Lifecycle funds, also known as target-date funds, are a type of investment fund designed to optimise returns and minimise risk by a specific date, usually an investor's retirement date. They are ideal for investors who don't want to actively manage their portfolio and are a popular option for 401(k) accounts. Lifecycle funds automatically adjust their asset allocation over time, shifting from higher-risk investments, such as stocks, to lower-risk investments, such as bonds, as the target date approaches. While these funds offer convenience and a set-and-forget retirement plan, they also have drawbacks, including high fees and potential limitations on returns.

| Characteristics | Values |

|---|---|

| Type of fund | Asset-allocation fund, also known as "age-based funds" or "target-date retirement funds |

| Who it's for | Investors with specific goals that require capital at set times, usually for retirement |

| How it works | Share of each asset class is automatically adjusted to lower risk as the desired retirement date approaches |

| Investment type | Stocks, bonds, and other fixed-income investments |

| Advantages | Convenience, preset glide path, managed through the target retirement date |

| Disadvantages | Age-based approach may be flawed, relatively high fees, may not suit all investing goals, potential for high management fees |

What You'll Learn

- Lifecycle funds are ideal for investors who don't want to actively manage their portfolio

- They are also known as age-based funds or target-date retirement funds

- Lifecycle funds are designed to be used by investors with specific goals that require capital at set times

- They are a popular choice for 401(k) investors

- The funds are relatively inflexible and can come with high management fees

Lifecycle funds are ideal for investors who don't want to actively manage their portfolio

Lifecycle funds, also known as target-date funds, are ideal for investors who don't want to actively manage their portfolio. These funds are designed to automate certain aspects of portfolio management, making them a popular choice for investors seeking a hands-off approach.

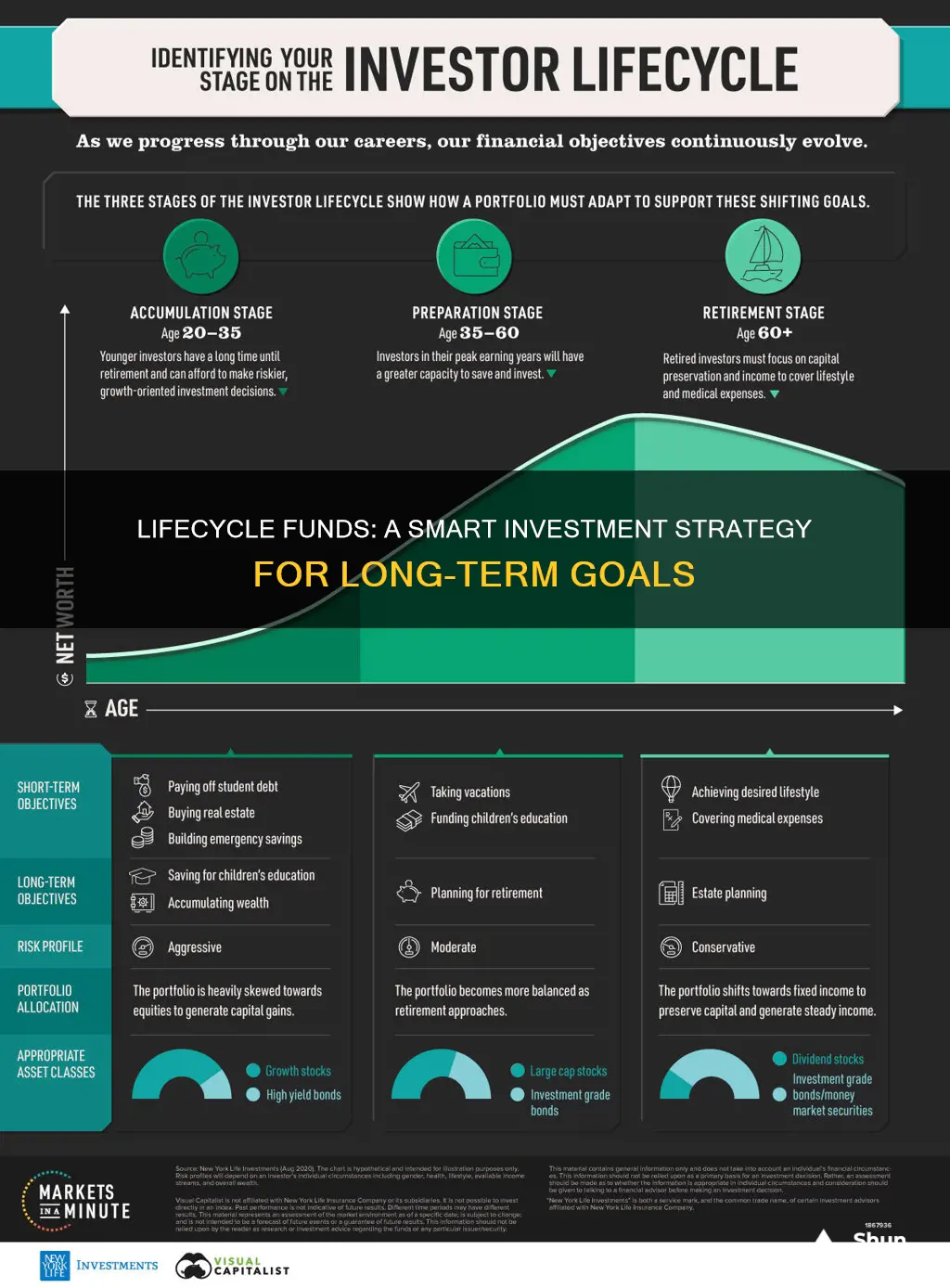

Lifecycle funds are structured to minimise risk and maximise returns by a specific date, usually the investor's retirement date. As this target date approaches, the fund gradually shifts from higher-risk investments, such as stocks, to lower-risk options like bonds. This helps to preserve capital and ensure that investors don't face sudden losses as they near retirement.

For example, an investor in their twenties might choose a lifecycle fund with a target retirement date of 2050. Initially, the fund will be aggressive, with a high percentage of stocks. However, each year, the fund automatically adjusts to include more bonds and fewer stocks. By 2035, halfway to the target date, the fund might comprise 60% stocks and 40% bonds. This gradual shift continues until the target retirement date, where the fund reaches a more conservative balance, such as 40% stocks and 60% bonds.

The convenience of lifecycle funds lies in their autopilot nature. Once an investor picks a fund with the right target date, the fund managers make all the decisions about asset allocation, diversification, and rebalancing. This set-and-forget approach is particularly appealing to investors who don't want to actively manage their portfolio and prefer a passive investment strategy.

However, it's important to consider the potential drawbacks of lifecycle funds. These funds are relatively inflexible, assuming retirement income will come solely from this fund. Additionally, they often come with high management fees, which can impact overall returns. Therefore, while lifecycle funds offer convenience, investors should carefully weigh the benefits against the potential costs and limitations.

Best Vanguard Funds for Your Taxable Investment Portfolio

You may want to see also

They are also known as age-based funds or target-date retirement funds

Life-cycle funds are also known as age-based funds or target-date retirement funds. They are a type of fund designed to optimise returns and minimise risk by a target date, usually an investor's retirement date. They are ideal for investors who don't want to actively manage their portfolio and are a popular option for 401(k) accounts.

When investing in a life-cycle fund, an investor chooses a fund with a target date that is typically 30 to 40 years away for younger investors and 15 years away for those nearing retirement age. The fund is then managed according to modern portfolio management theory, with the aim of maximising returns and minimising risk until the target date.

As the target date approaches, life-cycle funds gradually shift from higher-risk assets, such as stocks, to lower-risk assets, such as bonds and fixed-income investments. This is known as the "glide path" and is designed to preserve capital and ensure investors don't face sudden losses as they near retirement.

The Thrift Savings Plan (TSP) for employees of the US federal government offers life-cycle funds with retirement dates in five-year intervals ranging from 2025 to 2065. For example, the L 2030 fund is designed for investors who plan to retire and start withdrawing their money around 2030. The L Funds are adjusted every quarter to gradually shift them from higher-risk to lower-risk assets as they get closer to their target dates.

While life-cycle funds offer the advantage of convenience and a set-and-forget retirement plan, they also have some drawbacks. They may have relatively high fees compared to simple index funds, and they may not be suitable for investors who plan to retire before or continue working after the target date. Additionally, life-cycle funds assume that the fund is an investor's only source of retirement income, which may not always be the case.

Equity Funds: A Guide to Investing and Growing Your Wealth

You may want to see also

Lifecycle funds are designed to be used by investors with specific goals that require capital at set times

Lifecycle funds are designed for investors who have specific financial goals that require capital at predetermined times. These funds are typically used for retirement investing, but they can also be used for other financial goals that require capital at a specific time in the future. Each lifecycle fund is designed with a specific time horizon in mind, which is usually indicated by a target date in the fund's name.

For example, if an investor plans to retire in 2050, they would choose a lifecycle fund with a target date of 2050. Initially, the fund will have a higher allocation of stocks, which are more aggressive investments. As the target date approaches, the fund will gradually shift to a more conservative mix of investments, with a higher allocation of bonds and other fixed-income investments. This helps to preserve capital and ensure that the investor doesn't face a sudden loss as they near retirement.

The advantage of lifecycle funds is that they offer a convenient, set-and-forget retirement plan. Investors can put their investing activities on autopilot, as the fund automatically adjusts its asset allocation over time. This can be particularly beneficial for investors who don't want to actively manage their portfolio or conduct ongoing research and maintenance.

However, it's important to consider the limitations of lifecycle funds. They may have relatively high fees compared to simple index funds. Additionally, no two lifecycle funds follow the exact same path, and they are designed with the assumption that they are an investor's only source of retirement income. Therefore, investors should carefully review the prospectus of any lifecycle fund they are considering and ensure that it aligns with their retirement strategy and other sources of income.

Overall, lifecycle funds can be a useful tool for investors who have specific financial goals and want a passive approach to investing, but it's important to be aware of their potential drawbacks and ensure they fit within an investor's broader financial plan.

Investment Spending: Where Does the Money Come From?

You may want to see also

They are a popular choice for 401(k) investors

Lifecycle funds, also known as target-date funds, are a popular choice for 401(k) investors. They are designed to automate some aspects of portfolio management and are ideal for investors who don't want to actively manage their portfolios. Lifecycle funds are structured to minimise risk and maximise returns at a specific date, usually an investor's retirement date.

Lifecycle funds are popular with 401(k) investors because they don't require ongoing research and maintenance. These funds automatically adjust their asset allocation to lower risk as the desired retirement date approaches. This means that investors can put their investing activities on autopilot with just one fund.

For example, an investor who plans to retire in 2030 might choose a lifecycle fund with a target retirement date of 2030. Initially, the fund will be aggressive, with a high percentage of stocks. As the retirement date approaches, the fund will gradually shift to a more conservative mix of investments, with a higher percentage of bonds and other fixed-income investments. By the target retirement date, the fund will have a lower-risk portfolio to preserve the investor's capital.

While lifecycle funds offer convenience and a passive approach to retirement planning, they also have some downsides. These funds are relatively inflexible and can have high management fees. Additionally, the automated changing of portfolio assets may not suit all investors' goals, especially if they plan to retire before or continue working after the target date.

Contrarian Macro Fund: An Alternative Investment Strategy

You may want to see also

The funds are relatively inflexible and can come with high management fees

While life-cycle funds offer the advantage of convenience, they are not without their drawbacks. One notable disadvantage is their relative inflexibility. Life-cycle funds are designed for investors with specific goals who require capital at set times, typically for retirement. This rigid structure may not align with the goals of all investors, particularly those who plan to retire before or continue working beyond the target date. As the target date approaches, these funds gradually shift towards a more conservative mix of investments, which may not suit the investment strategy of every investor.

Additionally, life-cycle funds can come with high management fees. Investors are responsible for paying both the fees charged by the fund and the expense ratios of the underlying funds owned. These fees can be relatively high compared to simple index funds, and it's important for investors to weigh the cost against the benefits provided.

The inherent risk of stock market investing is another factor to consider. While life-cycle funds are designed to optimise returns and minimise risk through a particular date, there is no guarantee that the fund will provide high returns by the target date. A bear market, for instance, could significantly impact the fund's holdings just before the target date.

Furthermore, life-cycle funds assume that the investor's only source of retirement income is that single fund. This assumption may not hold true, as individuals may have other sources of income, such as Social Security or pensions, that are not taken into account by the fund managers. Consequently, life-cycle funds should be viewed as only one component of a comprehensive retirement plan.

Choosing a Location for Your Offshore Investment Fund Office

You may want to see also

Frequently asked questions

Lifecycle funds are asset-allocation funds in which the share of each asset class is automatically adjusted to lower risk as the desired retirement date approaches. They are also known as target-date funds.

Lifecycle funds are designed to be used by investors with specific goals that require capital at set times. These funds are generally used for retirement investing. Each fund defines its time horizon by naming the fund with a target date. As the target date approaches, the fund gradually makes the portfolio more conservative by shifting asset allocation from stocks to bonds.

Lifecycle funds offer the advantage of convenience as they can be put on autopilot with just one fund. They also have the advantage of a preset glide path, which offers investors greater transparency and confidence in the fund.

Lifecycle funds are relatively inflexible and can come with high management fees. The automated changing of portfolio assets may not suit your investing goals if you plan to retire before or continue working after the target date.