Investing in an index fund with Vanguard can be a great way to meet your financial goals. Vanguard is a uniquely structured company that passes on savings to its investors, as it is owned by its funds, which are in turn owned by its fund shareholders. Vanguard offers a range of index funds that track the performance of a specific market benchmark, such as the popular S&P 500 Index. These funds provide broad diversification, tax efficiency, and low costs, making them an attractive option for investors. To get started with investing in a Vanguard index fund, you can explore their products and use their Quick Start tool to discover resources tailored to your financial goals. You can also decide on an account type, such as a general investing, retirement, or higher-education savings account, and connect your bank to your Vanguard account.

| Characteristics | Values |

|---|---|

| Investment options | Mutual funds, exchange-traded funds (ETFs), stocks, bonds, CDs, and money market funds |

| Account types | General investing, retirement, and higher-education savings |

| Investment fees | $25 annual account service fee for brokerage and mutual fund-only accounts |

| Investment minimums | $1,000 for Vanguard Target Retirement Funds and Vanguard STAR Fund; $3,000 minimum for most other funds |

| Investment process | Choose an account, select a fund, enter fund information, enter dollar amount, select funding method, review and submit transaction |

| Investment costs | Average mutual fund and ETF expense ratio of 0.08% as of December 31, 2023 |

| Investment performance | 83% of index mutual funds and ETFs performed better than their peer-group averages over the last 10 years |

| Investment benefits | Broad diversification, tax efficiency, low costs, lower risk, and professional management |

What You'll Learn

How to open a Vanguard account

Opening a Vanguard account is a straightforward process. Here is a step-by-step guide on how to open a Vanguard account:

Select an account type:

The first step is to choose the type of account that aligns with your financial goals. Vanguard offers various account types, including retirement accounts (such as IRAs), general investing accounts, education savings plans, and small business retirement plans. Consider your short-term and long-term financial objectives when making this decision.

Gather the required information:

To open a Vanguard account, you will need to provide personal information, including your bank account and routing numbers, Social Security number, and employer's name and address. Please note that specific requirements may vary based on the type of account you choose.

Visit the Vanguard website:

Go to the Vanguard website and select the "Open an account" option on their Personal Investor homepage. If you are new to Vanguard, choose the "I'm new to Vanguard" option during the account opening process.

Provide your personal information:

Fill out the online application form with your personal details, such as name, email, date of birth, citizenship status, address, and phone number. Ensure that you review your information for accuracy before proceeding.

Set up your login credentials and security:

Create a username and password for your Vanguard account. You will also be required to agree to web terms, paperless documents, and set up security questions for added protection.

Connect your bank account:

Add your bank account details to your Vanguard account. You can search for your bank manually or select from a list of popular banks. Ensure that you select the correct bank, as some banks have similar names.

Fund your account:

Decide if you want to fund your account immediately or later. There is no cost to open a Vanguard account, but some financial products may have minimum investment requirements. If you choose to fund your account now, enter the amount of your initial bank transfer.

Provide employment information:

Enter your employment details, including your employer's address and any applicable requirements or regulations associated with your occupation.

Review and accept agreements:

Go through the final account opening pages, carefully reviewing your information. Once you are satisfied, accept the agreements, and you will receive a confirmation that your Vanguard account is now open.

Start investing:

After your account is open, you can start investing by selecting "My Accounts" and then "Buy & Sell." From there, you can purchase various investment products, such as mutual funds, ETFs, and other investment options.

SEI Investment Operations: Exploring Mutual Fund Strategies

You may want to see also

Choosing an investment account

- General investing accounts: These are flexible accounts suitable for a range of investment goals. They can be used for various investment products, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). General investing accounts provide easy access to your funds, allowing you to withdraw your money at any time. However, they may have different tax implications, so it's important to understand the tax treatment of your investments.

- Retirement accounts: Retirement accounts, such as Individual Retirement Accounts (IRAs), are specifically designed to help you save for retirement. They offer tax advantages, such as tax-deductible contributions or tax-free growth, depending on the type of IRA you choose (traditional or Roth IRA). These accounts usually come with restrictions on withdrawals before a certain age, such as 59 1/2 for IRAs in the US, to encourage long-term savings.

- Education savings accounts: If you're saving for higher education, consider a 529 plan or a similar education savings account. These accounts offer tax benefits to help you save for future education expenses. They are typically flexible, allowing you to use the funds for a range of education-related costs, such as tuition, fees, books, and sometimes even student loans.

- Brokerage accounts: These accounts are offered by brokerage firms and allow you to invest in a variety of investment products, including stocks, bonds, mutual funds, and ETFs. Brokerage accounts provide easy access to your funds and often come with tools and resources to help you manage your investments. However, they may have higher fees and commissions than other types of accounts.

When choosing an investment account, it's important to consider the fees and minimum investment requirements associated with each option. Additionally, make sure you understand the tax implications of each account type to make the most tax-efficient choice for your investments.

Mutual Fund Investing: Cutting Out the Broker

You may want to see also

Understanding Vanguard's fees and account minimums

Vanguard is known for its low-cost approach to investment funds. The average Vanguard mutual fund and ETF (exchange-traded fund) expense ratio is 82% less than the industry average.

Account and Advice Fees

Vanguard charges an annual account and service fee of $25 for each brokerage and mutual-fund-only account. However, there are ways to avoid this fee. For example, the fee is waived if you have at least $5 million in qualifying Vanguard assets. It can also be eliminated by signing up for e-delivery of statements and other important account documents.

Vanguard also offers four investment advice services, each with its own advisory fee schedules.

Trading Fees

Vanguard does not charge a commission to buy or sell Vanguard mutual funds and ETFs online in your Vanguard account. However, a few Vanguard mutual funds do charge fees to cover high transaction costs and discourage short-term trading. These fees vary from 0.25% to 1.00% of the transaction amount.

Minimum Investment Requirements

Most Vanguard mutual funds require a minimum investment of $3,000. However, you can invest in any Vanguard Target Retirement Fund or Vanguard STAR® Fund with just $1,000.

The minimum investment for Vanguard ETFs is $1 through their fractional share program. The minimum investment for non-vanguard ETFs or other individual securities, like stocks and bonds, is the market price of one share.

Other Costs

In addition to the fees and minimums mentioned above, there may be other costs associated with investing in Vanguard funds, such as bid-ask spreads and expense ratios. Vanguard's average expense ratio for mutual funds and ETFs is 0.08%, which is significantly lower than the industry average of 0.44%.

It's important to carefully review the fee and cost structure of any investment fund before making a decision.

Best Mutual Funds for Long-Term Investment Horizons

You may want to see also

The benefits of Vanguard index funds

Vanguard is a uniquely structured company that passes more savings directly to its investors. It was founded on the idea that an investment company shouldn't have any outside owners. This means that Vanguard's funds own the company, and investors own the funds. This structure allows the company to focus on investors' interests and pass on benefits as more investors choose their index funds.

Vanguard's index funds have an enviable cost advantage, with an average expense ratio that is 72% less than the industry average. This means that investors keep more of their money in the market. Vanguard also has a long history of strong performance, with 83% of their index mutual funds and ETFs outperforming their peer-group averages over the last 10 years.

Vanguard's index funds offer lower risk through broader diversification. Each index fund contains a preselected collection of hundreds or thousands of stocks and bonds. This diversification helps to minimize losses, as the strong performance of some stocks or bonds can offset the poor performance of others. Additionally, index funds do not change their holdings as often as actively managed funds, resulting in fewer taxable capital gains distributions, which can reduce investors' tax bills.

Vanguard's mutual funds are also professionally managed by experts, saving investors time and effort in choosing and monitoring their investments.

Diversify Your Portfolio: Invest in Multicap Funds

You may want to see also

How to buy Vanguard mutual funds online

Investing in a Vanguard index fund is a great way to benefit from broad diversification, tax efficiency, and low costs. Here is a step-by-step guide on how to buy Vanguard mutual funds online:

- Open a Vanguard Account: If you don't already have one, you will need to open a Vanguard investing account. This can be done quickly and easily through the Vanguard website. It is free to open an account, and you will need to fund it with an electronic bank transfer.

- Choose Your Fund: Vanguard offers a wide range of mutual funds to choose from. You can use their online tools to explore the different options and find the right fund for your investment goals. Consider factors such as your risk tolerance, time horizon, and investment amount when selecting a fund.

- Login and Select Account: From the Vanguard homepage, search for "Buy funds" or go to the Buy Funds page. Log in to your account, then scroll to find the specific account you want to use for your purchase and select it.

- Select Your Fund: If you are buying a new fund, choose the checkbox next to "Add another Vanguard mutual fund." A text box will appear where you can enter the fund name, ticker symbol, or fund number. Select the desired fund from the options that appear.

- Enter Purchase Details: Specify the dollar amount you want to purchase and click "Continue." Then, select your funding method from the dropdown menu and click "Continue" again.

- Review and Submit: On the Review and Submit page, carefully review the details of your transaction. When you are ready to proceed, click "Submit." You will then be taken to a Confirmation screen that will display the transaction details.

- Set Up Automatic Investments: Vanguard offers the option to set up automatic investments and withdrawals. You can choose the dollar amount and frequency of transactions, making it a convenient "set it and forget it" option.

Remember, investing carries risks, and past performance does not guarantee future results. Always do your research and consider your financial situation and goals before investing.

Utility Index Funds: When to Invest for Maximum Returns

You may want to see also

Frequently asked questions

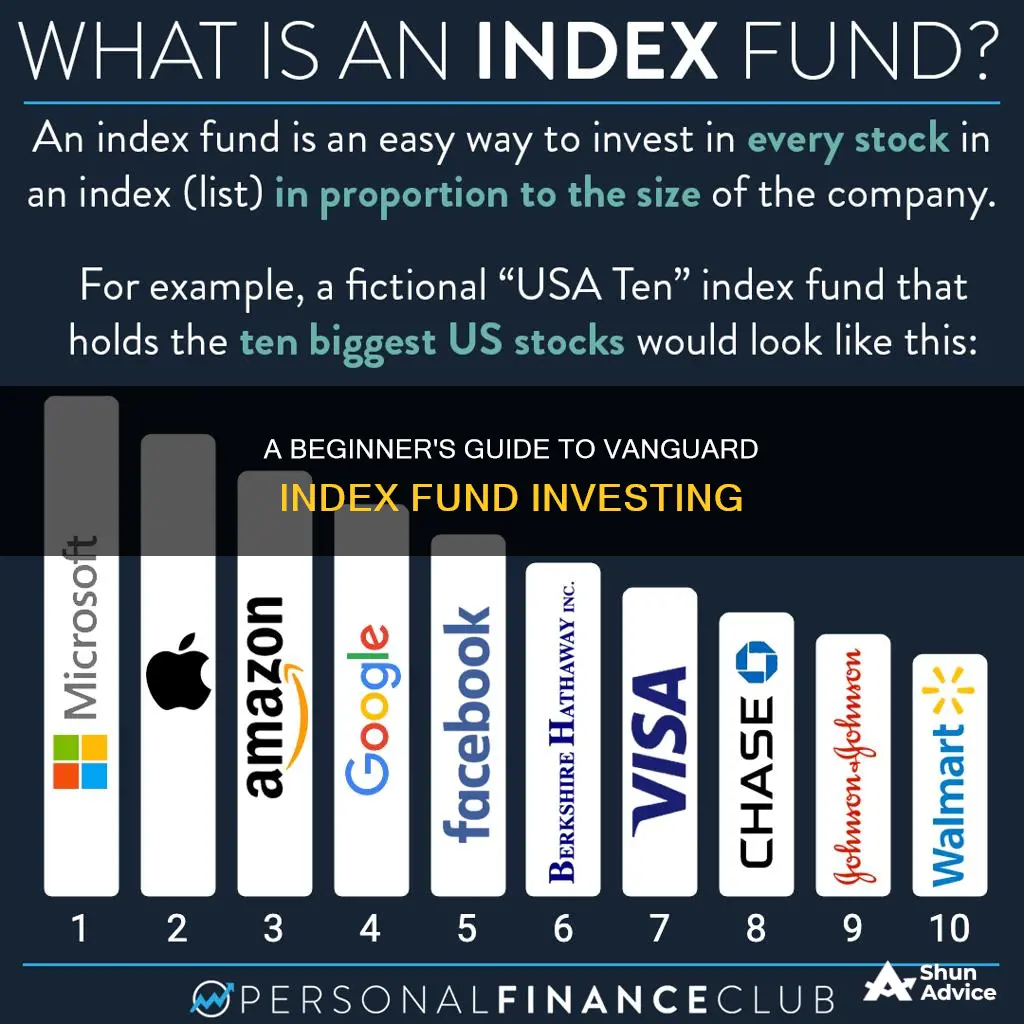

Vanguard index funds track the performance of a single market index, such as the S&P 500 or Nasdaq, to mirror its total market returns.

Vanguard creates index funds by buying securities that represent companies across an entire stock index or targeted to specific groups, such as industry sectors or firms in the same region. Individual investors then purchase shares of the fund that interests them, claiming a slice of its returns.

First, go to the Vanguard homepage and search for "Buy funds" or go to the Buy funds page. Log in, then select the account you'd like to use for your purchase. Choose an existing fund or add a new Vanguard mutual fund, then enter the fund information and the dollar amount you want to purchase. Choose your funding method and review the details of your transaction before submitting.

Vanguard offers mutual funds, exchange-traded funds (ETFs), stocks, bonds, CDs, and money market funds.