Index funds are a great investment vehicle for retirement planning, offering a low-cost, low-risk way to grow your wealth over time. By tracking a market index, such as the S&P 500, index funds aim to mirror the performance of the broader market, providing investors with a diversified portfolio of stocks or bonds. This passive investment strategy, which does not involve active management or stock picking, has proven effective in generating solid returns over the long term.

When investing in index funds for retirement, it is important to first establish clear goals and timelines. This will help determine the appropriate asset allocation between stocks and bonds, with more aggressive equity-based funds offering greater potential returns but also carrying more risk. It is generally recommended to reduce investment risk as retirement age approaches, shifting from stock-based funds to more conservative bond funds.

Additionally, fees and expense ratios should be carefully considered when selecting index funds, as these costs can eat into overall returns. Index funds are available through mutual fund companies or brokerages, with some funds even offering zero expense ratios.

By investing consistently in index funds, individuals can benefit from the long-term growth of the market, building a substantial nest egg for retirement without the need for active stock picking or market timing.

| Characteristics | Values |

|---|---|

| Type of fund | Mutual fund or exchange-traded fund (ETF) |

| Investment strategy | Passive, aims to replicate the performance of a market index |

| Investment objective | Long-term wealth building, often for retirement |

| Risk level | Lower risk due to diversification, but still subject to market risk |

| Fees | Low fees, including expense ratios and, for mutual funds, sales loads |

| Returns | Historically, indexes like the S&P 500 have averaged annual returns of around 10% |

| Investment minimums | Vary by fund and broker, but can be as low as $1 for fractional shares |

| Purchase options | Buy directly from fund company or through a broker |

| Taxes | More tax-efficient than actively managed funds; capital gains taxes apply for non-retirement accounts |

What You'll Learn

Index funds are a low-cost, easy way to build wealth

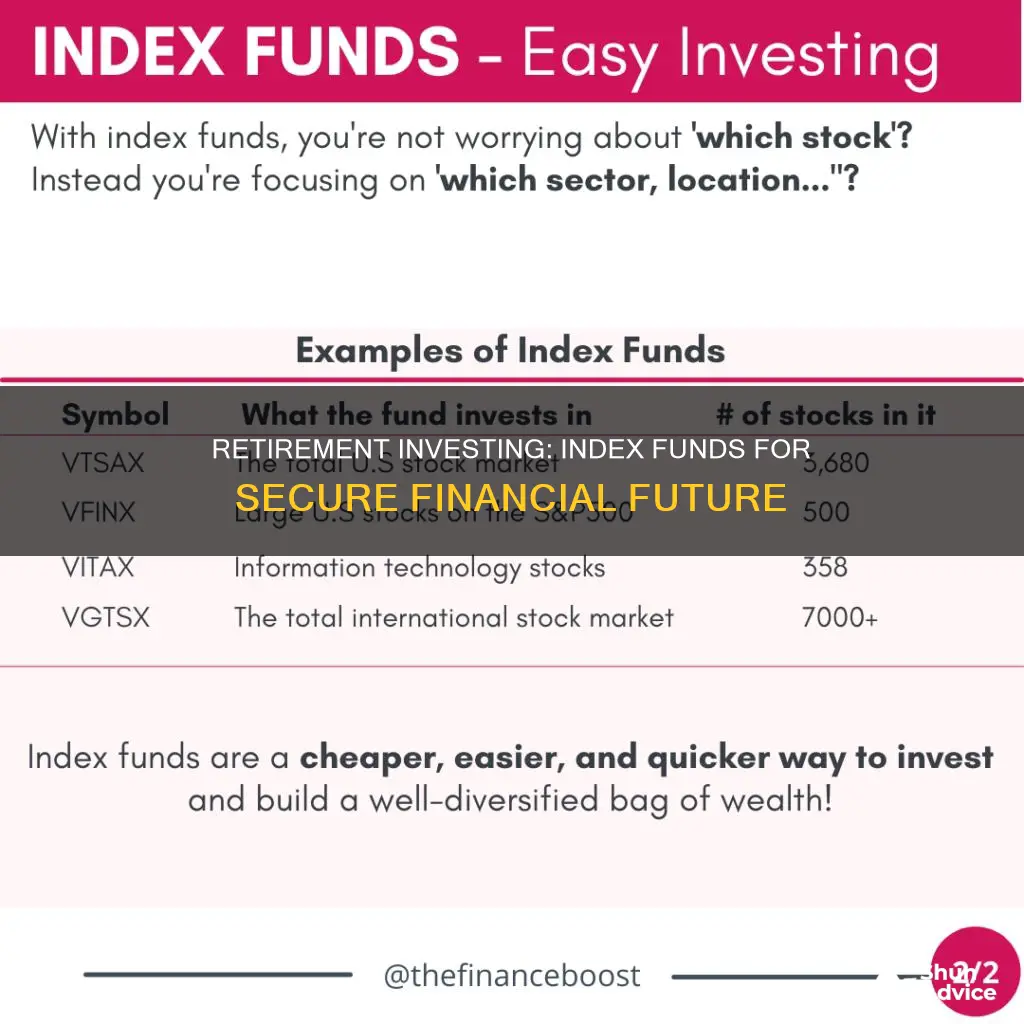

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500 or the Dow Jones Industrial Average. The goal of index investing is to replicate the performance of a particular market index as closely as possible, providing investors with a low-fee way to capture the returns of that index.

Index funds are considered a passive investment strategy because they do not require active management. Fund managers aim to replicate the index by investing in all the components of the index or a representative sample. This means that index funds are a low-cost option for investors, as they do not require the same level of research and analysis as actively managed funds.

Index funds are also a great way to build wealth over time. By investing in an index fund, you benefit from the overall growth of the market or industry that the fund is tracking. This means that you don't need to be an expert stock picker to succeed. Instead, you can simply invest in a broad-based index fund and hold it for the long term, allowing your wealth to grow over time.

When investing in index funds, it is important to consider your investment goals and timeline. If you have a long investment horizon and a higher risk tolerance, you may want to allocate a larger portion of your portfolio to equity-based index funds, which tend to offer greater potential returns. On the other hand, if you have a shorter timeline or a more conservative approach, you may want to focus on bond-based index funds, which offer more stability but lower returns.

Additionally, it is important to research the different types of index funds available and compare their fees and performance. Look for funds with low expense ratios, as these fees can eat into your returns over time. You should also consider the fund's performance over the long term, as this can give you an idea of what to expect in the future.

Overall, index funds offer a simple and effective way to build wealth over time. By investing in a diversified portfolio of index funds and holding them for the long term, you can benefit from the growth of the market while keeping costs low.

Artificial Intelligence: Mutual Funds for Future Tech Investors

You may want to see also

Decide on your investment goals

When it comes to investing in index funds for retirement, it's important to first establish clear investment goals. This means evaluating your risk tolerance, timeline, and overall financial objectives. Here are some key considerations to help you decide on your investment goals:

Risk Tolerance

Your risk tolerance refers to how much risk you are comfortable taking on in your investments. If you have a low risk tolerance, you may prefer more conservative investments, such as bond-based index funds, which offer more stable returns but lower potential gains. On the other hand, if you have a higher risk tolerance, you may be willing to invest in more aggressive options, such as equity index funds, which offer the potential for higher returns but also come with greater risk.

Investment Timeline

The length of your investment timeline plays a crucial role in determining your investment strategy. If you have a short-term investment horizon, you may need to take a more conservative approach to reduce the risk of losses. In this case, bond index funds or other low-risk options may be more suitable. On the other hand, if you are investing for the long term, such as for retirement, you may have the flexibility to take on more risk with stock index funds, which have the potential for higher returns over time.

Financial Objectives

Consider what you hope to achieve with your investments. Are you saving for retirement, building an emergency fund, or pursuing a specific financial goal? Each goal will have different time horizons and risk tolerances associated with it. For example, if you are investing for retirement, you may have a longer timeline and be willing to take on more risk to achieve potentially higher returns. On the other hand, if you are saving for a down payment on a house, you may have a shorter timeline and prefer more conservative investments to protect your capital.

Asset Allocation

Asset allocation refers to the mix of stocks, bonds, and other investments within your portfolio. This allocation should be aligned with your risk tolerance and timeline. If you have a longer timeline and a higher risk tolerance, you may allocate a larger portion of your portfolio to stocks or equity index funds. On the other hand, if you have a shorter timeline or a more conservative approach, you may allocate more to bonds or fixed-income investments. Diversification across different asset classes and sectors can help manage risk and improve the potential for long-term returns.

Expert Recommendations

Financial experts, including Andrew Rosen, a certified financial planner, suggest that a shorter time horizon indicates a lower risk tolerance, which would lead to a higher allocation of bond index funds. On the other hand, a longer time horizon affords you the ability to take on more risk and potentially increase your allocation of stock index funds. Additionally, Steven Jablonski, a financial advisor, provides the following guidelines for tailoring your index fund portfolio based on your risk preference and timeline:

- Aggressive Risk/Longer Timeline: 75% equities and 25% bonds.

- Moderate Risk/Moderate Timeline: 50-60% equities and 40-50% bonds.

- Conservative Risk/Short Timeline: 25% equities and 75% bonds.

By carefully considering these factors, you can establish clear investment goals and create a plan that aligns with your risk tolerance, timeline, and financial objectives. This will help guide your decisions when choosing specific index funds and creating a well-diversified portfolio suited to your needs.

Unlocking Pension Funds: Impact Investing with Fitzpatrick and Omidyar

You may want to see also

Pick the right index fund strategy for your timeline

The right index fund strategy for your timeline will depend on your risk appetite and investment goals. If you are nearing retirement and are risk-averse, you may want to opt for more conservative investments such as bond-based index funds, which offer more stable value but lower returns. On the other hand, if you are investing for retirement and have a long time horizon, you may want to consider more aggressive investments such as equity index funds, which offer higher potential returns but come with higher risk.

- Aggressive Risk/Longer Timeline: 75% equities and 25% bonds.

- Moderate Risk/Moderate Timeline: 50-60% equities and 40-50% bonds.

- Conservative Risk/Short Timeline: 25% equities and 75% bonds.

It is important to remember that even within these asset classes, there are different levels of risk. For example, large-cap stock indexes like the S&P 500 or NASDAQ 100 are generally considered lower risk, while small-cap indexes like the Russell 2000 or international indexes like MSCI Emerging Markets are considered higher risk.

Additionally, it is crucial to consider the fees associated with different index funds, as these can eat into your returns over time. Look out for load fees and expense ratios, and try to choose funds with low costs and a good performance track record.

Energy Funds: A Smart Investment for Your Future

You may want to see also

Research and analyse index funds

When researching and analysing index funds, there are several key factors to consider.

Firstly, it is important to understand the different types of index funds available. These can vary based on company size and capitalization (small-, mid- or large-cap indexes), geography (domestic or foreign exchanges), business sector or industry (e.g. consumer goods, technology, health), asset type (bonds, commodities, cash), and market opportunities (e.g. emerging markets).

Once you have decided on the type of index fund that aligns with your investment goals, you can start evaluating specific funds. Here are some key parameters to consider:

- Performance: Compare the fund's historical returns over different market cycles, not just during bull markets, against relevant benchmarks and similar funds.

- Risk: Assess the volatility of the fund and the types of assets it invests in. For example, does it focus on riskier assets like small-cap stocks or safer options like bonds?

- Investment Strategy: Understand the fund's investment strategy and the level of activity of the fund manager in making investment decisions.

- Expense Ratio: Evaluate the fund's expense ratio, which covers operating costs deducted from each shareholder's returns as a percentage of their overall investment. Lower expense ratios are generally preferable as they result in higher returns for investors.

- Taxes: Consider the tax implications of owning the fund, such as capital gains taxes if held outside tax-advantaged accounts.

- Portfolio Turnover Ratio (PTR): A high PTR indicates higher trading activity, potentially increasing transaction costs and taxes, while a lower PTR suggests lower costs and taxes.

- Fund Maturity Periods: Evaluate the duration over which the funds have been under management to ensure it aligns with your investment timeline.

- Risk-Adjusted Returns: Assess how much risk was taken to generate returns, using metrics such as Standard Deviation, Sharpe Ratio, and Beta.

- Fund Management: Evaluate the fund management team's experience, track record, investment philosophy, and continuity.

Additionally, when deciding between different index funds, it is important to compare factors such as expenses, taxes, investment minimums and account minimums, trading costs, fund selection, convenience, and impact investing.

Vanguard Funds: Where to Invest and Why

You may want to see also

Decide where to buy your index funds

When deciding where to buy your index funds, you have two main options: purchasing directly from a mutual fund company or going through a brokerage. Here are some factors to consider when making your decision:

Fund Selection

If you want to purchase index funds from various fund families, you may find that the selection offered by a mutual fund company is more limited compared to what a discount broker can provide. However, some mutual fund companies carry their competitors' funds, giving you more options.

Convenience

Consider choosing a single provider that can accommodate all your needs. For instance, if you plan to invest only in mutual funds or a mix of funds and stocks, a mutual fund company might be a suitable investment hub. On the other hand, if you require sophisticated stock research and screening tools, a discount broker that also offers the desired index funds may be a better option.

Trading Costs

Take into account the commission or transaction fees charged by brokers or fund companies for buying or selling index funds. Mutual fund commissions tend to be higher, typically $20 or more, while stock and ETF trading fees are usually below $10 per trade. Some brokers and fund companies may waive these fees, so it's worth checking before making a decision.

Impact Investing

If you want your investments to have a positive impact beyond financial returns, consider funds that target companies with a focus on environmental or social justice causes. These are known as impact investments.

Commission-Free Options

Look for brokers or fund companies that offer no-transaction-fee mutual funds or commission-free ETFs. This can help reduce your overall investment costs.

Atram Alpha Opportunity Fund: A Guide to Investing

You may want to see also

Frequently asked questions

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500. They are a passive investment strategy that aims to mirror the performance of the index by holding the same investments. Index funds are considered low-cost, low-risk, and tax-efficient, making them a popular choice for retirement investing.

When choosing an index fund, consider your investment goals, timeline, and risk tolerance. Research different types of indexes, such as broad stock indexes like the S&P 500 or NASDAQ, or bond indexes like the Bloomberg Barclays U.S. Aggregate Bond Index. Compare the fees and performance of different index funds that track your chosen index, and consider factors such as the fund's expenses, taxes, and investment minimums.

You can buy index funds directly from a mutual fund company or through a brokerage. Some popular options for buying index funds include Vanguard, Fidelity, and Charles Schwab. When deciding where to buy, consider factors such as fund selection, convenience, and trading costs.

First, decide on your investment goals and timeline, and choose an index fund strategy that aligns with your risk tolerance. Research and compare different index funds, and open an investment account with a brokerage or fund company. Set up a regular purchase plan to invest consistently over time, and consider setting up an investment review schedule to assess the performance of your index funds.