Investing $100,000 for retirement requires careful consideration and planning. Before investing, it is crucial to ensure that high-interest debts are paid off, and an emergency fund is established. Once these prerequisites are met, there are several investment options to consider.

Diversification is key when investing such a substantial sum. A well-diversified portfolio typically includes a mix of stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate.

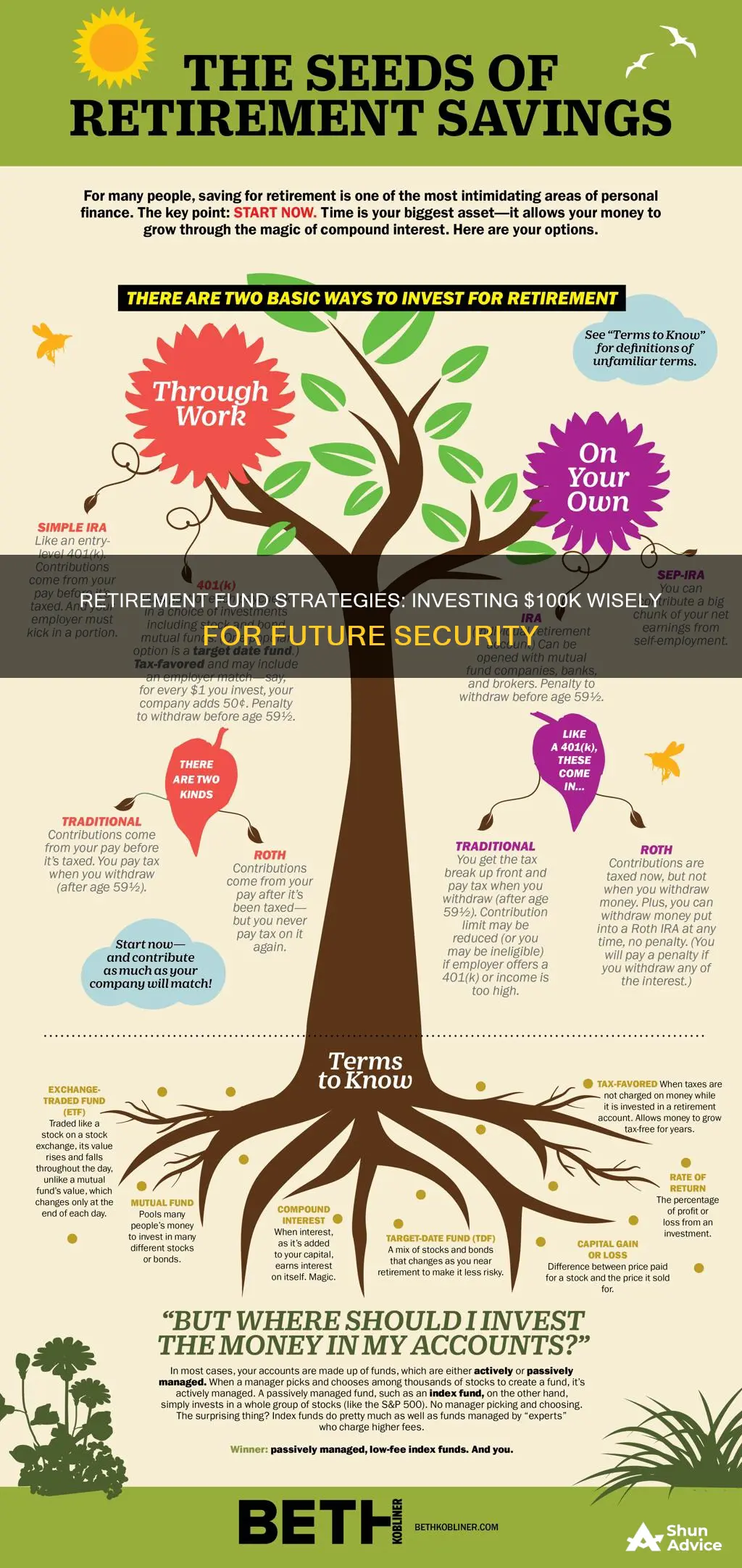

When investing for retirement, it is essential to maximise tax-advantaged retirement accounts, such as 401(k) plans and individual retirement accounts (IRAs). These accounts offer valuable tax benefits that can help shield your investments from taxes.

Additionally, it is important to consider your risk tolerance and investment goals. If you are risk-averse or nearing retirement, investing in less volatile assets like bonds or high-yield savings accounts may be more suitable. On the other hand, if you are comfortable with risk and have a long investment horizon, allocating a larger portion of your portfolio to growth stocks or investing in real estate may be appropriate.

Seeking advice from a financial professional can also help you make informed decisions about how to invest your $100,000 for retirement.

| Characteristics | Values |

|---|---|

| First steps | Pay off high-interest debt, set up an emergency fund, and fund a retirement plan |

| Investments | Stocks, bonds, mutual funds, exchange-traded funds (ETFs), index funds, dividend stocks, real estate, annuities, savings accounts, certificates of deposit (CDs), money markets, US Treasury bills, and health savings accounts (HSAs) |

| Investment advice | Robo-advisors, financial advisors, and brokers |

What You'll Learn

Pay off high-interest debt

If you have $100,000 in discretionary cash, it's important to first ensure you have no outstanding debt, especially high-interest credit card debt. Credit cards tend to charge high interest rates, often upwards of 18% if you don't pay off your balance in full each month. Therefore, it is recommended to pay off the balance in full as quickly as possible.

The interest on credit cards is compound interest, which is the most expensive interest for borrowers. The average interest rate on credit cards is around 24.37%, as of April 2024, and few investments can match this rate of return. As a result, it is highly recommended to eliminate all credit card debt before investing.

If you have multiple credit cards with unpaid balances, focus on paying off the card with the highest interest rate first. While doing so, continue to pay the minimum on your other cards. This strategy will help you minimize the amount of interest you pay over time.

In addition to saving you money on interest, paying off high-interest debt can also improve your credit score. Your credit score is influenced by your credit utilization ratio, which is the amount of credit you are currently using compared to your total available credit. By paying off your credit cards, you can improve this ratio and boost your credit score.

Once you have paid off your high-interest debt, you can move on to the next steps of financial planning, such as building an emergency fund and investing for the long term.

Index Funds: Where to Start and What to Know

You may want to see also

Set up an emergency fund

Setting up an emergency fund is an essential component of your overall financial well-being. An emergency fund will help you prepare for unexpected expenses and protect yourself from financial shocks. Here are some steps to help you set up an emergency fund with your $100,000 retirement funds:

Determine How Much You Need

The amount you need for your emergency fund depends on your personal situation and expenses. A common recommendation is to have enough cash to cover three to six months' worth of living expenses. This can vary depending on your income and financial situation. If you are the sole breadwinner in your household or have a sporadic income, you may want to set aside a larger amount.

Set Savings Goals

To make your savings goal more achievable, start with smaller milestones. Instead of aiming for three months' worth of expenses right away, set a goal for one month or two weeks. Reaching these smaller goals will give you the motivation to continue saving. Gradually increase your target with each milestone you achieve.

Start with Small, Regular Contributions

Begin by setting aside a small amount of money that you can comfortably save each month without straining your cash flow. You can cut back on non-essential expenses, such as a monthly coffee habit or a new pair of shoes, and allocate that money towards your emergency fund. Consistency is key—make sure to contribute to your savings regularly, whether it's monthly, weekly, or with each paycheck.

Automate Your Savings

To make saving easier, consider automating your contributions. Set up a separate savings account dedicated to your emergency fund and arrange for automatic transfers from your checking account or paycheck. This way, you save without having to remember to transfer the money manually each time.

Choose an Appropriate Account

When deciding where to keep your emergency fund, look for a safe and accessible option. A dedicated savings account with a bank or credit union is generally considered one of the safest choices. You can also use a prepaid card or keep cash on hand, but these options come with their own risks, such as the possibility of theft or loss.

When to Use Your Emergency Fund

Clearly define what constitutes an emergency or unplanned expense for you. This could include situations like a job loss, unexpected medical bills, car repairs, or home repairs. Having an emergency fund will help you avoid dipping into your retirement savings or relying on credit cards, which can lead to debt and higher interest rates. Remember, your emergency fund is meant to provide financial security and peace of mind during unexpected events.

The Right Time to Invest in Index Funds

You may want to see also

Diversify your portfolio

Diversifying your portfolio is a crucial step in achieving your financial goals. Here are some tips to diversify your portfolio when investing $100,000:

- Allocate your capital wisely: It is recommended to allocate no more than 60% of your capital to equities to reduce investment risk. Consider investing in stock funds, such as exchange-traded funds (ETFs), which allow you to diversify across specific industries and sectors.

- Invest in a variety of assets: Spread your investments across different asset classes, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. This helps to reduce the risk of your portfolio being heavily impacted if a particular company or sector underperforms.

- Consider your risk tolerance: Before investing, assess your risk tolerance. If you are risk-averse, consider investing in less volatile assets such as bonds, savings accounts, or certificates of deposit (CDs). If you have a higher risk tolerance, you may want to allocate a larger portion of your portfolio to growth stocks or alternative investments.

- Seek professional advice: Consult a licensed financial advisor who can provide investment solutions tailored to your financial goals and risk tolerance. They can help you navigate the different tax implications of various investments and recommend the best places to hold your investments, such as taxable brokerage accounts or tax-advantaged retirement accounts.

- Monitor and adjust your portfolio: Regularly review your portfolio to ensure it aligns with your financial goals and risk tolerance. Over time, the performance of different investments can cause your portfolio to become unbalanced. Rebalance your portfolio by adjusting your investments to match your desired allocation.

- Diversify within asset classes: When investing in a particular asset class, such as stocks, consider diversifying across different sectors and industries. For example, you could invest in a mix of technology, healthcare, and financial stocks to reduce the impact of sector-specific risks.

Mutual Fund Investment Guide for NRIs in India

You may want to see also

Invest in stocks, bonds, mutual funds, ETFs, and index funds

If you're looking to invest $100,000, stocks, bonds, mutual funds, ETFs, and index funds are all viable options. Here's some more information on each:

Stocks

Before investing in stocks, it's important to do your research and understand the risks involved. Diversifying your portfolio by investing in various companies and industries is crucial. You can use brokerage firms' research and analytical tools to help you decide which stocks to invest in. It's also a good idea to consider your risk tolerance and whether you want to manage your investments actively or take a more hands-off approach.

Bonds

Bonds are a type of debt issued by companies and governments. They offer a set interest rate on your deposit. The safer the investment, the lower the interest rate, and vice versa. For example, US Treasury bonds are considered safe and guarantee your money back plus interest. On the other hand, junk bonds have a high risk of missing payments or defaulting but offer a higher interest rate.

Mutual Funds

Mutual funds are professionally managed investment vehicles where your money is pooled with other small investors to buy a large portfolio of stocks, bonds, and other assets. You can buy and sell mutual funds only when the market closes at the end of the trading day. Mutual funds may have minimum investment requirements, and they often have higher fees due to active management.

ETFs (Exchange-Traded Funds)

ETFs are similar to mutual funds but can be bought and sold during the trading day like stocks. They typically track an index, such as the S&P 500, and are bought and sold on exchanges through brokerage firms. ETFs usually have lower fees than mutual funds, and they offer more transparency into their holdings, disclosing their holdings daily.

Index Funds

Index funds are a type of mutual fund that tracks the performance of a specific market index. Like ETFs, they provide a simple way to diversify your portfolio at a lower cost. Index funds trade once daily after the market closes and historically outperform actively managed mutual funds in the short and long term.

Rental Property vs Mutual Funds: Which is the Better Investment?

You may want to see also

Invest in real estate

Real estate is a rewarding investment option with the potential for generous profits. It is one of the few assets that tend to appreciate over time. There are two main ways to invest in real estate: traditional real estate investing and real estate investment trusts (REITs).

Traditional Real Estate Investing

Traditional real estate investing involves purchasing and flipping properties or renting them out for income. When investing in real estate, it's important to consider the location, market conditions, return on investment (ROI), property profitability, and associated costs.

- Purchasing a second home: This is a good option for beginners as it is easy to finance and can generate income through part-time rentals. It also offers potential for price appreciation and leverage.

- Single-family rental homes: These are more complex and may require a higher down payment, but they can provide a steady income stream.

- House flipping: This involves buying a home in need of repair, renovating it, and then selling it for a profit.

- Commercial property: Apartment complexes, office buildings, warehouses, and shopping centers can generate steady rent but are often more expensive than single-family homes.

- Multi-family rental properties: Investing in duplexes, triplexes, or fourplexes can be an easy way to quickly grow cash flow and are generally easy to manage and maintain.

Real Estate Investment Trusts (REITs)

REITs are publicly traded companies that invest in real estate and distribute income from rent or property sales to shareholders. They offer a simple and low-cost way to invest in real estate without the complexities of direct property ownership. REITs provide high levels of diversification, and investing in them is as easy as buying shares of any public company.

Other Considerations

When investing in real estate, it is important to assemble a team of professionals, including a financial advisor, real estate broker, accountant, and property manager. Additionally, consider your risk tolerance and conduct thorough research before investing.

Low-Cost Index Funds: When to Steer Clear

You may want to see also

Frequently asked questions

Before investing, it's important to pay off any high-interest debt, such as credit cards, and set up an emergency fund. It's also a good idea to determine your investment goals and risk tolerance.

Some options include investing in stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. You can also consider tax-advantaged retirement accounts, such as a 401(k) or an IRA, to maximize tax benefits.

It's important to diversify your portfolio and consider your short- and long-term financial goals, risk tolerance, and time horizon. You may also want to seek advice from a financial professional or use a robo-advisor for automated investment management.

Yes, consider maxing out your retirement contributions, staying vigilant about fees, and reallocating your portfolio to maintain your desired asset allocation. Additionally, if you have a large sum, you may want to consult with a financial advisor to determine the best investment strategies for your specific situation.