The All Weather Portfolio is an investment portfolio designed to perform well under different economic conditions. The portfolio was created by Ray Dalio and his firm Bridgewater Associates, one of the largest hedge funds in the world. It consists of 55% bonds, 30% stocks, and 15% hard assets (gold and commodities). This mixture performs well under the four economic environments highlighted by Dalio: rising prices (inflation), falling prices (deflation), rising growth (bull markets), and falling growth (bear markets).

The All Weather Portfolio is considered a well-diversified, low-risk portfolio that can weather any storm. It uses asset class diversification based on seasonality to limit volatility and drawdowns. The portfolio is suitable for investors who want to preserve their capital and achieve steady growth while tolerating some level of volatility.

To replicate the All Weather Portfolio, investors can allocate their investments across various asset classes, such as long-term bonds, intermediate-term bonds, stocks, gold, and commodities. It is recommended to rebalance the portfolio annually to maintain the original asset allocation.

It's important to note that the All Weather Portfolio may not be suitable for investors seeking high growth, as portfolios with a higher weight in equities tend to outperform over the long run. Additionally, some investors may find it challenging to stick with assets like gold, which can have extended drawdown periods.

All Weather Portfolio Characteristics

| Characteristics | Values |

|---|---|

| Creator | Ray Dalio |

| Purpose | To maximise diversification, minimise volatility, and enhance long-term returns |

| Investment Types | Stocks, bonds, commodities |

| Best For | Investors who can't stomach seeing their portfolio cut in half during downturns |

| Example ETFs | Vanguard Total Stock Market ETF (VTI), iShares 20+ Year Treasury ETF (TLT), iShares 7-10 Year Treasury ETF (IEF), SPDR Gold Shares ETF (GLD), PowerShares DB Commodity Index Tracking Fund (DBC) |

| Performance | From 9/26/16 to 3/17/18, the portfolio produced a net gain of +5.56% |

What You'll Learn

The All Weather Portfolio's asset allocation

The All Weather Portfolio is a well-diversified, low-risk portfolio designed by Ray Dalio to "weather" any economic environment. The portfolio is constructed using different types of assets that perform differently during different economic "seasons". Dalio proposes that the following four things affect asset value:

- Rising economic growth

- Declining economic growth

- Higher than expected inflation

- Lower than expected inflation

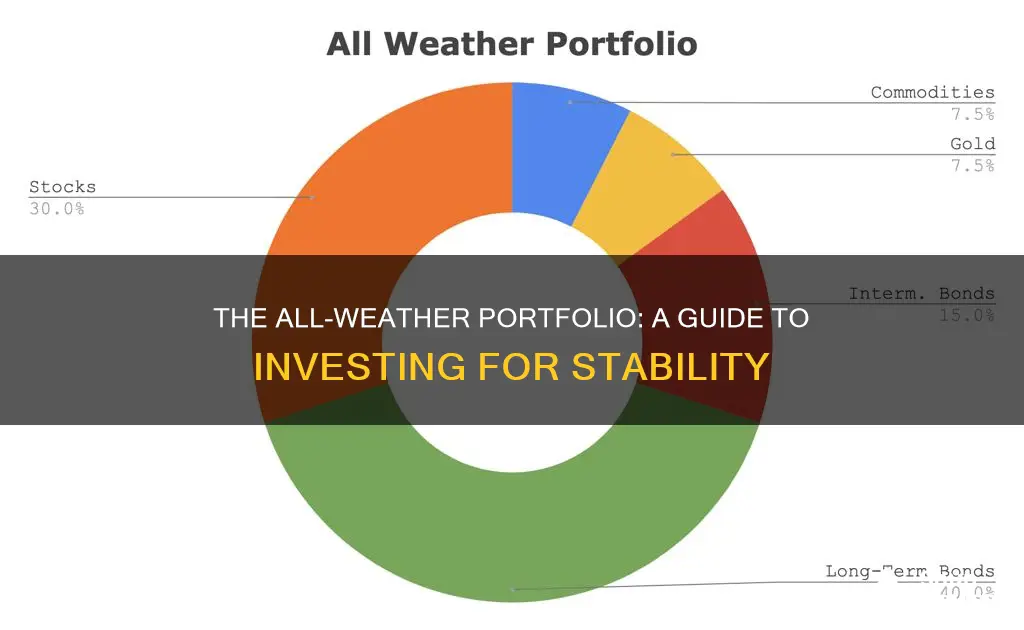

Based on these factors, Dalio expects to see four "seasons" of the economy, and chooses asset classes that perform well in each of these different seasons. The asset allocation for the All Weather Portfolio is as follows:

- 40% Long-Term Treasury Bonds

- 15% Intermediate-Term Treasury Bonds

- 30% Stock Market

- 7.5% Gold

- 7.5% Commodities

This portfolio can be implemented with five ETFs, making it accessible to the general public. The specific ETFs to use are:

- Vanguard Total Stock Market

- IShares 20+ Year Treasury Bond

- IShares 7-10 Year Treasury Bond

- SPDR Gold Trust

- PowerShares DB Commodity Index Tracking Fund

The All Weather Portfolio is designed to maximise diversification and minimise volatility, and is especially attractive during periods of market turmoil, for investors with a low-risk tolerance.

Investing Young: Better Than Saving?

You may want to see also

How to build the All Weather Portfolio

The All Weather Portfolio is a fund first created by Ray Dalio of Bridgewater Associates, the world's largest hedge fund. The idea behind the portfolio is to create a portfolio that can be held for life, allowing investors to invest through economic growth and stagnation and thrive during good times and bad times.

The portfolio is designed to perform well during both favourable and unfavourable market and economic situations. It contains flexible investment strategies that allow for diversification across different asset classes and alternative techniques, such as rotation out of underperforming sectors, to manage market volatility.

Choose your investments: The portfolio typically comprises long-term US bonds, intermediate US bonds, gold, and commodities. You can also choose to include short-term US bonds. The specific asset mix is as follows:

- 40% Long-Term US Bonds (20+ years)

- 15% Intermediate US Bonds (7-10 years)

- 7.5% Gold

- 7.5% Commodities

- Understand the economic conditions: Dalio's portfolio is based on four economic conditions that he identified: inflation (rising prices), deflation (falling prices), bull markets (rising growth), and bear markets (falling growth). He created a matrix to explain which assets perform best under each circumstance.

- Allocate your investments: Based on the matrix, allocate a higher percentage of your portfolio to bonds than any other asset class. The specific allocations are as follows:

- 40% Long-Term Treasury Bonds

- 15% Intermediate-Term Treasury Bonds

- 30% Stocks

- 7.5% Gold

- 7.5% Commodities

Choose your investment vehicles: You can use exchange-traded funds (ETFs) to implement the All-Weather Portfolio. Here are some examples of ETFs for each asset class:

- Vanguard Total Stock Market ETF (VTI) for stocks

- IShares 20+ Year Treasury ETF (TLT) for long-term bonds

- IShares 7-10 Year Treasury ETF (IEF) for intermediate-term bonds

- SPDR Gold Shares ETF (GLD) for gold

- PowerShares DB Commodity Index Tracking Fund (DBC) for commodities

- Rebalance your portfolio: Dalio suggests rebalancing the portfolio annually to maintain the original asset allocation. This involves modifying your asset allocation as the amount of money in each investment fluctuates with the changing market.

- Automate your investments: You can automate your investments by setting up regular contributions to your brokerage account, ensuring that you consistently invest in your future.

- Choose a brokerage account: You will need a brokerage account to purchase the investments for your portfolio. Some popular options include Vanguard, Fidelity, Schwab, and TD Ameritrade.

- Open an account and fund it: Follow the steps provided by your chosen brokerage to open an account and fund it with your desired amount.

- Purchase the investments: Once your brokerage account is set up and funded, you can purchase the investments for your All Weather Portfolio.

By following these steps, you can create your own All Weather Portfolio, a set-it-and-forget-it type of investment strategy designed to weather any economic climate.

Savings and Investment: Interplay in a Closed Economy

You may want to see also

How to rebalance the All Weather Portfolio

The All Weather portfolio is a multi-asset strategy developed by hedge fund manager Ray Dalio. It is a simple, effective way for everyday investors to own a combination of stocks, bonds, and commodities. The portfolio is designed to maximise diversification, minimise volatility, and enhance long-term returns.

The All Weather portfolio can be implemented using exchange-traded funds (ETFs). The following is an example of ETF allocations:

- 30% - Vanguard Total Stock Market ETF (VTI)

- 40% - iShares 20+ Year Treasury ETF (TLT)

- 15% - iShares 7-10 Year Treasury ETF (IEF)

- 7.50% - SPDR Gold Shares ETF (GLD)

- 7.50% - PowerShares DB Commodity Index Tracking Fund (DBC)

To maintain the desired level of diversification and risk management, the All Weather portfolio should be rebalanced regularly—at least annually, and ideally on a semi-annual or more frequent basis.

Rebalancing involves buying and selling assets to return to the target weightings. For example, if stocks increase in value and bonds decrease, an investor would sell some stocks and use the proceeds to buy more bonds, returning to the desired allocation.

It is important to note that rebalancing may trigger tax implications, such as capital gains taxes, which can impact overall returns. Therefore, it is advisable to hold portfolios that require frequent rebalancing in a tax-free or tax-deferred account.

Savings, Investments, and Economics: Understanding the Equation

You may want to see also

Who should/shouldn't invest in the All Weather Portfolio

The All Weather Portfolio is a low-risk, well-diversified portfolio designed by Ray Dalio to "weather" any economic environment. It is modelled after the risk-parity-based All Weather Fund by Bridgewater Associates, a hedge fund. The portfolio is designed to survive all economic environments by using different types of assets that perform differently during different "seasons" of the economy.

The All Weather Portfolio is mostly bonds, with only 30% allocated to stocks. It is designed for investors who have a low-risk tolerance and are primarily concerned with capital preservation. The portfolio is also attractive for investors who want a hands-off approach to investing.

The All Weather Portfolio is suitable for investors who:

- Have a low-risk tolerance

- Are primarily concerned with capital preservation

- Want a hands-off approach to investing

- Are nearing or at retirement age

- Cannot endure volatility and drawdowns

The All Weather Portfolio may not be suitable for investors who:

- Are comfortable with taking on more risk

- Are not concerned with capital preservation

- Are looking for higher returns

- Are young with a long investing horizon

- Are comfortable with market volatility and drawdowns

National Saving Certificates: Smart Investment Strategies

You may want to see also

The All Weather Portfolio's performance

The All Weather Portfolio, created by Ray Dalio and his firm Bridgewater Associates, is designed to perform well under different economic conditions. The portfolio is constructed to include a mix of stocks, bonds, and commodities, providing a balanced and defensive approach to investing. Here's a detailed look at its performance:

Performance Metrics:

- The portfolio has a medium risk profile, indicating moderate fluctuations in value. It is suitable for investors who can tolerate some volatility while seeking steady growth.

- From January 1871 to October 2024, the portfolio delivered a total return of 1251651.22%, equivalent to an annualized return of 6.33%.

- As of October 2024, the portfolio achieved a compound annual return of 7.71% over the previous 30 years, with a standard deviation of 7.44%.

- The portfolio experienced a maximum drawdown of -20.58%, which took 34 months to recover.

- During the Great Financial Crisis, the portfolio declined by less than half compared to a 60/40 stock/bond portfolio.

- The portfolio also demonstrated resilience during the COVID-19 crash in 2020, with more modest drawdowns.

- However, it is important to note that the All Weather Portfolio may underperform in high growth environments due to its lower allocation to stocks.

Comparison to Other Portfolios:

- The All Weather Portfolio has historically provided more consistent growth with less volatility than traditional portfolios such as the S&P 500 and a 60/40 stock/bond portfolio.

- During high inflation (1970s) and low growth (2000s) periods, the All Weather Portfolio outperformed the S&P 500 and 60/40 portfolios in terms of inflation-adjusted returns.

- The portfolio's heavy allocation to bonds may cause it to underperform in high growth environments where stocks excel. From 1973-2024, the All Weather Portfolio returned 4.6% annually (inflation-adjusted), compared to 6.5% for the S&P 500.

- The All Weather Portfolio is particularly attractive to investors who want to mitigate losses and preserve capital with decent growth.

Assessing Investment Risk: Measuring Portfolio Riskiness

You may want to see also

Frequently asked questions

The All Weather Portfolio is an investment portfolio designed to perform well under different economic conditions. It consists of 55% bonds, 30% stocks, and 15% hard assets (gold and commodities).

You can build an All Weather Portfolio by investing in a selection of low-cost ETFs. For example, you could invest in 40% long-term bonds, 30% stocks, 15% intermediate-term bonds, 7.5% gold, and 7.5% commodities.

To rebalance your All Weather Portfolio, you need to modify your asset allocation as the amount of money in each investment fluctuates. This involves three steps: finding your target asset allocation, comparing your portfolio to this target, and then buying or selling shares to get back to your target allocation.

The Golden Butterfly Portfolio is a modified version of the All Weather Portfolio. While the All Weather Portfolio is agnostic about the stock market, the Golden Butterfly skews towards prosperity. It also has a higher allocation to stocks, reflecting the fact that there have been more periods of economic growth than decline and recession.