Series C funding is the fourth stage of capital raising by a startup, and is typically the last stage of venture capital financing. It is a strategic and operational funding round where capital raised is used for research and development, feasibility studies, and market analysis. Companies that seek Series C funding are usually well-established and profitable, with a large customer base and strong demand for their core products or services. This funding round is used to reinforce the company's existing success and to scale its operations and growth. The funding is commonly used for entering new markets, research and development, or acquiring other companies.

What You'll Learn

How to find investors for Series C funding

Series C funding is the fourth stage of capital raising by a startup. Companies that have reached this stage are already successful and are looking for additional funding to develop new products, expand into new markets, or acquire other companies.

- Understand the nature of Series C funding: Series C funding is typically the final round of venture capital financing for a startup. It is more strategic and operational, with funds being used for research and development, feasibility studies, and market expansion. The goal is to scale the company and fuel its growth.

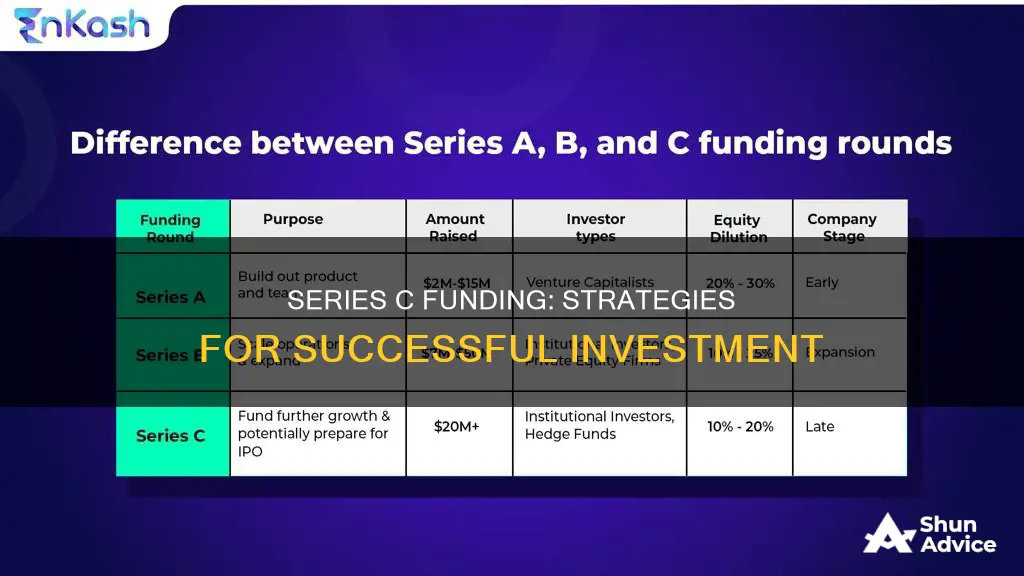

- Identify potential investors: Venture capital investors, private equity firms, and investment banks are the most common sources of Series C funding. Venture capital funds invest in early-stage startups, providing seed capital and strategic support. Private equity firms, on the other hand, may demand a larger percentage of equity in exchange for funding. Investment banks advise startups as they prepare for an initial public offering (IPO) and can provide loans, although these may come with high-interest rates and stringent qualification requirements.

- Network and build relationships: Attend industry events, conferences, and networking sessions to connect with potential investors. Leverage your existing network, including angel investors and micro-VC connections. Nurture these relationships by staying in touch and sharing updates on your startup's progress.

- Join an accelerator: Consider applying to a startup accelerator program. These programs can provide mentorship, resources, and access to potential investors. The top accelerators can increase your chances of securing Series C funding significantly.

- Leverage your team: The strength of your team is crucial when attracting investors. A diverse and experienced team with relevant industry expertise and a successful track record can make your startup more appealing to investors.

- Prepare a solid pitch and valuation: Craft a compelling pitch deck that showcases your startup's current success, revenue streams, healthy profits or high potential for profit, established customer base, and market share. Be prepared to provide detailed financial projections and growth opportunities to potential investors.

- Reach out to previous investors: Start by approaching investors who have previously backed your company in earlier funding rounds. They may be open to reinvesting and could also introduce you to bigger investors in their network.

- Utilize databases and platforms: Use platforms like Crunchbase and SeedLegals to find venture capitalists (VCs) and investors who are active in your industry or sector. These platforms can help you identify VCs that invest in your specific domain, increasing your chances of a successful pitch.

- Expand your network through LinkedIn: Stay active on LinkedIn and connect with other founders and sector influencers. Engage in groups and discussions to increase your visibility and demonstrate your expertise. This can help you attract the attention of potential investors and expand your network.

Invest in Precious Metals Mutual Funds: Diversify Your Portfolio

You may want to see also

How much money is involved in Series C funding

Series C funding is the fourth stage of capital raising by a startup. It is the final level of venture capital financing for a firm, but some companies may continue to Series D, E, F, or G funding.

Series C funding is generally between $30 million and $100 million, with an average of $50 million. However, some companies have raised much more, with some sources citing hundreds of millions of dollars.

Series C funding is used to expand the company, develop new products, or acquire other companies. It is also used to prepare the company for an IPO or acquisition.

To raise Series C funding, companies should find a leader investor, prepare a term sheet, include pro-rata rights, and prepare official documents.

A Guide to Investing in ICICI Mutual Funds

You may want to see also

How to prepare your company for Series C funding

Series C funding is the fourth stage of capital raising by a startup. It is typically the final step of a startup's fundraising, although some companies do undertake further rounds. Companies that have reached this stage are already quite successful and are looking to expand their operations, develop new products, or even acquire other companies.

- Find a lead investor: Research and identify investors who are actively investing in startups within your industry. Some prominent Series C investors include New Enterprise Associates, General Catalyst Partners, and Kleiner Perkins Caufield and Byers.

- Prepare a term sheet: A term sheet is a non-binding contract between the startup founder and the investor, outlining the financial model and guidelines to protect the interests of both parties. It also includes pro-rata rights, which allow investors to maintain their initial level of ownership during subsequent funding rounds.

- Prepare official documents: Official documents, such as contracts or mandates, are signed by both parties to finalise the funding deal. It is essential to have a basic understanding of these documents to ensure compliance and reduce the risk of being cheated.

- Consider a vesting schedule: Vesting ensures that full rights cannot be revoked by another person. Each founding member receives an equal share of the company's stock, encouraging them to take risks and pursue growth.

- Prepare an exit strategy: Series C funding is often the last round a company seeks before an IPO or acquisition. Investors will be interested in the company's IPO prospects and its plans to boost its value before going public.

- Network and build relationships: Start building relationships with potential investors early on. Leverage your network, including angel investors and VCs from leading venture capital firms. Nurture these connections and take as many new meetings as possible.

- Demonstrate growth and customer retention: Show that your company has the potential for long-term growth. Highlight your customer retention rate and low churn rates, indicating that your current clientele is satisfied and willing to purchase new products.

- Focus on product development: Investors will want to know about your plans for future product development and expansion into new markets or verticals. Be prepared to discuss potential sales growth from entirely new products that your current and future customers may find valuable.

By following these steps and demonstrating your company's success and growth potential, you can effectively prepare for Series C funding.

Vanguard Mutual Funds: Choosing Wellesley or Wellington

You may want to see also

What to expect from investors during Series C funding

Series C funding is the fourth stage of capital raising by a startup. It is typically the last stage of venture capital financing, although some companies may continue to Series D and beyond.

By the time a company reaches Series C funding, it is already well-established and successful, with a large customer base and strong demand for its core products or services.

Series C funding is used to expand and reinforce the success of the business. This could mean entering new markets, research and development, or acquiring other companies.

- Investors will expect the company to be profitable and have solid revenues and profits.

- There will likely be a mix of new and previous investors. Previous investors from venture capital firms and angel investors will often participate, and new investors may include large financial institutions such as investment banks and hedge funds, attracted by the lower risk of investing in an established company.

- Investors will be looking for a clear path to an exit, such as an IPO or acquisition, and will want to know the company's intentions to boost its value before an IPO.

- The company's valuation will be higher, and investors will pay a high price for shares.

- The company will need to have a large enough customer base to support its expansion plans.

- The company will need to demonstrate high customer retention and low churn rates.

- Investors will want to know about the potential for growth in sales from new products that existing and future customers will find appealing.

- The company may need to expand its workforce to keep up with demand.

- The company will need to have a strong management team in place, as investors will be less inclined to be involved in business decisions at this stage.

- The company will need to have clear goals and plans for how it will use the funds, and the amount raised will need to be sufficient to achieve these goals.

Axis Small Cap Fund: Smart Investing Strategies for Beginners

You may want to see also

What are the next steps after Series C funding

Series C funding is the fourth stage of capital raising by a startup. It is usually the final step of a startup's fundraising, though some companies do further rounds. Companies that make it to the Series C funding stage are doing very well and are ready to expand to new markets, acquire other businesses, or develop new products.

- Prepare for an IPO or acquisition: Series C funding is often the final push to prepare a company for its Initial Public Offering (IPO) or acquisition. This involves working with investment banks and other financial institutions to determine the best path forward for the company.

- Focus on strategic growth: Startups that have reached this funding round are thinking more strategically and about their long-term goals. This may include expanding to new markets, particularly on an international scale, developing new products, or making strategic acquisitions to reinforce their market position and drive further growth.

- Continue to build a strong team: As the company expands, it will need to hire talented individuals to support its growth. This includes expanding the existing team and bringing in new expertise to drive innovation and market competitiveness.

- Maintain a solid customer base: Series C companies should focus on retaining their existing customers and attracting new ones. This involves delivering high-quality products and services, responding to customer needs, and staying ahead of the competition.

- Monitor financial performance: It is crucial to closely track financial metrics, such as revenue, profitability, and cash flow. This enables the company to make data-driven decisions, identify areas for improvement, and demonstrate financial health to potential investors or acquirers.

- Comply with legal and regulatory requirements: As the company grows and expands globally, it is essential to adhere to the legal and regulatory frameworks of different jurisdictions. This includes compliance with tax, employment, and corporate laws to avoid legal issues and maintain a positive reputation.

- Explore additional funding options: While Series C is often the final funding round, some companies may require further investment. This could include Series D, E, or later-stage funding rounds, depending on the company's needs and growth trajectory.

- Strengthen corporate governance: As the company matures, establishing robust corporate governance practices becomes increasingly important. This includes maintaining proper records, putting in place effective internal controls, and ensuring compliance with regulatory requirements to mitigate risks and protect stakeholders' interests.

- Nurture relationships with investors: Maintaining strong relationships with existing investors is crucial. This involves regular communication, providing updates on the company's performance, and seeking their input on strategic decisions. Nurturing these relationships can also open doors to potential future funding opportunities if needed.

- Explore exit strategies: While not always the primary goal, Series C companies should consider potential exit strategies, such as an IPO or acquisition. This involves working with financial advisors and investors to evaluate the best options for the company and its stakeholders.

Explore Top Funds for Payment Company Investors

You may want to see also

Frequently asked questions

Series C funding is the fourth stage of capital raising by a startup, and the final level of venture capital financing for a firm. It is a strategic and operational funding round where capital raised is used for research and development, feasibility studies, and expansion.

Series C funding is provided by investors such as venture capital investors, private equity firms, and investment banks. These investors are often looking for a viable business with a strong track record and long-term odds of success.

Series C funding typically ranges from $30 million to $100 million, with an average of $50 million. The valuation of Series C companies is often over $100 million, and they are usually well-established, profitable businesses.