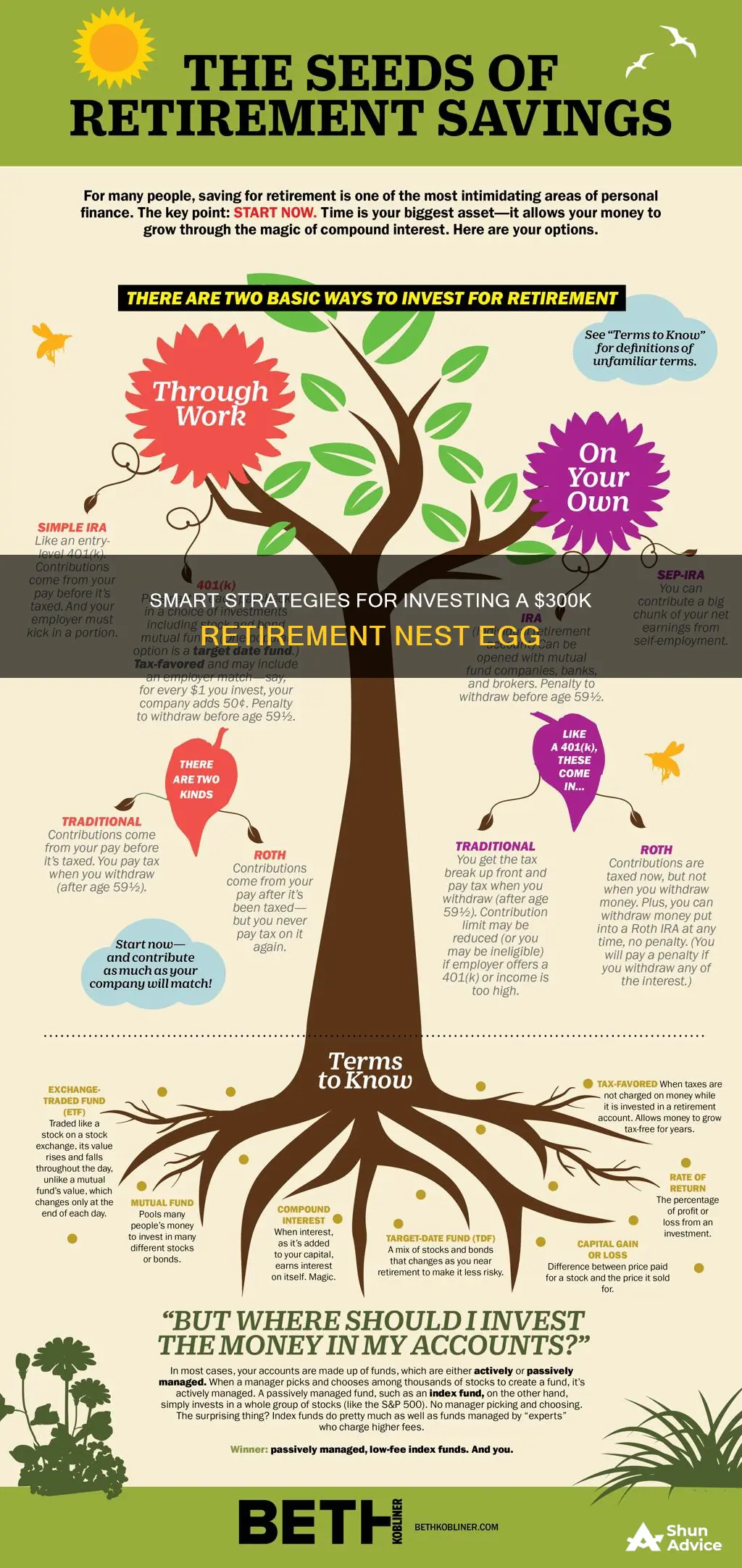

Investing 300k for retirement requires careful planning and consideration of various factors, such as your risk tolerance, financial goals, and retirement lifestyle. It's essential to consult a financial advisor to tailor a plan to your unique circumstances. Here are some general strategies to consider:

- Diversification: Spreading your investments across various assets, such as stocks, bonds, real estate, and alternative investments, is crucial to balance risk and maximise returns.

- Passive vs. Active Income: Some investments, like rental properties or small businesses, require active management, while others, like dividend stocks or ETFs, provide passive income.

- Retirement Location: The cost of living varies across locations, and some states offer financial incentives and tax breaks for retirees.

- Social Security and Annuities: Combining Social Security benefits with annuities can boost your monthly income and provide financial stability.

- Emergency Funds: Keeping a portion of your 300k in a high-yield savings account ensures instant access to funds during unexpected expenses.

- Debt Management: Prioritise paying off high-interest debt before investing to improve your financial standing.

| Characteristics | Values |

|---|---|

| Average monthly Social Security income check | $1,907 per person |

| Average monthly Social Security income check for a couple | $3,814 |

| Average monthly income at 62 | Social Security ($3,814) + Annuity ($1,888) = $5,702 |

| Average monthly income at 65 | Social Security ($3,814) + Annuity ($1,983) = $5,797 |

| Average monthly income at 70 | Social Security ($3,814) + Annuity ($2,138) = $5,952 |

| Average annual return before taxes | 6% |

| Federal marginal tax rate | 22% |

| Average total debt per household | £65,143 |

| Average monthly spend for $300k to last 26 years | $1,600 |

| Average monthly income for $300k to last 35 years | $714 |

| Average monthly income for $300k to last 25 years | $1,666 |

| Average annual return of stocks and ETFs | 10% |

| Average annual return of REITs | 7% to 10% |

| Average annual return of stocks | 7% |

What You'll Learn

How to make your money last

When it comes to making your money last during retirement, there are several factors to consider and strategies you can employ. Here are some guidelines to help you make the most of your $300,000 retirement savings:

- Understand your retirement goals and expenses: Determine your planned retirement age, lifestyle, and monthly expenses. This will help you calculate how long your savings will last and if any adjustments are needed.

- Follow the 4% rule or a more conservative withdrawal rate: The widely known 4% rule suggests withdrawing 4% of your savings annually, adjusted for inflation. However, a more recent recommendation suggests a 2.8% withdrawal rate to ensure your savings last longer and provide a more stable income.

- Combine with other sources of income: Social Security benefits and annuities can significantly boost your monthly income. For example, in 2024, the average monthly Social Security income for an individual was $1,907, while an annuity with a lifetime income rider can further enhance your income.

- Consider living off the interest: Instead of dipping into your principal savings, you can live off the interest generated from a fixed-interest savings account, such as a fixed annuity or a Certificate of Deposit (CD). This preserves your investment while providing a steady income stream.

- Seek professional financial advice: Consult a trusted financial advisor to create a tailored retirement plan that aligns with your goals and unique financial situation. They can guide you on effective asset allocation, risk management, and tax implications.

- Diversify your investments: Spread your investments across different asset classes and sectors to minimize risk. Consider a mix of stocks, bonds, real estate, and alternative investments. Diversification ensures that you don't put all your eggs in one basket and increases your chances of higher returns.

- Create an emergency fund: Set aside a portion of your $300,000 as an emergency fund to prepare for unexpected expenses. Aim to have enough to support you financially for at least three to six months.

- Pay off debts: Prioritize paying off high-interest debts, such as credit cards and loans, before investing. This will free up more of your money for investments and long-term financial goals.

- Invest in a high-yield savings account: Opt for a high-yield savings account that offers higher interest rates than traditional banks. This allows a conservative yet profitable way to offset the risk of other investments.

- Consider your risk tolerance: Assess your comfort with risk and how it aligns with your investment choices. If you are risk-averse, prioritize safer and more stable investments. If you are comfortable with higher risk, explore options with greater potential returns.

Why People Avoid Investing

You may want to see also

Understanding tax implications

When considering how to invest $300,000 for retirement, it's important to take into account the potential tax implications to ensure you're making the most of your money and avoiding unnecessary costs. Here are some key points to consider:

- Retirement income taxes on $300k are generally not very high, especially if you spread the distributions over 20-25 years or more. However, it's important to remember that tax laws can change over time, so it's a good idea to stay informed and consult with a financial advisor to ensure you're optimising your tax obligations.

- The tax you pay will depend on your overall income, including any other sources of income such as Social Security or pensions. In the US, taxes are progressive, meaning the more income you have, the higher the rates. So, with $300k in assets, you're likely to fall into a relatively low taxable income bracket.

- The way you receive your retirement income will also impact your taxes. For example, a pre-tax 401(k) will be taxed differently from an after-tax Roth IRA. Understanding the tax implications of different retirement income streams can help you make informed decisions about how to structure your retirement finances.

- State-level income taxes vary depending on where you live, so it's important to understand the specific tax laws in your state. Some states may offer tax breaks for retirees, while others may have higher income tax rates.

- If you plan to make large lump-sum withdrawals, such as for a vehicle purchase or home renovations, you may pay more in taxes in those years. It's important to consider the timing and amount of your withdrawals to manage your tax obligations effectively.

- Social Security benefits may be taxed depending on your income and filing status. In some cases, they may be tax-free, but with a high income, a portion of your benefits may be taxable. Understanding how Social Security benefits are taxed can help you accurately estimate your tax obligations during retirement.

- Finally, it's important to remember that tax laws and rates can change over time. Staying informed about any changes to tax laws and seeking professional financial advice can help you make the most of your investments and effectively plan for the future.

Startups: Invest or Avoid?

You may want to see also

The importance of financial advice

Financial advice is crucial when planning for retirement, and seeking help from a qualified professional can provide numerous benefits and save you from costly mistakes. Here are some reasons why financial advice is essential when considering how to invest $300k at retirement:

- Expert Guidance: Financial advisors are experts in their field, and they can provide valuable insights and guidance tailored to your unique situation. They will help you make informed decisions about your retirement savings and investments, ensuring your financial security.

- Anxiety Reduction: Retirement planning can be a stressful and complex process, and it's easy to become anxious about having enough savings. Financial advisors can help alleviate this anxiety by providing clarity, creating a comprehensive plan, and ensuring you are on track for a comfortable retirement.

- Improved Decision-Making: Advisors not only offer investment recommendations but also help you make better financial decisions. They will consider your risk tolerance, goals, and current market conditions to develop a strategy that aligns with your needs.

- Tax and Estate Planning: Taxes play a significant role in retirement planning. Financial advisors can guide you on tax-effective strategies, ensuring you don't pay more taxes than necessary and helping you understand the tax implications of your investment choices. They can also assist with estate planning, ensuring your wishes are carried out.

- Emotional Wellbeing: Several studies have shown a link between financial advice and improved emotional wellbeing. Those who receive financial advice tend to experience greater peace of mind, improved confidence about the future, and enhanced overall life satisfaction.

- Behavioural Coaching: A good financial advisor will provide behavioural coaching, helping you maintain a long-term perspective and avoid emotional investing mistakes. They will keep you focused on your financial goals and provide ongoing support and adjustments as needed.

- Maximising Returns: Financial advisors aim to maximise your investment returns while minimising risks. They can identify suitable investment opportunities and create a diversified portfolio to help grow your savings. Their expertise can potentially boost your returns and ensure your investments are well-managed.

- Regular Monitoring: Financial advisors don't just set up a plan and walk away. They continuously monitor your investments, make necessary adjustments, and help you stay on track. This proactive approach ensures your retirement plan adapts to changing market conditions and your evolving needs.

- Comprehensive Planning: Retirement planning involves much more than just investments. Financial advisors will consider your income sources, Social Security benefits, annuities, and other factors to create a comprehensive plan. They will also help you understand the impact of factors like healthcare costs, inflation, and unexpected expenses.

- Cost Savings: While hiring a financial advisor comes with fees, their expertise can ultimately save you money. They can help you avoid costly mistakes, identify tax-saving opportunities, and ensure your investments are optimised for the long term.

In summary, financial advice is invaluable when planning for retirement and investing $300k. It provides expert guidance, reduces anxiety, improves decision-making, and maximises your financial wellbeing throughout retirement. Working with a qualified financial advisor can give you confidence and peace of mind as you navigate this important stage of your life.

SIPs: Invest Now or Later?

You may want to see also

How to invest in stocks and shares

Investing in stocks and shares is a way to buy a small stake in a company. Companies issue shares to raise capital, which they use to develop their business and make bigger profits. Shareholders aim to make a profit by buying shares when the price is low and selling them when the price is higher.

There are two main ways to invest in stocks and shares: buying individual shares or investing in funds. When you buy individual shares, you are buying a small stake in one company. When you invest in funds, you are buying a mix of investments, so your risk is spread out.

If you want to invest in individual shares, you will need to understand how the stock market works. The value of shares is affected by many factors, including a company's earnings, news about the company, industry news, monetary policy, and inflation. It's important to remember that the value of your shares can go up or down, and you may lose your money.

If you want to invest in funds, you can choose from three main types: open-ended investment companies (OEICs), exchange-traded funds (ETFs), and investment trusts. OEICs are actively managed funds where investors buy units that rise and fall in value with the underlying assets. ETFs are passively managed funds that track an underlying index, such as the FTSE 100. Investment trusts are actively managed but, unlike OEICs, the share price may differ from the underlying value of the investments.

Before investing in stocks and shares, it's important to do your research and understand the risks involved. You should also consider seeking advice from an independent financial advisor who can help you define your goals, risk tolerance, and timeline for investing.

Apple: Invest Now or Miss Out?

You may want to see also

Alternative investments

When it comes to alternative investments, there are several options to consider. Here are some detailed suggestions to help you make the most of your $300k retirement fund:

Real Estate

Investing in real estate provides the opportunity for both short-term cash flow and long-term appreciation. You can buy property, often with the help of a loan, and lease it out to generate rental income. Over time, the property may also increase in value, allowing you to sell it for a profit. However, it's important to consider potential drawbacks, such as unexpected expenses, legal processes for evicting tenants, and challenges with selling the property quickly if needed.

Business Investments

Investing in a business, whether your own or someone else's, can be a way to generate income during retirement. This could be a source of recurring income or provide an opportunity to sell your equity for a payout. However, it's important to remember that small business startups can be unpredictable, and there is a risk of failure or needing additional funding.

Health Savings Account (HSA)

An HSA is designed for those with high-deductible health plans to help pay for medical expenses. Contributions to an HSA are often tax-deductible, and investment earnings can grow tax-free. Withdrawals for qualified medical expenses are also tax-free. While HSAs offer flexibility, it's important to consider the limited investment options and the potential for high fees.

Closed-End Funds (CEFs)

CEFs are a type of fund that invests in a variety of assets, including stocks, bonds, and other securities. They offer high yields, often around 7% on average, providing a steady income stream. CEFs are a good option for those seeking diversification, as they typically hold a variety of stocks and sectors.

Annuities

Annuities are a type of insurance product that can provide a steady income stream during retirement. By investing a lump sum, you can receive regular payments over a specified period or even for life. Annuities can help protect against the risk of outliving your savings and are often used in conjunction with Social Security benefits to maximize retirement income.

These alternative investment options can provide a way to diversify your retirement portfolio and maximize your income. It's important to carefully consider the risks and potential benefits of each option before making any decisions. Consulting with a financial advisor can help you make informed choices that align with your retirement goals and risk tolerance.

Savings, Investments, and Student Loans: Navigating the Tricky Triangle

You may want to see also

Frequently asked questions

Retiring on $300k is not possible in the US due to the high cost of living. However, in countries with a lower cost of living, $300k may be sufficient.

Returns vary depending on the type of investment. Diversifying your portfolio increases your chances of a higher return.

Typically, you owe taxes on any investment earnings, depending on your situation. However, you may be able to defer or avoid taxes by investing in a retirement account, such as a Roth IRA, or by utilising tax-loss harvesting and 1031 exchange opportunities in real estate investing.

There are various ways to invest $300k, including stocks, bonds, real estate, and retirement accounts. It is important to consider your financial goals, risk tolerance, and time horizon when deciding how to invest.