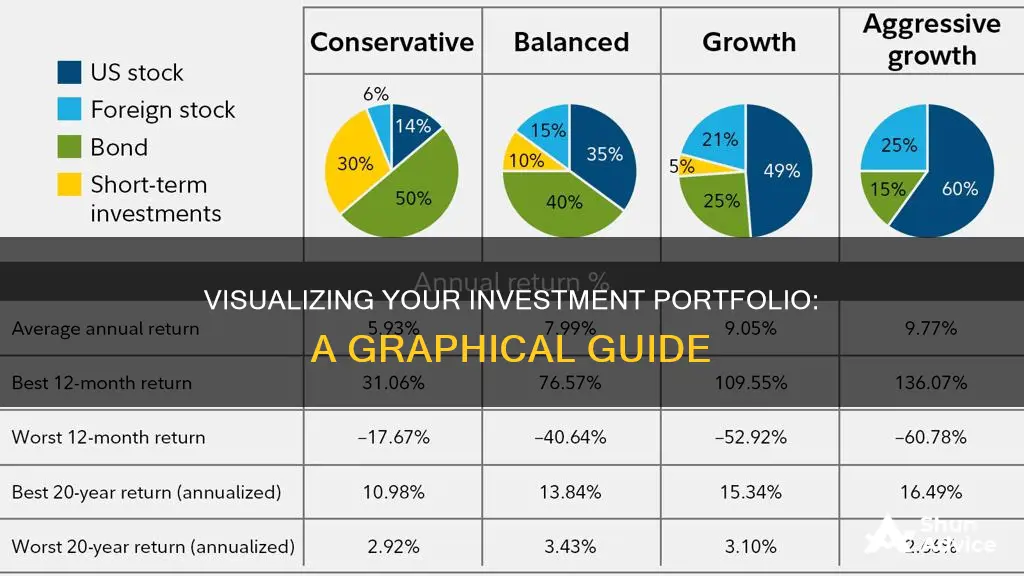

Visualising your investment portfolio is a great way to gain a deeper understanding of your investments and make more informed decisions. By using charts and graphs, you can track changes in your portfolio's value, identify trends and compare your portfolio's performance against benchmarks. This allows you to see the bigger picture and make adjustments to optimise your investment strategy. There are many tools and apps available to help you visualise your portfolio, such as Portfolio Charts, Portfolio Visualizer, StockCharts.com, and Spreadsheet.com. These platforms offer features like intuitive charts, real-time data, performance tracking, and portfolio analysis to help you make the most of your investments.

| Characteristics | Values |

|---|---|

| Purpose | To help investors achieve their financial goals and make informed decisions about their investments. |

| Data Visualization Tools | Line charts, stacked area charts, unique charts, ChartLists, SharpCharts, etc. |

| Data Sources | Historical data, real-world examples, intuitive charts, real-time data, etc. |

| Data Analysis | Backtesting, risk analysis, performance tracking, diversification analysis, etc. |

| Features | Free or low-cost, unbiased, ad-free, user-friendly, customizable, real-time alerts, etc. |

| Benefits | Improved decision-making, better understanding of investments, time and energy savings, increased financial success, etc. |

What You'll Learn

Using charts to visualise changes in your portfolio over time

Choose the Right Tools

Select a platform that offers a variety of chart types and customisation options. For example, Spreadsheet.com supports more than a dozen different types of charts, including line charts and stacked area charts, which can be useful for visualising portfolio changes over time. Portfolio Visualizer is another powerful tool that offers portfolio analysis and reporting, enabling you to turn complex data into actionable insights.

Track Your Portfolio

Start by creating a chart for your portfolio. You can do this manually by entering data into a spreadsheet or using a platform that syncs with your investment accounts. Basic information to include is the date on the x-axis and the total portfolio value on the y-axis. You can also break this down by individual investments to see how each contributes to the overall value.

Compare Different Metrics

Visualising different metrics side by side can provide valuable insights. For example, you can compare the total value of your portfolio with the daily closing price of each stock. This will help you identify if the overall value is increasing due to changing the composition of stocks, as opposed to the performance of individual stocks.

Monitor Composition Changes

Use stacked area charts to visualise the composition of your portfolio over time. This type of chart can show you the total number of shares in your portfolio and how the distribution of shares across different stocks has changed. By comparing stacked area charts over time, you can identify when you bought or sold certain holdings.

Analyse Performance

In addition to visualising your portfolio's composition, charts can help you analyse its performance. For example, you can use charts to track the price and performance of your investments over time, monitoring how they compare to various benchmarks, such as the S&P 500. This can help you identify top-performing investments and underperforming ones.

Stay Informed with Reports

Consider setting up daily or weekly reports to monitor your portfolio's performance. Many platforms offer email summaries that provide a performance update, news that impacts your portfolio, and alerts about your top-performing and underperforming investments. These reports can help you stay informed and make timely investment decisions.

Maximizing Cash Savings: Best Investment Options for You

You may want to see also

Tracking your portfolio with mobile apps

There are several mobile apps that can help you track your investment portfolio. These apps offer a range of features, from real-time information on your investments to retirement planning tools. Here are some of the most popular and highly-rated apps:

Empower (Formerly Personal Capital)

Empower is a comprehensive wealth management app that offers a range of tools and calculators to help with everything from net worth tracking to retirement planning. The app can track performance, asset allocation, and fees with easy-to-read graphs and charts. It also has an Investment Checkup feature that allows users to track investments by account, asset class, or individual security. Empower offers a free version and a fee-based wealth management service.

SigFig Wealth Management

SigFig is another popular app that allows users to track their investment accounts in one place. The free version of the app provides a real-time view of stocks, mutual funds, and exchange-traded funds (ETFs). It also offers weekly email summaries, news alerts, and a Portfolio Tracker to analyze hidden fees and overexposure to a particular stock or sector. SigFig also has a fee-based version that allows users to create a personalized plan.

Sharesight

Sharesight is a portfolio tracking app that can monitor the performance of investments using data from 60 stock exchanges. It can track the price and performance of stocks, ETFs, and mutual funds globally, as well as cryptocurrencies, real estate, private equity, and fixed-income investments. Sharesight offers a free version for up to ten holdings and fee-based plans with additional reporting features.

Yahoo Finance

The Yahoo Finance app offers an easy-to-use platform to track stocks, commodities, bonds, and currencies. It allows users to create and track the performance of their personal portfolios and sync multiple portfolios across devices. The app provides real-time stock information, personalized alerts, and full-screen interactive charting. It also offers access to business news, press releases, and financial information.

Simplifi by Quicken

Simplifi is a budgeting and personal finance app that allows users to link their financial accounts, including investment accounts such as IRAs, 401(k)s, and brokerage accounts. It provides a holistic view of your financial situation and offers guidance and suggestions. Simplifi has a subscription fee, but there is a one-month free trial available.

Ziggma

Ziggma is a platform designed for active investors, offering a unique dashboard, alerts, and a portfolio simulator. The dashboard provides information on portfolio yield, stock analysis, risk metrics, and fundamental stock metrics. Users can customize alerts to notify them when their investments are poorly positioned based on risk, diversification, or fundamentals. Ziggma offers a free version for a single portfolio and a premium version for multiple portfolios.

Adjusting Your Acorns Investment Portfolio: A Quick Guide

You may want to see also

Using spreadsheets to visualise your stock portfolio

Spreadsheets are a great way to visualise your stock portfolio and monitor your investments. You can use Google Sheets or Excel to build a custom spreadsheet that allows you to see the information that matters most to you. With spreadsheets, you can make a portfolio analysis tool that is tailored to your needs and preferences.

To get started, enter your headers. Determine what information you want to see and enter the relevant headers along the top of your spreadsheet. For example, you might want to include total dividends received, total gain or loss in dollars, total gain or loss percentage, and annualised gain or loss.

Next, input your basic stock data. This includes information such as the name, symbol, purchase date, purchase price, and number of shares. This information should already be known to you.

Then, it's time for some formulas! You can calculate the purchase cost by multiplying the purchase price by the number of shares. This can be done in Google Sheets or Excel by typing "=E6*F6" into the relevant cell.

You can also use the GOOGLEFINANCE function in Google Sheets to automatically update certain fields such as price, volume, PE, and EPS. For example, typing "=GOOGLEFINANCE(C6,"price") into a cell will populate the current price of the stock.

Once you have your data and formulas in place, you can start creating charts to visualise your portfolio. In Google Sheets, simply highlight the data you want to chart and select "Chart" from the "Insert" menu. You can create different types of charts, such as column charts or pie charts, to compare annualised gain/loss among your stocks or show the composition of your portfolio.

By using spreadsheets and charts, you can gain new insights into your stock portfolio and make more informed investment decisions.

Diversifying Taxable Investment Portfolios: Strategies for Long-Term Success

You may want to see also

Creating a ChartList to track your portfolio

To create a new ChartList, go to Your Dashboard and look for the "Your ChartLists" panel. You will see a button in the upper right corner that says "New", or you can find the "Add New List" button below the ChartList table. After naming your new list, you can add new charts, remove unwanted ones, and edit the list's settings.

Each symbol you add to your ChartList will be saved as a chart with your default ChartStyle. You can add symbols one by one or multiple at a time. If you add them one by one, scroll down to the "Add Charts to List" section of the Edit View page, select the "One" tab, enter the ticker symbol, and click "Add Chart". If you want to add multiple symbols at once, click on the "Many" tab in the same section, enter a list of ticker symbols separated by commas, and click "Add Charts".

Once you've added symbols to your ChartList, you can view them in several ways, including 10 Per Page view, CandleGlance, GalleryView, and Summary View. You can also turn on daily and/or weekly "ChartList Reports", which will automatically email you a performance summary for all the stocks, funds, indexes, or other securities saved in that ChartList.

In addition to your custom-built ChartLists, StockCharts also offers ChartPacks – pre-created ChartLists that you can install into your account with just a couple of clicks. For example, the "Market in a Nutshell" ChartPack contains 160 general-purpose charts stored inside 4 ChartLists.

Investment and Savings: Synonymous Expressions for Financial Equality

You may want to see also

Understanding the key features of a portfolio tracker

Portfolio trackers are tools or software that help investors monitor and manage their investments across various asset classes such as stocks, bonds, mutual funds, and ETFs, among others. They provide a consolidated view of all investment holdings, allowing investors to see their entire portfolio in one place. Here are some key features to look for in a portfolio tracker:

- Investment account aggregation: The ability to link and aggregate data from multiple investment accounts is crucial for effective portfolio tracking. Look for a tracker that can handle different asset classes and currencies flawlessly.

- Portfolio-level analytics: Smart portfolio analytics and relevant insights are essential. Choose a tracker that enables you to monitor performance and make adjustments as needed. It should also provide a dashboard with key performance indicators such as overall portfolio quality, yield, risk, and income.

- Performance tracking: Track performance at both the portfolio and individual stock levels. This helps gauge the effectiveness of your investment strategy and enables informed decision-making.

- Stock research tools: As stocks are the dominant asset class in most portfolios, look for a tracker that offers high-quality stock research tools and data. This includes financial information for fundamental analysis, well-designed stock ratings, and a powerful screener with a great user experience.

- Portfolio monitoring tools: Automate the monitoring of relevant parameters such as risk, diversification, and portfolio quality. Look for features like alerts and notifications that keep you updated without constant manual checking.

- Dividend tracking: A dividend tracker helps monitor and manage dividend income from various investments. It keeps track of dividend payouts, amounts, and changes, helping with income management and tax reporting.

- Real-time data and monitoring: Syncing all your investment accounts and accessing real-time data is critical. Look for a user-friendly dashboard that provides up-to-date information and enables you to make informed decisions.

- Retirement planning: A retirement planner tool that incorporates your 401(k) and IRAs can be valuable. It helps you determine if you're meeting your savings and retirement goals and create a spending plan accordingly.

- Fee monitoring: A portfolio tracker should help you avoid unnecessary fees. Look for features that monitor brokerage and mutual fund fees, as well as provide information on cost-effective investment options.

- Customization: The ability to customize your portfolio monitoring experience is important. This includes customizing alerts, watchlists, and the dashboard to suit your specific needs and preferences.

- Security: Finally, ensure that the portfolio tracker prioritizes security. Features like two-step remote authentication and data encryption are essential to protect your financial information.

Invest Wisely for Your Grandchild's Future: A Guide

You may want to see also

Frequently asked questions

There are several mobile investment apps that offer real-time information on all your investments in one place. Empower (formerly Personal Capital), SigFig Wealth Management, Sharesight, and Yahoo Finance are some of the most popular apps. These apps can sync data from financial accounts, measure performance against a benchmark, and offer retirement tracking and planning.

Some key features to look for in a portfolio tracker app include a free version of the app, the ability to sync all your financial accounts, a retirement planning tool, asset allocation monitoring, and the ability to compare your portfolio's return against a benchmark index.

You can create charts to track your portfolio by using a platform such as StockCharts.com or Spreadsheet.com. These platforms allow you to create charts and graphs to visualize your portfolio's performance and gain new insights. You can track the stocks and funds in your portfolio, review the market, and manage your investments more efficiently.