Apple Pay is a service provided by Apple as part of its Services portfolio, which includes Apple Music, AppleCare, Apple News, Apple Card, and Apple Arcade. While Apple has been investing heavily in research and development (R&D), with a record-breaking expenditure of $29.92 billion in 2023, it is unclear how much of this budget is specifically allocated to Apple Pay. However, given Apple's commitment to innovation and improving user experiences, it is likely that a significant portion of their R&D budget is directed towards enhancing their Services portfolio, including Apple Pay.

Apple's R&D spending has been increasing steadily over the years, with a projected spending of 7.8% of revenues in 2023, surpassing the previous high of 7.9% in 2003. This indicates that Apple is committed to investing in future technologies and maintaining its competitive edge.

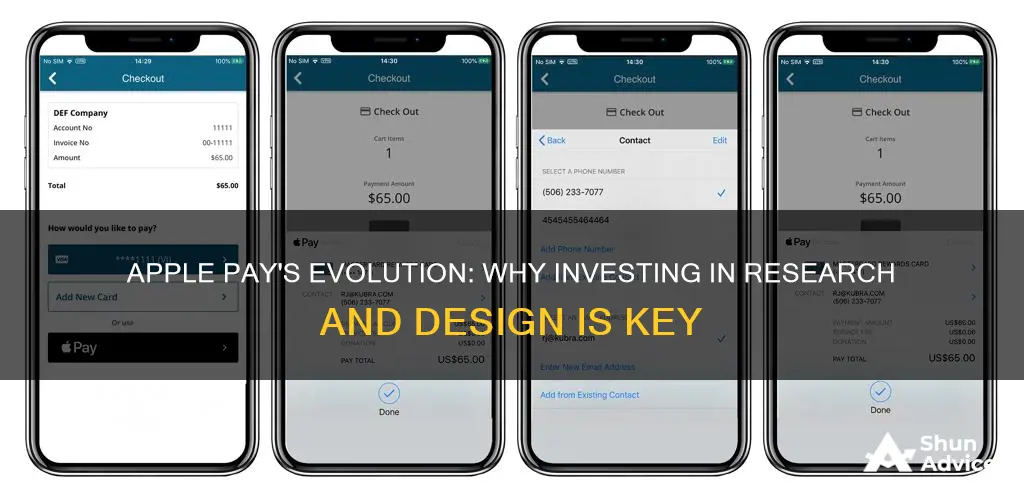

By investing more in research and design, Apple can not only enhance the user experience of Apple Pay but also differentiate its services from competitors. With the growing competition in the technology sector, increasing R&D spending can help Apple sustain its market position and develop innovative features for Apple Pay that improve security, functionality, and user-friendliness.

Additionally, Apple has been diversifying its product offerings beyond its flagship iPhone, with a focus on wearables and home businesses. This strategy may also extend to Apple Pay, with potential integrations or expansions into new areas.

In conclusion, while it is unclear exactly how much Apple invests specifically in Apple Pay research and design, their overall commitment to R&D and service improvements suggests that they recognize the importance of innovation in maintaining their market leadership and providing valuable services to their customers.

| Characteristics | Values |

|---|---|

| Increased investment in R&D | 7.8% of revenues in 2023, a 787% increase since 2012 |

| Diversification into new products | Wearables, home businesses, cloud technology, and media services |

| Commitment to future technologies | AR, VR, autonomous vehicles |

| Improvement of existing products | iPhone, iPad, MacBook |

| Development of new products | VR headset, Apple Vision Pro |

| Interest in transportation | $1 billion investment in Didi, a Chinese ride-sharing company |

| Interest in automotive space | Rumors of working on a car or car-related technology |

| Interest in virtual reality | Multiple VR projects in the works |

| Commitment to core products and services | iPhone, iPad, Mac, Apple Watch, and service programs |

| Acquisition of primary technologies | Purchase of Intel's modem division |

| Development of self-driving car technologies | Hired execs from Tesla |

| Investment in augmented reality | Development of AR apps and consumer AR glasses |

What You'll Learn

Apple Pay's market share and brand image

Apple Pay is part of Apple's Services portfolio, which includes Apple News, Apple Card, Apple Arcade, Apple TV, and others. While Apple doesn't disclose the market share of its individual services, the company's Services segment brought in $68.4 billion in net sales in 2022, a 24.4% increase from 2021. This segment's strong performance has been crucial in diversifying Apple's revenue streams and reducing dependence on hardware sales.

Apple's brand image is closely tied to its reputation for innovation and design. The company has consistently invested in research and development, with a record $29.92 billion spent in its 2023 fiscal year. This investment has resulted in the release of iconic products like the iPhone, iPad, and MacBook, solidifying Apple's position as a technology industry leader.

Apple's commitment to innovation and design is evident in its efforts to "own and control the primary technologies behind the products that [they] make." This strategy has led to the development of in-house processors for iPhones and wireless Bluetooth chips for AirPods, demonstrating Apple's willingness to invest in core technologies that enhance the user experience and differentiate its products.

Apple's dedication to research and design has also expanded its product ecosystem, with successful forays into new categories like wearables (Apple Watch) and hearables (AirPods). This diversification has contributed to Apple's market dominance, particularly in the wearables and hearables markets, where the Apple Watch and AirPods have gained significant traction.

In conclusion, Apple's market share and brand image are closely intertwined with its commitment to innovation and design. By investing in research and development, Apple has cultivated a loyal customer base, expanded its product offerings, and reinforced its position as a leading technology brand.

Amaravati: Invest Now or Never?

You may want to see also

Investing in future technologies like AR and VR

Apple has been investing heavily in research and development, with a focus on future technologies such as augmented reality (AR) and virtual reality (VR). In 2023, the company signalled its strong commitment to new technologies by boosting its R&D spending to an unprecedented 7.8% of revenues, amounting to $30 billion. This significant increase in investment challenges the notion that Apple has stagnated in innovation since the days of Steve Jobs.

Apple's interest in AR and VR is evident through its various projects in this domain. On the hardware side, Apple is reportedly working on the ""Apple VR" headset, which would offer users a more immersive experience than what is currently possible through FaceTime on iPhones, iPads, or Macs. Additionally, the company is developing lightweight AR glasses, referred to as "Apple Glasses" by the tech media, which are designed to coexist seamlessly with the user's surroundings.

Apple has also been investing in software technologies to complement its AR and VR hardware offerings. This includes ARKit, RoomPlan, RealityKit, Reality Composer, Reality Converter, and realityOS. The company's first venture into VR was QuickTime VR for the classic Mac OS.

Apple CEO Tim Cook's comments on VR indicate that the company has a great interest in this area and is likely working on multiple VR projects. Apple's massive R&D budget and its focus on future technologies suggest that it is committed to bringing innovative AR and VR products to market, revolutionizing the way users interact with and experience the world around them.

Nike: A Smart Investment Choice?

You may want to see also

Improving user experience and product differentiation

Apple Pay is part of Apple's Services portfolio, which also includes cloud services, the App Store, Apple Music, AppleCare, licensing, and other services. These services have become the company's cash cow, alongside the iPhone.

Apple has been increasing its R&D spending to improve user experience and product differentiation. In 2023, the company spent a record $29.92 billion on R&D, with plans to boost spending to 7.8% of revenues in 2023, potentially signalling investments in future technologies.

Apple's R&D spending has resulted in the release of various famous products, including the iPhone, iPod, MacBook, and iPad. The company has also diversified into wearables and home businesses, such as the Apple Watch, AirPods, and HomePod.

Apple's increased investment in R&D can be attributed to its business model, which aims to create disruptive innovation and gain a competitive advantage. By refining and releasing better versions of its products, Apple has maintained a loyal customer base and reinforced its brand image.

The company's R&D efforts have also led to improvements in its services, such as the development of its own wireless Bluetooth chip, which powers the AirPods. Additionally, Apple's "Project Titan" is reportedly working on self-driving car technologies, and it has also invested heavily in augmented reality technology.

Apple's R&D spending has multiple benefits, including enhancing the user experience, differentiating its products and services, and seeking to own and control the technology driving its products. The company's commitment to R&D demonstrates its focus on innovation and its ability to adapt to changing markets and technologies.

Investment Allocation: Understanding the Ideal Percentage of Your Paycheck

You may want to see also

Exploring new product categories and services

Apple's commitment to research and development has been integral to its success, with the company investing heavily in this area to drive innovation and maintain its competitive edge. This strategy has allowed Apple to expand its product ecosystem and enhance its brand image, solidifying its position as a leading technology company.

Apple's R&D efforts have resulted in the introduction of diverse products and services, including the iPhone, iPad, Apple Watch, AirPods, and HomePod. Additionally, they have ventured into software development, with iOS, macOS, watchOS, and tvOS powering their devices. Apple has also established a strong presence in the services sector, with offerings such as Apple Pay, Apple Music, Apple News, and Apple TV.

However, Apple recognizes the need to continuously explore new avenues to sustain its market leadership. This exploration includes potential ventures into new product categories and services. One notable area of interest is the transportation sector, with Apple investing in ride-sharing companies like Didi and reportedly working on autonomous vehicle technologies. This indicates a strategic shift towards smart car technologies and a potential future launch of an Apple car.

Another area that Apple is actively researching is virtual reality (VR) and augmented reality (AR). With the release of its first VR headset, Apple Vision Pro, in 2024, Apple is demonstrating its commitment to this emerging technology. The company is also rumored to be working on consumer AR glasses, which could revolutionize how we interact with digital content.

Apple's R&D spending patterns suggest that they are allocating significant resources to these new ventures. The company's increased investment in future technologies, such as AR, VR, and autonomous vehicles, challenges the notion that Apple has stagnated in innovation.

By exploring these new product categories and services, Apple is positioning itself for future growth and ensuring it remains at the forefront of technological advancements. This proactive approach to innovation will likely lead to the introduction of groundbreaking products and experiences for consumers, further solidifying Apple's reputation as a technology pioneer.

Renewable Energy: Our Future's Investment

You may want to see also

The impact of regulatory scrutiny and antitrust issues

Apple has faced regulatory scrutiny and antitrust issues in recent years, particularly regarding its Apple Pay service. In July 2022, a lawsuit was filed against Apple, accusing the company of antitrust violations by abusing its market power in mobile devices to suppress competition for its Apple Pay mobile wallet. The lawsuit was proposed as a class action by payment card issuers, including Iowa's Affinity Credit Union, and argued that Apple "coerces" consumers who use its smartphones, smartwatches, and tablets into using Apple Pay for contactless payments. This is unlike Android-based device makers, which allow consumers to choose alternative wallets such as Google Pay and Samsung Pay.

The plaintiffs claimed that Apple's conduct forced over 4,000 banks and credit unions using Apple Pay to pay at least $1 billion in excess fees annually. They also asserted that Apple's actions reduced the incentive for the company to improve Apple Pay's functionality and security. The lawsuit sought unspecified triple damages and a halt to Apple's alleged anticompetitive conduct.

In September 2023, Apple faced another antitrust lawsuit filed by three credit unions, alleging that Apple Pay's fees were too high and that the company excluded other digital wallets by restricting access to its NFC-scanning hardware. A federal judge, Jeffrey White, partially denied Apple's request to dismiss the suit, agreeing with the credit unions' argument that Apple Pay's exclusionary practices resulted in a lack of competition in the iOS digital payments market, which was harmful to consumers.

Additionally, in May 2024, the U.S. Justice Department sued Apple, accusing it of maintaining an iPhone monopoly and violating federal antitrust law. This lawsuit also targeted Apple Pay, claiming that Apple prevented other companies from offering competing applications in the digital wallet space. The regulatory scrutiny and antitrust issues faced by Apple have significant implications, and the company may need to make strategic changes to address these concerns.

Metals: A Safe Investment Haven?

You may want to see also

Frequently asked questions

Apple Pay should invest more in research and design to maintain its market position and stay competitive. With the right investments in R&D, Apple Pay can improve its user experience, differentiate its products and services, and gain a competitive advantage.

Apple's spending on research and development has been steadily increasing. In 2022, Apple spent $26.25 billion, a 19.79% increase from 2021. In 2023, Apple's R&D expenditure rose to a record $29.92 billion, a 13.96% increase year-over-year.

The spending indicates that Apple is committed to innovation and enhancing its products and services. It suggests that Apple is working on new products and services beyond its current lineup, potentially in the automotive and virtual reality spaces.

Apple has historically been a laggard in R&D spending compared to other top technology companies. In the June 2019 quarter, Microsoft spent 13.4% of its revenue on R&D, while Google spent 15.7%. However, Apple's R&D spending as a percentage of revenue has been increasing and is at its highest since 2003.

While increased R&D spending can lead to successful projects and enhanced innovation, it does not guarantee profitability or strong stock performance. Apple can also face losses even after significant investments in innovation. However, R&D can elevate Apple towards more revenue and reinforce its brand image, which has been crucial in maintaining its loyal customer base.