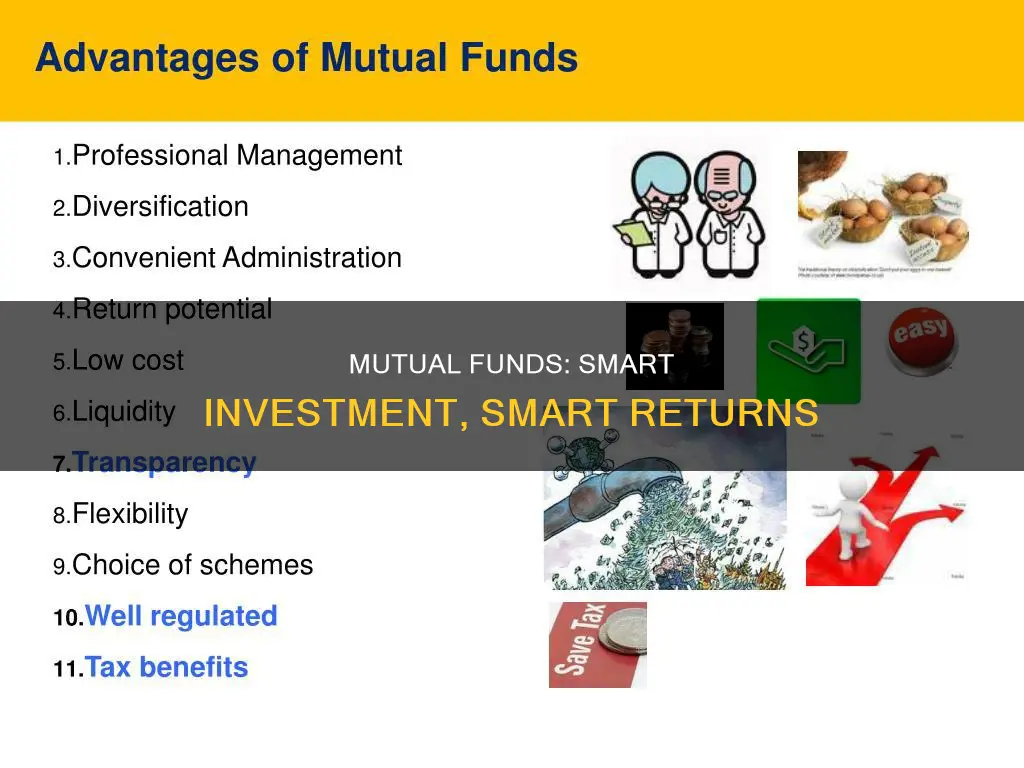

Mutual funds are a popular investment choice, especially for those looking to diversify their portfolios. They are investment pools that collect money from multiple investors and invest in a variety of securities, such as stocks, bonds, and other assets. The main advantages of investing in mutual funds include diversification, professional management, convenience, and accessibility. Mutual funds are also more liquid and tend to have lower fees due to economies of scale. However, it's important to remember that mutual funds are not guaranteed to rise in value and are subject to market risks.

| Characteristics | Values |

|---|---|

| Definition | A mutual fund is an investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. |

| Benefits | Professional management, diversification, affordability, liquidity, transparency, portfolio diversification, reduction of transaction costs, wide choice to suit risk-return profile, convenience and flexibility |

| Downsides | No control over costs, no tailor-made portfolios, managing a portfolio of funds, delay in redemption, high fees, commissions, and other expenses, large cash presence in portfolios, difficulty in comparing funds, lack of transparency in holdings |

| Types | By structure: open-ended funds, closed-ended funds, interval funds. By investment objective: growth funds, income funds, balanced funds, money market funds, load funds, no-load funds. By investment speciality: sector funds, theme funds, fund of fund, contra fund. By investment risk: high-risk funds, moderate-risk funds, low-risk funds |

Diversification

Mutual funds offer investors access to a wide range of investments, which would otherwise be difficult and costly to access individually. For example, an investor could gain exposure to hundreds of stocks or bonds through a single mutual fund. This allows investors to build a diversified portfolio quickly and cheaply, without needing to purchase individual securities.

Mutual funds also enable investors to access certain types of assets that would otherwise be inaccessible. For instance, foreign equities or exotic commodities may only be accessible to individual investors through mutual funds.

Additionally, mutual funds can provide a level of diversification that helps to lower risk if one company or industry fails. This is particularly beneficial for investors who don't want to spend time selecting individual investments but still want to benefit from the stock market's historically high average annual returns.

Overall, diversification is a significant advantage of mutual funds, providing investors with access to a wide range of investments, reducing risk, and offering the potential for higher returns.

Mutual Fund Investment: Quick, Easy, and Accessible

You may want to see also

Access to different markets

Mutual funds are an excellent way to gain access to a wide range of markets and asset classes. They are a form of investment vehicle that pools money from multiple investors, allowing them to purchase a diversified portfolio of stocks, bonds, or other securities. This provides individual investors with exposure to a professionally managed portfolio, potentially benefiting from economies of scale while spreading risk across multiple investments.

One of the key advantages of mutual funds is their ability to provide access to different markets and asset classes. Here are some of the markets and asset classes that mutual funds can offer investment opportunities in:

- Stocks: Mutual funds can invest in a range of stocks across different sectors and industries, providing investors with exposure to the stock market. This diversification helps to lower the risk of investing in individual stocks, as the impact of a single company's failure is mitigated.

- Bonds: Bond funds are another popular type of mutual fund. These funds invest in debt instruments such as debenture bonds or government securities, which are considered safer investments than stocks. Bond funds aim for higher returns than money market funds and can vary in risk and reward depending on the types of bonds included in the fund.

- Money Market Instruments: Money market funds invest in high-quality, short-term debt instruments issued by corporations, federal, state, and local governments. These funds have relatively low risks and are suitable for investors seeking capital preservation.

- Real Estate: Mutual funds can also provide access to the real estate market, allowing investors to gain exposure to this asset class without directly purchasing property.

- Derivatives: Mutual funds may invest in derivatives, which are financial contracts whose value is derived from an underlying asset, such as stocks, bonds, commodities, or currencies. This allows investors to gain exposure to the performance of these underlying assets without directly investing in them.

- Foreign and International Markets: International and global mutual funds invest in assets located outside of an investor's home country, providing access to foreign markets and diversifying portfolios across different geographic regions.

- Sector-Specific Funds: Sector mutual funds focus on specific sectors of the economy, such as finance, technology, or healthcare. This allows investors to gain targeted exposure to industries they believe will perform well.

By investing in mutual funds, individuals can access a diverse range of markets and asset classes that may otherwise be difficult or costly to invest in directly. This diversification across different markets helps to spread risk and potentially enhance long-term returns.

Mutual Funds and Gun Investments: Where Does Your Money Go?

You may want to see also

Professional management

Mutual funds are managed by professional money managers who conduct research and make skillful trades. This is a relatively inexpensive way for small investors to benefit from full-time managers who make and monitor investments. Mutual funds require much lower investment minimums, providing a low-cost way for individual investors to experience and benefit from professional money management.

Mutual funds are subject to industry regulations that ensure accountability and fairness for investors. In addition, the component securities of each mutual fund can be found across many platforms.

Mutual fund managers are legally obligated to follow the fund's stated mandate and to work in the best interest of mutual fund shareholders.

You can research and choose from funds with different management styles and goals. A fund manager may focus on value investing, growth investing, developed markets, emerging markets, income, or macroeconomic investing, among many other styles. This variety enables investors to gain exposure not only to stocks and bonds but also to commodities, foreign assets, and real estate through specialized mutual funds. Mutual funds provide prospects for foreign and domestic investment that might otherwise be inaccessible.

Dave Ramsey's Investment Strategy: Specific Fund Choices

You may want to see also

Low fees

Mutual funds are an excellent investment option for those seeking a professionally managed, diversified portfolio without the high fees typically associated with such services.

Mutual funds are a type of investment vehicle that pools money from multiple investors, allowing them to purchase a diversified portfolio of stocks, bonds, or other securities. This diversification helps to spread risk across multiple investments, providing a level of protection for investors.

One of the key advantages of investing in mutual funds is the low fees involved. While mutual funds do charge annual fees, expense ratios, or commissions, these costs are relatively low compared to other investment options. The fees cover the fund's operating expenses, including management fees, administrative costs, and marketing expenses.

The expense ratio, for example, is an annual fee expressed as a percentage of the fund's average net assets. This fee has decreased significantly over the years due to competition from index investing and exchange-traded funds (ETFs). In 1996, equity mutual fund investors incurred expense ratios of 1.04%, but by 2022, the average had dropped to 0.44%.

Additionally, there are "no-load" funds, which do not charge any sales commissions for purchasing or selling fund shares. These funds offer an even more cost-effective option for investors.

By investing in mutual funds, individuals can benefit from a professionally managed portfolio without incurring high fees. This makes mutual funds an attractive option for those seeking a balanced investment strategy without breaking the bank.

However, it is important to carefully review the fees associated with different mutual funds, as they can vary and significantly impact overall investment returns. Some funds may also have additional costs, such as redemption fees or account maintenance fees, which investors should consider when making their investment decisions.

Corporations' Hesitance Towards Mutual Funds: Exploring the Why

You may want to see also

Liquidity

Mutual funds can be traded on major stock exchanges, and investors can redeem their shares at any time. The fund usually must send the payment within seven days. Mutual fund shares are "redeemable", meaning investors can sell the shares back to the fund at the current net asset value (NAV) plus any redemption fees.

Mutual funds are also more liquid than individual stocks because they are required to hold a significant portion of their portfolios in cash to satisfy share redemptions each day. This allows investors to access their money quickly and easily.

However, it's important to be aware of any potential fees or penalties associated with early withdrawals, such as redemption fees or short-term trading fees, which some funds impose to discourage people from trading in and out of the funds frequently.

Withdrawing funds may also have tax implications, particularly if the investment has appreciated in value, which means taxes will have to be paid on the capital gains.

Despite these potential drawbacks, the high liquidity of mutual funds makes them a popular choice for investors.

Index Funds: How Much Should You Invest?

You may want to see also