Investing in mutual funds is a great way to build wealth over the long term. They are baskets of stocks, bonds or other securities, making it easy to build a diversified investment portfolio.

Mutual funds are a practical, cost-efficient way to build a diversified portfolio of stocks, bonds, or short-term investments. They are also relatively cheap and simple to invest in, thanks to the many trading apps and online brokerages available.

1. Set an investing goal: Identify what you're investing for, such as saving for retirement or buying a home.

2. Decide on an account type: Choose between a standard brokerage account, a retirement account like a 401(k), or an individual retirement account (IRA).

3. Decide on the right mix of stocks and bonds: Determine your asset mix based on your goals, investment horizon, and risk tolerance.

4. Pick an investment strategy: Choose between active and passive funds. Active funds aim to beat the market, while passive funds aim to match market returns.

5. Research mutual fund companies: Look for well-known companies with a good track record, such as Vanguard or Fidelity.

6. Research mutual funds: Study the fund provider's options and consider factors such as fees and historical performance.

7. Open an investing account: Choose a brokerage firm or a mutual fund company to open your account.

8. Buy mutual fund shares: Consider factors such as investment minimums and share classes.

9. Be a good long-term investor: Avoid trying to time the market and focus on your long-term investment goals.

10. Don't forget about taxes: Be mindful of the taxes incurred when investing in mutual funds, such as capital gains taxes and dividend taxes.

| Characteristics | Values |

|---|---|

| What are mutual funds? | A pool of money collected from investors that is then invested in securities such as stocks or bonds. |

| Who should invest in a mutual fund? | Both beginners and more experienced investors will benefit from the diversification of mutual funds. Experienced investors can find funds that target specific areas they think are poised for growth. |

| Active vs. passive funds | Active funds are managed by professional investors with the goal of outperforming a market index. Passive funds are managed to track the performance of a market index. |

| Types of mutual funds | Stock funds, bond funds, money market funds, index funds |

| How do mutual funds make money? | Income and appreciation are generally the two ways to make money in securities. Income comes in the form of interest or dividend payments that are then passed on to the investor. Appreciation can be reflected in the net asset value per share of the fund or distributed to investors in the form of capital gains, minus any losses. |

| How to choose a mutual fund | Consider whether a fund's investment objectives are aligned with your long-term financial plan. |

| How to buy mutual funds | Mutual funds can be purchased through online brokers or through the fund manager themselves. |

| How to sell mutual funds | Mutual funds are sold similarly to the way they're bought. Using an online broker or the fund's manager, you'll place a sell order and will receive the next available NAV as your price. |

| Why should you invest in a mutual fund? | Consider investing in a mutual fund if the fund's objective matches your investment needs. |

| Mutual fund fees | Management fees, 12b-1 fees, legal fees, accounting fees, administrative costs, load fees, no-load fees |

| How are mutual funds taxed? | If you own mutual funds in a taxable account such as a brokerage account, you'll owe capital gains tax if the fund has appreciated from where you bought it at the time of sale. |

| Mutual funds vs. ETFs | Minimum investments, trading, expense ratios, fees |

What You'll Learn

Understand the difference between active and passive funds

Understanding the Difference Between Active and Passive Funds

When it comes to investing in mutual funds, there are two main approaches: active and passive funds. These terms refer to the fund's investment strategy and have a significant impact on returns. Here's what you need to understand about these two types of funds:

Active Funds

Active funds aim to outperform the market, such as the S&P 500 index. They are managed by professional investors or fund managers who actively research and select specific stocks, bonds, or other securities to achieve higher returns. The fund manager's expertise comes at a cost, with active funds typically charging higher fees (around 1% of the fund's assets). These funds are more dynamic and flexible, adapting to market conditions. However, they also carry higher costs and risks. While active funds strive for higher returns, they may underperform the market, and their performance depends on the fund manager's skill and judgment.

Passive Funds

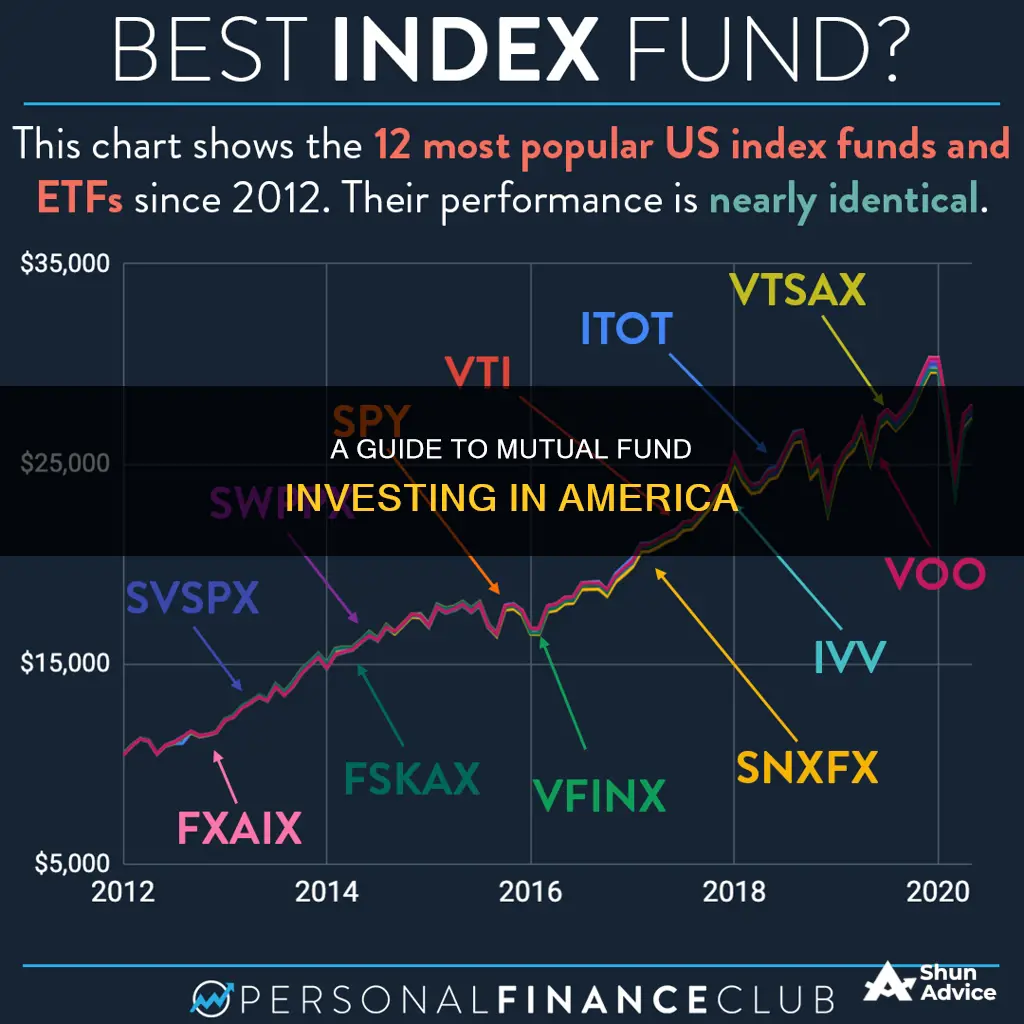

Passive funds, on the other hand, are designed to replicate the performance of a specific market index. Instead of trying to beat the market, they aim to match it. These funds are often called index funds and don't require an expensive investment team because they simply follow a predetermined strategy. As a result, passive funds have much lower fees, and sometimes no fees at all, which leaves more of the returns for investors. They are more static and rigid, sticking closely to the index they track. While they offer steady, long-term returns, they carry market-level risks and may not always outperform the market.

Performance and Risk

Over the long term, passive funds have consistently outperformed active funds due to their lower fees and reduced portfolio turnover. However, there are instances where skilled active managers can beat the market. Active funds strive for higher returns but come with higher costs and risks. Passive funds, while offering lower costs, carry market-level risks and may not generate substantial alpha.

Expense Ratios

Expense ratios are an important consideration when choosing between active and passive funds. Active funds have higher expense ratios due to the fund manager's research, analysis, and management efforts. Passive funds, on the other hand, have lower expense ratios because they follow a simplified investment strategy and have limited fund manager involvement.

Suitability

The choice between active and passive funds depends on your investment goals, risk tolerance, time horizon, and cost sensitivity. Active funds may be more suitable for investors seeking higher returns, willing to take on more risk, and having a longer investment horizon. Passive funds are often preferred by those who want lower fees, are satisfied with market-level returns, and have a shorter investment horizon.

Mutual Funds: US Market Investment Options for Indians

You may want to see also

Learn about the different types of mutual funds

There are several types of mutual funds available to investors, each with its own advantages and disadvantages. Here is an overview of some of the most common types of mutual funds:

- Equity Mutual Funds: These funds invest in the stocks of publicly traded companies and typically make up the majority of the mutual fund market. Equity funds can be further categorised based on company size, industry or sector, growth potential, and geographic location. They offer higher potential for growth but also come with higher volatility and risk.

- Bond Mutual Funds: Bond funds are a type of fixed-income mutual fund that invests in government and corporate debt. They are considered safer than equity funds but offer lower potential for growth. Bond funds are ideal for investors seeking a more stable investment with regular interest payments.

- Money Market Mutual Funds: These funds invest in high-quality, short-term debt instruments such as US Treasurys, certificates of deposit, and commercial paper. They are considered low-risk and make up a significant portion of the mutual fund market. Money market funds are ideal for investors seeking a safe and liquid investment option.

- Balanced or Hybrid Mutual Funds: These funds invest in a combination of stocks and bonds, typically with a fixed ratio such as 60% stocks and 40% bonds. Balanced funds offer investors a diversified portfolio with a mix of risk and stability. Target-date funds are a popular type of balanced fund that automatically adjusts the asset allocation based on an investor's retirement timeline.

- Index Mutual Funds: Index funds aim to replicate the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average (DJIA). They are passively managed, which results in lower fees for investors. Index funds have gained popularity due to their low cost and potential for better returns compared to actively managed funds.

- Specialty or Alternative Mutual Funds: This category includes a diverse range of funds such as hedge funds, managed futures, commodities, and real estate investment trusts (REITs). Socially responsible investing (SRI) funds are also gaining traction, with a focus on environmental, social, and governance (ESG) factors.

When choosing a mutual fund, it is essential to consider your investment goals, risk tolerance, and time horizon. Each type of mutual fund has its own characteristics and risk profile, so it is important to understand the fund's investment objectives, fees, and historical performance before making a decision.

HFT Funds: Strategies for Investing in High-Frequency Trading

You may want to see also

Research fees and minimum investments

When investing in mutual funds, it is important to research the fees and minimum investments required. Mutual funds have different structures that impact their costs. Open-end funds, which are the most common type, have no limit on the number of investors or shares, and their value rises and falls with the fund's performance. Closed-end funds, on the other hand, have a limited number of shares offered through an initial public offering (IPO) and are traded on the stock exchange.

Mutual funds also have different fee structures. "Load funds" charge a sales commission, typically passed on to the investor, while "no-load funds" or "no-transaction-fee funds" do not charge sales commissions and are a better deal for investors. The expense ratio, which is the annual fee for fund management, is also an important consideration. This is expressed as a percentage of the cash you invest and can impact your returns over time. Other fees to consider include shareholder transaction costs, investment advisory fees, and marketing and distribution expenses. These fees can be charged upfront or when investors redeem their shares.

In terms of minimum investments, some mutual funds offer $0 minimums, while others require a minimum initial investment, which can range from $500 to $5,000 for retail mutual funds and over $100,000 for institutional-class funds and hedge funds. The minimum investment amount depends on the fund's style, investment objective, and target investors. Some funds cater to smaller clients with low minimums, while others target high-net-worth individuals with higher minimums. It is important to note that some funds may waive or lower the minimum investment amount for retirement accounts or automatic recurring investments.

A Guide to Investing in India's Thriving Funds Market

You may want to see also

Decide where to buy mutual funds

You can buy mutual funds through online brokers or directly from the fund manager. However, it is recommended that you buy them directly from the mutual fund company to save money on fees. Alternatively, opening a brokerage account with a mutual fund company can also keep costs low. For example, you can buy Fidelity funds from Fidelity Investments, Vanguard funds from The Vanguard Group, and so on.

When deciding where to buy your mutual funds, you should compare features and fees, such as what mutual funds are on its platform and what the broker charges, including early redemption fees. Actively managed accounts, which are managed by a person or group of people who pick the investments and try to beat the market, usually have a higher expense ratio than passive index funds, which are built to replicate the performance of a specific market.

- Fidelity Investments: Offers four zero-fee funds and nearly 3,400 no-transaction-fee mutual funds.

- Charles Schwab: Offers nearly 4,300 no-load, no-transaction-fee mutual funds.

- E-Trade: Offers more than 6,000 no-load, no-transaction-fee mutual funds.

- Ally Invest: Offers access to more than 17,000 mutual funds, with no commission on no-load funds.

- The Vanguard Group: Long celebrated for its low-cost index funds, with more than 3,000 no-transaction-fee mutual funds for non-Vanguard funds.

- J.P. Morgan Self-Directed: Offers about 3,000 no-transaction-fee mutual funds.

- Interactive Brokers: Offers nearly 18,000 no-transaction-fee mutual funds.

- Merrill Edge: Offers more than 800 no-transaction-fee funds.

- Firstrade: Offers more than 11,000 mutual funds without charging clients a commission.

Strategizing Mutual Fund Investments: Diversifying Your Portfolio

You may want to see also

Learn how to buy and sell mutual funds

Mutual funds are a great way to invest in a diversified portfolio of securities for a relatively small minimum investment. They are also highly liquid, meaning they are easy to buy or sell.

How to buy mutual funds

You can buy mutual funds through online brokers or directly from the fund manager. When buying, you'll need to consider the following:

- Pricing: Mutual funds are priced at the end of each trading day based on their net asset value (NAV). The NAV is calculated by adding up the value of the fund's holdings, subtracting expenses and dividing by the number of shares outstanding. When making a purchase, you'll receive the next NAV, so if you place an order after the market has closed, you will receive the next day's closing NAV as your price.

- Minimum investment: Most mutual funds have a minimum investment of a few thousand dollars, and you can choose to buy a certain dollar amount of a fund or a specific number of shares.

How to sell mutual funds

Mutual funds are sold in a similar way to how they are bought. Using an online broker or the fund's manager, you'll place a sell order and receive the next available NAV as your price. Mutual funds don't trade throughout the day like stocks or ETFs, so you won't know the price you're selling at until the trade goes through.

Mutual funds are best used as vehicles for long-term investment and are commonly held in retirement accounts. You don't need to monitor the fund's performance daily or even weekly when you're invested for the long run. Checking in quarterly or a couple of times a year should be enough to make sure the fund is still aligned with your objectives.

Things to watch out for

When investing in mutual funds, it's important to be aware of the fees you'll be paying. Funds can charge fees for a number of operating expenses, including management fees, 12b-1 fees, and legal and accounting costs. You may also come across load and no-load funds. Loads, or commissions, are charged by some funds and paid to brokers at the time of purchase or sale of shares in the fund, typically calculated as a percentage of your overall investment. Funds that don't charge this commission are known as no-load funds.

Bond Funds: Best Time to Invest and Why

You may want to see also

Frequently asked questions

Mutual funds are a way to own a share in a larger investment portfolio that is owned jointly with other investors. Mutual funds invest in many different companies, sometimes hundreds or even thousands of them. By buying one share of the fund, you own a small stake in all its holdings. So a mutual fund gives you diversification, reducing your risk compared to buying a few stocks.

The first thing to consider is whether a fund’s investment objectives are aligned with your long-term financial plan. You'll also want to consider the fees associated with purchasing shares in a fund. Remember that if two funds have the same investment performance, the one with the lower fees will leave their investors better off.

Mutual funds can be purchased through online brokers or through the fund manager themselves. You'll need to decide whether you want to invest in active or passive funds. Active funds are managed by professional investors with the goal of outperforming a market index, such as the S&P 500 index. Passive funds are managed to track the performance of a market index and don't require an expensive investment team.

Mutual funds are sold similarly to the way they’re bought. Using an online broker or the fund’s manager, you’ll place a sell order and will receive the next available NAV (net asset value) as your price. Mutual funds sometimes have fees for selling the fund in a short period of time, known as early redemption fees, and are therefore not ideal for short-term trading.