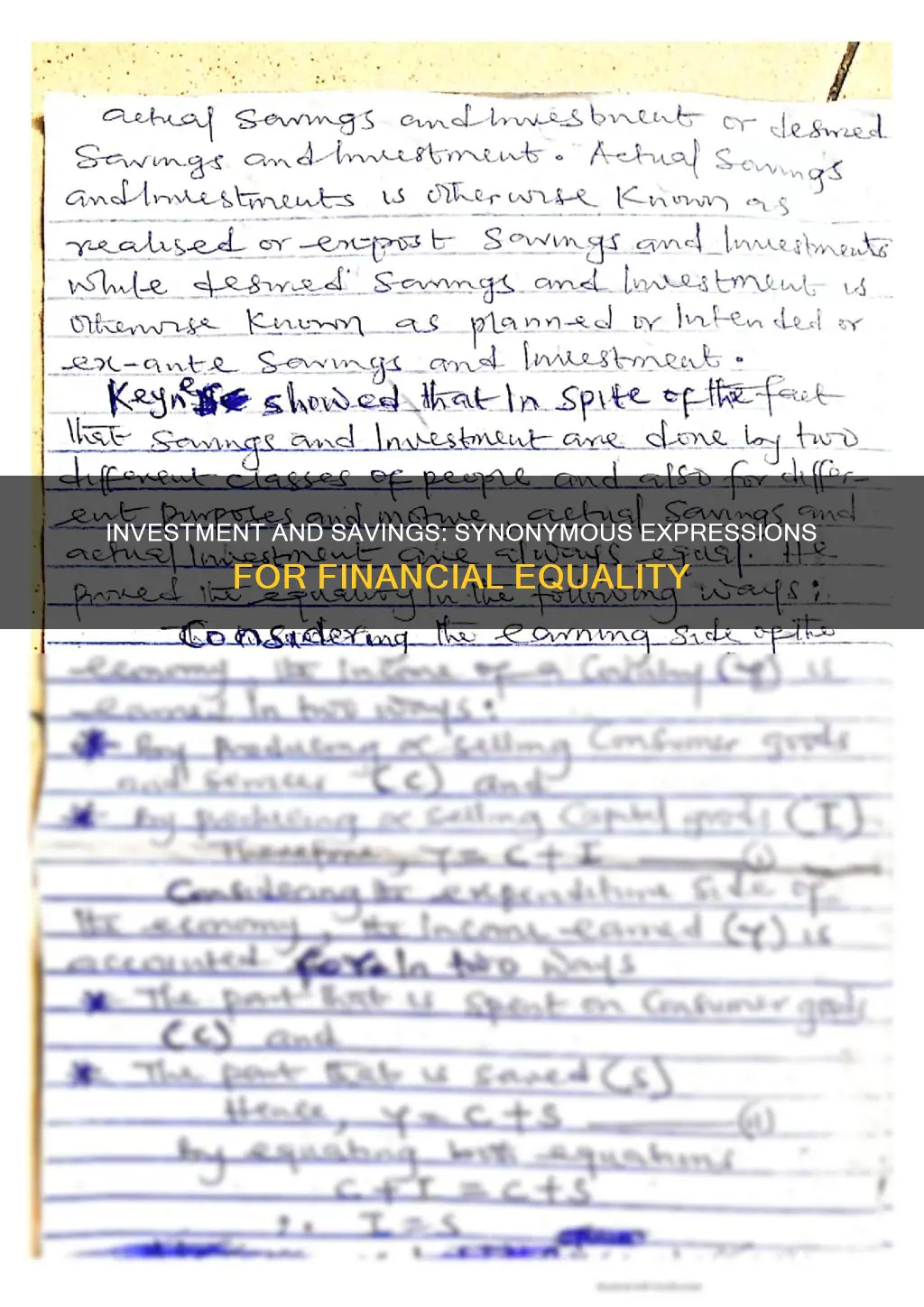

Understanding the difference between investing and saving is crucial for making informed decisions about your finances. Investing and saving have distinct objectives, with investing focusing on generating returns and saving aiming for long-term capital accumulation. To achieve financial stability and prosperity, a careful balance between investing and saving is necessary. The expressions that exemplify the investment-saving equality are investment equals savings and net investment equals net savings. These expressions highlight the relationship between the rate of return on investments and inflation, influencing the equilibrium between investing and saving over time.

| Characteristics | Values |

|---|---|

| Expression | "investment equals savings" |

| "net investment equals net savings" | |

| Requirement for equality | The rate of return on investments must be greater than the rate of inflation |

What You'll Learn

Investing vs Saving

Saving and investing are both important components of a healthy financial plan. However, they serve different purposes and come with their own sets of pros and cons. So, what exactly is the difference between saving and investing, and when should you choose one over the other?

Saving

Saving refers to putting money aside gradually, typically into a bank account, with the goal of using it for short-term financial objectives or unexpected situations. For example, saving can be used for purchasing a new gadget or going on vacation. It can also serve as an emergency fund for car repairs or medical bills. Savings accounts generally offer low returns but also come with low risk, making them ideal for individuals who need access to their money in the near future and cannot afford to lose any of it. One of the benefits of saving is that it provides a financial safety net and liquidity for short-term goals. Additionally, savings held in banks are usually protected by the Federal Deposit Insurance Corporation (FDIC), ensuring the safety of your funds. However, a potential drawback of saving is missing out on the higher returns that could be achieved through riskier investments. Savings may also lose purchasing power during periods of high inflation.

Investing

Investing, on the other hand, involves using your money to buy assets that are expected to increase in value over time, such as stocks, property, or shares in a mutual fund. Investing is typically associated with a longer-term horizon and is commonly used for achieving long-term financial goals, such as saving for a child's education or planning for retirement. Unlike saving, investing comes with a certain level of risk. There is always the possibility of losing money, and it may take longer to access your funds depending on the type of investment. However, investing offers the potential for higher returns than traditional savings accounts. For instance, investing in stocks allows you to own a small piece of a company and benefit from its growth and profits. By diversifying your portfolio and choosing investments that align with your goals, risk tolerance, and time horizon, you can potentially earn significant returns. Additionally, certain investment options, like a 401(k) retirement plan, offer tax benefits that further enhance the attractiveness of investing.

When to Save vs. Invest

The decision to save or invest depends on various factors, including your financial situation, goals, and risk tolerance. It is generally recommended to build an emergency fund and save for short-term goals before considering investing. Having three to six months' worth of living expenses set aside in a savings account can provide financial security and peace of mind. Additionally, if you have specific short-term goals, such as purchasing a new phone or laptop, saving is usually the more suitable option. On the other hand, if you are looking to achieve long-term financial objectives and are willing to take on some risk, investing may be the right choice. Starting early with investing can give you a significant advantage in building wealth over time, as it allows you to take advantage of the power of compounding returns. However, it is important to remember that investing requires discipline and a long-term perspective to navigate market volatility and avoid making impulsive decisions.

S-Corp Savings: Investing for Growth and Security

You may want to see also

Investment and Savings Equality Expressions

Understanding the difference between investing and saving is crucial for making informed decisions about your finances. Investing and saving are both important components of a financial plan, but they have distinct goals. Investing involves putting money into assets such as stocks, bonds, or real estate, with the expectation of generating a return. On the other hand, saving involves purchasing items with long-term value, like certificates of deposit or savings accounts, to accumulate capital over time.

While investing and saving have different purposes, achieving equality between the two is essential for financial stability and prosperity. This equality is represented by the expressions "investment equals savings" and "net investment equals net savings". These expressions highlight the balance between investing and saving, where the rate of return on investments must exceed the rate of inflation to maintain equality with savings.

For example, consider the expression "investment equals savings". If you invest $100 and save $105, your total balance after one year will be $105. In this scenario, the investment and savings equality is maintained. However, over time, as the rate of return on investments may fall below inflation, the balance will shift in favour of savings. Therefore, periodically evaluating and adjusting your financial plan is crucial to maintain investment-saving equality.

Another expression that reflects investment-saving equality is "net investment equals net savings". This expression considers the impact of inflation and government policies on your finances. Inflation erodes the value of money over time, affecting both savings and investments. Additionally, government spending, revenue, and debt influence the overall economic landscape, impacting interest rates and investment opportunities. Understanding these factors is essential for making informed decisions to maintain investment-saving equality.

Saving Plans: The Benefits of a Conservative Financial Strategy

You may want to see also

Public Savings

The relationship between public savings and investment equality is intricate and subject to various economic factors. For instance, an increase in public savings can lead to a reduction in the trade deficit, as the country relies less on foreign capital. Conversely, if the government borrows extensively, the trade deficit may rise, attracting more investment from abroad to maintain equality.

It's important to note that the dynamics of public savings and investment equality are interconnected with other economic variables, such as private savings, domestic investment, and the overall health of the economy. Changes in these variables can have ripple effects on the trade balance and capital flows. Therefore, understanding the behaviour of public savings in isolation may not provide a comprehensive view of the economy.

In conclusion, public savings play a pivotal role in a country's economic landscape, influencing the balance of trade and investment equality. The intricate relationship between public savings, private savings, and investment demands is a key aspect of macroeconomic analysis, and it underscores the complexity of managing a country's financial health.

How Interest Rates Affect Savings and Investments

You may want to see also

National Savings and Investment Identity

The national savings and investment identity is a macroeconomic concept that highlights the relationship between a country's savings and investments. It states that the supply of financial capital in an economy must equal the demand for financial capital. This relationship can be expressed as an equation:

Supply of Financial Capital = Demand for Financial Capital

S + (M - X) = I + (G - T)

In this equation, S represents private savings (by households and companies), M is imports, X is exports, I is investment, G is government spending, and T is taxes.

The national savings and investment identity provides a framework for understanding the flow of financial capital within an economy. It shows that a country's total savings comprise domestic household savings, domestic business savings, and government savings. If a country runs a trade deficit, it indicates that money is flowing into the country from abroad, contributing to the supply of financial capital. On the other hand, if a country has a trade surplus, it suggests that there is an outflow of financial capital to other countries.

The demand for financial capital represents the groups that are borrowing money. Businesses borrow to finance investments in factories, materials, and personnel, while the government borrows by selling treasury bonds when its spending exceeds tax revenues.

The national savings and investment identity is a useful tool for understanding the determinants of a country's trade and current account balance. It reveals that a nation's balance of trade is influenced by its levels of domestic savings and domestic investment. By rearranging the identity, we can express the relationship between these factors:

Trade Deficit = Domestic Investment - Private Domestic Savings - Government Savings

M - X = I - S - (T - G)

This equation demonstrates that when domestic investment exceeds domestic savings, including both private and government savings, the difference must be made up by capital flowing into the country from abroad, resulting in a trade deficit. Conversely, when domestic savings exceed domestic investment, the excess financial capital is invested in other countries, leading to a trade surplus.

The national savings and investment identity also provides insights into the impact of changes in savings and investment on a country's trade balance. For instance, an increase in domestic investment while keeping savings constant will lead to a higher trade deficit, as the additional financial capital for investment will need to come from abroad. On the other hand, an increase in domestic savings with constant investment will reduce the trade deficit as the country relies less on foreign capital.

In summary, the national savings and investment identity highlights the equality between the supply of and demand for financial capital in an economy. It provides a framework for understanding the interplay between savings, investments, and trade balances, offering valuable insights into the economic health and capital flows of a nation.

How to Make Your Savings Work for You

You may want to see also

Investment Tools

When it comes to investing, there is no one-size-fits-all approach. The investment tools and strategies that are suitable depend on the time horizon of your financial goals. Here are some investment tools tailored to short-term, intermediate-term, and long-term goals:

Short-Term Goals (generally less than five years)

Short-term goals typically involve amounts of money that can be saved relatively quickly. These goals could include saving for a vacation, a down payment on a car, home improvements, or purchasing a new appliance. When investing for the short term, it's crucial to prioritise principle preservation by choosing less risky investments. Some investment tools for short-term goals include:

- Cash Management Accounts: These accounts combine features of checking and savings accounts, offering benefits such as competitive interest rates and minimal to no fees. They are usually offered by non-bank financial institutions.

- Money Market Mutual Funds: Unlike traditional money market accounts, these are baskets of investments that hold your money in high-quality, short-term debt instruments, cash, and cash equivalents. However, they are not insured by the FDIC.

- Certificates of Deposit (CDs): CDs are short-term investments, ranging from a few months to several years. They offer a guaranteed return when the CD matures. An investor can have multiple CDs with staggered maturation schedules to ensure regular access to cash.

- High-Yield Savings Accounts: Online savings accounts can offer significantly higher interest rates than traditional banks, providing APYs of up to 3.75% or more.

- Short-Term Bond Funds: These funds offer slightly higher risk and return compared to bank deposits. They are available as exchange-traded funds (ETFs) or mutual funds and provide diversified investments in high-quality, investment-grade corporate and government bonds.

Intermediate-Term Goals

Intermediate-term goals involve building an emergency fund or saving for goals that are a few years away. While you want your money to grow, you also need to be able to access it when necessary. Some investment tools for intermediate-term goals include:

- Cash and Short-to-Intermediate-Term Investments: A mix of cash and short-term investments can help you build an emergency fund or rainy day fund.

- Certificates of Deposit: CDs can be used for intermediate-term goals by choosing longer maturation periods of several years.

- Bond Funds: Bond funds, particularly those with high-quality bonds, can provide monthly income and are suitable for intermediate-term goals.

- Diversified Index Fund Portfolio: For intermediate-term goals, you can consider adding stock index funds to your portfolio for enhanced returns. While stocks come with the risk of negative returns, they can provide solid long-term returns if you have a few years to weather potential downturns.

Long-Term Goals (typically ten or more years)

Long-term goals usually have a time horizon of ten or more years and involve substantial milestones like retirement or saving for a child's education. With a longer time horizon, you can focus on growth and take on more risk. Here are some investment tools for long-term goals:

- Individual Stocks: Individual stocks can be powerful long-term investments, offering the potential for steady growth in value and dividends.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds and are baskets of investment securities. They typically track a particular index, sector, commodity, or asset and can be traded on stock exchanges.

- Tax-Advantaged Retirement Accounts: These accounts, such as IRAs or 401(k)s, offer valuable tax benefits like tax-free growth, saving you on capital gains taxes.

- 529 Plans: These plans are ideal for saving for educational expenses, offering tax-free growth and no taxes on withdrawals as long as they are used for qualified educational expenses.

- Taxable Brokerage Account: For long-term goals outside of retirement or education, you can use a taxable brokerage account to invest in a diverse range of asset classes.

Saving or Investing: Where Should Your Money Go?

You may want to see also

Frequently asked questions

The two expressions that show the investment-saving equality are “investment equals savings” and “net investment equals net savings”.

Saving and investing are both important but have different goals. Investing is meant to produce a return, while saving is meant to accumulate long-term capital.

The key is to reach an appropriate balance between investment and saving over time.

A loan product, such as a home equity loan or a personal loan.

Saving is putting money aside for future use, while investing is putting money into something with the expectation of making a return or profit.