Target-date funds are a popular choice for retirement plans, offering a diversified, hands-off approach to investing. These funds are tailored to an investor's current age, with the balance between risk and income gradually adjusting as the investor approaches retirement age. The S&P 500 Index, on the other hand, is a specific market index that tracks the performance of 500 large companies. While target-date funds are actively managed, the S&P 500 is a passive index that does not change substantially over time. When considering how to invest in S&P Target Date 2025 Index Mutual Funds, it is important to understand the differences between these two investment options and the factors that should be taken into account when choosing between them.

| Characteristics | Values |

|---|---|

| Target Date | 2025 |

| Description | Provide diversified exposure to stocks, bonds, and cash for investors who have a specific date in mind (2021-2025) for retirement or another goal. |

| Investment Objective | Provide investors with an optimal level of return and risk, based solely on the target date. |

| Management | Adjust the allocation among asset classes to more conservative mixes as the target date approaches. |

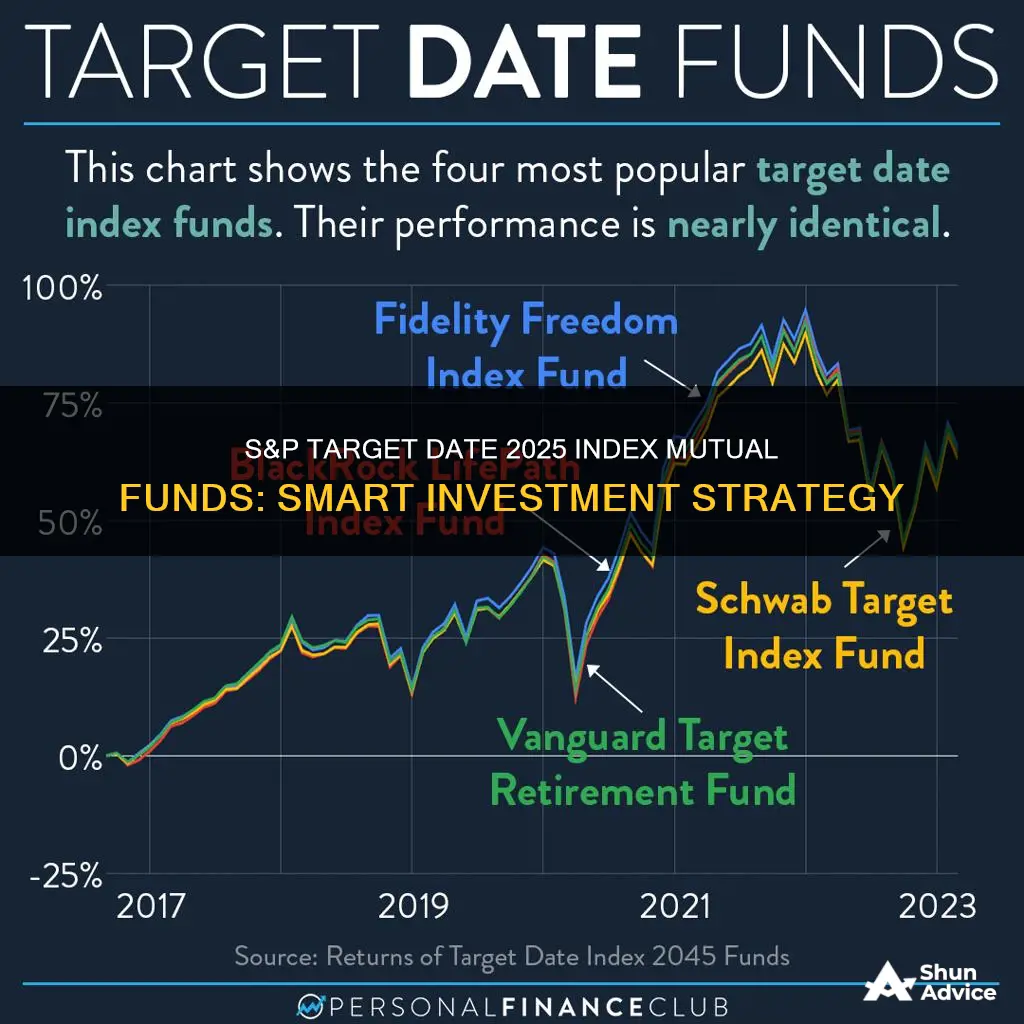

| Best Target-Date 2025 Mutual Funds | Voya Index Solution 2025 Port, Fidelity Simplicity RMD 2025 Fund, Principal LifeTime 2025 Fund, American Funds 2025 Trgt Date Retire Fd, MassMutual RetireSMART by JPMorgan2025Fd, 1290 Retirement 2025 Fund, Fidelity Sustainable Target Date 2025 Fd |

What You'll Learn

Target-date funds vs S&P 500 indexing

Target-date funds are a popular choice for 401(k) retirement plans. The fund is tailored to the current age of the investor and is rebalanced over time to reflect the degree of risk appropriate for each stage of their career. This means that the balance between risk and income gradually adjusts as the investor approaches retirement age. The appeal of target-date funds lies in their convenience, as employees don't need to take any action to update their portfolio.

However, target-date funds have certain drawbacks when compared to S&P 500 Index funds. Target-date funds are typically funds of funds, meaning they invest in other funds managed by the same company, resulting in higher fees for the investor. Additionally, they often include a small but unnecessary portion of safe investments, even when the target date is decades away. This can lead to inferior asset returns and higher opportunity costs.

On the other hand, the S&P 500 Index is determined by a committee of experts at Standard & Poor's, ensuring that each asset is a viable and trackable company. The selection process sets it apart from other funds, making it slightly less volatile than a total market index fund. Index fund fees are also significantly lower than those of actively managed funds, as they don't require a management team or staff of analysts.

While the S&P 500 Index fund provides strong diversification by investing in 500 companies, it does not change substantially over time. This can be a disadvantage for younger investors who may prefer riskier funds with greater potential returns. As a result, they may opt for other investment options to build early gains and recover from market downturns.

In summary, while target-date funds offer convenience and tailored investment strategies based on an individual's retirement timeline, they may come with higher fees and potentially lower returns. The S&P 500 Index fund, on the other hand, provides strong diversification and lower fees but may not be as responsive to the changing needs of investors over time, especially those approaching retirement age.

A Guide to Investing in Mutual Funds with COL Financial

You may want to see also

Target-date funds for retirement

Target-date funds, or TDFs, are a type of long-term investment account that automatically adjusts its asset allocation over time to reduce risk as you get closer to retirement. They are designed to help take the guesswork out of saving for retirement by providing a diversified mix of stocks, bonds, and other investments that change as you age.

TDFs are typically mutual funds that invest in a range of stocks, bonds, and other assets, providing a diversified portfolio for investors. The funds are designed to take on more risk when you are younger, investing more heavily in growth stocks, and gradually becoming more conservative as you approach retirement, with a greater focus on income stocks and bonds. This helps to balance the need for growth when you are young with the need for capital preservation as you get older.

For example, if you plan to retire in 2065, you would choose a target-date 2065 fund. The fund managers will adjust the portfolio's risk levels and asset allocation over time to ensure it remains appropriate for your age and stage in life. As the target date approaches, the fund will shift towards more conservative investments to help preserve your gains.

TDFs are a popular choice for retirement savings, especially for those who don't have the time or inclination to actively manage their investments. They are often used in 401(k) plans and are also available for individual retirement accounts (IRAs). However, it's important to note that TDFs may have higher fees than other passive investment options, as they are typically funds of funds and charge an extra layer of fees.

Overall, target-date funds offer a convenient and relatively hands-off approach to retirement planning, ensuring your investments remain appropriate for your life stage without requiring constant monitoring and adjustments.

Maximizing EIDL Funds: Strategies for Savvy Business Investments

You may want to see also

Diversified exposure to stocks, bonds, and cash

Target-date funds are a popular choice for retirement plans, especially for those who want a portfolio that automatically adjusts to their life stage. These funds are tailored to a specific age bracket, with the balance between risk and income gradually adjusting as the investor approaches retirement age.

Target-date portfolios, such as the S&P Target Date 2025 Index, provide a diversified exposure to stocks, bonds, and cash for investors. These portfolios aim to provide investors with optimal returns and risk levels based on their target retirement date. Over time, fund managers adjust the allocation of assets to more conservative mixes as this date approaches.

For example, a target-date fund may initially be heavily weighted towards growth stocks, with smaller percentages in income stocks and bonds for diversification. As the target date nears, the fund decreases its exposure to growth stocks and focuses more on safer income stocks and bonds. By the time retirement arrives, the fund has mostly shifted towards investment-grade bonds.

This type of fund offers convenience by automatically adjusting the portfolio to maintain suitable risk levels. However, target-date funds typically have higher fees as they are often funds-of-funds, investing in other funds managed by the same company.

When investing in target-date funds, it is important to consider the fees and the potential for higher returns in other investment options. Additionally, investors should be mindful of their risk tolerance, investment goals, and time horizon when constructing their portfolio.

Investing in Dementia Discovery: A Guide to the Dementia Discovery Fund

You may want to see also

Management adjusts allocation over time

A target-date fund for a young person will be heavily weighted towards stocks in general, and growth stocks in particular. This is designed to build up some early gains while the investor has plenty of time to recover from a market nosedive. As the target date approaches, the allocation is adjusted to more conservative mixes. This is because, as investors get closer to retirement, they are encouraged to shift towards less-risky, fixed-income assets. While bonds don't benefit as much from growth and price appreciation, they offer better security for your principal and more predictable income.

For example, a target-date fund may be initially designed for a person who wants to retire in 2025. In the early days, the fund will be heavily slanted towards growth stocks with smaller percentages in income stocks and bonds for diversification. Over the years, the investor increasingly wants to retain and build on those early gains. By 2020, the fund has dramatically decreased its exposure to growth stocks and focuses more on safer income stocks and bonds. Later, as the time for retirement payouts approaches, the fund has all but completed the shift towards safety and contains mostly investment-quality bonds.

The advantage of this type of fund is, in part, convenience. The investor doesn't have to do anything to update the portfolio. The decrease in risk over time prevents an unobservant investor from losing a large amount of money if the stock market crashes right before the retirement date.

Index Funds: The Smartest Investment Choice for Your Money

You may want to see also

Target-date funds: pros and cons

Target-date funds are a popular choice for retirement plans. They are tailored to an investor's current age, with the balance between risk and income gradually adjusting as the investor approaches retirement age.

Pros

- Simplicity: Target-date funds are simple and convenient, as they require little to no input from the investor. They are a "set it and forget it" investment option.

- Diversification: Target-date funds offer investors a well-diversified portfolio of stocks and bonds.

- Automatic rebalancing: Target-date funds automatically rebalance and reallocate assets as the investor gets older, reducing the investor's risk as they approach retirement.

- Lower fees: Target-date funds have become more competitive in recent years, and their fees have decreased significantly.

- Something for everyone: Target-date funds offer a range of options, including active and passive management, exposure to different markets, and a selection of asset allocation choices.

Cons

- High fees: Target-date funds are typically funds of funds, meaning investors pay an extra layer of fees. These fees can be relatively high compared to other funds, such as index funds.

- Poor performance: Target-date funds may underperform other investment options, and there is no guarantee of earnings.

- Too conservative: Target-date funds may become too conservative too quickly as investors approach retirement, reducing the potential for higher returns.

- Not tailored to individual needs: Target-date funds are off-the-shelf products that do not take into account an investor's specific financial situation or retirement goals.

- Lack of control: Investors may become indifferent to their investments, as the fund managers handle everything. This could lead to a lack of financial advice-seeking and a false sense of security.

Overall, while target-date funds offer a convenient and simple investment option, they may not be suitable for everyone. It is important for investors to consider their specific financial goals and needs before deciding whether to invest in target-date funds.

Investing in Funds: Diversification, Expertise, and Access

You may want to see also

Frequently asked questions

These funds are designed to provide a diversified, hands-off approach to retirement investing. They offer broad exposure to stocks, bonds, and other assets, with the allocation adjusted over time to become more conservative as the target date approaches. This ensures your risk level remains suitable as you near retirement.

When selecting a target date fund, consider the fund's glide path, underlying holdings, the fund manager's performance history, and fees. Ensure the target date aligns with your expected retirement year and risk tolerance.

Target date funds are available through employer-sponsored retirement plans, such as 401(k)s, or directly from mutual fund companies and brokerage accounts. You can also invest in target-date ETFs, which combine automated asset allocation with lower fees and the ability to trade like shares.

Target date funds have higher fees than passively managed fund choices, with annual fees averaging 0.51%. However, they offer a convenient, automated approach to retirement investing, adjusting your asset allocation over time without any manual input required.