The defence sector is an attractive prospect for investors, with India's defence stocks, in particular, witnessing a surge in prices. One mutual fund investing in the defence sector is the HDFC Defence Fund, which has done well since its inception in 1999, with an 86.28% return in 1 year. The fund seeks to provide long-term capital appreciation by investing predominantly in equity and equity-related securities of defence & allied sector companies. The expense ratio of the fund is 0.73% for Direct plans as on Sep 20, 2024.

For those looking to invest in the aerospace sector, the Fidelity Select Defense and Aerospace Fund (FSDAX) is a mid-cap value fund that has performed well since its inception in 1984, with an average annual return of 12.96% over the past 10 years. The fund's top 10 holdings include Lockheed Martin, Northrop Grumman Corporation, TransDigm Group Inc., and Boeing Company.

What You'll Learn

HDFC Defence Fund

The current fund manager of HDFC Defence Fund is Dhruv Muchhal. The fund has an Asset Under Management (AUM) of ₹7,57,067 Cr and the latest NAV as of 30 September 2024 is ₹21.91. The expense ratio is 0.73% and the fund is rated as a Very High-risk investment. The minimum SIP investment is set to ₹100 and there is an exit load of 1% if redeemed within 1 year.

Best TSP Funds to Invest in Now

You may want to see also

Best defence stocks in India

India's defence industry is a significant contributor to the country's economy, and its growth is expected to accelerate due to rising national security concerns. The country's defence sector covers a wide range of areas, including aerospace, land, and naval systems, with both public and private companies contributing to the manufacturing of defence equipment and supplies.

Hindustan Aeronautics Limited (HAL)

HAL is a major aerospace and defence company established in 1940. It designs, develops, manufactures, repairs, overhauls, and services various products, including aircraft, aero engines, avionics, helicopters, and aerospace structures. HAL has a diverse product portfolio, including aircraft such as HAWK, Su-30 Mki, and Light Combat Aircraft (LCA). It also manufactures a range of helicopters and offers inertial navigation systems, auto stabilisers, laser range systems, flight data recorders, and more.

Bharat Electronics Limited (BEL)

BEL is a Navratna Public Sector Undertaking (PSU) established in 1954. It manufactures specialised electronic products for the Indian Defence sector, including defence communication devices, electronic warfare systems, land-based radars, naval systems, C4I systems, and weapon systems. BEL also has a non-defence sector that deals with cybersecurity, e-mobility, railways, e-governance systems, homeland security, and more. The company has subsidiaries and joint ventures with local and international companies, providing a wide array of products.

Solar Industries India

Solar Industries India Ltd is a company that manufactures advanced batteries for the Army, Navy, Air Force, and launch vehicles. They also produce commercial batteries for automotive and standby VRLA applications. Over the past five years, the company's revenue has grown at an impressive rate, outperforming the industry average.

Cochin Shipyard Limited (CSL)

CSL is a leading player in the Indian shipbuilding and ship repair industry. It constructs various types of vessels and provides repair and refitting services, including upgrades, periodic layup repairs, and lifespan extensions. CSL's shipbuilding products include defence vessels such as aircraft carriers, hydrographic survey vessels, fast patrol vessels, offshore patrol vessels, and pollution control vessels.

Bharat Dynamics Limited (BDL)

BDL, established in 1970, is a manufacturing base for guided missile systems and related equipment for the Indian Armed Forces. It operates four manufacturing units and has emerged as one of the few companies globally equipped with advanced facilities for producing and supplying guided missiles, underwater weapons, and other defence equipment. BDL also provides product life cycle support and refurbishment services for vintage missiles.

Mazagon Dock Shipbuilders

Mazagon Dock Shipbuilders is a leading shipbuilding yard in India, established as a private company in 1934 and brought under government control in 1960. It specialises in constructing and repairing ships, submarines, and other engineering products. The company has constructed 802 vessels, including 28 warships and 7 submarines. It has also delivered cargo ships, supply vessels, passenger ships, water tankers, and other types of ships for customers in India and abroad.

Other Notable Defence Stocks in India:

- Garden Reach Shipbuilders & Engineers Ltd

- Astra Microwave Products

- Mishra Dhatu Nigam Limited

- MTAR Technologies Limited

- Paras Defence and Space Technologies Ltd

- DCX Systems Limited

- Apollo Micro Systems Limited

- Ideaforge Technology Limited

- Rossell India Limited

- Taneja Aerospace & Aviation Ltd

- CFF Fluid Control Ltd

- Sika Interplant Systems Ltd

- Krishna Defence & Allied Industries Ltd

Mutual Fund Investors: Declare Investments in Your ITR

You may want to see also

Aviation and defence mutual funds

Fidelity Select Defense and Aerospace Fund (FSDAX)

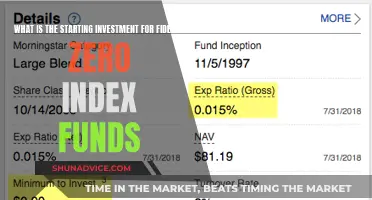

The Fidelity Select Defense and Aerospace Fund is a mid-cap value fund that aims for maximum capital appreciation. This fund has performed well since its inception in 1984, with an annual average return of 12.96% over the past 10 years. The fund typically invests at least 90% of its assets in common stocks of companies primarily engaged in the research, manufacturing, or marketing of products and services in the aerospace and defence industries. The expense ratio for FSDAX is 0.75%, and it is considered a high-risk investment by Morningstar. The fund's top holdings include well-known companies such as Lockheed Martin, Northrop Grumman Corporation, and Boeing Company.

HDFC Defence Fund

The HDFC Defence Fund is another option for investors interested in the defence sector. This fund seeks to provide long-term capital appreciation by investing predominantly in equity and equity-related securities of defence and allied sector companies. The fund has an expense ratio of 0.73% and an exit load of 1% if redeemed within one year. The current fund manager is Dhruv Muchhal, and the fund has an Asset Under Management (AUM) of ₹7,57,067 Cr as of September 30, 2024.

Invesco Aerospace and Defense Portfolio ETF (PPA)

The Invesco Aerospace and Defense Portfolio ETF is a highly-rated fund in the aerospace and defence sector. With a five-star rating from Morningstar, this fund has total assets of $1.4 billion and an annual average return of 10.21% over the past five years. The expense ratio for this fund is 0.61%, and it tracks the benchmark SPADE Defense Index.

Direxion Daily Aerospace & Defense Bull 3X Shares (DFEN)

This ETF tracks the Dow Jones U.S. Select Aerospace & Defense Index, providing 300% exposure to large-cap stocks in the aerospace and defence sectors. The fund has an expense ratio of 0.98%, a P/E ratio of 25.7, and an annual dividend yield of 2.03%.

In addition to these mutual funds, investors can also consider direct stock investments in aerospace and defence companies or comparable exchange-traded funds (ETFs) with an aerospace and defence focus. Some popular ETFs in this sector include FITE (SPDR S&P Kensho Future Security ETF) and DFEN (Direxion Daily Aerospace & Defense Bull 3X Shares).

Trust Fund Investment Strategies: Where to Begin?

You may want to see also

Defence stocks volatility

Defence stocks are susceptible to high volatility, influenced by factors such as government defence spending, geopolitical crises, and policy changes. Their performance is closely tied to national defence budgets and the global defence environment.

For instance, the Indian government's push for indigenous defence manufacturing and increased defence spending can boost the demand for defence equipment and supplies, potentially leading to a rise in stock prices. However, defence stocks can also underperform during long periods of peace due to shifting government spending priorities.

Additionally, defence stocks are influenced by the nature of defence contracts, which are typically long-term and cyclical, reflecting the extended production cycles required to manufacture sophisticated defence equipment.

To manage the volatility of defence stocks, investors can consider the following strategies:

- Diversification: Spreading investments across multiple defence companies and other sectors can help reduce the impact of volatility in the defence sector.

- Long-Term Investment Horizon: Defence stocks tend to be more stable over the long term, as short-term fluctuations are smoothed out.

- Fundamental Analysis: Conducting thorough research on the financial health, growth potential, and market conditions of defence companies can help identify stocks with stronger long-term prospects.

- Monitoring Geopolitical Environment: Staying informed about global political dynamics and defence policies can help anticipate potential impacts on defence stock performance.

- Risk Management: Setting stop-loss orders and regularly reviewing and rebalancing one's portfolio can help limit potential losses during periods of high volatility.

Funding Sources for Your Real Estate Investment

You may want to see also

Defence stocks and geopolitical risks

The defence industry has a reliable revenue source in government spending, which can be a steady source of income during economic slowdowns. For example, the US fiscal 2022 omnibus spending bill included a 4.7% increase in defence spending, and President Biden's fiscal 2023 budget proposes a further increase. This consistent funding stream makes defence stocks attractive to investors, particularly in times of economic uncertainty.

Several defence stocks are well-positioned to benefit from this increased defence spending. Vectrus (VEC), for instance, is a prime defence contractor that provides various services to US military bases worldwide. Boeing (BA), an aerospace and defence company, is another example, as it stands to gain from increased orders for its aircraft and defence systems.

However, it's important to note that defence stocks can also be influenced by other factors, such as broader market trends and company-specific issues. For instance, Boeing faced challenges due to the grounding of its 737 MAX aircraft and the impact of the pandemic on air travel. Therefore, while geopolitical risks and defence spending can be significant drivers, they are not the only factors shaping the performance of defence stocks.

When considering investing in defence stocks, it's crucial to conduct thorough research and understand the broader market dynamics and individual companies' strengths and weaknesses. Mutual funds, such as the HDFC Defence Fund, can provide a diversified way to invest in the defence sector, offering exposure to a range of companies within the industry.

Index Funds: Low-Cost, High-Return Investment Opportunities

You may want to see also

Frequently asked questions

The HDFC Defence Fund is an example of a mutual fund that invests in the defence sector.

The HDFC Defence Fund seeks to provide long-term capital appreciation by investing predominantly in equity and equity-related securities of defence & allied sector companies.

The top holdings of the HDFC Defence Fund include Bharat Electronics Ltd., Hindustan Aeronautics Ltd., Solar Industries India Ltd., Astra Microwave Products Ltd., and Larsen & Toubro Ltd.

The expense ratio of the HDFC Defence Fund is 0.73%.

The minimum investment required for the HDFC Defence Fund is Rs. 100, and the minimum additional investment is also Rs. 100.