Securing investment for a worker-owned cooperative business can be a challenging but rewarding endeavor. This unique business model, where employees collectively own and manage the company, often requires a different approach to funding compared to traditional businesses. This guide will explore various strategies and resources available to help you attract investors and secure the capital needed to launch or expand your worker-owned cooperative. From understanding the benefits of this business structure to identifying potential investors and crafting a compelling investment pitch, we'll provide practical insights to navigate the investment landscape and achieve your cooperative's financial goals.

What You'll Learn

- Business Plan: Craft a compelling business plan showcasing the cooperative's unique value and financial projections

- Funding Sources: Explore diverse funding options like grants, loans, and investor networks tailored to worker-owned cooperatives

- Community Support: Build a strong local network and leverage community resources to attract investors and gain support

- Employee Engagement: Foster a culture of ownership and involvement, demonstrating employee commitment and dedication to the cooperative's success

- Impact Investing: Highlight the social and environmental impact of the cooperative to attract impact-focused investors and investors seeking positive change

Business Plan: Craft a compelling business plan showcasing the cooperative's unique value and financial projections

Business Plan: Unlocking Investment for a Worker-Owned Cooperative

A well-crafted business plan is essential for attracting investors to your worker-owned cooperative. Here's a structured approach to creating a compelling narrative that highlights your cooperative's unique strengths and financial potential:

Executive Summary:

Begin with a concise executive summary that encapsulates the core of your cooperative's vision. Clearly articulate the problem your business aims to solve and the competitive advantage your worker-owned structure offers. Highlight the benefits of employee ownership, such as increased engagement, productivity, and long-term commitment. Provide a snapshot of your target market, industry trends, and your cooperative's unique value proposition. This section should leave investors eager to delve deeper into your plan.

Market Analysis:

Conduct a thorough market analysis to demonstrate your understanding of the industry and target audience. Identify your target market segment and analyze its size, growth potential, and demographics. Research competitors and highlight any gaps or opportunities your cooperative can capitalize on. Emphasize how your worker-owned structure enables you to offer innovative solutions or superior customer service that sets you apart. Provide concrete examples of market research or customer feedback that supports your claims.

Business Model and Operations:

Dive into the specifics of your cooperative's business model. Explain how you will generate revenue, manage costs, and achieve profitability. Detail your production or service delivery processes, including any unique operational strategies that contribute to your competitive edge. Describe the roles and responsibilities of your worker-owned structure, emphasizing the involvement and empowerment of employees in decision-making processes. Outline your plans for recruitment, training, and retention of talented individuals who align with your cooperative's values.

Financial Projections:

This section is critical for convincing investors of your cooperative's financial viability. Present clear and realistic financial projections, including income statements, balance sheets, and cash flow statements for the next 3-5 years. Explain the assumptions behind your projections, such as sales growth rates, cost structures, and pricing strategies. Provide a detailed breakdown of startup costs, including initial investments required for equipment, infrastructure, and working capital. Showcase your understanding of financial metrics relevant to your industry, such as return on investment (ROI) and break-even analysis.

Investment Opportunity and Use of Funds:

Clearly articulate how the investment will be utilized to propel your cooperative's growth. Explain the specific areas where the funds will be allocated, such as expanding operations, marketing initiatives, or technology upgrades. Highlight the potential return on investment for both the cooperative and its investors. Discuss the ownership structure and the distribution of profits among employees, demonstrating how the cooperative's success is directly linked to the dedication and performance of its workforce.

Exit Strategy and Risk Mitigation:

Address potential investor concerns by outlining a realistic exit strategy. Explain how investors can expect to recoup their investments and the timeline for potential exits. Additionally, identify and mitigate risks associated with your cooperative's operations. This demonstrates your foresight and ability to navigate challenges.

Remember, a successful business plan should be concise, well-organized, and backed by thorough research and data. By presenting a compelling narrative that highlights the unique value of your worker-owned cooperative and its financial potential, you increase your chances of attracting the necessary investment to bring your vision to fruition.

Federal Retirement Thrift Investment Board: Managing the TSP

You may want to see also

Funding Sources: Explore diverse funding options like grants, loans, and investor networks tailored to worker-owned cooperatives

When seeking investment for a worker-owned cooperative business, it's essential to understand the unique nature of these enterprises and tailor your funding strategies accordingly. Worker-owned cooperatives, by design, prioritize the interests of their employees and the community over traditional profit-driven motives. This distinct approach often attracts impact investors and those seeking social and environmental returns. Here's a breakdown of various funding sources to consider:

Grants and Government Funding:

Many governments and public organizations offer grants and financial assistance to support cooperative businesses. These grants often aim to promote economic democracy, local job creation, and community development. Research and apply for grants from government agencies, economic development funds, or social impact investors. For instance, the US Department of Agriculture (USDA) provides loans and grants to support agricultural cooperatives, while the National Cooperative Business Association (NCBA) offers various resources and funding opportunities for cooperatives across industries.

Community Investment and Crowdfunding:

Engage with your local community to tap into alternative funding sources. Community investment platforms and crowdfunding websites can be powerful tools to raise capital from individuals who align with your cooperative's values. Crowdfunding campaigns not only provide financial support but also help build a community around your business. Websites like Kickstarter or Indiegogo can be utilized to showcase your cooperative's mission and goals, attracting investors who believe in your cause.

Cooperative-Specific Investors and Networks:

Connect with investor networks and organizations dedicated to supporting worker-owned cooperatives. These networks often provide not only financial resources but also mentorship, strategic guidance, and access to a like-minded community. For example, the Cooperative Development Institute (CDI) offers various resources, including technical assistance and funding opportunities, to help cooperatives establish and grow. Similarly, the National Cooperative Business Association (NCBA) provides a platform for cooperatives to connect with investors and access capital.

Loans and Credit Unions:

Traditional lending institutions, such as credit unions, can be a valuable source of funding for worker-owned cooperatives. These institutions often have a more flexible approach to lending and may prioritize the social impact of your business. They might offer loans, lines of credit, or even cooperative-specific financial products. Building a relationship with local credit unions and explaining the unique nature of your cooperative can increase your chances of securing favorable loan terms.

Impact Investors and Social Venture Capital:

Impact investors are increasingly interested in supporting businesses that create positive social and environmental outcomes. These investors seek to generate financial returns while contributing to meaningful change. Tailor your business plan and pitch to highlight how your worker-owned cooperative addresses social or environmental challenges. Networks like the Global Impact Investing Network or the Social Venture Network can connect you with potential investors who align with your cooperative's mission.

Classic Cars: Passion or Profit?

You may want to see also

Community Support: Build a strong local network and leverage community resources to attract investors and gain support

To secure investments for your worker-owned cooperative business, building a robust local network and leveraging community resources are essential strategies. This approach not only helps attract investors but also fosters a sense of community support, which is invaluable for the long-term success of your cooperative. Here's a detailed guide on how to achieve this:

Engage with Local Communities: Start by identifying and actively engaging with local communities that align with your cooperative's values and mission. These could include local businesses, non-profit organizations, trade unions, or community centers. Attend local events, join relevant online forums and groups, and participate in community meetings. By becoming an active member of these communities, you increase your visibility and establish your cooperative as a valuable asset to the local ecosystem. For example, if your cooperative is focused on environmental sustainability, engage with local environmental groups and initiatives, offering your services or resources to support their projects.

Network and Build Relationships: Networking is crucial in building a strong local network. Attend local business conferences, workshops, and networking events where you can meet potential investors, partners, and community leaders. Introduce yourself and your cooperative to these individuals, highlighting the unique benefits of a worker-owned cooperative model. Share success stories and case studies of similar cooperatives that have thrived with community support. Building relationships takes time, so be consistent in your efforts and follow up with people you meet. Offer to collaborate on projects or provide resources that can benefit the community, and they will likely return the favor.

Leverage Local Resources: Local resources can provide significant support for your cooperative. Approach local governments, foundations, and grant-making organizations to seek financial assistance or grants. Many governments and foundations have initiatives to support cooperative businesses and community development. They often provide funding, resources, or tax incentives to encourage such ventures. Additionally, local universities, colleges, and vocational training centers can be valuable partners. They may offer internships, apprenticeships, or training programs for your cooperative's workers, ensuring a skilled workforce. Local media outlets can also be powerful allies; they can help spread the word about your cooperative, attracting more investors and customers.

Organize Community Events: Hosting community events is an excellent way to engage and involve local residents. Organize workshops, seminars, or information sessions to educate the community about worker-owned cooperatives and their benefits. These events can also serve as a platform to showcase your cooperative's products or services. For instance, a local food cooperative could host a cooking workshop using their produce, engaging the community and generating interest. Such events create a sense of ownership and pride in the community, making them more inclined to support your cooperative's investment needs.

Offer Incentives and Partnerships: To attract investors, consider offering incentives such as equity shares or profit-sharing arrangements for community members who contribute to the cooperative's success. This not only builds a sense of community ownership but also provides a financial incentive. Additionally, forming strategic partnerships with local businesses or organizations can help expand your reach and resources. For example, partnering with a local credit union to provide financial services or with a marketing agency to promote your cooperative's brand can be mutually beneficial.

By implementing these strategies, you can create a strong local network and leverage community resources to attract investors and gain support for your worker-owned cooperative business. This approach not only secures financial investments but also fosters a sense of community engagement and ownership, which is crucial for the long-term sustainability and success of your cooperative.

Unraveling the Secrets: How Predictive Investment Strategies Work

You may want to see also

Employee Engagement: Foster a culture of ownership and involvement, demonstrating employee commitment and dedication to the cooperative's success

Employee engagement is a critical aspect of any successful cooperative business, especially when seeking investment. A worker-owned cooperative thrives on the collective effort and commitment of its employees, and fostering a culture of ownership and involvement is key to attracting investors and ensuring long-term success. Here's a strategy to achieve this:

Involve Employees in Decision-Making: One of the most powerful ways to engage employees is by giving them a voice in the company's direction. Set up regular meetings or forums where employees can discuss business strategies, goals, and potential challenges. Encourage open communication and ensure that every team member feels valued and heard. For instance, you could implement a system where employees vote on key decisions, such as choosing new projects, setting budgets, or selecting suppliers. This democratic approach empowers workers and demonstrates their active participation in the cooperative's growth.

Provide Training and Development Opportunities: Invest in your employees' professional growth. Offer training programs, workshops, or mentorship schemes to enhance their skills and knowledge. When employees feel that the cooperative is committed to their development, they are more likely to be engaged and dedicated to the organization's success. Additionally, providing opportunities for career advancement within the cooperative can boost morale and create a sense of loyalty.

Encourage Participation in Social Activities: Building a strong sense of community within the cooperative is essential. Organize social events, team-building activities, and community initiatives that bring employees together. These activities foster camaraderie, improve communication, and create a supportive work environment. For example, you could start a monthly social hour where employees can relax, share ideas, and build relationships. This not only enhances employee engagement but also creates a positive image of the cooperative as a great place to work.

Recognize and Reward Achievements: Implement a recognition system to acknowledge and reward employees for their hard work and achievements. This can be in the form of public appreciation, incentives, or even small perks. When employees feel appreciated, they are more likely to be motivated and committed. For instance, you could create a 'Worker of the Month' program or provide bonuses based on individual or team performance.

Promote a Healthy Work-Life Balance: A happy and healthy workforce is essential for long-term success. Encourage employees to maintain a balanced lifestyle by offering flexible work arrangements, promoting physical and mental well-being, and ensuring reasonable working hours. Employees who feel their personal lives are respected and supported are more likely to be engaged and productive.

By implementing these strategies, you can create a culture of ownership and involvement, where employees are actively committed to the cooperative's success. This level of engagement will not only attract investors but also ensure the long-term sustainability and growth of your worker-owned cooperative business.

The Ultimate Guide to Designing and Procuring Investment Castings

You may want to see also

Impact Investing: Highlight the social and environmental impact of the cooperative to attract impact-focused investors and investors seeking positive change

When seeking investment for a worker-owned cooperative business, it's crucial to emphasize the social and environmental impact of the cooperative to attract impact-focused investors and those seeking positive change. Here's how you can effectively communicate this:

Showcase Community Engagement: Worker-owned cooperatives often thrive in close-knit communities. Highlight how the cooperative actively engages with local residents, businesses, and organizations. For instance, demonstrate how the cooperative supports local initiatives, sponsors community events, or provides employment opportunities to community members. This not only strengthens the cooperative's ties with the community but also showcases its commitment to social responsibility.

Environmental Sustainability: Impact investors are increasingly interested in businesses that prioritize environmental sustainability. Emphasize the cooperative's efforts to minimize its environmental footprint. This could include implementing energy-efficient practices, reducing waste, using eco-friendly materials, or adopting renewable energy sources. Provide data and certifications that validate these initiatives, such as energy audits, waste management reports, or sustainability awards.

Social Impact Measurement: Investors appreciate transparency and measurable outcomes. Develop key performance indicators (KPIs) to track the social impact of the cooperative. For example, measure the number of jobs created, the percentage of employees from underrepresented backgrounds, or the reduction in carbon emissions. Present these metrics in a clear and concise manner, demonstrating the positive change the cooperative brings to its community and the environment.

Long-Term Sustainability and Resilience: Impact investors often seek businesses with a strong foundation for long-term success. Explain how the worker-owned cooperative model ensures stability and resilience. Describe the cooperative's decision-making processes, member involvement, and the benefits of shared ownership. By showcasing the cooperative's ability to adapt and thrive, you can attract investors who value sustainable and resilient business practices.

Storytelling and Case Studies: Impact investing is not just about numbers; it's also about the story behind the investment. Share case studies or success stories that illustrate the positive impact of the cooperative. For instance, feature stories of employees who have benefited from the cooperative's model, or highlight how the cooperative has addressed social or environmental challenges in the community. This narrative approach will make the cooperative's mission more relatable and compelling to potential investors.

By emphasizing these aspects, you can effectively communicate the value proposition of your worker-owned cooperative to impact-focused investors, attracting those who seek to make a positive difference through their investments.

The Great Debate: Flipping vs. Buy and Hold – Which Strategy Wins?

You may want to see also

Frequently asked questions

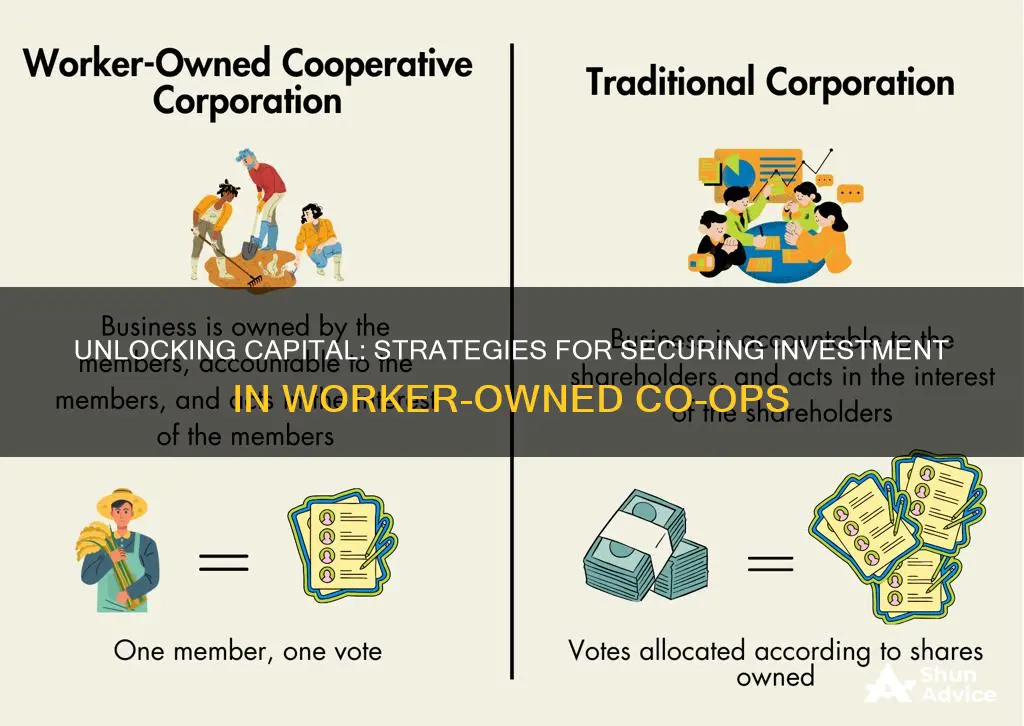

A worker-owned cooperative is an enterprise where the workers are also the owners, sharing the profits and decision-making. This business model promotes employee engagement, job satisfaction, and long-term sustainability. Investment is crucial for a worker-owned cooperative to secure capital for initial setup, expansion, or overcoming financial challenges, ensuring the business can thrive and provide for its members.

Building a strong business plan is essential. Highlight the cooperative's unique value proposition, such as increased worker retention, community impact, and shared decision-making. Investors are often attracted to the social and environmental benefits of cooperatives. Network with local investors, angel investors, and venture capitalists who support impact-driven businesses. Demonstrate the cooperative's potential for financial returns and its commitment to employee welfare.

Yes, there are dedicated funding options for cooperatives. Many governments and financial institutions offer grants, low-interest loans, and tax incentives to support worker-owned businesses. These programs recognize the social impact and long-term benefits of cooperatives. Additionally, cooperative-specific investors and funds are available, focusing on providing capital to worker-owned enterprises. Research and apply for these specialized funding sources to secure investment.

Involve workers in the investment process by explaining the benefits of ownership and the impact of their investment. Foster a culture of shared responsibility and engagement through regular meetings and feedback sessions. Provide training and support to help workers develop the skills needed to manage the business effectively. Regularly review and adapt the business strategy based on worker input and market demands to ensure the cooperative's long-term success and sustainability.