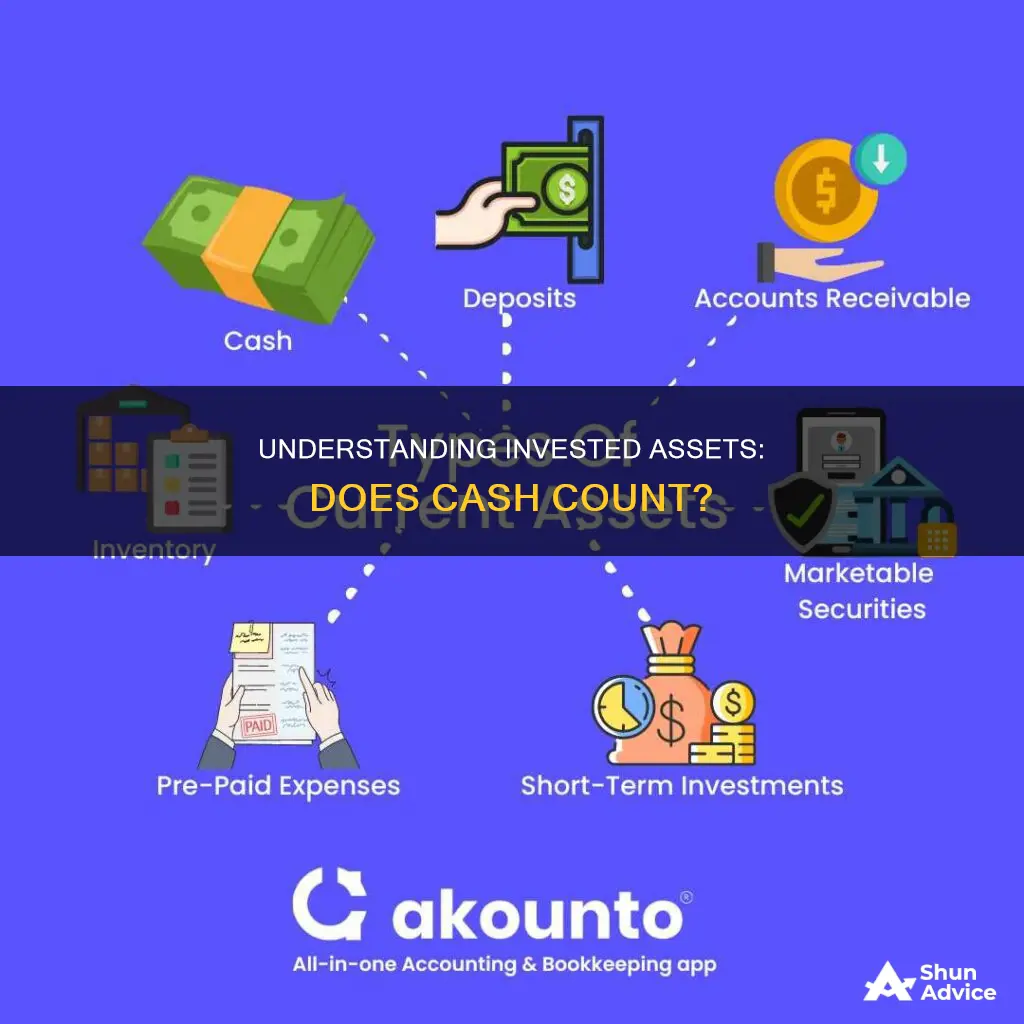

Whether or not average invested assets include cash depends on the investor and their financial goals. While some investors view cash as a wasted asset, others believe that keeping some cash on hand provides a wealth of opportunities. Generally, cash and cash equivalents are considered highly liquid, low-risk investments that can provide portfolio stability and emergency funds. However, the opportunity cost of holding cash is that investors may miss out on market gains and the potential for higher returns from stocks and bonds. Therefore, investors must carefully consider their risk tolerance, financial goals, and current market conditions when deciding how much cash to include in their invested assets.

| Characteristics | Values |

|---|---|

| Recommended cash allocation | 2-10% of your portfolio |

| Advantages of cash allocation | Liquidity, portfolio stability, emergency funds |

| Cash equivalent securities include | Savings, checking and money market accounts, and short-term investments |

| Cash allocation depends on | Your financial goals and objectives, your time horizon for investing, your risk tolerance, your current stage in life |

| Cash allocation for retirees | A portion of your retirement portfolio can be directed to cash equivalents to help you reliably meet income needs over a 2-3 year period |

| Cash allocation for younger investors | Younger investors have a longer runway to weather market corrections, and they can take advantage of down markets to dollar-cost average to add more shares |

| Cash allocation for large expenses | If you know you have a large expense coming up, such as buying a house, then it's unwise to put that money at risk of short-term market fluctuations |

| Cash allocation for career goals | Entrepreneurs may want to maintain large cash positions to allow for future self-funding of a startup or to make an angel investment |

| Cash allocation in high-interest-rate environment | Money market funds, high-yield savings accounts, CDs |

| Cash allocation for emergency funds | Enough cash to cover expenses for at least three months |

What You'll Learn

Liquidity and financial opportunities

Cash is the most liquid asset, while tangible items like real estate, art, and collectibles are less liquid. Financial assets such as stocks, bonds, and other exchange-traded securities fall on a spectrum of liquidity, with some being more liquid than others. The liquidity of an asset is crucial when considering investment opportunities as it indicates how quickly it can be converted into cash to seize these opportunities.

Market liquidity and accounting liquidity are the two main types of liquidity. Market liquidity refers to the efficiency of a market in facilitating the buying and selling of assets at stable prices. A stock market with a high volume of trade will generally have a narrower spread between the bid and ask prices, indicating higher liquidity. Accounting liquidity, on the other hand, measures an individual's or company's ability to meet their financial obligations with their liquid assets.

Several ratios are used to measure liquidity, including the current ratio, quick ratio, acid-test ratio, and cash ratio. These ratios help assess an entity's ability to meet short-term obligations and provide insight into their financial health.

Maintaining sufficient liquidity is essential for both individuals and companies. For individuals, it provides peace of mind and the ability to pursue new opportunities. For companies, it is crucial for meeting customer withdrawals, compensating for balance sheet fluctuations, and funding growth initiatives.

When determining the appropriate level of cash in an investment portfolio, it is essential to consider factors such as financial goals, risk tolerance, and time horizon. While cash provides liquidity and stability, it may not be ideal for long-term investment goals due to the potential erosion of its value over time due to inflation. Therefore, a balanced approach is necessary to ensure that cash holdings do not hinder the potential for higher returns from other investments.

Restricted Cash: A Viable Investment Option?

You may want to see also

Emergency funds

When it comes to emergency funds, accessibility and liquidity are key. You want to ensure that your money is easily accessible and can be quickly converted into cash without penalties. Here are some recommended ways to invest your emergency funds to balance liquidity and potential returns:

- Money Market Accounts: These accounts, offered by banks or credit unions, are a mix between a checking and savings account. They are considered low risk and typically provide Annual Percentage Yields (APYs) of around 3-4%. Many money market accounts offer debit card and/or check-writing privileges, and your money is protected by the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Association (NCUA) up to $250,000 per account.

- High-Yield Savings Accounts: These accounts, often offered by online banks, provide higher interest rates than traditional savings accounts, allowing you to earn around 3-4% APY compared to the average of 0.3% for traditional savings. Your money is easily accessible through online transfers, wire transfers, or check requests. Like money market accounts, they are FDIC-insured.

- Certificates of Deposit (CDs): CDs can offer higher interest rates than checking accounts, especially for longer maturities. However, accessing your money before the maturity date usually incurs a penalty. To increase liquidity, consider creating a CD ladder with smaller CDs that mature at different intervals. Some banks also offer no-penalty CDs, which provide slightly lower interest rates but allow you to withdraw your money without sacrificing earned interest.

While it may be tempting to invest your emergency funds in riskier assets like stocks or real estate, financial experts generally advise against this due to the potential for loss and the reduced liquidity of these investments. The primary goal of an emergency fund is to provide a stable financial cushion that you can access quickly in times of need. Therefore, it's best to prioritize liquidity and preservation of capital over the potential for higher returns.

Invest Cash Safely: Strategies for Secure Financial Growth

You may want to see also

Cash equivalents

- Treasury bills

- Short-term government bonds

- Banker's acceptance

- Commercial paper

- Money market accounts

- Certificates of deposit

Companies carry cash and cash equivalents for several reasons:

- To pay current debts

- To save for future capital investments

- To plan for emergencies

- To meet financial covenants

Understanding Proceeds From Equipment Sales: Cash From Investing?

You may want to see also

Risk and volatility

While cash and cash equivalents are generally considered to be among the safest and most liquid of investments, they do carry certain risks. Notably, cash investments have historically not been able to achieve one of the most important long-term investing goals: returning more than inflation. As Matthew Diczok, head of fixed income strategy at Merrill and Bank of America Private Bank, puts it, "If you're not generating returns above the inflation rate, you're not increasing your purchasing power over time; you're essentially on an investment treadmill, not really getting anywhere."

Another downside of cash investments is "reinvestment risk", which refers to the financial cost of having to invest cash flows at potentially lower yields in the future. Short-term interest rates can change quickly, and if you haven't "locked in" rates for a longer period, you are exposed to these market moves.

Additionally, while cash can provide liquidity and portfolio stability, it may also result in missed opportunities for higher returns. As financial planner Andy Moran notes, "In the short term, cash is king, but over the long term, cash is trash." This is because cash investments tend to have lower returns than stocks and bonds over the long term.

When it comes to volatility, cash investments are generally considered to be less volatile than other assets, such as stocks or real estate. Volatility refers to the likelihood and magnitude of sudden swings or big changes in an asset's price. Cash and cash equivalents, such as savings accounts, money market accounts, and short-term investments, typically have stable values and are not subject to the same level of price fluctuations as riskier assets.

However, it is important to note that even cash investments can be affected by market volatility and economic conditions. For example, during times of high interest rates, cash investments may become more attractive as they offer higher yields. On the other hand, during periods of low interest rates, investors may seek higher returns in riskier assets, potentially reducing the demand for cash investments.

In summary, while cash and cash equivalents offer stability and liquidity, they also carry the risk of underperforming inflation and missing out on potential gains from riskier assets. As with any investment, it is essential to consider your financial goals, risk tolerance, and time horizon before deciding on the appropriate allocation of cash in your portfolio.

Understanding the Investing Activities on a Cash Flow Statement

You may want to see also

Cash allocation

Generally, cash and cash equivalents, such as savings and money market accounts, should comprise between 2% and 10% of a portfolio. This range can vary based on unique circumstances, and some situations may call for higher cash allocations. For example, investors in their 20s tend to hold more assets in cash, with a median cash balance of $43,639, while those nearing retirement may increase their cash reserves to weather economic downturns and provide peace of mind.

While cash provides liquidity and stability, it is important to consider the potential downsides. Cash holdings may miss out on market gains and may not keep up with inflation over time. Therefore, finding the right balance between cash and other investments is crucial to achieving financial goals.

Cash Investments: What Are They?

You may want to see also

Frequently asked questions

Keeping cash in your portfolio can provide liquidity in an emergency and help you weather a market downturn. It also allows you to take advantage of new investment opportunities.

Keeping too much cash in your portfolio means missing out on potential higher returns from investing in stocks and bonds. Additionally, cash has historically not been able to keep up with rising prices due to inflation.

The general rule of thumb is to keep between 2% and 10% of your portfolio in cash or cash equivalents. However, this may vary depending on your financial goals, risk tolerance, and personal circumstances. Some investors recommend keeping at least 5% in cash, while others suggest up to 20%.

Instead of keeping a large amount of cash in your portfolio, you can consider investing in short-term, low-risk options such as money market funds, high-yield savings accounts, or certificates of deposit (CDs). These options provide liquidity while potentially earning higher interest.

Your age is an important factor to consider when deciding how much cash to keep. Younger investors with a longer investment horizon may be advised to hold less cash and take on more risk. On the other hand, retirees or those closer to retirement may want to keep a larger cash position for peace of mind and to meet income needs.