Investing $2 million for retirement requires careful planning and consideration of various factors. While it can offer a comfortable and secure retirement, it's important to manage it effectively. The first step is to estimate your retirement budget, considering expenses, lifestyle choices, healthcare costs, inflation, and income tax. Diversifying your investment portfolio across different asset classes and sectors is crucial, and seeking expert financial advice can be beneficial. Additionally, it's essential to start investing early and consistently, taking advantage of tax-advantaged plans and employer-matching programs. Annuities can provide guaranteed lifetime income, but it's important to choose the right type of annuity and consider potential tax implications. Overall, a well-planned strategy that addresses individual needs and goals is key to successfully investing $2 million for retirement.

| Characteristics | Values |

|---|---|

| Retirement age | 65 |

| Annual income | $100,000 |

| Annual expenses | $80,000 |

| Annual savings | $5,677-$11,658 |

| Monthly savings | $453.31-$948 |

| Investment options | High-yield savings account, one-year treasury bills, certificates of deposit, S&P 500 index funds, annuities |

| Annual income from annuities | $110,052-$234,803 |

What You'll Learn

Estimate your retirement budget

Estimating your retirement budget is the first step in saving $2 million for retirement. Creating a hypothetical retirement budget can help you estimate what you’ll spend year to year and what your target retirement withdrawal rate should be.

Your retirement budget should include the normal costs of living, such as:

- Mortgage or rent

- Car payments

- Health care expenses

- Food

- Insurance

- Utilities

You may also need to include any money you plan to spend to maintain your desired lifestyle. For example, this might include travel expenses or money spent on hobbies.

Additionally, consider where debt fits into your retirement budget. If you want to retire with $2 million and no debt, you’ll need to figure out how you can save and pay down debt aggressively during your working years.

It's also important to consider how long you have until retirement. For example, if you’re 25 now and want to retire at 65, you’d have 40 years to save and invest. You’d have to grow your portfolio by $50,000 a year on average. However, if you’re getting a late start, say at age 35, you’ll need to decide whether retiring at 65 with $2 million is a realistic goal. Having 30 years to save means you’d need to increase your portfolio by $66,666 a year on average.

Moreover, don't forget to take inflation into account. A “regular” inflation rate is 3% per year, which means the cost of living will increase by this much every year you are in retirement. With a 3% annual inflation rate, $2 million would last about 20 years.

Finally, your retirement expenses will depend on the lifestyle you choose. The funds could be depleted in as little as ten years if you prefer a more luxurious lifestyle with frequent travel and premium accommodations.

Is Now the Time to Invest?

You may want to see also

Consider your timeline

When considering investing $2 million for retirement, it is essential to think about your timeline. This involves estimating how long you have until retirement, which will influence the growth needed in your investment portfolio each year. For example, if you are 25 years old and plan to retire at 65, you have 40 years to save and invest. This means growing your portfolio by an average of $50,000 per year. However, if you are starting later, at 35 years old, and still want to retire at 65, you will need to increase your portfolio by an average of $66,666 per year.

Starting early is crucial, as it gives your assets more time to compound and grow. Even if you are already saving and investing, increasing the amount you consistently add to your nest egg can make a significant difference. The more time you have and the more consistently you invest, the easier it will be to achieve your retirement goal.

When considering your timeline, it is also essential to be realistic about your retirement age. If you are starting with a smaller nest egg or want to retire earlier, you may need to adjust your expectations. For example, if you are starting at 35 and feel that increasing your portfolio by $66,666 per year is not feasible, you may need to consider retiring at 70 or 75 to give yourself more time to reach the $2 million mark.

Additionally, your timeline will influence the types of investments you choose. Generally, the longer your timeline, the more allocation you can have towards equities, as you have more time to recover from potential market downturns. Shorter timelines, on the other hand, may require a larger allocation of low-risk, fixed-income assets.

Your risk tolerance also plays a role in your investment choices and is closely tied to your timeline. As you get older, your risk tolerance typically decreases because there is less time to recover from market losses. Therefore, when considering your timeline, it is essential to evaluate your risk appetite and how it may change over time.

In summary, when investing $2 million for retirement, carefully consider your timeline by estimating your retirement age, calculating the annual growth needed in your portfolio, and adjusting your investment strategies and risk tolerance accordingly. Starting early, being consistent, and making informed choices based on your goals will help you achieve a comfortable retirement.

ESG Investors: Why the Lack of Interest in SRI?

You may want to see also

Use tax-advantaged plans

If you're looking to retire with $2 million, tax-advantaged plans are a great place to start. These plans can help you save for retirement while minimizing your tax burden. Here's a detailed and instructive guide on how to use tax-advantaged plans effectively:

Types of Tax-Advantaged Plans

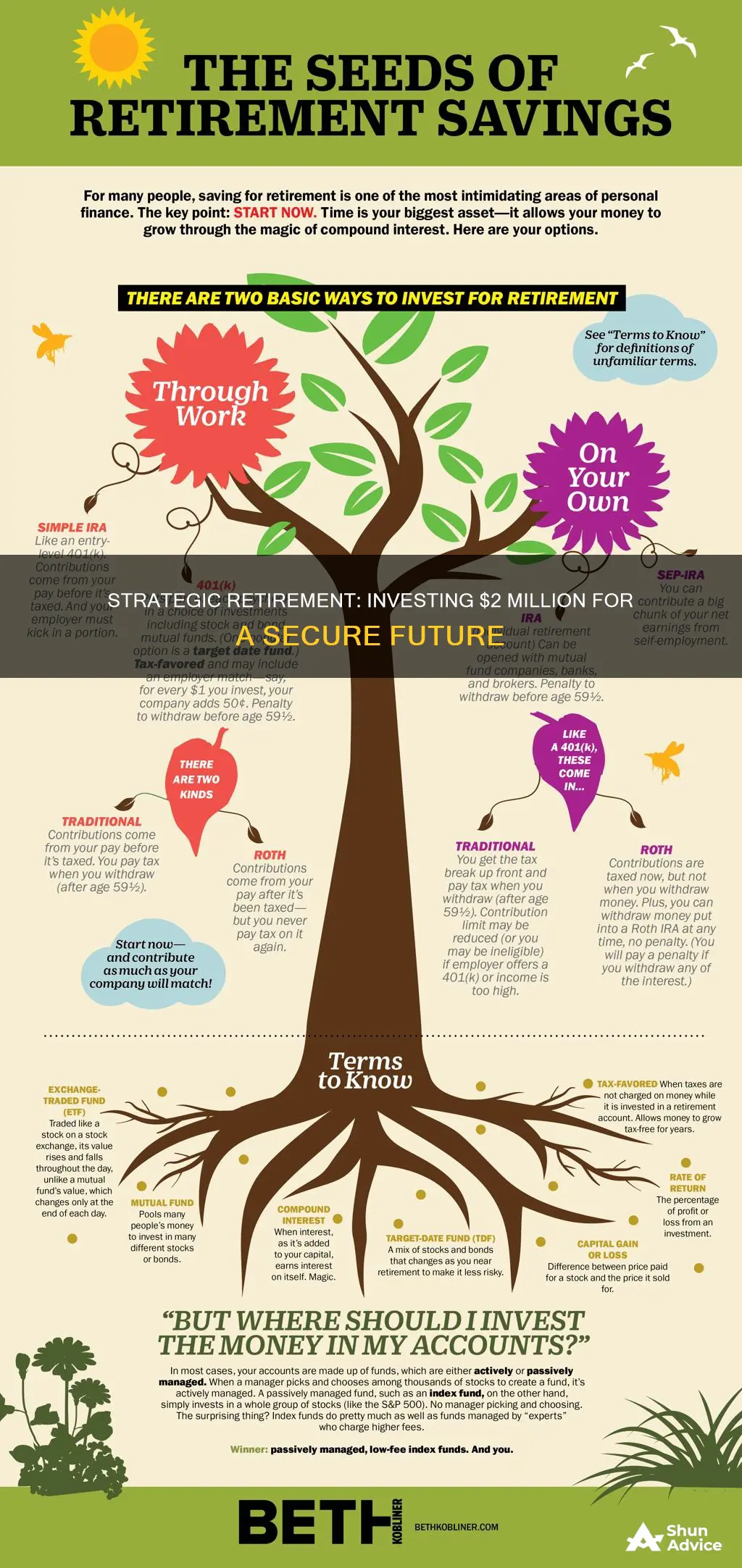

There are two main types of tax-advantaged plans: tax-deferred and tax-exempt.

Tax-Deferred Plans

Tax-deferred plans, such as Traditional Individual Retirement Accounts (IRAs) and 401(k) plans, offer upfront tax breaks. You get immediate tax deductions on the full amount you contribute, but you pay taxes on the withdrawals in retirement. This means that the tax is deferred until a later date. For example, if you contribute $3,000 to a tax-deferred account this year, you'll only pay taxes on your income minus that contribution. However, when you withdraw the money in retirement, it will be taxed as income.

Tax-Exempt Plans

Tax-exempt plans, such as Roth IRAs and Roth 401(k)s, work differently. You make contributions to these plans with after-tax dollars, meaning there's no immediate tax advantage. However, the investments grow tax-free, and qualified withdrawals in retirement are also tax-free.

Choosing the Right Plan for You

The right type of tax-advantaged plan depends on your financial situation and expectations for future income. If you expect your income to be lower during retirement than it is now, focus on tax-deferred plans like Traditional IRAs, as they provide immediate tax advantages. On the other hand, if you anticipate a higher income and tax rate in the future, consider tax-exempt plans like Roth IRAs, as withdrawals from these accounts will be tax-free.

Annual Contribution Limits

It's important to note that tax-advantaged plans like IRAs and 401(k)s have annual contribution limits. In 2024, individuals can contribute up to $7,000 to IRAs, or $8,000 if they're 50 or older. For 401(k)s, the limit is $23,000, or $30,500 with a catch-up contribution. These limits may impact your ability to reach the $2 million retirement goal, so be sure to plan accordingly.

Employer-Sponsored Plans

If your employer offers a 401(k) plan, contributing to it is a great way to save for retirement. Take advantage of any employer matching contributions, as this is essentially "free money" added to your retirement savings. Additionally, 401(k) plans often include tax-deferred status, which can further enhance the tax benefits.

Other Tax-Advantaged Investments

While plans like IRAs and 401(k)s are popular, there are other tax-advantaged investments to consider as well. Municipal bonds, for example, provide tax-free income at the federal level and may also be exempt from state and local taxes. Depreciation on real estate investments can also yield tax advantages through deductions on the cost basis of the property.

Consult a Professional

Finally, remember that retirement planning can be complex, and it's always a good idea to consult a qualified investment planner, financial advisor, or tax specialist. They can help you navigate the various tax-advantaged options and create a personalized plan that aligns with your financial goals.

Mortgage Debt vs Retirement Savings: Navigating the Financial Tightrope

You may want to see also

Invest in stocks

If you're looking to retire with $2 million, investing in stocks is a crucial component of your retirement strategy. Here are some detailed instructions and considerations for investing in stocks to achieve your retirement goal:

Diversification

Diversifying your investment portfolio is essential to managing risk effectively. Avoid putting all your money into only one or two stocks, no matter how tempting it may be to invest in a particular company. Diversification helps protect your retirement nest egg from significant losses in case a particular stock or industry performs poorly. Spread your investments across various sectors and asset classes to minimize the impact of market downturns.

Online Brokerage Accounts

To actively invest in stocks, you'll need to open an online brokerage account. Choose a brokerage that offers a wide range of investment options, including stocks, mutual funds, and exchange-traded funds (ETFs). Some brokerages also provide access to other investments like bonds, futures, options, and cryptocurrencies, allowing for even greater diversification. When selecting a brokerage, consider the fees associated with trading, as these can eat into your returns. Look for commission-free stock and ETF trades to keep more of your earnings.

Time Horizon and Risk Tolerance

Investing in stocks carries more risk than other investments, but the potential for higher returns makes it attractive for long-term retirement goals. Stocks tend to fluctuate in value, and their prices can be volatile in the short term. However, over longer periods, stocks have historically provided strong returns. If you're investing for retirement, you likely have a long time horizon, which gives your portfolio time to recover from any periods of volatility. Be sure to assess your risk tolerance and adjust your stock allocation accordingly.

Active vs. Passive Investing

Active investing involves trying to beat the market by carefully selecting individual stocks or following specific strategies. This approach requires more time, research, and expertise. Passive investing, on the other hand, involves buying and holding a diversified portfolio of stocks or investing in index funds that track a stock market index, such as the S&P 500. Passive investing is generally more accessible for beginners and those who don't want to actively manage their investments.

Dollar-Cost Averaging

Consider employing a strategy called dollar-cost averaging, especially if you're investing for the long term. This involves investing a fixed amount of money in stocks at regular intervals, such as monthly or quarterly. By doing so, you purchase more shares when prices are low and fewer shares when prices are high, helping to lower the average cost per share over time. This strategy helps take the emotion out of investing and reduces the risk of trying to time the market.

Monitoring and Rebalancing

Once you've invested in stocks, it's important to monitor your portfolio periodically. Keep an eye on how your investments are performing and make adjustments as necessary. Over time, some investments may grow out of proportion with others, throwing your portfolio out of balance. Rebalancing involves adjusting your holdings to return your portfolio to its intended allocation. For example, if stocks now make up a larger percentage of your portfolio than you intended, you would sell some stocks and use the proceeds to buy more of the underweighted investments.

Financial Literacy: Powering Personal Finance

You may want to see also

Increase your savings rate

Saving for retirement can be a daunting task, especially if you are starting later in life. However, there are ways to increase your savings rate to ensure you are on track for a comfortable retirement. Here are some strategies to help you boost your savings rate:

- Start saving early: The earlier you start saving, the more time your money has to grow through compound interest. If you are just starting to save in your 30s, don't panic. You can still catch up by increasing your savings rate and taking advantage of the power of compound interest over time.

- Increase your savings rate gradually: Aim to save a higher percentage of your income each year. For example, if you get a 2% pay raise, put that extra 2% towards your retirement savings. Over time, you will be able to save a larger portion of your income without feeling the pinch.

- Take advantage of employer matching: If your employer offers matching contributions to your retirement plan, such as a 401(k), be sure to contribute enough to get the full match. This is essentially free money that can boost your savings rate at no additional cost to you.

- Avoid lifestyle inflation: As your income increases, avoid the temptation to increase your spending proportionally. Instead, focus on increasing your savings rate. If you get a raise, celebrate by saving more rather than splurging on non-essential purchases.

- Redirect payments: If you have paid off a debt, such as a car loan, redirect the monthly payment amount towards your retirement savings. This way, you won't feel like you are cutting into your spending money, and your savings rate will increase.

- Automate your savings: Set up automatic contributions from your paycheck or checking account into your retirement savings account. This way, you save without even thinking about it, and your savings rate will increase over time.

- Maximize tax-advantaged plans: Contribute the maximum amount allowed to tax-advantaged retirement plans, such as a 401(k) or IRA. This will help you save on taxes while boosting your savings rate.

- Diversify your investments: Don't put all your eggs in one basket. Diversify your investment portfolio across different asset classes and sectors to protect against market declines and increase your savings rate over the long term.

- Stay consistent: Saving for retirement is a marathon, not a sprint. Stay consistent with your savings rate and continue to increase it gradually over time. Even if you can't save a large percentage right now, staying consistent will pay off in the long run.

By implementing these strategies, you can increase your savings rate and be well on your way to a comfortable retirement. Remember to seek professional financial advice to create a personalized plan that fits your unique circumstances.

ELSS: Right Time to Invest?

You may want to see also

Frequently asked questions

This depends on your age and how much money you currently have. If you start at 25, you need to save $453.31 per month to reach $2 million by 72. If you start at 35, you need to save $948 per month. If you start at 45, you need to save $2,078 per month.

Here are some options for stable, long-term income investing:

- High-yield savings accounts

- One-year treasury bills

- Certificates of deposit

- S&P 500 index funds

Some common mistakes to avoid when investing for retirement are:

- Not investing early enough. The earlier you start, the more time your assets have to compound and grow.

- Not diversifying your investment portfolio. It's important to allocate your resources over a broad spectrum of asset classes and sectors to protect against the risk of significant loss.

- Panicking when the market declines. Instead, stick to your investment strategy and don't turn temporary declines into permanent losses.