Investing in short-term Treasury bills can be a wise financial decision for those seeking a safe and liquid investment option. These bills, issued by the government, offer a low-risk way to grow your money over the short term. This guide will provide an overview of the process, including understanding the different types of Treasury bills available, the benefits of short-term investments, and the steps to purchase them through a brokerage account or directly from the government.

What You'll Learn

- Understanding Treasury Bills: Learn about the basics of short-term debt instruments issued by the government

- Benefits of Short-Term Investing: Discover the advantages of quick returns and low risk

- Market Timing: Strategies for buying and selling T-bills at optimal times

- Purchase Channels: Explore various platforms and brokers for acquiring T-bills

- Risk Management: Techniques to minimize potential losses in short-term investments

Understanding Treasury Bills: Learn about the basics of short-term debt instruments issued by the government

Treasury bills, often referred to as T-bills, are a type of short-term debt instrument issued by the government to manage its financial operations and borrowing needs. These bills are considered one of the safest and most liquid investment options available to the public, making them an attractive choice for investors seeking a secure and relatively low-risk investment. Understanding the basics of T-bills is essential for anyone looking to explore this investment avenue.

When the government needs to raise funds for various purposes, such as financing budget deficits or managing cash flow, it issues T-bills. These bills are typically due for maturity in a short period, ranging from a few days to one year. The primary advantage of T-bills is their short-term nature, which means investors can access their funds relatively quickly compared to longer-term government bonds. This feature makes T-bills an attractive option for investors who prefer a more flexible and accessible investment strategy.

The process of investing in T-bills is relatively straightforward. The government auctions T-bills to the public, and investors can purchase them directly from the government or through financial institutions. These bills are often sold at a discount to their face value, and investors earn a return when the T-bill matures and is redeemed at its full face value. The discount rate is determined by market forces and can vary depending on factors such as interest rates and the overall demand for government debt.

One of the key advantages of T-bills is their low risk. Since they are backed by the full faith and credit of the government, investors are guaranteed to receive the face value of the T-bill upon maturity. This makes T-bills an excellent choice for risk-averse investors who prioritize capital preservation and liquidity. Additionally, T-bills are highly liquid, meaning investors can easily convert them into cash without significant loss, providing a safety net for investors.

Understanding the mechanics of T-bills is crucial for investors. When purchasing a T-bill, investors lock in a fixed interest rate for the specified maturity period. This rate is typically lower than what one might earn on longer-term investments, but it offers a stable and predictable return. T-bills are often used by investors as a way to generate a steady income stream, especially for those seeking a conservative investment strategy.

In summary, Treasury bills are short-term debt instruments issued by the government, offering a secure and liquid investment option. With their low-risk nature and guaranteed redemption, T-bills are an attractive choice for investors seeking capital preservation and a flexible investment approach. By understanding the basics of T-bills, investors can make informed decisions and potentially benefit from the stability and predictability of this government-backed investment vehicle.

Understanding Short-Term Investments: Are They Current Assets?

You may want to see also

Benefits of Short-Term Investing: Discover the advantages of quick returns and low risk

Short-term investing in Treasury bills offers a unique set of advantages for those seeking a balanced approach to wealth management. One of the primary benefits is the potential for quick returns. Treasury bills, often referred to as T-bills, are short-term debt securities issued by the government. They mature in a matter of weeks or months, providing investors with a relatively rapid return on their investment. This is particularly appealing to those who prefer a more immediate financial outcome, allowing them to access their capital and generate profits faster compared to longer-term investments.

The low-risk nature of T-bills is another significant advantage. These securities are considered one of the safest investments available, as they are backed by the full faith and credit of the U.S. government. This means that investors can be confident in the security of their funds, knowing that the risk of default is virtually non-existent. In times of economic uncertainty or when diversifying investment portfolios, short-term T-bills can provide a stable and reliable option, ensuring that capital is protected while still offering some growth potential.

For investors with a preference for liquidity, T-bills excel in this aspect as well. Due to their short-term nature, these bills can be easily converted into cash without significant loss. This liquidity is especially valuable for those who may need quick access to their funds, such as individuals with upcoming financial obligations or those who prefer a more flexible investment strategy.

Additionally, short-term investing in T-bills can be an excellent way to gain exposure to the financial markets without taking on excessive risk. It allows investors to participate in the economy's growth while minimizing potential losses. This strategy is particularly beneficial for beginners or those who want to test the waters of investing without committing large sums of money for extended periods.

In summary, short-term investing in Treasury bills provides a compelling opportunity for individuals to benefit from quick returns, low risk, and high liquidity. It caters to those who prefer a more dynamic and responsive investment approach, allowing them to capitalize on market opportunities while maintaining a safety net. By understanding the advantages of T-bills, investors can make informed decisions to align their financial goals with a well-rounded investment strategy.

Unlocking Wealth: Discover the Ultimate Long-Term Investment Strategy

You may want to see also

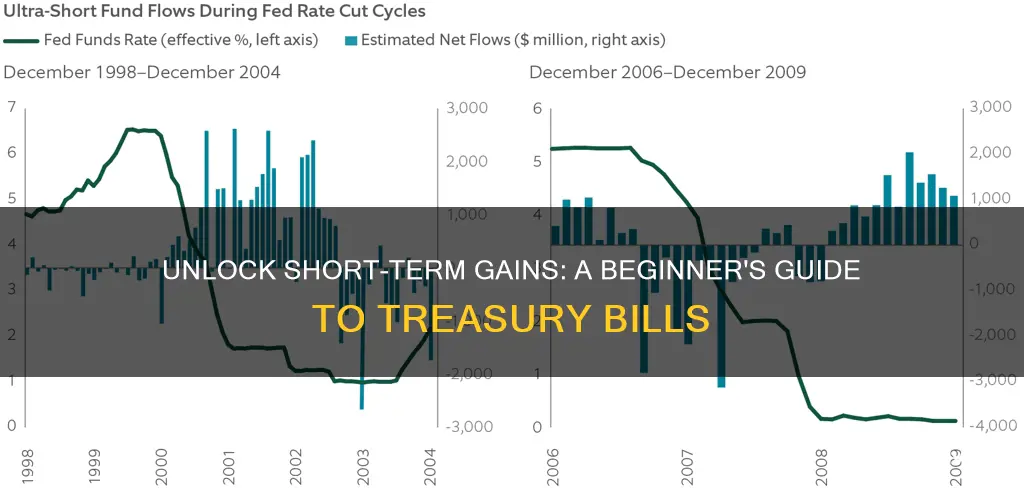

Market Timing: Strategies for buying and selling T-bills at optimal times

Market timing is a crucial aspect of investing in short-term Treasury bills, as it can significantly impact your returns. Here are some strategies to help you make informed decisions and potentially maximize your profits:

- Understand Market Dynamics: Before making any investment, it's essential to grasp the underlying market dynamics. Treasury bills (T-bills) are low-risk securities, but their prices can fluctuate based on market conditions. Keep an eye on economic indicators such as interest rates, inflation, and economic growth. When interest rates rise, T-bill prices typically fall, and vice versa. Understanding these relationships will enable you to anticipate price movements and make timely decisions.

- Monitor Auction Results: T-bills are issued through regular auctions, and the auction results can provide valuable insights. Pay attention to the auction's demand, as it reflects market sentiment. High demand often leads to lower yields, making it an opportune time to buy. Conversely, if demand is low, yields might be higher, indicating a potential selling opportunity. Analyzing auction data can help you identify patterns and make more accurate predictions.

- Utilize Technical Analysis: Technical analysis involves studying historical price and volume data to identify patterns and trends. For T-bill investors, this can include examining price charts, identifying support and resistance levels, and recognizing chart patterns. For example, if you notice a T-bill approaching a key resistance level, it might be a good time to consider selling, as prices may reverse or consolidate. Similarly, buying when the price breaks above a support level can be a profitable strategy.

- Stay Informed about Economic Releases: Economic data releases can significantly impact T-bill prices. Keep track of important economic indicators such as GDP, employment reports, and inflation data. Positive economic news often leads to higher interest rates and lower T-bill prices, while negative news might trigger a sell-off. Being proactive and anticipating these releases can help you time your trades effectively.

- Consider Market Sentiment and News: Market sentiment and news flow can influence investor behavior, causing rapid price movements. Positive news or market optimism might drive T-bill prices higher, while negative sentiment could lead to a sell-off. Stay updated on financial news and be aware of any events or announcements that could impact the market. This awareness will enable you to make timely adjustments to your T-bill portfolio.

- Risk Management and Diversification: While market timing can be profitable, it's essential to manage risk. Diversify your T-bill investments across different maturities and denominations to minimize risk. Additionally, consider implementing stop-loss orders to limit potential losses if market conditions turn unfavorable. Regularly reviewing and rebalancing your portfolio can help maintain an optimal risk-reward ratio.

Long-Term Investment Strategies: Navigating the Market's Future

You may want to see also

Purchase Channels: Explore various platforms and brokers for acquiring T-bills

When it comes to investing in short-term Treasury bills, understanding the various purchase channels is crucial for making informed decisions. Treasury bills, often referred to as T-bills, are low-risk, short-term securities issued by the U.S. Department of the Treasury. They are highly liquid and offer a safe haven for investors seeking a secure and stable investment option. Here's a breakdown of the different platforms and brokers you can explore to acquire T-bills:

Online Brokerage Accounts: One of the most popular and convenient ways to invest in T-bills is through online brokerage platforms. These platforms provide a user-friendly interface, allowing investors to buy and sell various financial instruments, including T-bills, with just a few clicks. Many well-known brokers, such as Fidelity, Charles Schwab, and TD Ameritrade, offer this service. These online brokers typically provide access to the secondary market, where you can buy and sell existing T-bills from other investors. They often have low fees and offer educational resources to help you understand the investment process.

Direct from the U.S. Treasury: You can also purchase T-bills directly from the U.S. Department of the Treasury. This option is ideal for those who prefer a more hands-on approach and want to avoid any additional fees or commissions. The Treasury offers various bill maturities, including 13-week, 26-week, and 52-week bills. You can visit the Treasury's official website to learn about the current auction schedule and place your bids online. This method requires a bit more research and understanding of the auction process, but it gives you direct control over your investments.

Financial Advisors and Wealth Managers: For those who prefer a more personalized approach, consulting a financial advisor or wealth manager can be beneficial. These professionals can provide tailored investment advice and help you navigate the T-bill market. They may have access to exclusive deals or be able to negotiate better terms on your behalf. While this option may come with higher fees, it can be valuable for those seeking a more comprehensive financial strategy.

Banking Institutions: Traditional banks and credit unions also offer T-bill investment options. These institutions often provide access to the primary market, where you can purchase T-bills directly from the Treasury. They may also offer additional services like bill maturity notifications and automatic reinvestment options. While banking institutions might have limited product offerings compared to online brokers, they can be a convenient choice for those who already have a banking relationship.

Secondary Market Dealers: In addition to online brokers, there are specialized dealers who focus on the secondary market for T-bills. These dealers often have extensive networks and can provide access to a wide range of T-bill maturities and denominations. They may offer more competitive pricing and faster execution, making them an attractive option for active traders.

When exploring these purchase channels, it's essential to consider factors such as fees, liquidity, and the level of research and support provided. Each platform or broker will have its own set of advantages, so it's worth comparing them to find the best fit for your investment goals and preferences.

Understanding Long-Term Investment: A Guide to Current Asset Classification

You may want to see also

Risk Management: Techniques to minimize potential losses in short-term investments

When it comes to short-term investments like Treasury bills, effective risk management is crucial to safeguarding your capital and ensuring a positive return. Here are some techniques to minimize potential losses in this low-risk investment arena:

Diversification: One of the fundamental principles of risk management is diversification. Instead of investing all your funds in a single Treasury bill, consider spreading your investments across different maturity dates and denominations. This strategy reduces the impact of any single investment's performance on your overall portfolio. For instance, you could allocate a portion of your capital to 3-month bills, another part to 6-month bills, and so on. By diversifying, you lower the risk associated with interest rate fluctuations and market volatility, as different maturity dates will react differently to economic changes.

Regular Monitoring and Adjustment: Short-term investments require a proactive approach to risk management. Regularly monitor the performance of your Treasury bills and stay updated on economic indicators that could influence interest rates. If you notice a significant shift in market conditions or economic forecasts, consider adjusting your portfolio. For example, if interest rates are expected to rise, you might want to sell your short-term bills and reinvest in longer-term options to capitalize on the higher yields. This proactive approach allows you to manage risk by making informed decisions based on market trends.

Set Stop-Loss Orders: Implement stop-loss orders to limit potential losses. A stop-loss order is an instruction to sell an investment if it reaches a certain price. For Treasury bills, you can set a stop-loss order to automatically sell if the market value drops below a specified threshold. This technique is particularly useful in volatile markets, ensuring that you don't incur substantial losses if the investment value declines. Remember to set the stop-loss price carefully, considering the historical volatility of the specific Treasury bill you're investing in.

Consider Credit Risk: While Treasury bills are generally considered low-risk, it's essential to understand the credit risk associated with the issuing government or entity. Research the creditworthiness of the issuer and assess the likelihood of default. This evaluation will help you make informed decisions, especially when comparing different Treasury bill options. Diversifying across various issuers can also reduce credit risk exposure.

Stay Informed and Educated: Continuously educate yourself about the Treasury bill market and economic factors that influence short-term investments. Stay updated on financial news and market trends to make informed choices. Understanding the underlying economic principles will enable you to anticipate market movements and adjust your investment strategy accordingly.

Maximizing Returns: Smart Short-Term Investment Strategies

You may want to see also

Frequently asked questions

Short-term Treasury bills, also known as T-bills, are a type of U.S. government debt security with a maturity period of less than one year. They are considered low-risk investments and are issued by the U.S. Department of the Treasury. T-bills are highly liquid and are often used by investors seeking a safe and short-term investment option.

You can purchase T-bills directly from the U.S. Department of the Treasury or through a brokerage account. The Treasury offers various ways to buy T-bills, including through the TreasuryDirect system, which allows you to purchase and manage your investments online. Alternatively, you can buy T-bills through a broker who specializes in government securities.

Short-term Treasury bills offer several advantages. Firstly, they are considered low-risk investments as they are backed by the U.S. government. T-bills also provide a stable return with a fixed interest rate, making them attractive for risk-averse investors. Additionally, T-bills are highly liquid, meaning you can easily convert them into cash without significant loss.

The U.S. Treasury issues T-bills on a regular basis, typically on a weekly or bi-weekly schedule. The specific dates and amounts are determined by the Treasury and are usually announced in advance. This frequency allows investors to access short-term funding options regularly.

The minimum investment amount for T-bills is relatively low, making them accessible to a wide range of investors. For most T-bill offerings, the minimum purchase is $100. This low barrier to entry allows individuals to start investing in government securities with a small amount of capital.