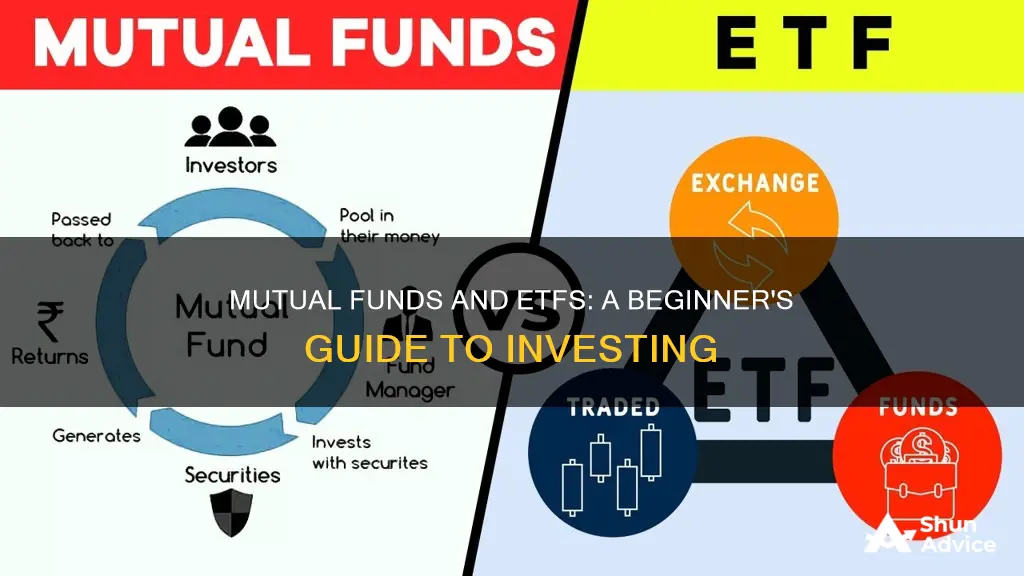

Mutual funds and ETFs (exchange-traded funds) are popular investment vehicles for those looking to grow their money. Both are a collection of securities, like stocks and bonds, that are traded on an exchange. However, there are some key differences between the two.

Mutual funds are a practical and cost-efficient way to build a diversified portfolio. They are actively managed by professionals and are bought and sold once a day after the market closes. Mutual funds also tend to have higher fees than ETFs, including sales commissions and management fees.

On the other hand, ETFs are known for their low fees and flexibility. They can be traded like individual stocks on an exchange throughout the day. ETFs are passively managed, meaning they aim to replicate the performance of a broader index like the S&P 500. Due to their passive nature, ETFs generally have lower expense ratios than mutual funds, resulting in more profits for investors.

Both mutual funds and ETFs are viable options for investors, offering diversification and the potential for growth. However, it is essential to carefully consider the fees, investment objectives, and risks associated with each before making any investment decisions.

| Characteristics | Values |

|---|---|

| Similarities | Both ETFs and mutual funds represent professionally managed collections or "baskets" of individual stocks or bonds. |

| Both are less risky than investing in individual stocks and bonds. | |

| Both offer a wide variety of investment options. | |

| Both are overseen by professional portfolio managers. | |

| Differences | ETFs can be traded intra-day like stocks but mutual funds can only be purchased at the end of each trading day. |

| Mutual funds have been around for longer. | |

| Mutual funds usually have higher minimum investment requirements than ETFs. | |

| ETFs are usually passively managed, mutual funds can be actively or passively managed. | |

| ETFs are more tax-efficient than mutual funds. | |

| Mutual funds are actively bought and sold between investors and the fund company. |

What You'll Learn

Mutual funds vs ETFs: pros and cons

Mutual funds and exchange-traded funds (ETFs) are both investment vehicles made up of a diversified portfolio of securities. They are similar in structure, but there are some key differences. Here are the pros and cons of each:

Mutual Funds:

Pros:

- Diversification: Mutual funds provide instant diversification, which is ideal for investors who lack the interest, time, or funds to build a portfolio with individual stocks.

- Professional management: Actively managed mutual funds aim to beat the market, providing opportunities for better earnings.

- Fractional shares: Mutual funds allow for "dollar-cost investing", a strategy where a specific amount is invested on a schedule. Fractional shares ensure the full amount of the investment is utilised.

- Convenience: Mutual funds allow for automatic reinvestment of dividends and capital gains distributions.

Cons:

- Higher expense costs: Actively managed mutual funds tend to have higher investment costs than passively managed ETFs.

- Higher capital gains taxes: Mutual funds pass along capital gains at the end of the year, so shareholders pay taxes on those gains even if the fund performed poorly overall.

- Lack of transparency: Mutual funds are not required to disclose their holdings as frequently as ETFs, making them less transparent.

- Less liquidity: Mutual fund shares can only be redeemed once per day after trading is over, making them less liquid than stocks or ETFs.

- History of underperformance: Actively managed mutual funds often fail to achieve their objective of beating a benchmark, and even passively managed mutual funds tend to underperform their ETF counterparts.

ETFs:

Pros:

- Diversification: ETFs provide an easy, cost-efficient way to increase portfolio holdings without the need to buy individual stocks.

- Tax efficiency: ETFs are more tax-efficient due to their exchange-traded nature, and the ability to pass shares back and forth on the exchange reduces the chance of capital gains.

- Tradeability: ETFs trade like stocks, providing the opportunity to take advantage of share price fluctuations throughout the trading day.

- Transparency: ETF holdings are disclosed daily, so investors know exactly what they own.

- Liquidity: ETFs can be bought or sold throughout the trading day, adding a layer of liquidity.

Cons:

- Lack of fractional shares: ETFs do not usually offer fractional shares, so investors must purchase whole shares regardless of the cost.

- Passive management: ETFs that follow an index do not attempt to beat the benchmark, so gains may be smaller.

- Tracking error: ETFs may not always reflect their holdings exactly.

Vanguard Index Funds: Best Bets for Your Money

You may want to see also

How to choose the right investment type for your goals

When choosing the right investment type for your goals, it's important to understand the differences between mutual funds and ETFs (exchange-traded funds). Both are popular investment vehicles that offer diversification and professional management, but there are some key distinctions to consider. Here are some factors to help you decide which investment type aligns better with your goals:

Investment Flexibility

ETFs offer more flexibility in terms of trading. They are bought and sold on a stock exchange throughout the day, providing intraday liquidity. This means you can buy or sell them whenever you want, giving you more control over the price of your trade. Mutual funds, on the other hand, are traded only once a day at the market close, and the price is the same for all investors on that day.

Investment Minimums

ETFs typically have lower investment minimums. You can buy an ETF for the price of a single share, which can be as little as as little as $50 or a few hundred dollars. Mutual funds, on the other hand, often have higher minimum initial investments, usually a flat dollar amount that can range from $500 to $5,000 or more.

Investment Control

With ETFs, you have more hands-on control over the price of your trade. They provide real-time pricing, and you can use sophisticated order types to have greater control over your purchase or sale. Mutual funds are simpler in this regard, as you get the same price as everyone else who traded that day, regardless of when you placed your order.

Investment Automation

If you want to set up automatic investments or withdrawals, mutual funds are a better choice. Mutual funds allow you to automate transactions based on your preferences. ETFs do not offer this feature.

Investment Type

If you're specifically looking for an index fund, both ETFs and mutual funds can fit the bill. However, most ETFs are index funds, while mutual funds come in both active and indexed varieties. Index funds are passively managed, aiming to match the performance of a market index, while active funds aim to outperform the market through active management.

Tax Efficiency

ETFs generally offer better tax efficiency. As passive investments, they tend to generate fewer capital gains for investors since they have lower turnover. Mutual funds, especially actively managed ones, may trigger capital gains taxes for shareholders even if they have unrealized losses on their overall investment.

Costs and Fees

When it comes to costs, the comparison is nuanced. ETFs often have lower expense ratios than actively managed mutual funds. However, mutual funds can also be index funds, and when comparing index mutual funds with ETFs, the cost difference may not be significant. Additionally, ETFs may be subject to commission fees from brokers, while mutual funds can be purchased without trading commissions.

In conclusion, the right investment type for your goals depends on various factors, including your investment horizon, risk tolerance, tax sensitivity, desired level of control, and preference for automation. Consider your personal circumstances and financial objectives when deciding between mutual funds and ETFs.

RIA Mutual Fund Investment: What's the Catch?

You may want to see also

Understanding the differences between mutual funds and ETFs

While mutual funds and ETFs (exchange-traded funds) are similar in many ways, there are some key differences to be aware of when deciding which investment type is right for you.

Both mutual funds and ETFs are professionally managed collections, or "baskets", of individual stocks or bonds. They are both less risky than investing in individual stocks and bonds and offer built-in diversification. They also both offer a wide variety of investment options, overseen by professional portfolio managers.

Management

While both can be actively or passively managed, most ETFs are passive investments that track a market index or sector sub-index. Mutual funds, on the other hand, are usually actively managed by a fund manager or team who makes decisions to buy and sell stocks or other securities within the fund.

Trading

ETFs can be traded intra-day like stocks, whereas mutual funds can only be purchased at the end of each trading day based on a calculated price known as the net asset value. This means that ETFs are a better choice for active traders.

Investment minimums

Mutual funds typically have higher minimum investment requirements than ETFs. Mutual funds usually require a minimum investment of hundreds or thousands of dollars, whereas you can invest in an ETF if you have enough money to buy a single share.

Cost

Mutual funds usually have more active management and therefore higher expense ratios. ETFs are often cheaper to invest in.

Tax efficiency

ETFs are usually more tax-efficient than mutual funds because, as passively managed portfolios, they tend to realise fewer capital gains.

Mid-Cap Funds: Smart Investment Timing for Optimal Returns

You may want to see also

How to buy and sell mutual funds and ETFs

Mutual funds and ETFs (exchange-traded funds) are similar in that they are both professionally managed collections or "baskets" of individual stocks or bonds. They are also similar in that they are both subject to market volatility and the risks of their underlying securities. However, there are some key differences between the two.

Buying Mutual Funds and ETFs

Mutual funds pool money from multiple investors to buy shares of stocks, bonds, or other securities. They are typically bought from an investment company or through a workplace retirement plan. Most mutual funds have minimum investment requirements, which can range from $500 to $5,000 or more. Mutual funds can be bought and sold once a day, at the 4 pm market close.

ETFs, on the other hand, are traded on an exchange throughout the day, like the stocks they own. They can be bought and sold at any point during the trading day using straightforward or sophisticated strategies. ETFs can be purchased for the price of one share, which can be as little as $50 or a few hundred dollars.

Selling Mutual Funds and ETFs

Mutual funds and ETFs can be sold in similar ways as they are bought. Mutual funds are typically sold once a day at the market close, while ETFs can be sold at any point during the trading day.

It is important to note that mutual funds and ETFs are subject to different tax treatments. Mutual funds and ETFs must pass on any net gains they realize to their shareholders at least once a year. This means that even if you haven't sold any of your shares, you may owe taxes on the fund's realized gains. ETFs are generally considered more tax-efficient than mutual funds because they make fewer distributions and are not typically required to liquidate assets to cover shareholder redemptions.

Mutual Fund Strategies: Long-Term Investments for Financial Freedom

You may want to see also

The tax implications of investing in mutual funds and ETFs

When considering investing in mutual funds and ETFs, it is important to understand the tax implications of each. While the tax treatment of both investments is similar in the eyes of the IRS, there are some key differences that can impact your tax bill.

Mutual funds and ETFs are both subject to capital gains tax and taxation of dividend income. However, the way that these investments are structured and managed can lead to differences in tax efficiency. Mutual funds are typically actively managed, meaning that fund managers are constantly rebalancing the fund by buying and selling securities. This can result in capital gains for shareholders, even if they have an unrealized loss on their overall investment. These capital gains will be passed on to shareholders at least once a year and will need to be included in their tax returns.

ETFs, on the other hand, are usually passively managed. They track market indexes or specific sector indexes and have a unique mechanism for buying and selling, which can result in fewer taxable events. When an ETF manager accommodates investment inflows and outflows, they create or redeem "creation units", which are baskets of assets that approximate the ETF's investment exposure. This means that investors are usually not exposed to capital gains on any individual security in the underlying structure.

Additionally, the majority of ETFs are passively managed, which creates fewer transactions as the portfolio only changes when there are changes to the underlying index it replicates. This results in fewer taxable events compared to actively managed mutual funds.

It is also important to note that the tax efficiency of ETFs and mutual funds can depend on the type of securities included in the fund. Funds that include high-dividend or interest-paying securities will generally receive more pass-through dividends and distributions, which can result in a higher tax bill.

When deciding between investing in mutual funds and ETFs, it is essential to consider the potential tax implications and how they may impact your overall investment strategy.

Mutual Funds: Smart Investment, Smart Returns

You may want to see also

Frequently asked questions

Mutual funds and ETFs are both managed "baskets" or "pools" of securities, such as stocks and bonds. However, mutual funds are usually actively managed, whereas ETFs are typically passively managed, tracking a market index or sector sub-index. Mutual funds can only be bought and sold at the end of each trading day, whereas ETFs can be traded throughout the day like stocks. Mutual funds usually have higher minimum investment requirements than ETFs, which can be purchased for the price of a single share.

Mutual funds are a good option for investors who want to make regular deposits and don't want the hassle of having to monitor the price of their trades. They also suit investors who are looking for a fund that could potentially beat the market.

ETFs are a good option for investors who want to keep costs down, as they usually have lower expense ratios than actively managed mutual funds. They also offer greater tax efficiency and more flexibility, as they can be traded throughout the day.