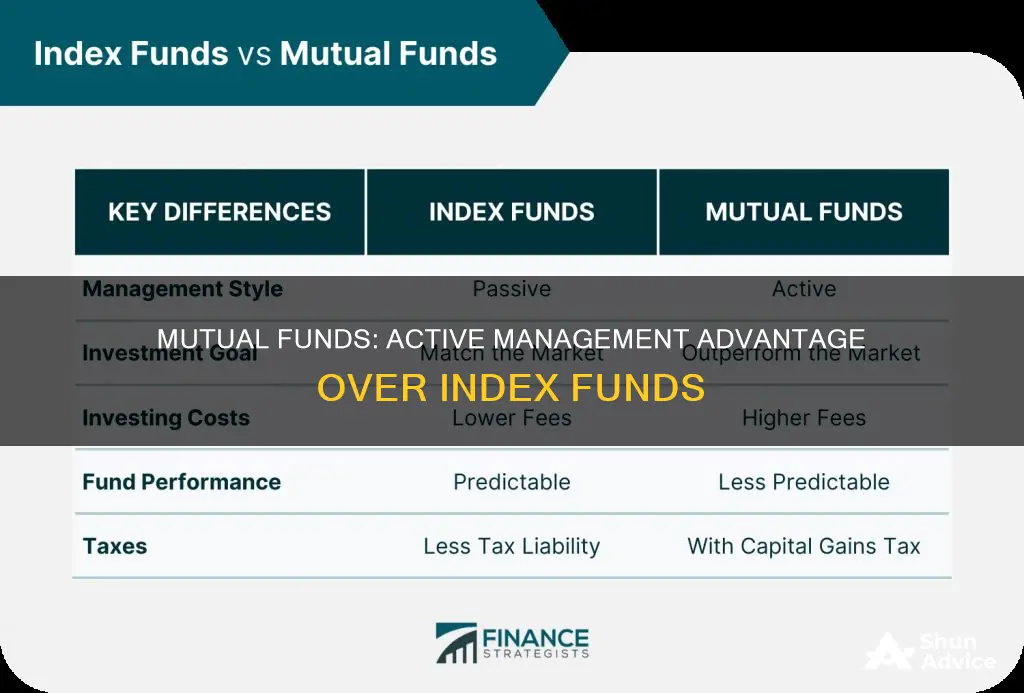

Index funds and mutual funds are both investment options for those looking to diversify their portfolios. While index funds are a type of mutual fund, there are some key differences between the two. Mutual funds are actively managed by professionals who pick and choose stocks, bonds, or other investment options to include in the fund, with the goal of outperforming the average stock market index. Index funds, on the other hand, are passively managed and designed to mirror the performance of a particular index, such as the S&P 500. This means that when the index increases or decreases, the value of the fund will follow suit. Mutual funds have higher fees due to their active management, while index funds tend to be cheaper and have lower taxes. When deciding between the two, it's important to consider your financial goals and investing philosophy. If you're looking for passive, low-cost diversification, then index funds might be the better choice. However, if you're investing for retirement and can handle the higher fees, mutual funds could be the way to go.

| Characteristics | Values |

|---|---|

| Management style | Mutual funds are actively managed by professionals; index funds are passively managed |

| Investment objective | Mutual funds aim to beat the market; index funds aim to mirror the market |

| Cost | Mutual funds have higher fees than index funds |

| Performance | Mutual funds' performance is less predictable; index funds' performance is relatively predictable |

| Investment type | Mutual funds can invest in stocks, bonds, or a combination of both; index funds invest in a specific list of securities |

| Control | Mutual funds have no control over the management team; index funds have no control over which stocks are added or removed from the index |

| Tax efficiency | Mutual funds may have to pay capital gains taxes on distributions held in taxable investment accounts; index funds may also have to pay these taxes |

What You'll Learn

Mutual funds are actively managed, index funds are passively managed

Mutual funds are actively managed, while index funds are passively managed. This is one of the key differences between the two types of funds.

Actively managed mutual funds have a team of financial experts who pick and choose the stocks, bonds or other investment options to include in the fund. The goal is to put together a collection of stocks that will beat the average returns of the stock market or a particular benchmark index. The fund manager or management team makes all the investment decisions. They choose which stocks to buy or sell, and how many shares to purchase or sell from the portfolio. The objective of an actively managed mutual fund is to outperform the index and earn higher returns.

Index funds, on the other hand, are passively managed. They don't require a team of experts to pick stocks. Instead, they simply copy the index they are based on. Index funds are designed to mirror the performance of a particular index or the stock market as a whole. If a stock is in the index, it will be in the fund. The sole objective of an index fund is to match the performance of the underlying index.

Actively managed mutual funds tend to have higher fees than index funds to cover the cost of the fund managers and their teams. These higher fees can impact the returns of the fund. Index funds, on the other hand, tend to be cheaper to own and are known for their low investment costs.

While actively managed mutual funds aim to beat the market, history has shown that it is extremely difficult to beat passive market returns year after year. Most fund managers fail to outperform their benchmark index in any given year. However, there are some fund managers who do beat the market, especially when overall market conditions are unfavourable.

Bloomberg's Best Investment Fund Options: Where to Start?

You may want to see also

Mutual funds have higher fees

Actively managed mutual funds also charge higher expense ratios than index funds. Expense ratios for actively managed mutual funds can be 10 times higher than those of comparable index funds. Many broad-based index funds have expense ratios of 0.10% or less.

Actively managed funds also generally trade more frequently than passive index funds, triggering more taxable events for shareholders and creating additional costs.

The higher fees associated with mutual funds cut directly into the returns received from the fund, which is why many actively managed mutual funds underperform.

Hedge Funds: Higher Returns, Lower Risk than Mutual Funds

You may want to see also

Mutual funds try to beat the market, index funds mirror it

Mutual funds and index funds are both investment options for those looking to diversify their portfolios. However, there are some key differences between the two.

Mutual Funds Try to Beat the Market

Mutual funds are investments that allow multiple investors to pool their money together to invest in something—usually stocks, bonds, or other securities. Mutual funds are actively managed, meaning they have a team of professionals who pick and choose the stocks, bonds, or other investment options included in the fund. The goal of a mutual fund is to outperform the market or a particular benchmark index.

Index Funds Mirror the Market

Index funds, on the other hand, are passively managed. They are designed to mirror the performance of a particular index, such as the S&P 500 or the Dow Jones Industrial Index. An index fund manager buys the same securities as tracked by the index, with the same weightings. The sole purpose of an index fund is to provide investors with exposure to a certain asset class, and it does not aim to outperform the index.

Fees and Costs

Another difference between mutual funds and index funds lies in their fees and costs. Mutual funds have higher operating costs due to the team of professionals managing the fund. These costs are passed on to the investors through higher fees and expense ratios. Index funds, on the other hand, tend to have lower fees and expense ratios since they are passively managed and do not require a team of professionals to actively select investments.

Performance

Historically, it has been difficult for mutual funds to beat the market consistently. According to the S&P Indices versus Active (SPIVA) scorecard, only 12.02% of funds outperformed the S&P 500 in the last 15 years. While there are some fund managers who have beaten the market, the majority of mutual funds underperform compared to index funds after fees.

Suitability

The suitability of mutual funds or index funds depends on an individual's financial goals and investing philosophy. If an individual is seeking passive, low-cost diversification, then index funds may be a better option. On the other hand, if an individual believes in a more active management approach and is willing to pay higher fees for the potential of higher returns, then mutual funds may be more suitable.

Mutual Fund Tax Strategies: Secrets to Tax-Free Investing

You may want to see also

Mutual funds may underperform their benchmark index

Actively managed mutual funds typically have higher fees than index funds, as they require a portfolio manager and a team of researchers to make investment decisions. These fees are bundled into the mutual fund expense ratio, which is paid by the shareholder. The higher fees can eat into the returns of the fund, leading to underperformance.

Additionally, it is difficult for fund managers to consistently pick stocks that outperform the market. In 2021, 79% of fund managers underperformed the S&P 500, and historically, only a small percentage of funds have been able to beat the market over the long term. This makes it challenging for investors to pick the funds and managers that will consistently outperform.

The underperformance of actively managed mutual funds compared to index funds has been demonstrated by various studies. The Wharton School at the University of Pennsylvania found that 97% of fund managers for large- and midsize companies produced lower returns compared to their index counterparts. Similarly, the S&P Indices versus Active (SPIVA) scorecard showed that only 12.02% of funds outperformed the S&P 500 in the last 15 years.

While mutual funds offer the potential for higher returns through active management, the higher fees and the challenge of consistently beating the market can lead to underperformance relative to their benchmark index.

Saudi Wealth Fund: Where is it Invested?

You may want to see also

Index funds are a type of mutual fund

Index funds have become an important investing tool because they offer instant diversification with low expense ratios and less risk than owning individual stocks. They are also much cheaper to own than actively managed funds because they are based on an index rather than active management. The fund company doesn't pay a pricey research staff to find the best investments but instead mechanically copies the index itself. As a result, index funds usually charge a low expense ratio to investors, making them one of the best investments.

Another benefit of index funds is that they tend to be more tax-efficient. Because they have less turnover, they may create lower tax liabilities for investors. However, one downside of index funds is that they deliver an average return. An index fund delivers the weighted average returns of its assets, and it must be invested in all the index's stocks, so it can't avoid the losers.

When deciding whether to invest in index funds or mutual funds, it's important to consider your financial goals. If you're looking for passive, low-cost diversification, then an index fund may be a good fit. Additionally, index funds tend to outperform actively managed funds. On the other hand, if you're looking for the potential to outperform the market and are willing to pay higher fees, then a mutual fund might be a better option.

Fidelity's Energy Sector Fund: A Smart Investment Choice?

You may want to see also

Frequently asked questions

Index funds are a type of mutual fund that invests exclusively in companies listed on a specific index, like the S&P 500. Mutual funds, on the other hand, are actively managed and can invest in stocks, bonds, and other assets chosen by a fund manager.

Mutual funds offer the potential to outperform the market and provide investors with access to investing professionals who can help with long-term investing plans. Mutual funds also offer diversification across multiple assets and the fund managers may adjust holdings to preserve capital in a down market.

Mutual funds typically have higher fees than index funds due to the cost of active management. They may also underperform their benchmark index and distribute capital gains taxes on distributions held in taxable investment accounts.

Index funds are passively managed, which means they have lower fees than mutual funds. They also offer instant diversification with low expense ratios and less risk than owning individual stocks. Additionally, index funds are considered tax-efficient since they have less turnover.

Index funds deliver average returns and investors have no control over which stocks are included in the index. Index funds may also track a poor-performing index and investors may have to pay capital gains taxes on distributions held in taxable investment accounts.