Fossil fuel companies are fueling the climate crisis, and investors are increasingly looking to divest from these companies. Fossil Free Funds, for example, is a search platform that allows investors to see if their money is being invested in fossil fuel companies or companies with high carbon footprints. Despite the overall growth of sustainable funds, fossil-fuel-free funds still make up a small percentage of this universe. However, there are a growing number of green funds offered by major brokerage firms that investors can opt into. For example, the S&P 500 Fossil Fuel Free Index includes fossil fuel-free equities from the broader S&P 500 Index, consisting of companies that do not own fossil fuel reserves.

What You'll Learn

- Fossil-fuel-free funds are a small percentage of sustainable funds

- Fossil-fuel-free funds may still have fossil-fuel exposure

- Fossil-fuel-free funds can invest in renewable energy

- Fossil-fuel-free funds can focus on green bonds

- Fossil-fuel-free funds can be evaluated using criteria like Morningstar's fossil-fuel involvement measure

Fossil-fuel-free funds are a small percentage of sustainable funds

Morningstar, a well-known investment research firm, defines fossil fuel involvement more broadly. They consider a fund's percentage exposure to companies that derive at least 5% of their revenue from thermal-coal extraction, thermal-coal power generation, oil and gas production, or oil and gas power generation. Alternatively, they may derive 50% of their revenue from oil and gas products and services. By this broader definition, only a small percentage of sustainable funds are truly fossil-fuel-free.

To ensure that your investments align with your values, it's important to evaluate funds using additional criteria, such as fossil-fuel involvement measures and designations like the Morningstar Low Carbon Designation, which indicates lower-than-average fossil-fuel involvement.

Another important distinction to make is between fossil-fuel-free funds and low-carbon funds. Fossil-fuel-free funds completely avoid investing in fossil fuels, while low-carbon funds have lower-than-average fossil-fuel involvement but may not completely avoid it.

It's worth noting that sustainable funds are on the rise, with a total of 303 funds as of the end of 2019, up from 270 at the end of 2018. However, these funds vary in their definitions of sustainability, with some focusing on green bonds or renewable energy investments.

As an investor, it's crucial to do your research and understand the specific definitions and criteria used by different funds to determine their level of fossil fuel involvement. This will help you make informed decisions that align with your values and financial goals.

Trust Fund Investment: Strategies for Long-Term Wealth

You may want to see also

Fossil-fuel-free funds may still have fossil-fuel exposure

Fossil-fuel-free funds are on the rise, with a total of 303 funds as of the end of 2019, up from 270 at the end of 2018. However, Morningstar research shows that fossil-fuel-free funds still make up a small percentage of sustainable funds.

Funds define fossil-fuel-free differently. For example, three State Street ETFs use the term "Fossil Fuel Reserves Free" in their names. These funds exclude companies that own "proved and probable coal, oil, and/or natural gas reserves used for energy purposes", but they still have overall fossil-fuel exposure ranging from 4.3% to 7.4%.

From Morningstar's perspective, fossil-fuel involvement is defined more broadly as a portfolio's percentage exposure to companies that derive at least 5% of their revenue from thermal-coal extraction, thermal-coal power generation, oil and gas production, or oil and gas power generation, or 50% of their revenue from oil and gas products and services. By this definition, only a few sustainable funds avoid investing in fossil fuels altogether. By prospectus, just 91 of the 303 sustainable funds say they are fossil-fuel-free or even low carbon. And when we apply our definition of fossil-fuel involvement to the portfolios of diversified sustainable equity funds, only 10% are not involved.

To ensure avoidance of fossil fuels and investments in low-carbon options, investors should evaluate funds using additional criteria such as fossil-fuel involvement measures and the Morningstar Low Carbon Designation.

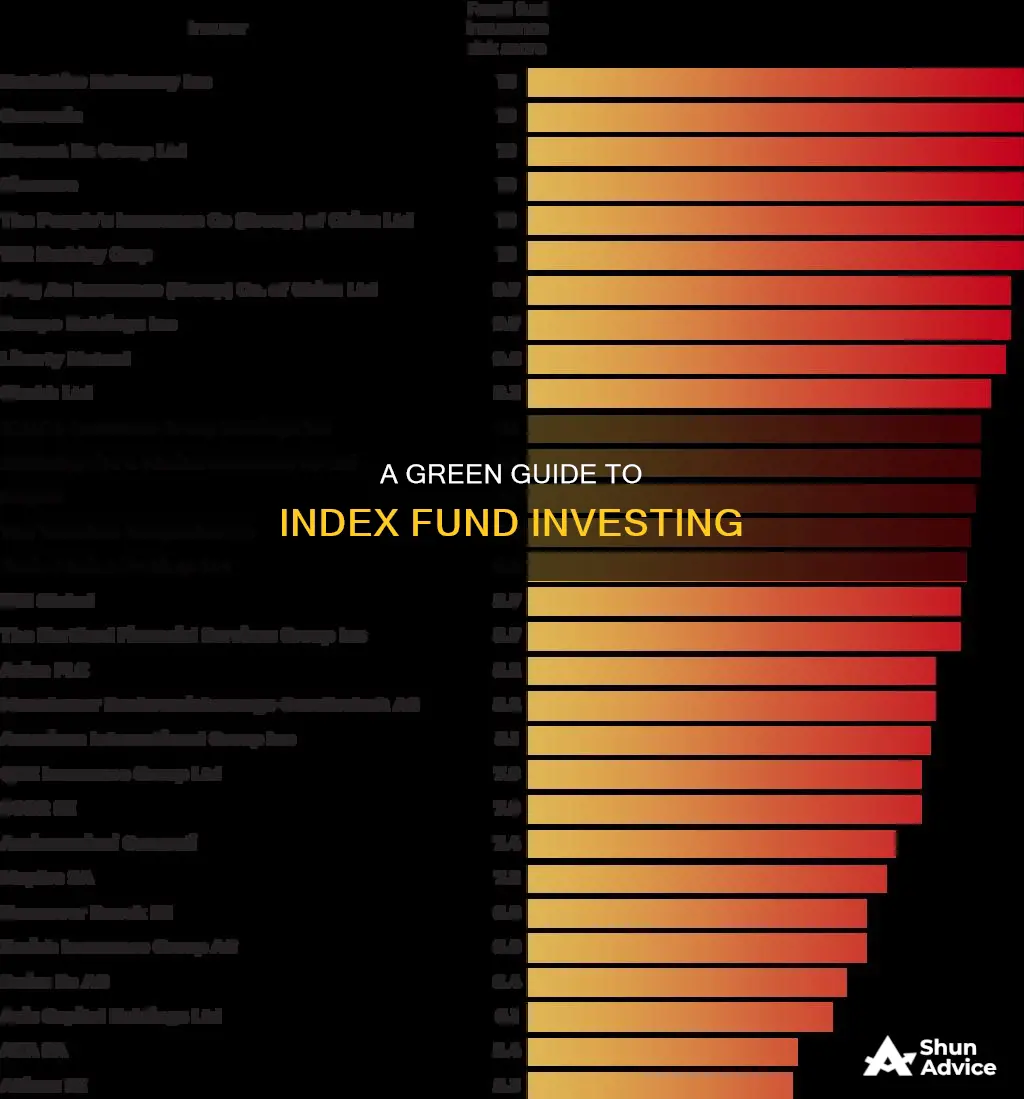

Fossil Free Funds is a search platform that looks at the climate impact of popular mutual funds and shows if your money is being invested in fossil fuel companies or companies with high carbon footprints. It covers 3,000 stock funds available in the US. It tracks fund exposure to fossil fuel companies, fossil finance and insurance, and clean energy leaders.

Fossil fuel investments carry real financial risks. When emissions are constrained, fossil fuel companies will have their carbon assets stranded. Over the past years, a growing divestment movement of institutional and individual investors representing trillions in assets under management have responded to this risk by divesting all or some of their fossil fuel investments.

Dave Ramsey's Investment Strategy: Specific Fund Choices

You may want to see also

Fossil-fuel-free funds can invest in renewable energy

For example, Green Century Funds, which are explicitly defined as fossil fuel-free, invest in environmental leaders and innovators, including renewable energy, energy and water efficiency, and healthy food companies. Similarly, "green" funds are a type of "socially responsible" index or mutual fund that enables investors to invest in companies that are ostensibly pro-climate.

Additionally, some sustainable funds contribute to climate action by specifically investing in renewable energy. According to Morningstar's Sustainability Landscape report, only a small percentage of sustainable funds are truly fossil-fuel-free. However, their research also highlights that some sustainable funds are defined as fossil-fuel-free even if they have overall fossil-fuel exposure of up to 7.4%. This discrepancy occurs due to varying definitions of fossil-fuel involvement, with some funds only excluding companies that own fossil fuel reserves.

To ensure true avoidance of fossil fuels, investors should carefully evaluate funds using additional criteria, such as fossil-fuel involvement measures and designations like the Morningstar Low Carbon Designation, which indicates lower-than-average fossil-fuel involvement and low levels of carbon risk.

A Beginner's Guide to Vanguard Index Fund Investing

You may want to see also

Fossil-fuel-free funds can focus on green bonds

By this definition, only a few sustainable funds avoid investing in fossil fuels altogether. To ensure complete avoidance of fossil fuels, investors should evaluate funds using additional criteria such as fossil-fuel involvement measures and the Morningstar Low Carbon Designation. This designation is given to funds with lower-than-average fossil-fuel involvement and low levels of carbon risk. Sustainable funds tend to have higher levels of avoidance when it comes to thermal coal, which is considered the fossil fuel with the worst carbon impact.

There are several trusted options for fossil fuel-free investment funds. The Triodos Pioneer Impact Fund, managed by Triodos Investment Management, invests in small and medium-sized companies that are innovators in meeting sustainability challenges. The FP WHEB Sustainability Fund, for UK residents only, invests exclusively in companies providing solutions to sustainability challenges. The Castlefield Sustainable European Fund screens out fossil fuels and other destructive industries, while the EdenTree Responsible & Sustainable Global Equity Fund invests only in companies making a positive contribution to society and the environment.

Additionally, the Impax Environmental Markets Plc is an investment trust focused on environmental businesses, and the PensionBee Fossil Fuel-Free Pension Plan is one of the UK's first mainstream private pension plans to exclude companies with reserves in oil, gas, or coal. The Artemis Positive Future Fund invests in companies driving positive environmental and social change, and the Janus Henderson Future Technologies fund focuses on companies providing technology solutions with a positive impact. These funds offer individuals opportunities to align their investments with their values and contribute to a more sustainable future.

Understanding 401(k) Investment: Timing Your Retirement Savings

You may want to see also

Fossil-fuel-free funds can be evaluated using criteria like Morningstar's fossil-fuel involvement measure

Morningstar's definition of fossil-fuel involvement is a portfolio's percentage exposure to companies that derive at least 5% of their revenue from thermal-coal extraction, thermal-coal power generation, oil and gas production, or oil and gas power generation, or 50% of their revenue from oil and gas products and services. This definition helps investors understand the true nature of a fund's involvement with fossil fuels, even if it brands itself as "fossil-fuel free".

By applying Morningstar's definition of fossil-fuel involvement to the portfolios of diversified sustainable equity funds, only 10% were found to have no involvement. This highlights the importance of evaluating funds using criteria like Morningstar's fossil-fuel involvement measure to ensure that investors are making informed decisions and aligning their investments with their values.

In addition to Morningstar's fossil-fuel involvement measure, investors can also refer to the Morningstar Low Carbon Designation, which is given to funds with lower-than-average fossil-fuel involvement and low levels of carbon risk. This designation provides further insight into a fund's commitment to sustainability and low-carbon options.

By utilizing these evaluation criteria, investors can make more informed decisions when considering fossil-fuel-free funds and ensure that their investments align with their sustainability goals.

Bond Fund Benefits: Diversify and Gain with Less Risk

You may want to see also

Frequently asked questions

Fossil Free Funds is a search platform that looks at the climate impact of popular mutual funds and shows you if your money is being invested in fossil fuel companies. You can also search for mutual funds and ETFs by name, ticker, or asset manager to see if they’re invested in fossil fuel companies.

Examples of index funds that are fossil fuel-free include the S&P 500 Fossil Fuel Free Index and the SPDR S&P 500 Fossil Fuel Reserves Free ETF.

If you are looking for alternatives to investing in index funds that are not fossil fuel-free, you can consider investing in "green" funds, government bonds, municipal bonds, or "green" community banks.