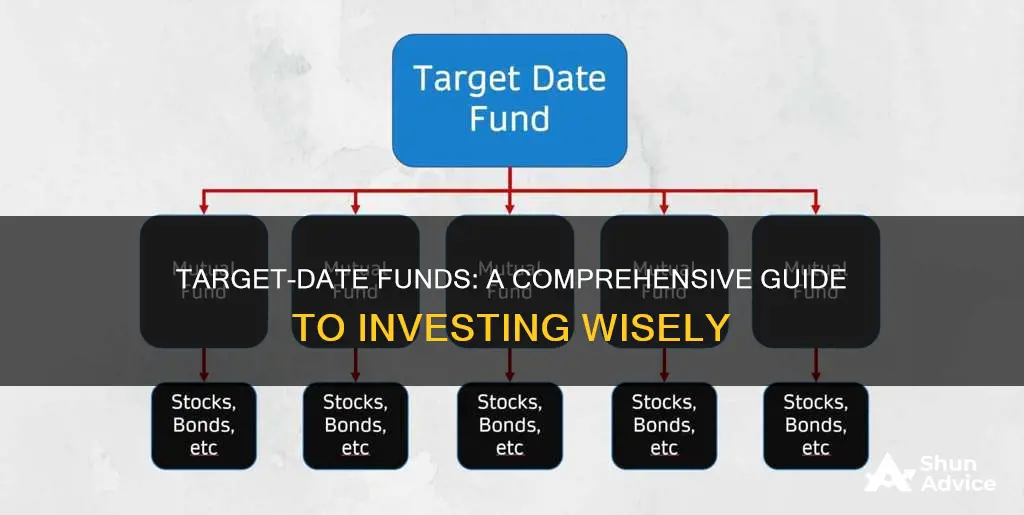

Target-date funds are a popular investment option for retirement plans, such as 401(k) accounts. They are designed to simplify retirement investing by offering a set it and forget it approach. These funds automatically rebalance an investor's portfolio over time, shifting from riskier growth stocks to more conservative choices as the investor approaches their target retirement date. The target date in the fund name corresponds with the investor's planned retirement year, and the fund's asset allocation gradually becomes more conservative to preserve gains and reduce investment risk. While target-date funds offer a convenient, diversified investment strategy, they may not suit everyone, as they follow a one-size-fits-all approach and have higher fees compared to other passive investments.

| Characteristics | Values |

|---|---|

| Purpose | Retirement savings |

| Type of fund | Mutual fund, "fund of funds" |

| Investment strategy | Passive, active or hybrid |

| Investment mix | Stocks, bonds, cash, cash equivalents, short-term investments, fixed-income investments |

| Risk | High initially, gradually becomes more conservative |

| Management | Automatic, professional |

| Advantages | Simplicity, diversification, rebalancing, long-term investment |

| Disadvantages | Fees, lack of customisation, one-size-fits-all |

| Suitability | Investors with a known savings goal or target retirement date |

What You'll Learn

How to choose a target-date fund

Target-date funds are a "set it and forget it" retirement savings option that removes the headache of deciding on a mix of assets and rebalancing those investments over time. Here are some key considerations on how to choose a target-date fund:

Understand the Basics

Target-date funds, also known as life-cycle funds or target-retirement funds, aim to balance the risk and reward of your investment portfolio as you age. The fund automatically rebalances your portfolio with the right mix of stocks, bonds, and money market accounts as you get closer to retirement. These funds are often named with the target retirement year in mind, making it easier to choose one that aligns with your retirement goals.

Compare Costs

Target-date funds can be expensive, with higher fees than standard mutual funds due to their structure as funds-of-funds. Compare expense ratios, which represent the annual fee as a percentage of your investment. The average target-date fund had an expense ratio of 0.52% in 2020, but they can range from as low as 0.1% to over 1.5%. Lower expense ratios are often found in passively managed funds that track an index, while actively managed funds that select individual stocks tend to have higher fees.

Evaluate the Investment Philosophy

Understand the fund's investing philosophy and how it aligns with your risk tolerance. Two identically named target-date funds can have very different strategies for shifting from stocks to bonds as you age. Consider your risk appetite and whether you want a more conservative or aggressive approach. Additionally, look at the specific categories of domestic and international holdings, such as large-cap and small-cap stocks, and the allocation between regions.

Consider Diversification

Choose a target-date fund that offers broad market exposure and diversification across asset classes. Ensure that the fund provides exposure to both domestic and international stocks and bonds, as well as other asset classes if appropriate for your risk profile. Diversification helps spread risk and potentially enhance returns over the long term.

Assess Your Existing Investments

When selecting a target-date fund, consider your existing investments, both within your 401(k) and outside of it. Ensure that you are not overly exposed to certain asset classes or unintentionally overlapping with your target-date fund holdings. A target-date fund can serve as a core holding, and you can complement it with allocations to other asset classes that fit your unique circumstances.

Review Performance and Glide Path

While target-date funds are designed for the long term, it's important to periodically review your fund's performance and ensure it aligns with your goals. Assess the fund's glide path, which illustrates how the asset allocation will shift from riskier to more conservative investments over time. Decide if you prefer a "to" fund, which freezes the asset allocation at retirement, or a "through" fund, which continues to adjust the allocation even after retirement.

Arbitrage Funds: A Smart Investment Strategy for Savvy Investors

You may want to see also

The advantages and disadvantages of target-date funds

Target-date funds (TDFs) are a popular investment choice, particularly for those saving for retirement. These funds offer a simple, hands-off approach to investing, and their popularity has grown due to their ease of use and wide availability through employer-sponsored retirement plans. So, what are the pros and cons of investing in target-date funds?

Advantages:

Simplicity and Diversification: TDFs offer a "set-it-and-forget-it" approach, making them an attractive option for investors who don't want to be hands-on with their portfolio. The fund automatically adjusts its asset allocation over time, providing a simple, all-in-one investment solution. Additionally, TDFs provide instant diversification, as they hold a mix of stocks, bonds, and other investments, which can be challenging for individual investors to replicate on their own.

Professional Management: These funds are managed by investment professionals who handle the asset allocation, investment selection, and ongoing rebalancing. This removes the stress and time commitment of managing a portfolio, especially for investors who lack the time, interest, or knowledge to actively manage their investments.

Long-Term Focus: TDFs are designed with a specific retirement date in mind, and the asset allocation becomes more conservative as that date approaches. This automatic adjustment helps investors maintain an appropriate level of risk, ensuring they are not overexposed to stocks or other risky assets as they near retirement.

Disadvantages:

Limited Control: While TDFs offer simplicity, they also provide less flexibility and control compared to building your own portfolio. The fund's managers make all the investment decisions, and you cannot choose specific investments within the fund. This lack of control may be a disadvantage for more experienced or hands-on investors.

Potential for Higher Fees: Target-date funds often come with higher expense ratios compared to managing your own portfolio of index funds or ETFs. These fees cover the cost of professional management, but they can eat into your investment returns over time. It's important to carefully review the fees associated with any TDF before investing.

One-Size-Fits-All Approach: While TDFs are designed to suit a broad range of investors, they may not be tailored to your specific needs and circumstances. Factors such as your risk tolerance, life expectancy, and other sources of retirement income may not be fully considered in the fund's design. As such, a TDF may not be the most optimal investment strategy for everyone.

In conclusion, target-date funds offer a simple, automated approach to investing, making them a popular choice for retirement savings. However, it's important to carefully consider the disadvantages, including higher fees and limited control, to determine if a TDF is the right investment strategy for your financial goals and personal preferences.

A Guide to Mutual Fund Investing with Little Capital

You may want to see also

How to invest in a target-date fund

Target-date funds are a "set it and forget it" retirement savings option that removes the headache of deciding on a mix of assets and rebalancing those investments over time. They are designed to invest heavily in riskier growth stocks in the early years to rack up gains while the investor has plenty of time to recover from any short-term losses. As retirement nears, the fund automatically shifts towards more conservative, lower-risk investments such as bonds and cash.

Step 1: Understand the Basics

Firstly, it is important to understand what target-date funds are and how they work. These funds are designed to help manage investment risk by shifting the risk profile of their investments over time. You pick a fund with a target retirement year, and as that date approaches, the fund focuses more on assets with a traditionally lower-risk profile.

Step 2: Evaluate Your Risk Tolerance

Before investing in any fund, it is crucial to assess your risk tolerance. Target-date funds can vary in terms of the level of risk they take on. Some funds might be more aggressive, with a higher allocation to stocks, while others might be more conservative, focusing more on bonds and cash equivalents. Choose a fund that aligns with your risk tolerance and investment goals.

Step 3: Compare Different Funds

There are various target-date funds offered by different financial institutions, such as Vanguard, Fidelity, and T. Rowe Price. Compare the fees, investment strategies, and current portfolio breakdown of these funds to determine which one best suits your needs. Consider factors such as expense ratios, investment philosophies, and the mix of assets in the fund.

Step 4: Consider Your Time Horizon

Think about your planned retirement age and choose a fund with a target date that aligns with it. For example, if you plan to retire around 2040, you would choose a target-date fund with that year in its name. This step is crucial because the fund's investment strategy and asset allocation will be tailored towards that target date.

Step 5: Enroll in the Fund

Once you have selected the target-date fund that meets your needs, the next step is to enroll and make your investment. You can do this by opening a brokerage account with a fund manager, an online broker, or directly through the fund provider. Keep in mind that some funds may have minimum initial investment requirements, so ensure you review the fund's prospectus before enrolling.

Step 6: Monitor Your Investment

While target-date funds are designed to be a "set it and forget it" option, it is still important to periodically review your investment's performance. Check in on your fund at least once a year to ensure it still aligns with your investment goals and risk tolerance. Additionally, consider how your target-date fund fits with your overall investment portfolio to avoid overlap or duplication.

G Fund: A Safe and Secure Investment Option

You may want to see also

The different types of target-date funds

Target-date funds (TDFs) are designed to be long-term investment accounts that are automatically adjusted over the years as the investor approaches a specific milestone, such as retirement. They are also known as life-cycle funds or target-retirement funds.

TDFs are designed to invest heavily in riskier growth stocks in the early years to rack up gains while the investor has plenty of time to recover from any short-term losses. In later years, the investment choices lean towards more conservative options to consolidate gains and avoid untimely losses.

TDFs are popular offerings in 401(k) plans and are offered by many companies as the default investment option. They are also an option for people investing in individual retirement accounts (IRAs).

- Actively managed funds: An active portfolio management team selects actively managed investments with the objective of outperforming broad market indexes.

- Passively managed funds: A passive portfolio management team selects passively managed investments designed to achieve performance that aligns with an index, like the S&P 500 or Russell 2000.

- Hybrid or blend funds: A hybrid or blend portfolio management team uses a combination of the above two options, investing in actively managed investments when they believe it makes sense and using passively managed investments in areas where they believe active management may not add much value.

- To retirement funds: These funds will generally reach their most conservative allocation at the target retirement date and maintain that allocation for the duration of the retirement period.

- Through retirement funds: These funds will continue to adjust the mix of stocks, bonds, and cash through the target retirement date, reaching their most conservative allocation at some point past the retirement date.

Invest Like a Billionaire: Accessing Bill Ackman's Strategies

You may want to see also

Tips for choosing a target-date fund

- Pick your target date carefully. Choose a fund with a target year closest to when you plan to retire. For example, if you are 30 years old and want to retire at 65, choose a target date fund with a date 35 years in the future.

- Assess your risk tolerance. Compare funds with similar target dates and examine their investment strategies so that you can select the one that aligns with your risk tolerance. Remember to monitor the fund's performance periodically to ensure it continues to meet your investment goals.

- Determine whether the fund will take you to or through retirement. Read the fund's prospectus to understand what the target date means and how the fund's asset allocation will change over time.

- Monitor the glide path of your target-date fund. Periodically review the investments of your target-date fund to ensure that the investment manager has not changed the way the fund reallocates assets over time. Ensure that any changes to the glide path are consistent with your retirement investment strategy and risk tolerance.

- Pay attention to fees. The cost of a mutual fund is known as its expense ratio, an annual fee expressed as a percentage of your investment. The average target-date fund had an expense ratio of 0.52% in 2020, but these fees can range from as low as 0.1% to more than 1.5%. Compare fees and fund philosophies to find the best fit for your goals and risk tolerance.

A Guide to Investing in Other Funds with Fidelity

You may want to see also

Frequently asked questions

A target-date fund is a long-term investment account that is automatically adjusted over the years as the investor approaches a specific milestone, such as retirement. Target-date funds are also known as life-cycle funds or birthday funds.

Target-date funds are popular because they simplify retirement investing. They are a "set it and forget it" option that removes the headache of deciding on a mix of assets and rebalancing those investments over time. They are also diversified and rebalanced.

Pick a fund with a target year closest to your retirement year. For example, if you are 30 years old and plan to retire at 65, choose a target-date fund with a date 35 years in the future. Assess how much risk you are willing to take and determine whether the fund will take you to or through your retirement.