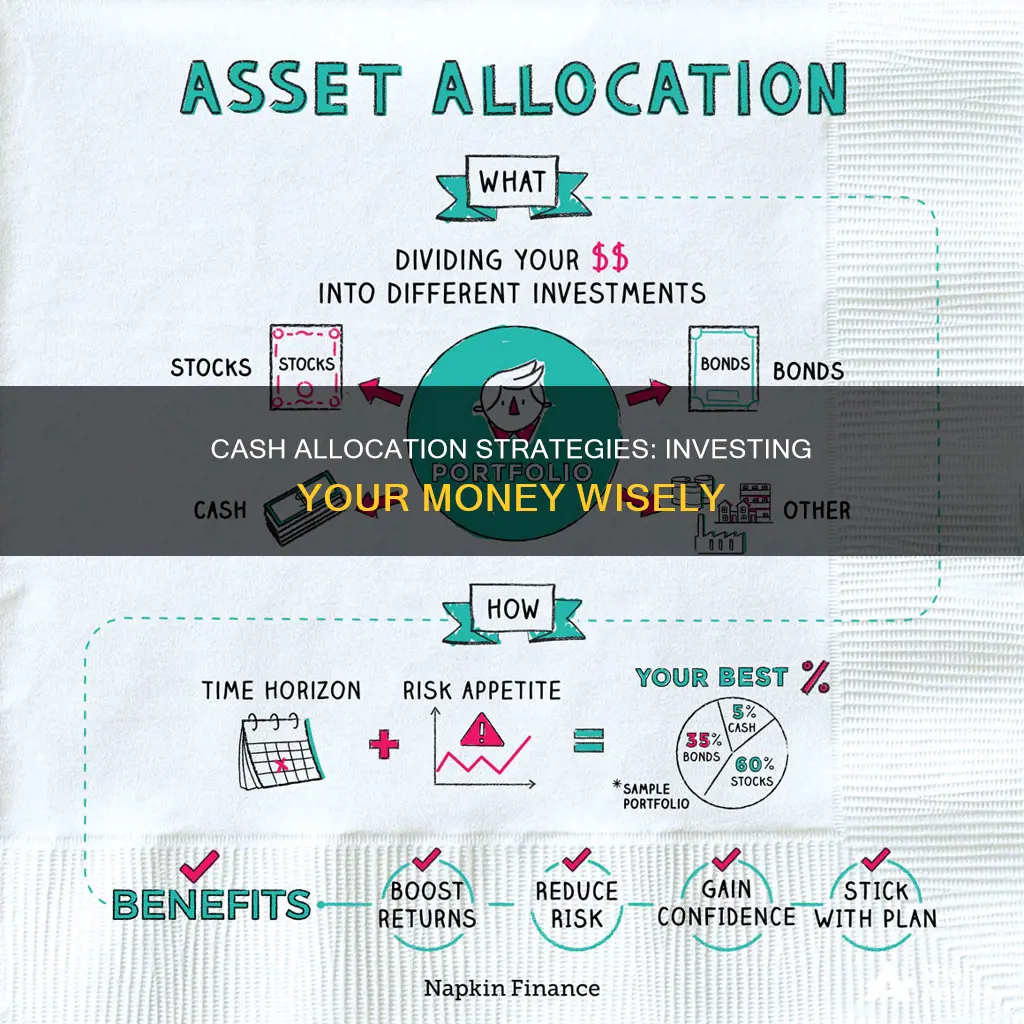

Cash allocation is an important part of any investment strategy. While cash and cash-like assets such as savings accounts, money market accounts, and certificates of deposit are not typically thought of as investments, they are an important piece of the asset allocation puzzle. These highly liquid assets offer a very low rate of return but also come with very low risk, making them a stable investment asset.

The benefits of cash allocation include liquidity, portfolio stability, and emergency funds. The general rule of thumb is that cash and cash equivalents should comprise between 2% and 10% of your portfolio, but this will depend on your financial goals, risk tolerance, and time horizon. For example, if you are planning a big purchase within the next few years, it makes sense to set aside a larger portion of cash in advance.

While cash may provide a sense of safety, it is important to be strategic about cash allocation as part of your overall investment strategy.

| Characteristics | Values |

|---|---|

| Purpose | Emergency funds, peace of mind, liquidity, portfolio stability, investment opportunities |

| Percentage of portfolio | 2-10% |

| Time horizon | Short-term: cash assets, savings, money market accounts, CDs, bonds. Long-term: stocks, equity funds |

| Risk tolerance | Conservative: cash, money market funds, CDs, bonds. Aggressive: stocks, equity funds |

| Returns | Low |

| Opportunity cost | High |

| Reinvestment risk | High |

What You'll Learn

- Stocks: historically the highest-returning asset class, but also the riskiest

- Bonds: safer, more conservative assets with lower rates of return

- Cash and cash-like assets: highly liquid, low-risk investments with low rates of return

- Risk tolerance: how much of your investment you're willing to lose for potential gains

- Time horizon: how long before you need the money

Stocks: historically the highest-returning asset class, but also the riskiest

Stocks are a type of security in which investors can allocate their money. They are typically considered a risky investment option, but they also offer the highest potential returns.

Stocks are a type of equity, which is one of the three main asset classes, the other two being fixed income and cash or cash equivalents. Within the stock market, there are different subclasses of stocks, such as large-cap, mid-cap, and small-cap stocks, which refer to the market capitalization of the company. Large-cap stocks are issued by companies with a market capitalization of over $10 billion, while small-cap stocks are issued by companies with a market cap of less than $2 billion. Small-cap stocks tend to be riskier due to their lower liquidity.

The level of risk and potential return of stocks varies depending on the specific type of stock and the overall market conditions. Stocks are considered riskier than other asset classes because investors can quickly lose their principal investment. Stock prices can be unpredictable, especially for novice investors, and they can fluctuate significantly in the short term. However, stocks have historically delivered average annual returns that have exceeded the rate of inflation, making them a good option for long-term investment goals.

When investing in stocks, it is important to conduct thorough research and consider factors such as financial goals, risk tolerance, and investment horizon. Stocks are generally recommended for investors with a long time horizon who are comfortable with high-risk, high-return options. One common guideline is to hold a percentage of stocks in your portfolio equal to 100 minus your age. For example, if you are 30 years old, 70% of your portfolio should be in stocks.

Additionally, it is worth noting that stocks should not be the only asset class in an investment portfolio. Diversification across different asset classes, such as stocks, bonds, and cash, is crucial to balance risk and potential returns. Regular portfolio reviews and adjustments are necessary to ensure that your investments align with your financial goals and risk tolerance.

Investing: Negative Cash Flow's Impact and Insights

You may want to see also

Bonds: safer, more conservative assets with lower rates of return

Bonds are a type of fixed-income security, which means they provide a fixed and regular income in the form of interest payments. They are considered a safer and more conservative investment option compared to stocks due to their lower volatility and more stable returns. While they may not offer the same high growth potential as stocks, they are a crucial component of a well-diversified investment portfolio.

Bonds are essentially loans made by investors to governments or corporations, who use the funds for projects or to finance their operations. In return, the issuer of the bond promises to pay the investor a specified rate of interest over a set period, known as the coupon rate. At the end of the bond's maturity period, the issuer repays the face value of the bond to the investor.

The interest payments received from bonds can provide a steady source of income, making them attractive to conservative investors, especially those seeking current income, such as retirees. Additionally, bonds are considered lower-risk because, in the event of bankruptcy, bondholders have a higher claim on the company's assets than shareholders.

When considering investing in bonds, it's important to understand the different types available. Government bonds, issued by national governments, are generally considered the safest as they are backed by the full faith and credit of the issuing government. Corporate bonds, on the other hand, are issued by companies and tend to offer higher interest rates but also carry more risk. The risk associated with corporate bonds depends on the financial health and creditworthiness of the issuing company.

It's worth noting that while bonds are considered a safer investment, they are not entirely risk-free. Bond prices can fluctuate in response to changes in interest rates and inflation. When interest rates rise, bond prices tend to fall, and vice versa. Additionally, there is also the risk of default, where the issuer fails to make interest payments or repay the principal amount. This risk is typically higher for corporate bonds, especially those issued by less financially stable companies.

When constructing a conservative investment portfolio, it's common to include a significant allocation to bonds. For example, a conservative portfolio might consist of 40% short-term government bonds, 40% ultra short-term corporate bonds, and 20% ultra short-term government bonds. Such a portfolio aims to preserve capital and provide a steady income while minimising volatility and potential losses.

In summary, bonds are a crucial component of a conservative investment strategy. They offer a safer and more stable option for investors seeking to preserve their capital and generate a steady income. While they may not provide the high returns associated with riskier assets, they play an important role in diversifying an investment portfolio and protecting it from more volatile market forces.

Cash App Investing: Are There Any Fees Involved?

You may want to see also

Cash and cash-like assets: highly liquid, low-risk investments with low rates of return

Cash and cash-like assets are highly liquid, low-risk investments with low rates of return. They are a good option for conservative investors who want to protect their money from potential losses while still benefiting from modest growth.

Cash and cash-like assets include money in your checking account, savings account, or money market account. They also include cash equivalents, which are investments with short-term maturities (less than 90 days) such as stocks, bonds, and mutual funds that can be quickly converted to cash.

While cash and cash-like assets are safe and liquid, they may not be the best option for long-term investing. Historically, cash has barely kept up with rising prices, and it has not been able to achieve one of the most important long-term investing goals: returning more than inflation.

Therefore, cash and cash-like assets are best used for two strategic purposes:

- Money for emergencies: It is advisable to have savings that could last you at least three months in case of unexpected expenses or loss of income. This cash should be in highly liquid forms, such as bank savings or checking accounts, so that it is readily available when needed.

- Money to be invested: This is money that you plan to invest soon but are waiting for the right time or opportunity. This money should be kept in accounts that you can access relatively quickly, such as a traditional money market mutual fund or a managed solution like a separately managed account.

While cash and cash-like assets are important for emergency funds and short-term investing, they should only occupy a small place in most investment portfolios relative to stocks and bonds. This is because they offer lower potential returns, and inflation can erode the purchasing power of money invested in low-risk assets over time.

Understanding Invested Assets: Does Cash Count?

You may want to see also

Risk tolerance: how much of your investment you're willing to lose for potential gains

Risk tolerance is a crucial aspect of investing, as it determines how much risk an investor is willing to take on in pursuit of potential gains. It is defined by the U.S. Securities and Exchange Commission (SEC) as "an investor's ability and willingness to lose some or all of an investment in exchange for greater potential returns".

When assessing your risk tolerance, it's important to consider both your willingness to take risks and your financial ability to do so. Your willingness tends to remain constant, even as your financial position changes, and it is influenced by factors such as your comfort with market volatility and your natural temperament. On the other hand, your financial ability to take risks will shift over time, depending on factors such as your liquidity needs, time horizon, and the importance of the financial goal.

For example, if you are saving for retirement decades away, you may have a higher risk tolerance and be comfortable investing mostly in stocks, despite their volatility, as you have ample time to recover from potential downturns. In contrast, if you are nearing retirement or saving for a down payment on a house, you may have a lower risk tolerance and opt for a more conservative approach with a higher proportion of bonds and cash.

It's worth noting that while cash and cash equivalents are generally considered safe investments, they may not provide returns that outpace inflation over the long term. Therefore, it is crucial to strike a balance between cash and other investments to achieve your financial goals.

To summarise, understanding your risk tolerance is vital for making informed investment decisions. By considering both your willingness to take risks and your financial ability to do so, you can tailor your investment portfolio to align with your goals and comfort level.

Strategies to Maximize Cash Investments in Just One Year

You may want to see also

Time horizon: how long before you need the money

When deciding how to allocate your cash investments, it's important to consider your time horizon, or how long it will be before you need the money. If you're investing for a short-term goal, such as a vacation in the near future, you'll want to take on less risk, as a sudden market decline could put a serious dent in your investments. In this case, experts recommend allocating most of your investments in cash assets, such as savings or money market accounts, certificates of deposit (CDs), or even certain high-quality bonds. While these options offer lower returns, they are also less risky, ensuring that you don't lose the money you need in the short term.

On the other hand, if you have a longer time horizon, such as saving for retirement, you can afford to take on more risk. In this case, you may opt for a higher allocation of stocks or equity funds, which have the potential for higher growth. Keep in mind that with aggressive, higher-risk allocations, your account value may fall in the short term, but if you have a long time horizon, you can wait for the market to recover. Historically, the stock market has recovered after every downturn, although the recovery time is unpredictable.

It's also important to note that as your time horizon shortens, you may want to adjust your asset allocation to be more conservative, even if you have a high-risk tolerance. For example, if you are nearing retirement, you may want to switch to a bond- and fixed-income-heavy portfolio to protect the money you've accumulated.

Additionally, it's worth considering the impact of inflation on your cash investments. While cash and cash equivalents are safe and liquid, they may not offer returns that outpace inflation, which can erode your purchasing power over time. Therefore, it's crucial to strike a balance between cash allocations and investments with higher growth potential to ensure your money retains its value.

Overall, determining the appropriate cash allocation depends on your individual circumstances and goals. It's recommended to seek advice from a financial advisor to create a personalized investment plan that aligns with your time horizon and risk tolerance.

How Cashing Investments Affect Debt Service Coverage

You may want to see also

Frequently asked questions

A general rule of thumb is that cash and cash equivalents should comprise between 2% and 10% of your portfolio. However, the precise percentages depend on your personal situation and needs. Cash should occupy a small place in most investment portfolios, relative to stocks and bonds.

Cash and cash equivalents are among the safest and most liquid of investments. Cash is available when you need it and there is little risk to the principal. However, cash has historically not been able to achieve one of the most important long-term investing goals: returning more than inflation.

Cash is a good investment when you need money for emergencies or when you plan to invest soon but are waiting for the right time or opportunity.