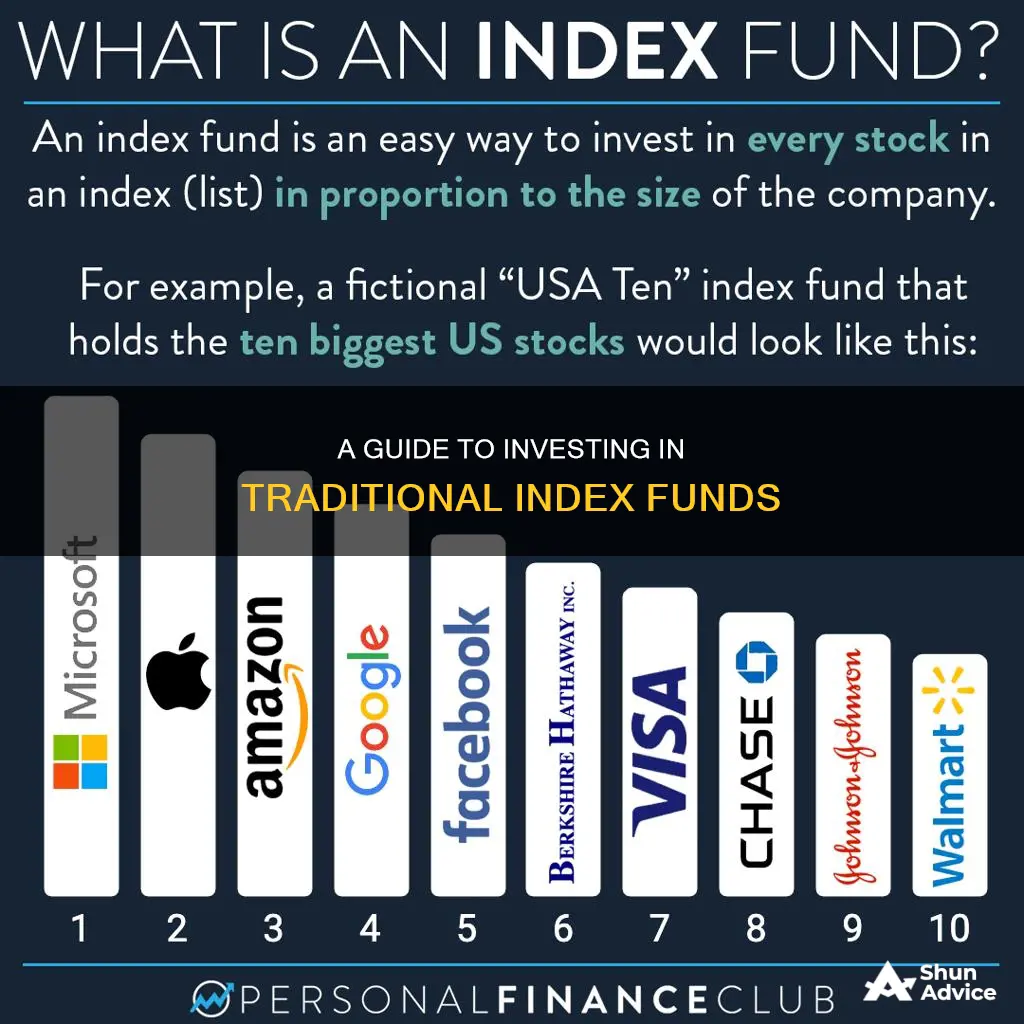

Index funds are a great way to build wealth over time, especially for beginners. They are a type of investment fund that aims to mirror the performance of a specific market index, like the S&P 500. By investing in an index fund, you are able to diversify your portfolio and reduce risk, as your investments are tied to the performance of a wide range of companies.

Index funds are passively managed, meaning they don't require active decision-making on which investments to buy or sell. This passive management strategy makes index funds a low-cost option, as fees tend to be lower compared to actively managed funds.

To invest in index funds, you can open a brokerage account, a traditional IRA, or a Roth IRA. You can also invest through your employer's 401(k) plan. When choosing an index fund, consider factors such as the fund's expenses, investment minimums, and long-run performance.

Index funds offer an easy and effective way to build wealth, providing diversification, low fees, and minimal investment research.

| Characteristics | Values |

|---|---|

| Definition | A type of mutual fund or exchange-traded fund (ETF) that holds all (or a representative sample) of the securities in a specific index, with the goal of matching the performance of that benchmark as closely as possible. |

| Benefits | Low fees, tax advantages (they generate less taxable income), and low risk (since they’re highly diversified). |

| Downsides | A portfolio that rises with its index falls with its index. |

| How to invest | 1. Research and analyze index funds; 2. Decide which index fund to buy; 3. Purchase your index fund. |

| Considerations | Long-run performance, expense ratio, trading costs, fund options, convenience. |

What You'll Learn

Choose an index fund with the lowest costs and closest index tracking

When choosing an index fund, it is important to consider both the costs and how closely the fund tracks the index. Here are some factors to keep in mind:

- Index tracking: First, consider how closely the index fund tracks the performance of the index. This is one of the most important factors in choosing an index fund. The fund should aim to mirror the performance of the underlying index as closely as possible. You can compare the returns of the index fund to the returns of the benchmark index to evaluate how closely the fund tracks the index.

- Costs: Index funds typically have lower costs than actively managed funds, but it is still important to consider the fees associated with the fund. Look for funds with low expense ratios, as these fees can eat into your investment returns over time. Other costs to consider include investment minimums, account minimums, and trading costs.

- Diversification: Index funds offer built-in diversification, as they invest in a basket of stocks or bonds that make up the index. However, some indexes may be more diversified than others. For example, a broad index like the S&P 500 offers more diversification than an index that focuses on a specific industry or sector.

- Performance: Consider the long-term performance of the index fund to get an idea of how it might perform in the future. Keep in mind that past performance is not a guarantee of future results, but it can give you an idea of how the fund has performed relative to the index over time.

- Tax efficiency: Index funds are generally more tax-efficient than actively managed funds because they tend to buy and sell holdings less frequently, resulting in fewer capital gains distributions. This can reduce your tax bill, especially if you are investing in a taxable account.

- Fund size: Larger index funds tend to have lower fees, as the costs are spread out over a larger number of investors. However, smaller funds may offer more specialized investments or focus on specific sectors or industries.

By considering these factors, you can choose an index fund with the lowest costs and closest index tracking, maximizing your investment returns and minimizing your risks.

Retirement Funds: Best Indian Investment Options

You may want to see also

Research and analyse index funds

Index funds are a type of investment vehicle that tracks a market index, such as the S&P 500 or the Russell 2000. They are designed to mirror the performance of the index by holding the same stocks or bonds or a representative sample of them. When researching and analysing index funds, there are several key factors to consider:

- Index selection: Choose an index that aligns with your investment objectives and the segments of the market you want exposure to. Popular indexes include the S&P 500, Dow Jones Industrial Average, Nasdaq Composite, and Russell 2000.

- Fund fees and costs: Index funds are known for their low fees, but it's important to compare the expense ratios of different funds. The expense ratio represents the annual percentage-based charge for managing the fund, which is subtracted from each shareholder's returns. Additionally, consider the investment minimum and account minimum required to invest in a particular index fund.

- Tracking error: Evaluate the tracking error, which indicates how closely the fund matches the returns of its benchmark index. A wide tracking error may suggest challenges in efficiently managing the fund's holdings.

- Fund size and liquidity: Larger funds often offer more liquidity and lower trading costs, but it's important to compare the trading costs and liquidity of different funds to assess how easy it would be to liquidate your investment if needed.

- Diversification: Index funds provide instant diversification by allowing you to invest in a basket of securities rather than individual stocks. Consider the level of diversification offered by the fund and whether it aligns with your risk tolerance.

- Fund provider and accessibility: Research the fund provider's reputation and track record. Also, consider the accessibility of the fund, including whether it can be purchased directly from the fund provider or through a brokerage account or investment app.

- Performance and historical returns: Evaluate the fund's historical performance and returns over different time periods. Compare these returns with those of the benchmark index to assess how well the fund has tracked the index.

- Tax implications: Index funds are generally tax-efficient due to their low turnover ratios. However, consider the tax implications of investing in the fund, especially if held outside tax-advantaged accounts, as capital gains taxes may apply.

M1 Finance: Invest in One Fund for Easy Diversification

You may want to see also

Decide which index fund to buy

When deciding which index fund to buy, there are several factors to consider.

Firstly, it is important to understand the different types of index funds available. These can be categorised by the index they track, such as the S&P 500, Dow Jones Industrial Average, or Nasdaq Composite, or by the type of companies they include, such as large-cap, mid-cap, or small-cap funds. There are also sector-specific index funds, which focus on specific industries like healthcare or information technology.

Once you have decided on the type of index fund you want to invest in, you can compare specific funds. Morningstar analysts Ryan Jackson and Mo'ath Almahasneh recommend looking for funds that are representative, diversified, investable, transparent, sensible, and have low turnover.

Financial advisors also recommend choosing index funds with low expense ratios, as these fees can eat into your returns over time. It is also worth considering the tax implications of investing in an index fund, as mutual funds tend to be less tax-efficient than ETFs.

Finally, consider the investment minimums and account minimums required to invest in a particular index fund, as these can vary significantly between funds.

CEF Funds: Where the Rich Invest Their Money

You may want to see also

Determine how hands-on you'd like to be

There are several ways to invest in index funds, depending on how actively you want to manage your investments. Here are some options:

DIY

If you are an active investor, you can buy and sell index funds yourself through a brokerage account. You will need to determine which index funds best fit your needs and monitor their performance. If you are investing through a company-sponsored plan like a 401(k), you may have a limited selection of funds to choose from.

With active help

Working with a financial professional can be beneficial for investors who want guidance. A professional can typically walk you through the index funds that may align with your goals and, in some cases, handle the buying and monitoring for you.

Robo-advisors

Robo-advisors, such as Wealthfront and Betterment, can also be a good option for those who want a more hands-off approach. They will invest in a handful of index funds and ETFs based on your risk tolerance and investment timeline. Robo-advisors automatically rebalance your portfolio based on market conditions and usually have lower fees than traditional financial advisors.

Liquid Fund Investment Strategies: Where to Invest?

You may want to see also

Decide how much money to invest

When deciding how much money to invest in a traditional index fund, it is important to consider your financial situation and goals. Here are some key factors to keep in mind:

- Investment goals: Determine your investment goals, such as saving for retirement, education, or health expenses. Each goal may require a different type of account, such as an employer-sponsored retirement plan, an Individual Retirement Account (IRA), a 529 plan for education savings, or a Health Savings Account (HSA). Understanding your goals will help you choose the right type of account and index fund.

- Risk tolerance: Consider your risk tolerance, which refers to how comfortable you are with fluctuations in the value of your investments. Index funds are generally considered lower-risk investments due to their diversification, but different types of index funds carry different levels of risk. For example, broad market funds are more diversified and less risky than sector funds, which focus on a specific industry or market.

- Financial situation: Assess your financial situation, including your income, expenses, and savings. Calculate the amount you can comfortably afford to invest after covering your essential expenses and building an emergency fund. This will help you determine how much you can invest initially and on an ongoing basis.

- Investment minimums and fees: Some index funds have investment minimums, which is the minimum amount required to invest. Consider the investment minimums of the funds you are interested in and choose the ones that align with your budget. Additionally, be mindful of any fees associated with the funds, such as expense ratios, sales loads, or transaction costs. These fees can impact your returns over time.

- Diversification and asset allocation: Diversification is a key advantage of index funds, as they allow you to invest in a wide range of securities. Consider your overall investment portfolio and determine how much you want to allocate to index funds. Diversifying your investments across different asset classes and industries can help manage risk.

- Time horizon: Think about your investment time horizon, or how long you plan to invest for. If you are investing for the long term, you may be able to ride out short-term market fluctuations and take advantage of compound growth. Index funds are generally suitable for long-term investing.

By considering these factors, you can make an informed decision about how much money to invest in a traditional index fund. Remember to seek professional financial advice if needed, as this will help you make the most suitable choices for your specific circumstances.

Mutual Funds: Best Investment Option for Your Money

You may want to see also

Frequently asked questions

An index fund is a type of mutual fund or exchange-traded fund (ETF) that holds all (or a representative sample) of the securities in a specific index, aiming to match its performance.

You should first decide on your investment goals and risk tolerance. Then, research and analyse different index funds and decide which one best fits your needs and goals. Finally, consider the fund's expenses, taxes, investment minimums and long-run performance before making a decision.

You can buy an index fund directly from a mutual fund company or a brokerage. You will need to open an investment account, such as a brokerage account, IRA or Roth IRA, and then choose from a number of different index funds.

Index fund costs will vary but they are generally cheaper than investing in actively-managed funds. Most index funds will cost you less than 20 basis points, or 0.20%, which means you'll pay less than $20 for every $10,000 invested.

Broadly diversified index funds tend to be safer than individual stocks because they are less risky and more diversified.