Index funds are a popular investment choice for those seeking low-cost, diversified, and passive investments that tend to outperform many higher-fee, actively traded funds. They are designed to replicate the performance of financial market indexes, like the S&P 500, and are ideal for long-term investing, such as retirement accounts.

Broad-based index funds are a type of index fund that tracks a broad market index, such as the S&P 500, and offers investors greater diversification and lower risk than individual stocks. These funds are passively managed, aiming to replicate the performance of the index without actively trying to beat the market.

1. Understand Broad-Based Index Funds: Know that broad-based index funds aim to mirror the performance of a broad market index, providing diversification across various sectors and asset classes. They are passively managed, have lower fees, and offer lower risk compared to individual stocks.

2. Choose a Brokerage Platform: Select an online brokerage platform that provides strong customer support, robust research tools, and analytical tools to help you make informed investment decisions.

3. Open and Fund an Account: Provide personal information, set up login credentials, complete an investment goals and risk tolerance questionnaire, and deposit funds into your account.

4. Research Broad-Based Index Funds: Compare different broad-based index funds by analysing their performance history, management fees, and the indexes they track. Look for funds with low fees and strong historical performance.

5. Purchase Shares: Use the funds in your brokerage account to purchase shares of your chosen broad-based index fund through the platform's website or app.

6. Monitor and Adjust: Periodically review your investment portfolio to ensure it remains aligned with your financial goals and make adjustments as necessary.

| Characteristics | Values |

|---|---|

| Type of fund | Mutual fund or exchange-traded fund (ETF) |

| Investment strategy | Passive |

| Investment aim | To mirror the performance of a designated index |

| Management style | Not actively managed |

| Fees | Lower than actively managed funds |

| Risk | Lower than individual stocks |

| Diversification | High |

| Tax efficiency | Higher than actively managed funds |

What You'll Learn

Understand broad-based index funds

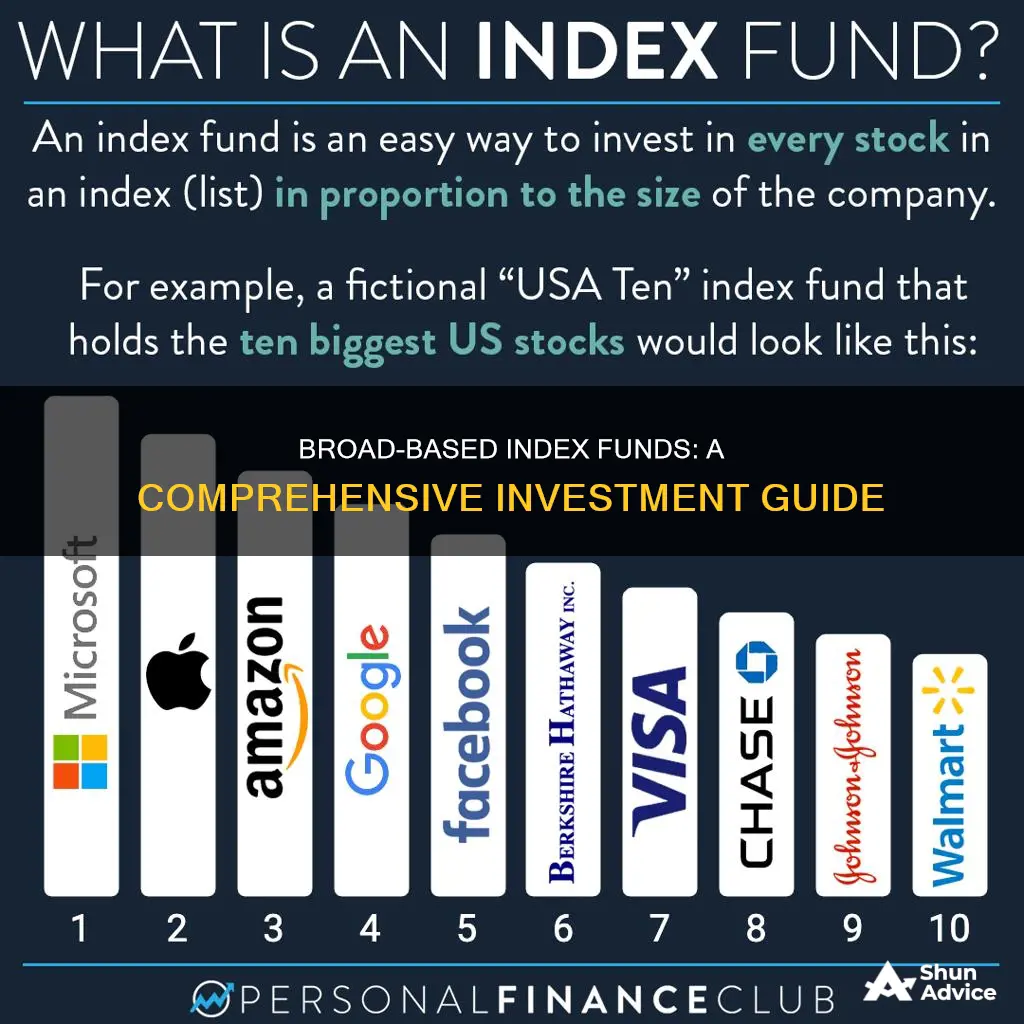

Broad-based index funds are a type of investment fund that tracks a broad market index, such as the S&P 500, Dow Jones Industrial Average, or the Nasdaq Composite. These funds are designed to reflect the movement and performance of a large group of stocks or an entire market, also known as a market index. By investing in a broad-based index fund, you are essentially investing in a diversified portfolio of stocks that aims to mirror the performance of the underlying index.

Here's what you need to know about broad-based index funds:

Broad-based index funds can take the form of mutual funds or exchange-traded funds (ETFs). The fund managers aim to replicate the performance of the index by constructing a fund that closely resembles it, without actively managing it. This means that the fund simply tracks the index without trying to beat the market. Broad-based index funds closely follow popular indexes and aim to replicate the overall performance of the market by purchasing and holding stocks from companies listed on the selected index.

Examples of Broad-Based Index Funds

Some examples of broad-based index funds include:

- Fidelity ZERO Large Cap Index (FNILX)

- Vanguard S&P 500 ETF (VOO)

- IShares Core S&P 500 ETF (IVV)

- Shelton NASDAQ-100 Index Direct (NASDX)

- Vanguard Total Stock Market ETF (VTI)

- SPDR Dow Jones Industrial Average ETF Trust (DIA)

Advantages of Broad-Based Index Funds

Broad-based index funds offer several benefits to investors:

- Low fees: Index funds generally have lower fees compared to actively managed funds.

- Lower turnover: Index funds have low turnover, which helps minimize turnover costs and fees.

- Diversification: Broad-based index funds allow investors to spread their risk across a variety of companies and industries.

- Passive management: Passive management can lead to lower expenses and better tax efficiency.

- Lower risk: Compared to owning individual stocks, broad-based index funds are considered lower risk due to their diversification.

Disadvantages of Broad-Based Index Funds

While broad-based index funds have many advantages, there are also some drawbacks to consider:

- Lack of adaptability: Broad-based index funds follow indexes, even during market downturns, which can hurt performance if the market continues to decline.

- No control over index composition: The fund will follow the composition of the index, including any additions or removals of companies.

- Generally no short-term gains: Broad-based index funds are not designed to capture short-term gains.

How to Invest in Broad-Based Index Funds

To invest in broad-based index funds, you'll need a brokerage account or a retirement account such as a self-managed IRA. You can then research and compare broad-based index funds based on factors like management fees and performance. Once you've found funds that match your goals and investment horizon, you can purchase shares through your account or through a broker.

Mid-Cap Funds: Smart Investment for Long-Term Growth

You may want to see also

Choose a brokerage or retirement account

To invest in broad-based index funds, you'll need to open a brokerage account or use a retirement account such as a self-managed IRA. You can open a brokerage account with an online brokerage platform, which often provides customer support, research tools, and analytical tools. When choosing a brokerage platform, consider factors such as the platform's reputation, the quality of its tools, and any associated fees.

Once you've opened your account, you can start researching broad-based index funds that align with your investment goals and risk tolerance. Look at the management fees and historical performance of the funds to make an informed decision. When you're ready to invest, you can purchase shares of your chosen fund through your brokerage or retirement account, or with the help of a broker.

It's worth noting that some broad-based index funds may be available directly from the fund provider, without needing to go through a broker or open a separate account. However, having all your investments in a single brokerage account can be more convenient for some investors.

A Beginner's Guide to Mutual Fund Investing with $500

You may want to see also

Research and select funds

Researching and selecting broad-based index funds is a crucial step in your investment journey. Here are some detailed guidelines to help you make informed decisions:

Understand the Broad-Based Index Funds Landscape:

Before selecting specific funds, familiarize yourself with the broad-based index funds landscape. These funds aim to mirror the performance of a broad market index, such as the S&P 500, Dow Jones Industrial Average, or the Nasdaq Composite. By design, they provide diversification across various sectors and reduce the risk associated with individual stocks.

Define Your Investment Goals and Risk Tolerance:

Start by clearly defining your investment goals. Are you investing for retirement, short-term gains, or a specific financial milestone? Each goal will have different time horizons and risk profiles. Additionally, assess your risk tolerance—how much risk are you comfortable taking? This will influence the types of funds you choose.

Evaluate Fund Performance and Track Record:

When evaluating potential funds, consider their historical performance and track record. Look at their returns over the past five to ten years to gauge their potential for future returns. Remember that past performance doesn't guarantee future results, but it provides valuable insight.

Compare Fees and Expenses:

Broad-based index funds are known for their low fees, but these can vary between funds. Compare the expense ratios, which represent the ongoing fees charged as a percentage of your investment. Keep in mind that lower fees can translate to higher returns over time.

Consider the Fund's Diversification and Composition:

Review the composition of the fund to ensure it aligns with your investment goals and risk tolerance. Evaluate the sectors and industries represented in the fund. If you're seeking diversification, ensure the fund invests in a wide range of companies and sectors rather than being concentrated in a specific area.

Assess the Fund's Management:

While broad-based index funds are passively managed, it's still important to consider the fund's management team. Look at the fund provider's reputation and their track record in managing similar funds. A well-established and reputable fund provider can inspire more confidence.

Analyze the Fund's Trading Costs and Minimum Investments:

Different brokers may offer varying trading costs for the same fund. Compare these costs, as they can eat into your returns. Additionally, consider the minimum investment requirements for each fund, ensuring they align with your budget and investment plans.

Review Fund Options Across Different Brokers:

Not all brokers offer the same fund options. Research the fund availability across different brokers to ensure you have access to the funds that match your criteria. This step is crucial if you plan to use a specific broker for your investments.

Monitor and Evaluate Funds Regularly:

Don't set and forget your investments. Regularly monitor the performance of the funds you select and evaluate them against your initial criteria. Stay updated with any changes in the fund's composition, management, or fees. This will help you make informed decisions about adjusting your portfolio if needed.

Seek Professional Advice:

Consider consulting a financial advisor, especially if you're new to investing or have a complex financial situation. They can provide personalized guidance in selecting funds that align with your goals, risk tolerance, and time horizon.

Remember, investing in broad-based index funds offers diversification and a relatively lower-risk approach to investing in the stock market. However, it's important to conduct thorough research and due diligence before making any investment decisions.

Explore Mutual Funds for Your Defence Sector Investment

You may want to see also

Buy shares

Once you have decided on a broker and chosen your fund(s), you can proceed to buy shares. If you decide to invest in multiple funds, you will also need to decide how much to invest in each fund type. Generally, younger investors saving for retirement should consider putting a larger allocation of their portfolio into higher-risk investments such as stocks. The closer an investor is to retirement, the more they may want to consider shifting a larger chunk of their holdings into bonds or other lower-risk assets.

To buy shares of an index fund, you will need to open an investment account. A brokerage account, individual retirement account (IRA), or Roth IRA will all work. You can then buy the fund in the account. When you go to purchase the fund, you may be able to select a fixed dollar amount to spend or choose a number of shares. The share price of the index fund and your investing budget will determine how much you are willing to spend. For example, if you have $1,000 to invest and the fund you are looking at is selling for $100 a share, you could buy 10 shares.

You can open a brokerage account that allows you to buy and sell shares of the index fund that interests you. Index funds come in both exchange-traded fund (ETF) and mutual fund forms. Alternatively, you can typically open an account directly with a mutual fund company that offers an index fund you're interested in.

Again, it pays to look at costs and features when deciding the best way to buy shares of your index fund. Some brokers charge extra for their customers to buy index fund shares, making it cheaper to go directly through the index fund company to open a fund account.

That said, many investors prefer to have all their investments held in a single brokerage account. Plus, many brokers allow customers to buy fractional shares of index funds in exchange-traded fund (ETF) form. If you anticipate investing in several index funds offered by various fund managers, the brokerage option could be the best way to combine all your investments under a single account.

Mutual Funds: Least Liquid Investment Options for Long-Term Goals

You may want to see also

Monitor and adjust

Once you've invested in broad-based index funds, it's important to monitor and adjust your portfolio to ensure it aligns with your financial goals. Here are some key considerations for monitoring and adjusting your index fund investments:

- Performance evaluation: Regularly review the performance of your index funds by comparing their returns to the underlying index they track. While you shouldn't expect identical returns, any significant underperformance may indicate an issue with the fund. Remember to consider the impact of fees and taxes when evaluating performance.

- Cost evaluation: Keep an eye on the fees associated with your index funds, including expense ratios and transaction costs. If the fees start to outweigh the benefits of the investment, it may be time to consider alternative options.

- Diversification: Index funds offer built-in diversification, but it's important to ensure your portfolio remains diversified over time. Review your holdings regularly to ensure you have exposure to different asset classes, sectors, and geographic regions.

- Rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation. This may involve buying or selling index funds to return your portfolio to its target allocation.

- New investment opportunities: Stay informed about new investment opportunities and consider adding them to your portfolio if they align with your financial goals. This could include new index funds that track different indexes or focus on specific sectors or trends.

- Risk management: Index funds are generally less risky than individual stocks, but it's important to monitor your risk exposure. Evaluate your risk tolerance and make adjustments as necessary to ensure your portfolio aligns with your risk preferences.

- Long-term focus: Remember that index funds are typically long-term investments. Don't make impulsive decisions based on short-term market fluctuations. Instead, focus on your long-term financial goals and make adjustments accordingly.

Fidelity's High Initial Investment Strategy for Money Market Funds

You may want to see also

Frequently asked questions

Broad-based index funds track a broad market index, such as the S&P 500, and are considered passive investments. They offer investors greater diversification and lower risk than individual stocks.

Broad-based index funds have several advantages, including:

- Low fees: They generally have lower fees compared to actively managed funds.

- Lower turnover: They have low turnover, which helps minimize turnover costs and fees.

- Diversification: They allow investors to spread their risk across a variety of companies and industries.

- Passive management: They are passively managed, which can lead to lower expenses and better tax efficiency.

- Lower risk: They are considered lower risk than owning individual stocks because they provide exposure to a number of companies in the same sector, industry, or market capitalization.

To invest in broad-based index funds, you need a brokerage account or a retirement account such as a self-managed IRA. You can then research and choose broad-based index funds that match your goals and time horizon, considering factors such as management fees and fund performance. Finally, you can purchase shares through your account or through a broker.