Investing in mutual funds is a great way to build a diversified portfolio without the hassle of picking individual stocks and bonds. Mutual funds are an excellent option for people who don't have the time, education, money, or willingness to manage a large portfolio of investments.

Before investing in mutual funds, it's important to identify your financial goals and risk tolerance. Are you investing for the short term or the long term? Do you want to take on more risk for potentially higher returns, or would you prefer a more conservative approach?

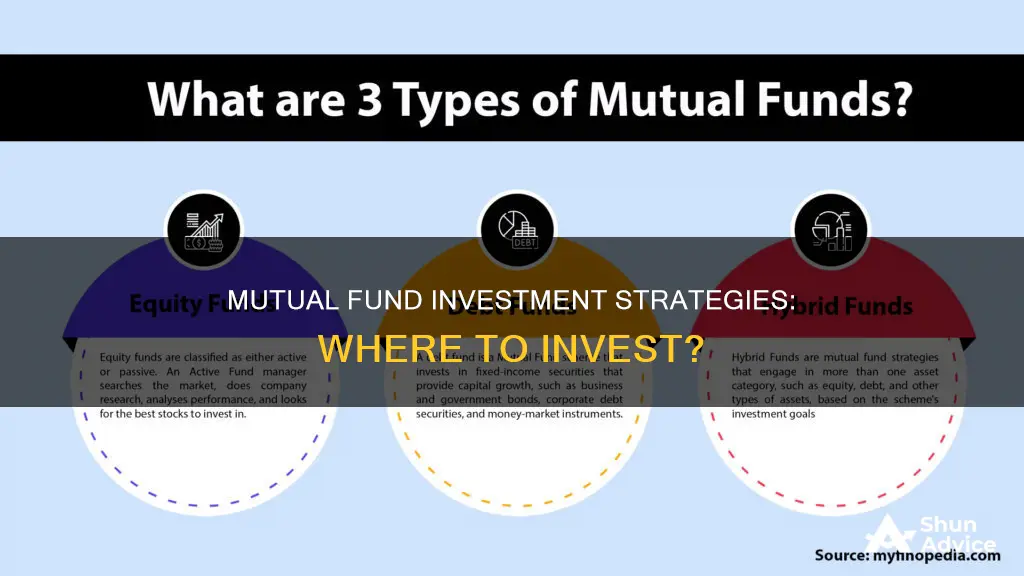

Once you've established your goals and risk tolerance, you can start researching different types of mutual funds, such as stock funds, bond funds, target-date funds, and money market funds. Compare the fees, performance, and investment strategies of different funds to find the ones that align with your objectives.

You can invest in mutual funds through a brokerage account, an employer-sponsored retirement plan like a 401(k), or directly through the fund company. When investing in mutual funds, pay attention to the fees, as they can significantly impact your returns.

By following these steps, you can make informed decisions about which mutual funds to invest in, helping you work towards your financial goals.

| Characteristics | Values |

|---|---|

| Investment goals | Long-term goals, mid-term goals, near-term goals |

| Investment strategy | Long-term mutual fund investment, mid-term mutual fund investment, near-term mutual fund investment |

| Investment type | Stock mutual funds, Bond mutual funds, Money market mutual funds, Target-date funds, Index funds, Passive funds, Active funds |

| Investment account | Standard brokerage account, 401(k), IRA, Roth IRA, Taxable brokerage account, Education savings account |

| Investment mix | Stocks, Bonds, Commodities |

| Investment research | Mutual fund companies, Mutual fund fees, Mutual fund performance, Mutual fund historical performance, Mutual fund expense ratio |

| Investment account opening | 401(k), IRA, Taxable brokerage account, Robo advisor, Financial advisor |

| Investment purchase | Mutual fund shares, ETF shares |

| Investment plan | Long-term investor, Taxes |

| Exit strategy | Backend loads, Capital gains taxes, Financial advisor, Tax professional |

What You'll Learn

Long-term vs. short-term goals

When investing in mutual funds, it's important to consider your long-term and short-term goals. Mutual funds are a great way to build a diversified portfolio without the hassle and high costs of investing in individual stocks and bonds. Here are some things to keep in mind when investing in mutual funds to achieve your financial goals:

Long-Term Goals:

- Time Horizon: If you're investing for the long term, you have a longer time horizon to ride out the inevitable ups and downs of the stock market. Historically, the stock market has offered strong average annual returns over longer periods, making it suitable for long-term goals like retirement planning or saving for your child's education.

- Risk and Return: With a longer time horizon, you can afford to take on more risk in pursuit of higher returns. A higher allocation of stock-based mutual funds, typically 70% to 100%, is common for long-term investment goals. "Growth funds" focus on companies expected to grow faster than others, offering the potential for larger gains but also carrying more risk.

- Investment Strategy: Active mutual funds, which aim to beat the market through stock picking, may be suitable for long-term goals as they have the potential for richer returns. However, they usually come with higher fees. Passive or index funds, on the other hand, aim to match market performance and typically charge lower fees.

Short-Term Goals:

- Time Horizon: For short-term goals, such as buying a home or a car within a few years, the focus is on preserving capital and maintaining liquidity. The recommended time horizon for mutual funds is at least three to five years due to sales charges and potential market volatility.

- Risk and Return: Since short-term goals have a shorter time horizon, the investment approach is typically more conservative to reduce the potential for rapid changes in investment value. Balanced mutual funds, which invest in both stocks and bonds, can help offset the risk associated with stocks.

- Investment Strategy: For short-term goals, it's generally recommended to avoid stock and bond mutual funds due to their volatility. Instead, consider short-term vehicles like savings accounts or money market funds, or income funds if you're investing for current income.

Whether you're investing for the long term or the short term, it's crucial to identify your financial goals, time horizon, and risk tolerance. This will help you determine the right mix of stocks, bonds, and other investments within your mutual fund portfolio. Remember to consider fees, past performance, and the fund's management strategy when selecting specific mutual funds to invest in.

Retirement Fund Investment: Choosing the Right Option

You may want to see also

Active vs. passive funds

When deciding how to invest in mutual funds, you'll need to consider whether to take an active or passive approach. Here's what you need to know about active vs. passive funds:

Active Funds

Active funds are managed by professionals who research the market and buy and sell with an eye toward beating the market. Active funds seek to outperform a benchmark index and require a more hands-on approach, often involving a portfolio manager. Active funds tend to have higher fees due to the increased transaction costs and salaries for analysts. While active funds aim to beat the market, they rarely succeed in doing so over the long term. Active funds offer more flexibility as managers are not required to hold specific stocks or bonds and can use various hedging techniques. They also allow for more tailored tax management strategies.

Passive Funds

Passive funds, often called index funds, aim to track and duplicate the performance of a benchmark index like the S&P 500 or Dow Jones Industrial Average. Passive funds are more of a hands-off approach, requiring less buying and selling. They tend to have lower fees since they simply follow an index and don't require as much research. Passive funds offer the benefit of ultra-low fees, good transparency, and tax efficiency. However, they may offer limited investment options and smaller returns.

Passive investing tends to deliver better overall returns and is often the preferred choice for most investors. However, active investing can be useful for certain portions of a portfolio, such as investments in illiquid or little-known securities. Many investment advisors recommend blending active and passive styles to take advantage of the strengths of both approaches.

Dimensional Fund Investing: What Products Are Offered?

You may want to see also

Investment account options

There are several types of investment accounts you can use to invest in mutual funds. These include:

- Standard brokerage account: You can open a standard brokerage account through an investment company or bank. These accounts allow you to invest in a wide range of securities, such as stocks, bonds, and mutual funds. Examples of brokerage firms include Fidelity and TD Ameritrade.

- 401(k): A 401(k) is a tax-advantaged retirement account that is commonly offered by employers as part of their benefits package. Mutual funds are usually the most common investment option for 401(k)s.

- Traditional Individual Retirement Account (IRA): If your employer doesn't offer a retirement savings plan, you can open a traditional IRA at most investment companies. IRAs offer a wider range of investment options compared to 401(k)s.

- Roth IRA: Roth IRAs are another type of retirement account that allows you to invest with after-tax dollars, meaning your contributions grow tax-free.

- Taxable brokerage account: These accounts lack the tax benefits of 401(k)s or IRAs but offer the advantage of being able to make withdrawals at any time without penalties.

- Education savings accounts: If you want to save for your children's college education, you can open a 529 college savings account and invest in mutual funds.

When choosing an investment account, consider factors such as your investment goals, time horizon, risk tolerance, and the fees associated with the account. Additionally, some accounts may have minimum investment requirements, so ensure you have enough funds to meet those requirements.

Private Equity Funds: Impact Investing Strategies Revealed

You may want to see also

Asset allocation

- Asset allocation refers to the mix of different asset classes, such as stocks, bonds, cash, and other investments, within your mutual fund portfolio. It is important because it determines the risk and return characteristics of your investments.

- The right asset allocation for you will depend on your investment goals, time horizon, and risk tolerance. For example, if you are investing for the long term, such as retirement, you may want to allocate a larger portion of your portfolio to stocks, which tend to provide higher returns over time but come with higher risk. On the other hand, if you are investing for the short term, you may want to allocate more to bonds or cash equivalents, which are generally less risky but provide lower returns.

- Diversification is an important principle in asset allocation. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the risk of losing money. Mutual funds themselves provide some level of diversification by pooling money from multiple investors to invest in a variety of securities. However, it is still important to diversify across different mutual funds to further reduce risk.

- It is important to regularly review and rebalance your asset allocation to ensure it remains aligned with your investment goals and risk tolerance. Over time, the performance of different assets within your portfolio may cause your allocation to shift. For example, if stocks have had a strong year, they may now make up a larger portion of your portfolio than you intended. To rebalance, you can sell some of your stock holdings and use the proceeds to buy more of the underweighted assets.

- Different types of mutual funds will have different asset allocation strategies. For example, growth funds typically invest mainly in stocks to maximize returns, while income funds may focus on bonds or dividend-paying stocks to provide a steady income stream. It is important to understand the asset allocation strategy of any mutual fund you are considering investing in to ensure it aligns with your goals and risk tolerance.

- When determining your asset allocation, it is important to consider not only the potential returns but also the level of risk you are comfortable with. Different asset classes come with different levels of risk. For example, stocks are generally considered riskier than bonds, and small-cap stocks are typically riskier than large-cap stocks. Your age and investment horizon can also impact the level of risk you are willing to take. Younger investors with a longer time horizon may be more comfortable taking on more risk in pursuit of higher returns.

The Mindset of Investment Fund Managers: Traits and Insights

You may want to see also

Investment strategy

When deciding what to invest in, it's important to first identify your goals and risk tolerance. Are you investing for the short-term or the long-term? Do you want to take on more risk for the potential of greater returns, or would you prefer a more conservative approach?

Once you have a clear understanding of your goals and risk tolerance, you can start researching different types of mutual funds. There are four main categories: stock, money market, bond, and target-date funds.

If you're investing for the long-term, consider stock mutual funds, which have the potential for higher returns but come with higher risk. If you're looking for a more balanced approach, consider a target-date fund, which automatically adjusts its risk profile over time. For a stable and consistent return, opt for a money market fund. And if you're looking to invest in bonds, there are various types of bond funds to choose from, each with its own risk profile.

When evaluating specific mutual funds to invest in, there are a few key factors to consider:

- Fees and expenses: Mutual funds charge various fees, such as expense ratios, sales charges, and redemption fees. These fees can eat into your returns over time, so it's important to understand them before investing.

- Past performance: While past performance doesn't guarantee future results, it can give you an idea of how the fund has performed relative to its peers or benchmark indices.

- Investment strategy: Decide if you want an actively managed fund, which aims to beat the market but comes with higher fees, or a passively managed fund (index fund), which aims to replicate the performance of a benchmark index and typically has lower fees.

- Fund provider: Choose a reputable fund provider, such as Vanguard or Fidelity, and consider the specific funds they offer that align with your goals and risk tolerance.

Remember, investing in mutual funds is a long-term strategy, so don't get too caught up in the short-term ups and downs of the market. Focus on your long-term goals and make sure to regularly review and rebalance your portfolio to ensure it still aligns with your risk tolerance and investment objectives.

Vanguard Windsor II: Uncovering its Security Strategy

You may want to see also

Frequently asked questions

There are several types of mutual funds, including stock, money market, bond, and target-date funds. Each of these funds has different investment profiles, risk levels, performance results, and fees.

Mutual funds offer diversification, professional management, and a variety of investment options. However, they also come with high fees, commissions, and other expenses that can eat into your returns.

When choosing a mutual fund, consider your investment goals, risk tolerance, and the fees associated with the fund. Compare the performance of the fund over the last three, five, and ten years, and check if it has outperformed the S&P 500.