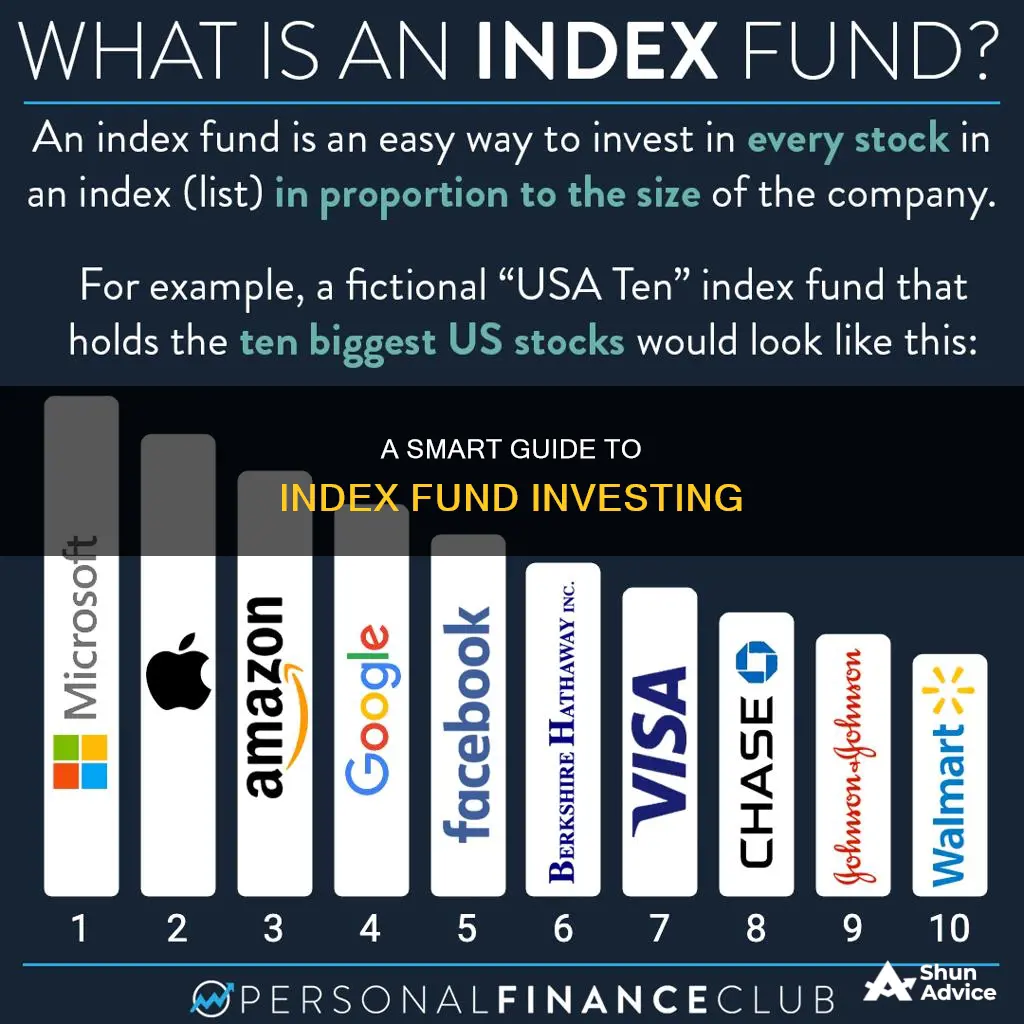

Index funds are a type of investment vehicle that tracks a market index, such as the S&P 500 or the Russell 2000. They are a great way to build wealth over the long term, especially for beginners, as they are a low-cost, low-fuss way to invest in the stock market without excessive fees or the need to become a stock market expert.

Index funds are passively managed, meaning that they aim to match the performance of a market index rather than trying to beat it. This means that investing decisions are based solely on trying to match the index. This passive management style also means that index funds are very tax-efficient compared to many other investments, as they don't do as much buying and selling of their holdings, so they avoid generating capital gains that can add to your tax bill.

There are hundreds of indexes that you can track using index funds, including large U.S. stocks, small U.S. stocks, international stocks, and bonds.

To invest in index funds, you will need to open an investment account with a brokerage platform such as Fidelity or Vanguard, or you can use a robo-advisor such as Betterment or Wealthfront. You can then decide which index fund to invest in by considering factors such as the fund's fees, performance, and how closely it tracks its underlying index.

| Characteristics | Values |

|---|---|

| Type of investment vehicle | Mutual fund or exchange-traded fund (ETF) |

| Aim | To match the returns of a specific market index |

| Benefits | Diversification, lower fees, lower taxes, lower risk, ease of trade, relatively safe, tax efficiency |

| Indexes tracked | S&P 500, Nasdaq Composite Index, Russell 2000, Bloomberg US Aggregate Bond Index, FTSE Global All Cap ex US Index, MSCI EAFE Index, Dow Jones Industrial Average |

| Investment options | Broad-market index funds, sector-based index funds, market-cap index funds, smart-beta index funds, commodity index funds, bond index funds |

| Costs | Expense ratio, sales load, investment minimum, trading costs |

| Risks | Average market returns, possible tracking errors, no downside protection, no control over investment holdings |

| Investment account options | Brokerage account, individual retirement account (IRA), robo-advisor, financial advisor |

What You'll Learn

Understand index funds and how they work

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. Index funds are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup. These passive investments do not require active management, as they are designed to replicate the performance of financial market indexes.

Index funds are a popular investment choice as they offer a simple, low-cost way to gain exposure to a broad, diversified portfolio. They are also considered safer than individual stocks due to their inherent diversification. By investing in an index fund, you can reduce your risk as you are not dependent on the performance of a single stock. Instead, your investment is tied to the performance of a wide range of companies, which provides more stability.

Index funds are suitable for both beginner and experienced investors. They are a good option for those seeking a long-term investment strategy, particularly for retirement planning. Index funds offer the benefit of low fees and minimal research, making them an attractive choice for those who want a more hands-off approach to investing.

When choosing an index fund, it is important to consider the fund's expenses, taxes, and investment minimums. Compare the expense ratios of different funds tracking the same index, as higher fees can eat into your returns over time. Additionally, consider the fund's performance over at least a five-to-ten-year period to gauge its potential future returns.

To invest in an index fund, you can open a brokerage account, a traditional IRA, or a Roth IRA. You can then choose from a variety of index funds, such as an S&P 500 fund, a fund that tracks government bonds, or a fund that tracks international stocks. It is recommended to diversify your portfolio by investing in several index funds to minimise risk.

Money Market Funds: When to Invest for Maximum Returns

You may want to see also

Decide on your investment goals

Before investing in index funds, it is important to have clear investment goals and a thorough understanding of your personal situation and life goals. This includes considering factors such as your risk tolerance, budget, and retirement timeline.

For instance, if you are nearing retirement, you may opt for the relative stability of a bond index fund over an equity index fund. It is worth noting that while risk and volatility are inherent in investing, some types of index funds are riskier than others.

Additionally, when setting your investment goals, consider how your investments can align with your values. For example, if you are passionate about environmental issues, you may want to explore clean-energy index funds and other ESG (environmental, social, and governance) investing opportunities.

- What is my risk tolerance, and how does it fit within my budget?

- When do I plan to retire, and how far away am I from that milestone?

- What types of investments align with my values and interests?

- How can I best diversify my portfolio to balance risk and maximize returns?

By carefully considering these questions and seeking professional advice when needed, you can make informed decisions about your investment goals and choose index funds that align with your financial plan and risk profile.

Arbitrage Funds: A Smart Investment Move for Europeans

You may want to see also

Choose an investment platform

Once you've decided on the index fund you want to invest in, you'll need to choose an investment platform. You can purchase an index fund directly from a mutual fund company or a brokerage. The same goes for exchange-traded funds (ETFs). These are like mini mutual funds that trade like stocks throughout the day.

When choosing where to buy an index fund, consider the following:

- Fund selection: Do you want to purchase index funds from various fund families? The big mutual fund companies carry some of their competitors' funds, but the selection may be more limited than what's available through a discount broker.

- Convenience: Find a single provider who can accommodate all your needs. For example, if you're just going to invest in mutual funds (or even a mix of funds and stocks), a mutual fund company may be able to serve as your investment hub. But if you require sophisticated stock research and screening tools, a discount broker that also sells the index funds you want may be better.

- Trading costs: If the commission or transaction fee isn't waived, consider how much a broker or fund company charges to buy or sell the index fund. Mutual fund commissions are typically higher than stock trading commissions, about $20 or more. Compare that with less than $10 a trade for stocks and ETFs.

- Impact investing: Want your investment to make a difference outside your portfolio? Some funds target companies with a focus on environmental or social justice causes.

- Commission-free options: Do they offer no-transaction-fee mutual funds or commission-free ETFs?

You'll also need to open an investment account, such as a brokerage account, individual retirement account (IRA), or Roth IRA, to purchase shares of an index fund.

A Simple Guide to Investing in Fidelity 500 Index Funds

You may want to see also

Research and select an index fund

Index funds are a great investment for building wealth over the long term. They are a group of stocks that mirror the performance of an existing stock market index, such as the S&P 500. Index funds are considered a passive investment strategy, meaning they don't require active management. Instead, they aim to replicate the performance of a specific market index.

Investment Objective and Risk Tolerance

Before investing in an index fund, it is important to understand your investment objectives and risk tolerance. Index funds can vary in terms of the market index they track, the geographic location of the investments, the business sector or industry they focus on, and the market opportunities they present. Some index funds may focus on specific industries, countries, or investment styles, such as dividend stocks. Consider your investment goals and how much risk you are comfortable taking on.

Performance and Track Record

When selecting an index fund, it is crucial to evaluate its long-term performance and track record. Look at the fund's historical returns over at least a five-to-ten-year period to get an idea of its potential future returns. Keep in mind that past performance does not guarantee future results, but it can give you an indication of how the fund has performed over time.

Fees and Expenses

Index funds typically have lower fees and expenses compared to actively managed funds. However, it is still important to consider the expense ratio, which is the ongoing fee charged by the fund company. Compare the expense ratios of different index funds tracking similar indexes to ensure you are getting a competitive rate. Also, be mindful of other fees, such as sales loads or commissions, which can eat into your investment returns.

Diversification and Risk Management

One of the benefits of index funds is diversification, which helps to reduce risk. Consider the level of diversification offered by the index fund and how it aligns with your risk tolerance. A broadly diversified index fund, such as the S&P 500, provides exposure to a wide range of companies across different sectors and industries. This can help reduce the impact of individual stock performance on your investment.

Fund Size and Reputation

Look at the size and reputation of the fund provider. Larger fund providers, such as Vanguard, BlackRock, or Charles Schwab, often have a strong track record and focus on keeping costs low for investors. A fund's size can also impact its liquidity and trading costs.

Investment Minimums and Restrictions

Some index funds, especially mutual funds, may have minimum investment requirements or other restrictions. Consider your budget and whether you can meet the initial investment threshold. Additionally, be aware of any limitations on purchasing or selling shares, as these can impact your ability to invest in the fund.

Tax Efficiency

Index funds can have tax implications, so it is important to understand the tax efficiency of the fund you are considering. Mutual funds, for example, tend to be less tax-efficient than ETFs due to taxable capital gains distributions at the end of the year. Compare the tax consequences of different fund structures to make an informed decision.

Brokerage Options

Finally, consider the brokerage options available for purchasing the index fund. You can usually buy index funds directly from the fund company or through a broker. Compare the costs, convenience, and investment options offered by different brokers to find the best fit for your needs.

A Beginner's Guide to Index Funds: Investing Your First $100

You may want to see also

Buy shares

Once you've decided on the index fund you want to invest in, you can buy shares. You can do this by opening a brokerage account that allows you to buy and sell shares of the index fund. Alternatively, you can open an account directly with a mutual fund company that offers the index fund you're interested in.

If you plan on investing in several index funds, it may be more convenient to open a brokerage account so that all your investments are held in one place. Many brokers also allow customers to buy fractional shares of index funds in exchange-traded fund (ETF) form.

When buying shares of an index fund, you'll need to buy enough to reach the fund's investment minimum. After that, you can typically buy fractional shares. You'll also need to decide whether you want dividends deposited into your account as cash or reinvested to purchase additional fund shares.

If you're buying shares of an index fund through a broker, you'll typically search for or enter the ticker symbol of the fund and the dollar amount you want to invest.

Costs

When deciding how to buy shares of an index fund, it's important to consider costs. Some brokers charge extra for customers to buy index fund shares, so it may be cheaper to go directly through the index fund company.

If you're comparing index funds, the expense ratio (the cost to administer the fund each year) will be a key factor. All else being equal, a lower expense ratio is preferable.

Other fees to look out for include trading fees and loads (special fees charged by certain mutual funds when you buy or sell them).

Where to buy

You can buy shares of an index fund directly from a mutual fund company or a brokerage. Exchange-traded funds (ETFs) can also be purchased directly or through a brokerage.

When choosing where to buy, you may want to consider factors such as fund selection, convenience, trading costs, impact investing options, and commission-free options.

Purchase plan

Investing is typically an ongoing practice, so it's important to think about your plan for buying index funds over time. Financial advisors often recommend dollar-cost averaging, which involves investing a set amount of money at regular intervals. This helps to reduce the impact of market volatility on your investments.

You can set up automatic investments with your brokerage to ensure that you invest regularly.

Exit strategy

While buying and holding is a common investment strategy, it's also important to consider when and how you'll sell your shares. If you're investing in a taxable account, you'll need to take capital gains taxes into account. A financial advisor or tax professional can help you determine the best strategies for managing withdrawals.

Mutual Funds: Active Management Advantage Over Index Funds

You may want to see also

Frequently asked questions

Index funds are a type of investment fund – either a mutual fund or an exchange-traded fund (ETF) – that is based on a preset basket of stocks, or index. Fund managers aim to replicate the index without active management, whether they create it themselves or rely on another company.

Index funds are popular with investors because they promise ownership of a wide variety of stocks, greater diversification, lower risk and lower costs.

When choosing an index fund, it's important to research the assets under management (AUM), the fee structure, the ease of trading and access to the fund, and the background of the managers in charge.

You can buy an index fund directly through an index-fund provider like Vanguard or Fidelity. You can also invest in index funds through other brokerage accounts and certain investment apps.