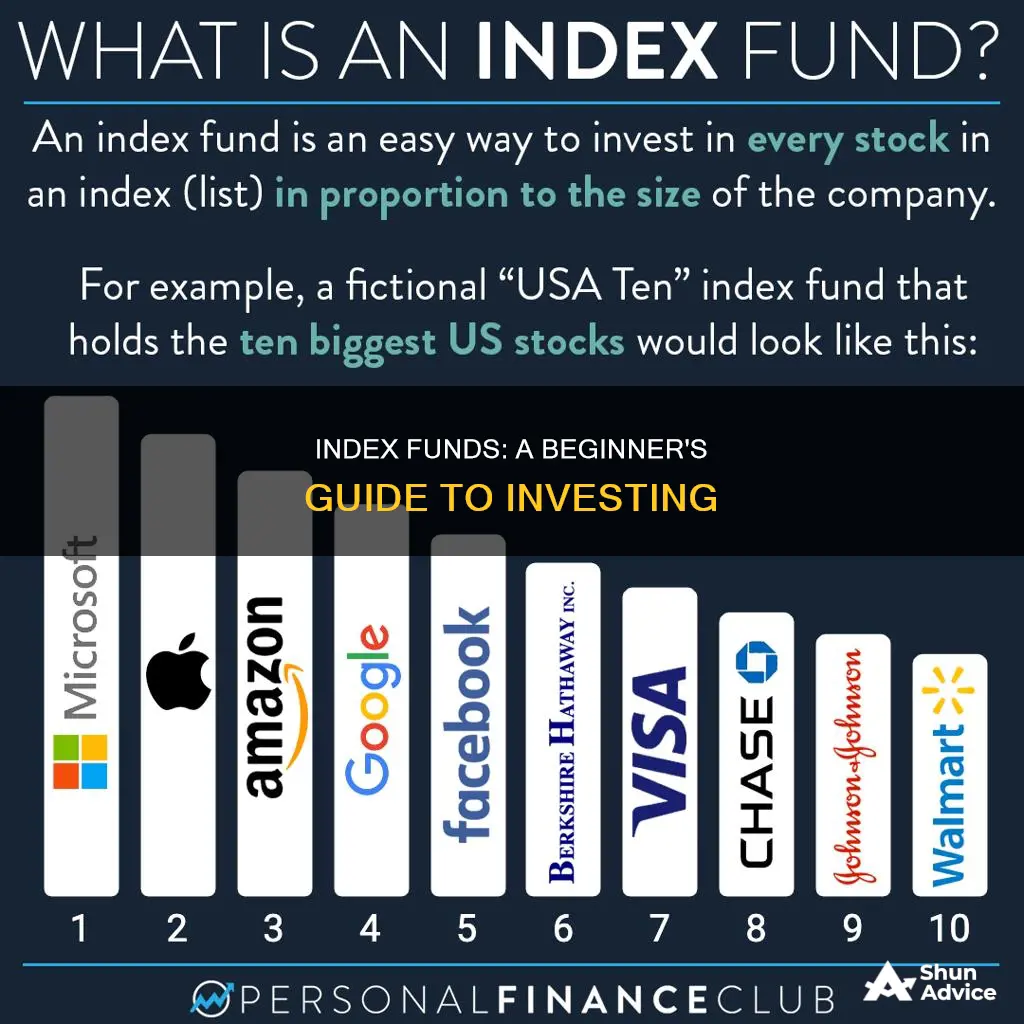

Index funds are a type of investment vehicle that mirrors the performance of a designated market index, such as the S&P 500 or the Dow Jones Industrial Average. They are typically mutual funds or exchange-traded funds (ETFs) that hold a basket of securities in the same or similar proportion to the index they track. Index funds are passively managed, meaning they don't require active decision-making on which investments to buy or sell. This passive management strategy makes index funds a low-cost investment option with lower fees than actively managed funds. They are also considered less risky than individual stocks because they track the performance of an index as a whole, reducing volatility.

When investing in index funds, it is important to have clear goals and timelines in mind. For example, more aggressive investments like equity index funds offer greater potential returns but come with higher risks. On the other hand, more conservative investments, like bond-based index funds, offer more stable value but lower returns. It is also crucial to pick the right index fund strategy and evaluate your risk appetite. Additionally, researching different types of indexes and individual funds is essential, considering factors such as company size, geography, business sector, and asset type.

To start investing in index funds, individuals can open an investment account with a brokerage firm or directly with a mutual fund company. They can then purchase shares of their chosen index fund, either through a brokerage account or a retirement account like an IRA or 401(k). It is recommended to regularly review and rebalance the index fund portfolio to ensure it aligns with the investor's goals and risk tolerance.

| Characteristics | Values |

|---|---|

| Investment type | Mutual fund or exchange-traded fund (ETF) |

| Investment aim | To match the returns of a specific market index |

| Investment vehicle | Stocks, bonds, commodities, cash |

| Investment strategy | Passive |

| Investment costs | Low fees, low tax, low risk |

| Investment research | Minimal |

| Investment performance | Often outperform actively managed funds over the long term |

| Investment risk | Less volatile than individual stocks |

| Investment return | Average annual return of nearly 10% for S&P 500 since 1928 |

What You'll Learn

Understand the benefits of index funds

Index funds are considered one of the smartest types of investments, offering broad diversification, low costs, and attractive returns. Here are some key benefits to understand:

Broad Diversification

The most obvious benefit of investing in index funds is instant diversification, reducing the likelihood of losing your money. Index funds typically track a specific market index, such as the S&P 500, and hold the same investments in similar proportions. This means your portfolio's performance is matched to that of the chosen index. For example, an S&P 500 index fund would hold about 500 different stocks, ensuring your investments are not overly reliant on the performance of any single company.

Low Costs

Index funds are known for their low costs, including management fees and taxes. The expense ratios of index funds are typically low, ranging from 0.05% to 0.07%, and some have no expense ratios at all. In contrast, actively managed mutual funds often have expense ratios ranging from 1% to 2%. The low costs of index funds can make a significant difference in your returns over time.

Attractive Returns

Index funds have consistently outperformed actively managed funds over time. Even renowned investors like Warren Buffett have endorsed index funds, stating that they are the "smartest investment most people can make." In 2007, Buffett made a $1 million bet that an S&P 500 index fund would outperform an actively managed hedge fund over a decade, and he won decisively. This demonstrates the potential of index funds to generate attractive returns.

Passive Management

Index funds are passively managed, meaning they simply mirror the performance of their designated index. Unlike actively managed funds, they do not require a manager to actively trade or a research team to make recommendations. This passive nature leads to lower management fees and transaction costs, making index funds an affordable option for investors.

Tax Advantages

Index funds also offer tax advantages due to their lower turnover ratios. Their low turnover ratios mean they generate less taxable income, resulting in lower capital gains taxes for investors. Additionally, when selling securities, index funds can choose from various lots to sell those with the lowest capital gains and minimize the tax burden.

In summary, index funds offer a range of benefits, including broad diversification, low costs, attractive returns, passive management, and tax advantages. These features make index funds a compelling option for investors seeking a simple and effective way to build wealth over time.

Fidelity Investments: Trade Free Funds and Their Benefits

You may want to see also

Choose an index

Choosing an index is an important step in investing in index funds. Index funds are a type of investment vehicle that aims to match the returns of a specific market index. Indexes are ways to group securities together, such as based on size or geography, and index funds provide exposure to these indexes. When choosing an index, it is important to consider your financial plan, risk tolerance, budget, and investment goals. Here are some factors to consider when choosing an index:

- Company size and capitalization: Index funds can track small, medium, or large companies, also known as small-, mid-, or large-cap indexes.

- Geography: Some indexes focus on stocks that trade on foreign exchanges or a combination of international exchanges.

- Business sector or industry: You can choose funds that focus on specific sectors or industries, such as consumer goods, technology, or health-related businesses.

- Asset type: There are funds that track bonds, commodities, or cash.

- Market opportunities: Some funds focus on emerging markets or other growing sectors.

- S&P 500: This index includes 500 of the top companies in the U.S. stock market and is considered one of the most popular indexes.

- Dow Jones Industrial Average: This index tracks the 30 largest U.S. companies.

- Nasdaq Composite: This index tracks over 3,000 tech stocks.

- Russell 2000: This index tracks 2,000 smaller companies, also known as small-cap companies.

- MSCI EAFE: This index tracks large and mid-cap stocks of companies based in 21 developed nations outside the U.S. and Canada.

When choosing an index, it is also important to research the different index funds that track that index and consider factors such as fees, performance, and investment minimums. By selecting an index that aligns with your financial goals and risk tolerance, you can make a more informed decision about which index to choose for your index fund investment.

Global Bond Funds: Diversify and Grow Your Investments

You may want to see also

Decide where to buy

You can buy an index fund directly from a mutual fund company or a brokerage. The same goes for exchange-traded funds (ETFs). These are like mini mutual funds that trade like stocks throughout the day.

When choosing where to buy an index fund, consider the following:

- Fund selection: Do you want to purchase index funds from various fund families? The big mutual fund companies carry some of their competitors’ funds. However, the selection may be more limited than what’s available in a discount broker’s lineup.

- Convenience: Find a single provider who can accommodate all your needs. For example, if you’re just going to invest in mutual funds (or even a mix of funds and stocks), a mutual fund company may be able to serve as your investment hub. But if you require sophisticated stock research and screening tools, a discount broker that also sells the index funds you want may be better.

- Trading costs: If the commission or transaction fee isn’t waived, consider how much a broker or fund company charges to buy or sell the index fund. Mutual fund commissions are higher than stock trading ones (about $20 or more). Compare that with less than $10 a trade for stocks and ETFs.

- Impact investing: Want your investment to make a difference outside your portfolio? Some funds target companies with a focus on environmental or social justice causes.

- Commission-free options: Do they offer no-transaction-fee mutual funds or commission-free ETFs?

In addition, you'll need to open an investment account. A brokerage account, individual retirement account (IRA) or Roth IRA will all work. You can then buy the fund in the account.

Factors to consider when choosing where to buy

- Fund selection and guidance: Does the platform offer the index funds you want? If using a brokerage account yourself, how convenient is it to use? Does it have a mobile app and is the user experience good?

- Transaction fees: How much does the broker or fund company charge to buy or sell the index fund?

- Management fees: How much does the investment platform or financial advisor charge for their services?

Mutual Fund Investment Strategies: Where to Invest?

You may want to see also

Pick your funds

Now that you have decided on your goals and timelines, you can pick the index fund strategy that will help you achieve your goals.

There are many different types of index funds, so it is important to do your research. Here are some factors to consider:

- Company size and capitalization: Index funds can track small, medium-sized or large companies.

- Geography: Some funds focus on stocks that trade on foreign exchanges or a combination of international exchanges.

- Business sector or industry: You can choose funds that focus on consumer goods, technology, or health-related businesses.

- Asset type: There are funds that track bonds, commodities, and cash.

- Market opportunities: These funds focus on emerging markets or other growing sectors.

When deciding which index funds to invest in, it is important to consider the fees and costs associated with each fund. Look at the expense ratio, which is the annual percentage-based charge that covers all fees related to managing the fund. Even small differences in fees can have a big impact on your investment returns over time.

Another cost to consider is the investment minimum, which is the minimum amount required to invest in a particular fund. This can vary from a few hundred to a few thousand dollars.

Once you have researched the different types of index funds and considered the fees and costs, you can choose the funds that best fit your investment goals and risk tolerance.

Some popular index fund choices include:

- Large-cap U.S. stocks: Vanguard S&P 500 ETF (VOO), iShares Russell 1000 ETF (IWB), Invesco QQQ Trust (QQQ)

- Small-cap U.S. stocks: iShares Core S&P Small-Cap ETF (IJR), iShares Russell 2000 ETF (IWM)

- U.S. total stock market: Vanguard Total Stock Market Index (VTSAX), Schwab Total Stock Market (SWTSX), iShares Russell 3000 ETF (IWV)

- Total international stock market: Fidelity International Index Fund (FSPSX), Schwab International Index Fund (SWISX)

- Total U.S. bond market: Fidelity U.S. Bond Index (FXNAX), Vanguard Total Bond Market Index (VBTLX)

- Total international bond market: SPDR Bloomberg International Treasury Bond ETF (BWX), Invesco International Corporate Bond ETF (PICB)

It is important to note that you don't need to invest in a large number of index funds to achieve diversification. In fact, a simple portfolio of two to three index funds is often enough to provide adequate diversification for the average investor.

Smart Mutual Fund Investments: 16K Options

You may want to see also

Buy shares

Once you've decided on your investment goals and chosen the right index fund strategy, you can open an investment account and purchase your first index fund. You can do this through a brokerage account, an individual retirement account (IRA), or a Roth IRA.

When you go to purchase the fund, you may be able to select a fixed dollar amount to spend or choose a number of shares. The share price of the index fund and your investing budget will determine how much you're willing to spend. For instance, if you have $1,000 you'd like to invest in an index fund, and the fund you're looking at is selling for $100 a share, you'd be able to purchase 10 shares.

You can open a brokerage account that allows you to buy and sell shares of the index fund that interests you. Alternatively, you can open an account directly with a mutual fund company that offers an index fund you're interested in.

It's worth looking at the costs and features when deciding the best way to buy shares of your index fund. Some brokers charge extra for their customers to buy index fund shares, making it cheaper to go directly through the index fund company to open a fund account.

That said, many investors prefer to have all their investments held in a single brokerage account. Plus, many brokers allow customers to buy fractional shares of index funds in exchange-traded fund (ETF) form. If you anticipate investing in several index funds offered by various fund managers, the brokerage option could be the best way to combine all your investments under a single account.

How to buy index funds in 3 steps

Decide where to invest your money

You can either open an account with the broker that offers the fund you want or open an account with your preferred broker. Many of the major brokers offer their own index funds, but they tend to largely track the major indices, so performance should be similar across brokers.

Pick your index fund(s)

Some of the most popular index fund choices include:

- Large-cap U.S. stocks: Vanguard S&P 500 ETF (VOO), iShares Russell 1000 ETF (IWB), Invesco QQQ Trust (QQQ)

- Small-cap U.S. stocks: iShares Core S&P Small-Cap ETF (IJR), iShares Russell 2000 ETF (IWM)

- U.S. total stock market: Vanguard Total Stock Market Index (VTSAX), Schwab Total Stock Market (SWTSX), iShares Russell 3000 ETF (IWV)

- Total international stock market: Fidelity International Index Fund (FSPSX), Schwab International Index Fund (SWISX)

- Total U.S. bond market: Fidelity U.S. Bond Index (FXNAX), Vanguard Total Bond Market Index (VBTLX)

- Total international bond market: SPDR Bloomberg International Treasury Bond ETF (BWX), Invesco International Corporate Bond ETF (PICB)

Buy shares of an index fund

Once you have picked your broker and chosen your fund(s), all you have left to do is buy your shares. However, if you decide to invest in multiple funds, you still have to decide how much to invest in each fund type.

In general, younger investors planning for retirement should consider putting a larger allocation of their portfolio in higher-risk investments, such as stocks, as they have more time on their side before needing the money. The closer someone is to retirement, the more they may want to consider shifting a larger chunk of their holdings into bonds or other lower-risk assets since they are less likely to lose value in the short term.

Mutual Fund Minimums: Why the Barrier to Entry Exists

You may want to see also

Frequently asked questions

An index fund is a group of stocks that aims to mirror the performance of an existing stock market index, such as the Standard & Poor's 500 index. An index fund will be made up of the same investments that make up the index it tracks.

When deciding on an index fund, consider your risk tolerance, budget, and investment goals. You should also research the fund's fees, portfolio construction, and performance.

You can buy an index fund directly from a mutual fund company or a brokerage, or through an online broker. You will need to open an investment account, such as a brokerage account, individual retirement account (IRA), or Roth IRA, and then purchase the fund through that account.

Index funds offer built-in diversification, low fees, and minimal maintenance. However, they may not be as diverse as expected, and investors give up control over their portfolio holdings.