The Franklin India Bluechip Fund is a mutual fund that aims to generate long-term capital appreciation by investing primarily in large-cap companies. The fund has a very high risk rating and is suitable for investors who are prepared to invest for at least 3-4 years and can tolerate moderate losses. The fund has delivered strong returns since its inception, with a 1-year return of 38.61% and a 3-year return of 52.39%. The minimum investment amount is ₹500, and the fund can be purchased directly from the Franklin Templeton Mutual Fund website or through platforms like MF Central and MF Utility.

| Characteristics | Values |

|---|---|

| Fund Name | Franklin India Bluechip Fund |

| Fund Type | Equity Large Cap |

| Fund House | Franklin Templeton Mutual Fund |

| NAV | ₹1055.9782 as of 1st October 2024 |

| Investment Amount | Minimum SIP amount: ₹500 |

| Investment Duration | No lock-in period |

| Risk | Very High |

| Returns | 38.61% in the last year, 52.39% in the last 3 years, 387.60% since scheme launch |

| Expense Ratio | 1.83% |

| Exit Load | 1% if redeemed within 1 year |

| Taxation | 20% if redeemed within one year, 12.5% if redeemed after one year |

What You'll Learn

How to buy Franklin India Bluechip Fund

The Franklin India Bluechip Fund is a mutual fund that can be purchased directly from the website of the fund house, Franklin Templeton Mutual Fund. It can also be bought through platforms like MF Central and MF Utility. Alternatively, investors can seek help from a mutual fund distributor, such as a bank.

The fund has a minimum SIP amount of ₹500, with no lock-in period. The latest NAV (Net Asset Value) as of 1st October 2024 is ₹1,162.16, and the fund has an AUM (Asset Under Management) of ₹8,234.60 Crores. The expense ratio is 1.83%, and the fund has a Very High-risk rating.

The Franklin India Bluechip Fund is a large-cap fund that invests in a range of companies, with a bias towards large-cap stocks. It is suitable for investors who are looking for high returns over a period of at least 3-4 years and are prepared for the possibility of moderate losses.

Social Security's Uninvested Funds: Why and What If?

You may want to see also

Investment strategy and portfolio

The Franklin India Bluechip Fund is a mutual fund scheme from Franklin Templeton Mutual Fund. The fund's investment objective is to generate long-term capital appreciation by actively managing a portfolio of equity and equity-related securities. The scheme will invest in a range of companies, with a bias towards large-cap companies.

The fund has delivered 19.15% returns since its inception 29 years ago. As of 1st October 2024, the fund's latest NAV (Net Asset Value) is ₹1,162.16, and it has an AUM (Asset Under Management) of ₹8,234.60 Crores. The fund has a minimum SIP investment of ₹500.

The fund's portfolio is largely conservative, with most holdings in Large Cap stocks and debt instruments. As of 31st August 2024, the fund had 97.44% investment in domestic equities, with 59.2% in Large Cap stocks, 14.82% in Mid Cap stocks, and 2.86% in Small Cap stocks. The fund's top holdings include HCL Technologies Limited, Larsen & Toubro Ltd., Mahindra & Mahindra Ltd., and Reliance Industries Ltd.

The fund has a Very High-risk rating as per SEBI's Riskometer. It is suitable for investors looking to invest money for at least 3-4 years and seeking high returns. These investors should also be prepared for the possibility of moderate losses in their investments.

Mutual Funds: Risky Business and Poor Investment Choice

You may want to see also

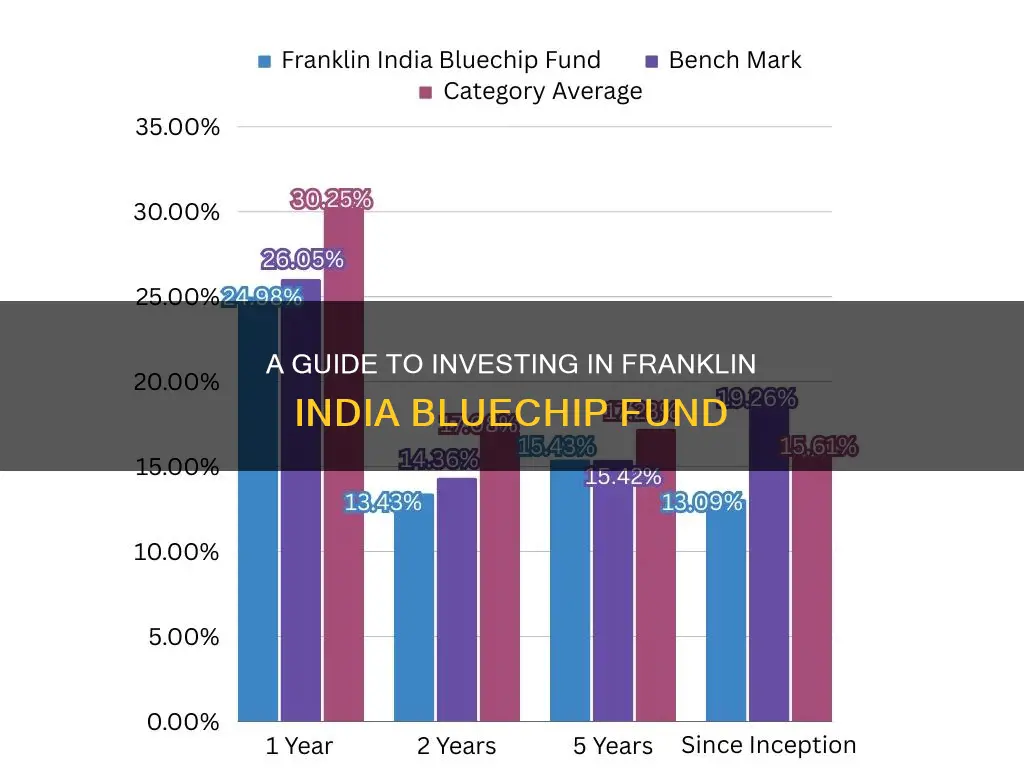

Risk and returns

The Franklin India Bluechip Fund is a large-cap fund, which means it invests in the largest 100 stocks listed in the Indian markets. These larger stocks are expected to be less risky than smaller stocks, which may have higher potential for growth. The fund has a very high risk rating according to SEBI's Riskometer, and investors should be prepared for the possibility of moderate losses. The fund has a minimum SIP investment of ₹500 and no lock-in period.

The fund's portfolio is largely conservative, with most of its holdings in Large Cap stocks and debt instruments. As of 31-Jul-2023, the fund had invested 96.97% in Equity and 3.03% in Cash & Cash Eq. The fund has delivered 19.15% returns since its inception 29 years ago. The expense ratio of the fund is 1.82%.

When investing in this fund, or any other large-cap fund, it is important to remember that you should only invest if you do not need to redeem your investment in less than five years. If you invest for five years or more, you can expect gains that beat the inflation rate and returns of fixed-income options. However, you should be prepared for ups and downs in your investment value during this time.

The Global Investment Hub: Where Funds Call Home

You may want to see also

Tax and fees

The Franklin India Bluechip Fund is a mutual fund that invests in large-cap companies. The fund's objective is to generate long-term capital appreciation by actively managing a portfolio of equity and equity-related securities. The expense ratio for the fund is 1.83%, which is slightly higher than the category average of 2.01% or 2.03%. The expense ratio is an annual fee that the fund charges for managing your investment and is deducted from the Net Asset Value (NAV) on a daily basis.

When investing in this fund, there is no lock-in period, meaning you can redeem your investment at any time. However, if you redeem your investment within one year, there is an exit load of 1% and short-term capital gains tax will be applicable. The current short-term capital gains tax rate is 15% or 20%, depending on the source. If you redeem your investment after one year, long-term capital gains tax will be applicable. The current long-term capital gains tax rate is 10% or 12.5%, depending on the source, if your total long-term capital gains exceed a certain threshold.

It is important to note that the tax rates mentioned above may not include cess or surcharge. Please refer to the latest tax regulations for the most accurate and up-to-date information.

Unlock Real Estate Funding: Strategies for Investors

You may want to see also

Investment timeline

The Franklin India Bluechip Fund is a large-cap fund that invests in big companies. The fund has been in operation for 29 years and 8 months, delivering 19.15% returns since its inception. As of July 2024, the fund has a net asset value (NAV) of around ₹985-1056 and an expense ratio of 1.83%. The minimum SIP investment amount is ₹500.

When considering an investment timeline for the Franklin India Bluechip Fund, it is important to note that this fund is designed for long-term capital appreciation. The fund managers aim to generate returns that exceed the inflation rate and fixed-income options over a period of five years or more. Therefore, investors should be prepared to commit to a minimum investment horizon of five years.

Investing in equity funds, including the Franklin India Bluechip Fund, carries a certain level of risk. The fund's portfolio is considered conservative, with a focus on large-cap stocks and debt instruments. However, it is still subject to market volatility, and the value of your investment may fluctuate over time. As with any investment, there is a possibility of incurring moderate losses.

It is recommended to consult a financial advisor or conduct further research to determine if this fund aligns with your investment goals, risk tolerance, and time horizon. Additionally, consider diversifying your investments across different asset classes and sectors to mitigate risks and improve long-term returns.

Best Mutual Funds to Invest in India: Top Picks

You may want to see also

Frequently asked questions

You can buy mutual funds directly from the website of the fund house. For instance, the Franklin India Bluechip Fund can be purchased from the website of Franklin Templeton Mutual Fund. You can also buy mutual funds through platforms like MF Central, MF Utility, and others. If you are not comfortable buying mutual funds online, you can seek help from a mutual fund distributor, such as a bank.

The minimum SIP amount of the Franklin India Bluechip Fund is ₹500.

No, there is no lock-in period for the Franklin India Bluechip Fund.

The expense ratio of the Franklin India Bluechip Fund is 1.83%.