The Fidelity Blue Chip Growth Fund is a mutual fund that seeks long-term capital growth by investing primarily in large blue-chip companies. Blue-chip companies are typically well-known or established companies with the potential for above-average growth and are usually included in the Dow Jones Industrial Average or the S&P 500. The fund is managed by Fidelity veteran Sonu Kalra, who selects companies with specific criteria in mind, including durable competitive advantages and sustainable growth rates. With no minimum initial investment, low commission rates, and strong historical returns, the Fidelity Blue Chip Growth Fund is an attractive option for investors seeking exposure to large-cap stocks.

| Characteristics | Values |

|---|---|

| Overall Score | 7.8/10 |

| Class Retirement | FBGKX |

| Class No Load | FBGRX |

| Total Net Assets | $49.13 billion |

| Net Expense Ratio | 0.68% |

| 52 Week Avg Return | 55.54% |

| YTD Lipper Ranking | Quintile 2 (21st percentile) |

| Objective | Long-term capital growth |

| Minimum Initial Investment | $0 |

| Total Assets | $67.8 billion |

| Expense Ratio | 0.470% |

Investment strategy

The Fidelity Blue Chip Growth Fund seeks long-term capital growth by investing primarily in large blue-chip companies that offer above-average growth opportunities. Blue-chip companies are typically well-known or established companies with stocks that are projected to produce above-average returns over longer periods. These stocks are known for their dividends, potential for growth and stability, and lower volatility in returns.

The fund invests at least 65% of its total assets in domestic or foreign blue-chip firms, which are defined as companies with a market capitalization of at least $200 million if their stock is included in the S&P 500 or the Dow Jones Industrial Average, or $1 billion if not included in either index. As of November 27, 2023, the fund had assets totaling nearly $44.51 billion invested in 324 different holdings, with two-thirds of its holdings in the technology and consumer cyclical sectors.

The fund is managed by Fidelity veteran Sonu Kalra, who joined the company in 1998 and has managed the fund since July 2009. Kalra selects companies with "durable competitive advantages, sustainable double-digit growth rates, and management that allocates capital well." The fund's top holdings include Alphabet Inc. Class A, Apple Inc., Amazon Inc., Meta Platforms Inc. Class A, and Facebook Inc.

The Fidelity Blue Chip Growth Fund is an option for investors seeking a core holding concentrated in large-cap stocks, offering low commission rates and no account minimums to start. However, it's important to note that investing in stocks, including blue-chip stocks, carries risks associated with general economic factors, specific holdings, and the skill of the fund manager.

Corporate Bond Funds: When to Invest for Maximum Returns

You may want to see also

Performance

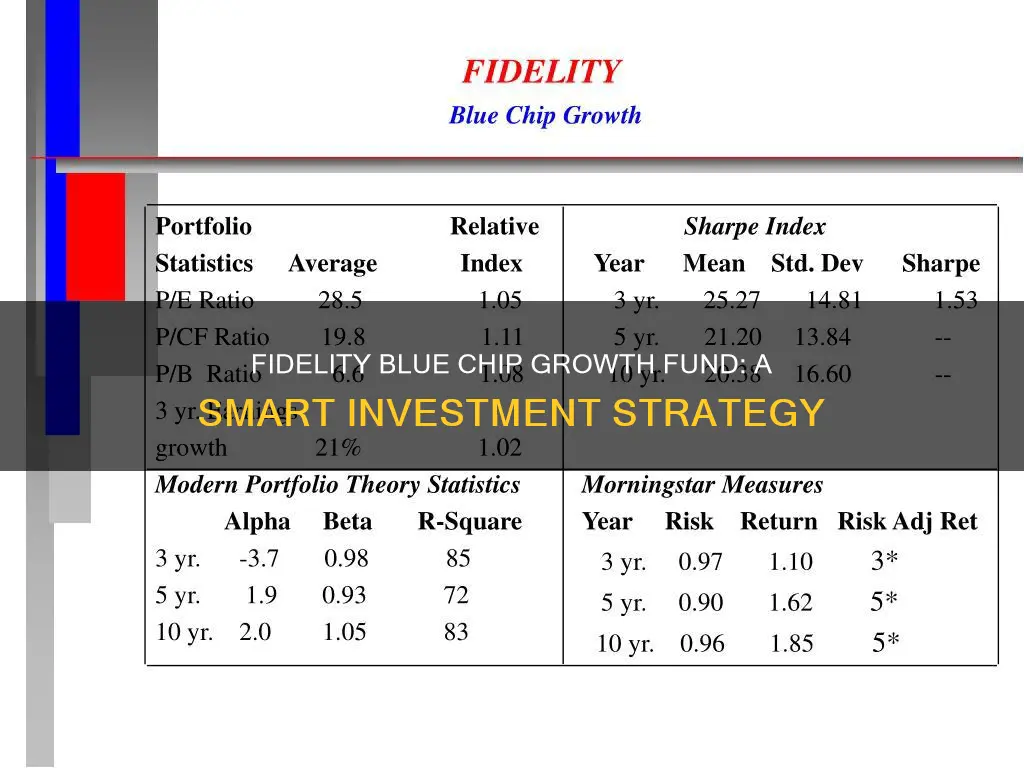

The Fidelity Blue Chip Growth Fund seeks long-term capital growth by investing primarily in large blue-chip companies that offer above-average growth opportunities. As of November 27, 2023, the fund had assets totalling almost $44.51 billion invested in 324 different holdings. The fund has a strong performance history, with returns of 25.50% over the past year, 6.23% over the past three years, 15.12% over the past five years, and 14.60% over the past decade.

The fund's expense ratio is 0.68%, which is lower than the average large-value fund. Morningstar ranks the fund's risk and return as above average compared to other funds in its peer group for the trailing three years. As of September 2016, the fund's top 10 holdings comprised just under 36% of the fund's assets, including Alphabet Inc. Class A, Apple Inc., Amazon Inc., Facebook Inc., and Broadcom Ltd.

The fund is managed by Fidelity veteran Sonu Kalra, who joined the company in 1998 and has managed the fund since July 2009. Kalra selects companies with "durable competitive advantages, sustainable double-digit growth rates, and management that allocates capital well." The fund has a Morningstar Medalist Rating and is rated 7.8/10 by U.S. News.

Arbitrage Funds: A Smart Investment Strategy for Savvy Investors

You may want to see also

Risk and volatility

The Fidelity Blue Chip Growth Fund is a large-growth fund that seeks long-term capital growth by investing primarily in large blue-chip companies. While blue-chip stocks are known for their potential to produce above-average returns over the long term, investing in the Fidelity Blue Chip Growth Fund still carries certain risks and volatility.

Firstly, it is important to understand that investing in stocks, including blue-chip stocks, carries inherent risks. The value of stocks can fluctuate due to various economic factors, and the returns may not always be positive. During market downturns, large-cap stocks, which make up a significant portion of the fund's investments, tend to exhibit greater volatility and risk. This means that the fund's performance may be more sensitive to market conditions, potentially resulting in larger price swings.

Additionally, the fund's focus on a specific type of stock, blue-chip, and its concentration in particular sectors, such as technology and consumer cyclicals, introduce sector-specific risks. If the technology or consumer cyclical sectors underperform or experience negative trends, the fund's performance could be significantly impacted. While blue-chip stocks are generally considered less volatile than other investments, the fund's specific holdings and sector allocations can still introduce volatility.

Moreover, the fund's exposure to foreign securities and currencies presents additional risks. Investing in foreign markets carries its own set of challenges, including political, economic, and currency-related risks. Changes in exchange rates, geopolitical events, or economic downturns in foreign countries can affect the value of foreign securities and, consequently, the fund's performance.

It is also worth noting that the fund's performance depends in part on the skill and investment strategies employed by its manager, Sonu Kalra. While Kalra is a Fidelity veteran with a specific selection strategy, the success of the fund is tied to the effectiveness of this strategy and Kalra's decision-making.

In summary, while the Fidelity Blue Chip Growth Fund offers the potential for long-term capital growth by investing in well-known and established companies, it is not without risk. The volatility associated with stock investments, the concentration in specific sectors, and the exposure to foreign securities introduce uncertainties that can impact the fund's performance. Therefore, investors should carefully consider their risk tolerance and conduct thorough research before investing in the Fidelity Blue Chip Growth Fund.

Index Funds: A Beginner's Guide to Investing

You may want to see also

Management

The Fidelity Blue Chip Growth Fund is managed by Sonu Kalra, a Fidelity veteran who joined the company in 1998. Kalra selects companies with "durable competitive advantages, sustainable double-digit growth rates, and management that allocates capital well." The fund has been under his management since July 2009, and he also manages other Fidelity funds.

The fund falls within Morningstar's large growth category and is currently closed to new investors. It seeks long-term capital growth by investing primarily in large blue-chip companies that offer above-average growth opportunities. As of November 27, 2023, the fund had assets totaling almost $44.51 billion invested in 324 different holdings. The fund invests 80% of its assets in blue-chip stocks, which are well-known or established companies with the potential for above-average growth.

The fund's top holdings include Alphabet Inc. Class A, Apple Inc., Amazon Inc., Facebook Inc., and Broadcom Ltd. It has returned 25.50% over the past year, 6.23% over the past three years, 15.12% over the past five years, and 14.60% over the past decade. The fund's expense ratio is 0.68%, lower than the average and median large-value fund as classified by Morningstar.

DSP Blackrock Tax Saver Fund: A Smart Investment Strategy

You may want to see also

How to buy

To buy into the Fidelity Blue Chip Growth Fund, you must first decide which class of shares you want to purchase. The two options are Class Retirement (FBGKX) and Class No Load (FBGRX).

Once you have decided which share class you want to buy, you can proceed to purchase shares in the fund. There is no minimum initial investment for the Fidelity Blue Chip Growth Fund. The fund has an expense ratio of 0.68% and no commission fees for U.S. stocks, options, or crypto. Margin loan rates range from 5.83% to 6.83%.

The fund is managed by Sonu Kalra, who joined Fidelity in 1998 and has managed the fund since July 2009. The fund seeks long-term capital growth by investing primarily in large blue-chip companies that offer above-average growth opportunities. As of November 27, 2023, the fund had assets totaling almost $44.51 billion invested in 324 different holdings.

Best Vanguard Index Funds to Invest $1000 Minimum

You may want to see also

Frequently asked questions

The Fidelity Blue Chip Growth Fund is a mutual fund that seeks long-term capital growth by investing in blue-chip stocks, which are stocks of well-known or established companies with the potential for above-average growth.

The fund invests primarily in large blue-chip companies, which are typically defined as companies with a market capitalization of at least $1 billion and whose stocks are included in major stock market indices like the S&P 500 or the Dow Jones Industrial Average.

The fund aims to invest at least 80% of its assets in blue-chip stocks, believing that these companies offer above-average growth potential. The fund's manager, Sonu Kalra, selects companies with durable competitive advantages, sustainable double-digit growth rates, and effective capital allocation.

As of November 27, 2023, the fund had returned 25.50% over the past year, 6.23% over three years, 15.12% over five years, and 14.60% over the past decade. The fund's expense ratio is 0.68%.