Investing is a powerful way to build wealth and secure your financial future, but it doesn't have to mean trading your time for money. The concept of not working while investing involves creating passive income streams that generate returns without your direct involvement. This can be achieved through various strategies such as investing in dividend-paying stocks, real estate investment trusts (REITs), or peer-to-peer lending platforms. By carefully selecting assets that provide regular income, you can achieve financial freedom and enjoy the benefits of wealth creation without the need for constant work. This approach requires research, planning, and a long-term perspective, but it offers the potential for a more relaxed and fulfilling lifestyle.

What You'll Learn

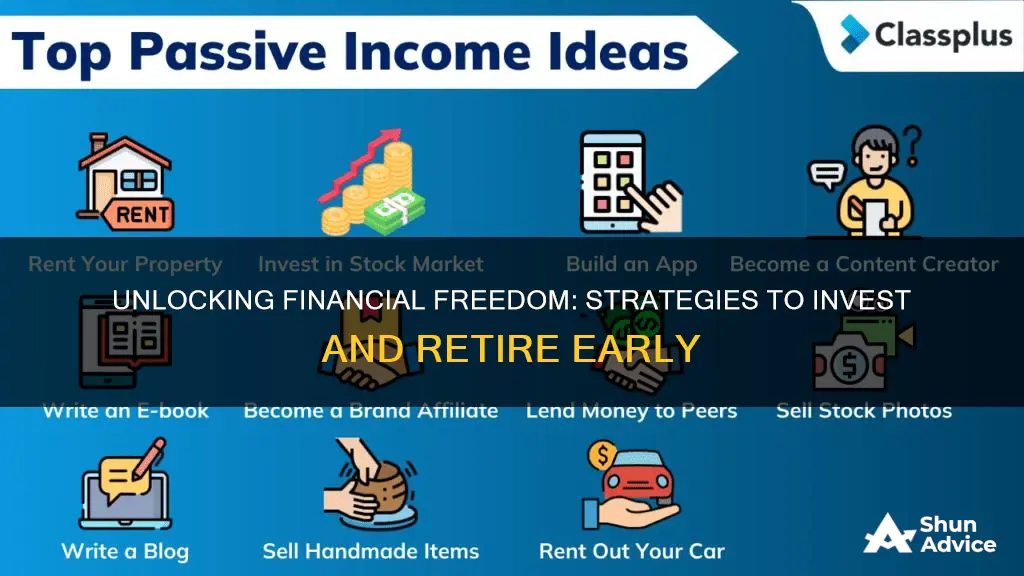

- Passive Income Streams: Diversify with rental properties, dividends, or royalties

- Frugal Living: Cut expenses, save on essentials, and invest surplus

- Side Hustles: Explore freelance work, online businesses, or creative pursuits

- Financial Automation: Utilize tech for budgeting, investing, and wealth management

- Early Retirement Strategies: Focus on high-yield investments and efficient wealth creation

Passive Income Streams: Diversify with rental properties, dividends, or royalties

The concept of passive income is an attractive one for those seeking financial freedom and the ability to work less while still earning a steady stream of cash. One of the most effective ways to achieve this is by diversifying your income streams, and one powerful method is through rental properties, dividends, and royalties. These avenues offer the potential to generate income with minimal ongoing effort, allowing you to truly invest and not work in the traditional sense.

Rental properties are a classic example of passive income. By purchasing a property, you can generate a steady income stream through rent. This approach requires an initial investment, but once the property is leased, the rent payments come in regularly with minimal effort. Over time, the property can appreciate in value, providing both a financial cushion and a long-term asset. It's important to research the local market, consider the costs of maintenance and taxes, and potentially engage a property management company to handle the day-to-day tasks, ensuring a smooth and profitable venture.

Dividend income is another powerful tool in the passive income arsenal. Investing in dividend-paying stocks or mutual funds allows you to earn a regular income stream without actively trading or managing the investments. Dividends are a portion of a company's profits paid out to shareholders, and they can provide a steady cash flow. Diversifying your dividend portfolio across different sectors and industries can further reduce risk and provide a more consistent income. This strategy is particularly appealing for those seeking a more hands-off approach to investing.

Royalties, often associated with creative works, can also be a passive income source. If you have a patent, copyright, or trademark, you can license it to others and earn royalties. For instance, an author can license their book's copyright, receiving royalties each time the book is sold. Similarly, inventors can license their patents to companies, generating a passive income stream. This method requires an initial creative effort but can provide long-term financial benefits with minimal ongoing work.

Diversifying your passive income streams is key to managing risk and maximizing returns. By combining rental properties, dividend investments, and royalties, you can create a robust financial portfolio. Each of these income streams has its own set of risks and rewards, and by carefully selecting and managing them, you can achieve a more secure and sustainable financial future. This approach allows you to invest in a way that generates income without the need for constant work, providing the freedom many aspire to.

Piggyvest: Unlocking Your Investment Potential with a Simple, Secure Approach

You may want to see also

Frugal Living: Cut expenses, save on essentials, and invest surplus

Frugal living is a powerful strategy to gain financial freedom and achieve your investment goals without the need for extensive work. It involves a shift in mindset and a commitment to reducing expenses, saving on essentials, and investing wisely. Here's a comprehensive guide to embracing a frugal lifestyle and maximizing your financial potential:

- Identify and Cut Expenses: The first step towards frugal living is understanding your spending habits. Start by listing all your monthly expenses, including fixed costs like rent, utilities, and insurance, as well as variable expenses such as groceries, entertainment, and transportation. Analyze this list critically and identify areas where you can cut back. For instance, consider cooking at home instead of dining out, negotiating bills, or canceling unnecessary subscriptions. Small changes can lead to significant savings over time.

- Save on Essentials: Frugality doesn't mean sacrificing your basic needs. Instead, focus on smart shopping and finding cost-effective alternatives. For groceries, plan meals, create a shopping list, and take advantage of discounts, coupons, or store loyalty programs. When it comes to housing, consider sharing accommodations or exploring more affordable neighborhoods. Look for ways to reduce utility bills by adopting energy-efficient practices, such as using smart power strips and LED bulbs. These simple adjustments will help you save money on essentials without compromising your quality of life.

- Prioritize and Invest Surplus: Once you've reduced your expenses, the next step is to allocate your savings effectively. Create a budget that allocates a portion of your income to savings and investments. Start by setting short-term goals, such as building an emergency fund or saving for a vacation. Then, look towards long-term financial objectives, like investing in stocks, bonds, or real estate. Consider consulting a financial advisor to create a personalized investment plan. By investing your surplus wisely, you can grow your wealth over time, potentially reaching a point where your investments generate enough income to cover your living expenses, allowing you to truly invest and not work.

- Embrace a Minimalist Lifestyle: Minimalism is a powerful philosophy that can complement your frugal living journey. It encourages owning fewer possessions and focusing on experiences rather than material goods. By adopting a minimalist mindset, you can reduce clutter, save money on maintenance, and free up time for activities that bring you joy. This approach often leads to a more fulfilling life, where financial freedom and personal happiness go hand in hand.

Remember, frugal living is a journey, and it may take time to see significant results. Be patient, stay disciplined, and regularly review your progress. With consistent effort, you can achieve financial independence and make your investments work for you, ultimately leading to a life where you can choose when and how much you work.

Starbucks Stock: Buy or Bye?

You may want to see also

Side Hustles: Explore freelance work, online businesses, or creative pursuits

Exploring side hustles can be a great way to generate extra income and potentially build a successful business while still maintaining a flexible lifestyle. Here are some ideas and strategies to consider:

Freelance Work:

Freelancing is an excellent avenue to start your side hustle journey. With the rise of remote work, numerous opportunities exist for freelancers in various fields. Identify your skills and expertise and offer your services online. Websites like Upwork, Fiverr, and Freelancer provide platforms to connect with clients worldwide. You can offer services such as writing, graphic design, web development, virtual assistance, or even specialized skills like data analysis or marketing consulting. The key is to showcase your portfolio, provide excellent customer service, and build a reputation to attract more clients.

Online Businesses:

Starting an online business allows you to create a passive income stream with minimal ongoing work. Consider your passions and hobbies, and think about how you can monetize them. For example, if you love baking, you could start an online bakery and deliver custom cakes or pastries. Alternatively, you could create an e-commerce store to sell handmade crafts or vintage items. Social media platforms like Instagram and TikTok have also made it easier to build an online presence and sell products directly to customers. You can also explore dropshipping, where you sell products without holding inventory by partnering with suppliers.

Creative Pursuits:

If you have a creative flair, consider turning your hobbies into a side hustle. Photography, for instance, can be a lucrative business with the right equipment and marketing. You can sell your photos on stock photo websites or offer your services for events and portraits. Similarly, if you're skilled in cooking or baking, you could start a catering service or sell your recipes online. Other creative options include graphic design, illustration, video editing, or even teaching art classes online. These pursuits often require initial investments in equipment or software, but they can provide a fulfilling and profitable side income.

When starting your side hustle, it's crucial to set clear goals, create a business plan, and manage your time effectively. Consider the time commitment required and ensure it aligns with your lifestyle and other responsibilities. Additionally, stay organized with accounting and record-keeping to ensure compliance with any legal requirements.

Remember, the key to success is finding something that aligns with your interests and skills, allowing you to enjoy the process while earning an income. With dedication and a well-planned strategy, your side hustle can become a sustainable and rewarding venture.

MN Investments: Will Fondell's Strategy Pay Off?

You may want to see also

Financial Automation: Utilize tech for budgeting, investing, and wealth management

Financial automation is a powerful strategy to achieve financial freedom and security without the need for traditional employment. By leveraging technology, you can streamline your financial processes, make informed decisions, and potentially grow your wealth over time. Here's a guide on how to utilize tech for budgeting, investing, and wealth management:

Budgeting and Expense Tracking: Start by utilizing budgeting apps or software that can help you gain control over your finances. These tools often allow you to connect your bank accounts and credit cards, automatically categorizing your expenses. You can set up budgets for different areas of your life, such as housing, transportation, entertainment, and savings. Regularly reviewing your spending patterns and comparing them to your budgeted amounts will help you identify areas where you can cut back and save more. Many of these apps also provide insights and visualizations, making it easier to understand your financial habits and make adjustments.

Automated Savings and Investment Platforms: Take advantage of online platforms that offer automated savings and investment solutions. These platforms often provide robo-advice, which uses algorithms to create personalized investment portfolios based on your risk tolerance, financial goals, and time horizon. You can set up automatic transfers from your checking account to your savings or investment accounts, ensuring consistent contributions. Some platforms also offer fractional shares, allowing you to invest in companies with small amounts of money, making it accessible to everyone. Additionally, look for platforms that provide tax-efficient investment options, such as tax-advantaged retirement accounts, to maximize your returns.

Robo-Advisors for Investment Management: Consider using robo-advisors, which are digital platforms that provide automated investment management services. These tools use sophisticated algorithms to build and manage a diversified investment portfolio tailored to your financial objectives. Robo-advisors typically offer low fees and provide a user-friendly interface to track your investments in real-time. They can automatically rebalance your portfolio to maintain your desired asset allocation, ensuring that your investments stay on track. With features like automatic re-investment of dividends and regular contributions, these platforms make investing simple and efficient.

Financial Automation Tools for Wealth Management: Wealth management is an essential aspect of long-term financial success. Explore automated wealth management services that offer portfolio optimization, tax-efficient strategies, and retirement planning. These tools can help you optimize your asset allocation, minimize tax liabilities, and ensure your investments are aligned with your financial goals. Additionally, look for platforms that provide financial planning resources, such as calculators for retirement income needs, net worth tracking, and financial goal setting. By utilizing these tools, you can make informed decisions about your wealth management strategy.

In summary, financial automation empowers you to take control of your financial future. By utilizing budgeting apps, automated savings and investment platforms, robo-advisors, and wealth management tools, you can make your money work for you without the need for constant active management. These technologies provide convenience, accessibility, and personalized guidance, allowing you to build a robust financial foundation and potentially achieve your investment goals while minimizing the need for traditional employment.

Paycheck Investing: A Guide to Regularly Buying Amazon Stock

You may want to see also

Early Retirement Strategies: Focus on high-yield investments and efficient wealth creation

The concept of early retirement is an appealing one, allowing individuals to enjoy their later years without the constraints of a traditional 9-to-5 job. One of the key strategies to achieve this goal is by focusing on high-yield investments and efficient wealth creation. This approach involves maximizing returns on your investments while minimizing the time and effort required to build wealth. Here's a detailed guide on how to embark on this path:

Identify High-Yield Investment Opportunities: The first step is to seek out investments that offer substantial returns with relatively low risk. This could include real estate investments, particularly in rental properties, which can provide a steady income stream. Another option is to invest in dividend-paying stocks, where companies distribute a portion of their profits to shareholders. These dividends can offer a regular income, and over time, the stock price may also appreciate. Additionally, consider peer-to-peer lending platforms that allow you to lend money to individuals or businesses, potentially earning higher interest rates than traditional savings accounts.

Diversify Your Investment Portfolio: Diversification is a crucial aspect of risk management. By spreading your investments across various asset classes, you can minimize the impact of any single investment's poor performance. Include a mix of stocks, bonds, real estate, and alternative investments in your portfolio. For instance, you could invest in index funds or exchange-traded funds (ETFs) that track a specific market or sector, providing instant diversification. Remember, the goal is to create a balanced portfolio that generates consistent returns over the long term.

Automate Your Wealth Creation Process: Efficiency is key to early retirement. Automate your investment process to make it effortless and consistent. Set up regular contributions to your investment accounts, such as a 401(k) or an individual retirement account (IRA). You can arrange for these contributions to be directly deducted from your paycheck or bank account, ensuring a steady flow of capital into your investment portfolio. Automation also allows you to take advantage of dollar-cost averaging, where you invest a fixed amount regularly, regardless of the market's volatility. This strategy can be particularly beneficial in the long run.

Minimize Fees and Taxes: High-yield investments often come with associated costs and fees. These can eat into your returns, so it's essential to minimize them. Opt for low-cost index funds or ETFs, which typically have lower expense ratios than actively managed funds. Additionally, consider tax-efficient investment vehicles like Roth IRAs, which offer tax-free growth and withdrawals, or tax-efficient mutual funds that minimize capital gains distributions. By reducing fees and optimizing your tax situation, you can keep more of your hard-earned money.

Build Passive Income Streams: The ultimate goal is to create a passive income that covers your living expenses, allowing you to retire early. Focus on investments that generate recurring income, such as rental properties or dividend-paying stocks. As your wealth grows, you can reinvest the dividends or rental income to create a self-sustaining cycle. Additionally, consider licensing your intellectual property or creating digital products that provide ongoing revenue with minimal ongoing effort.

By implementing these strategies, you can work towards financial independence and early retirement. It requires careful planning, a long-term perspective, and a willingness to adapt to market changes. Remember, the key is to maximize returns while minimizing the effort required, ensuring a comfortable and financially secure future.

Unveiling the Secrets: How Investment Management Firms Navigate the Markets

You may want to see also

Frequently asked questions

Investing in passive income streams is a popular way to generate money without daily involvement. This can include investing in real estate through REITs (Real Estate Investment Trusts), which allows you to own a share of a property portfolio without managing individual properties. Another option is investing in dividend-paying stocks or mutual funds, where companies distribute a portion of their profits to shareholders regularly. These strategies provide a steady income stream and can be a way to build wealth over time with minimal ongoing effort.

Index funds and exchange-traded funds (ETFs) are excellent choices for beginners who want to invest with minimal effort. These funds track a specific market index, such as the S&P 500, and offer instant diversification across multiple companies. They are managed by professionals, making them a hands-off investment strategy. Additionally, automated investment platforms, also known as robo-advisors, provide a simple way to invest by offering pre-built portfolios based on your risk tolerance and goals, requiring little to no manual intervention.

Cryptocurrencies have gained significant attention as a potential investment opportunity, but they are also known for their volatility. Investing in cryptocurrencies can be a high-risk, high-reward venture. While some investors have made substantial profits, it requires a good understanding of the market and the ability to make quick decisions. Cryptocurrency investments often involve a higher level of research and monitoring compared to traditional investments. It's essential to diversify your portfolio and only invest what you can afford to lose.

Yes, several investment strategies are designed to minimize the need for constant monitoring. One popular approach is dollar-cost averaging, where you invest a fixed amount of money at regular intervals, regardless of the asset's price. This strategy helps to smooth out market volatility and reduces the risk of investing a lump sum at an inopportune time. Another strategy is to invest in target-date funds, which are designed to provide a balanced portfolio based on your expected retirement date, automatically adjusting as you get closer to that target.

Investing in the stock market without being a stockbroker is entirely possible through online brokerage platforms and robo-advisors. These platforms allow you to open an account, deposit funds, and start investing in stocks, bonds, and other securities with just a few clicks. Many of these platforms offer low or no-fee trading, making it an affordable option. Additionally, robo-advisors provide a simplified investment approach by offering automated portfolio management based on your financial goals and risk tolerance, eliminating the need for manual stock selection.